Intuit QuickBooks Entrepreneurship in 2024 Report: Majority of Americans Believe Starting a Business Better Way to Build Wealth Than Buying a House

Nearly a Quarter Surveyed Considering Starting a Business in 2024

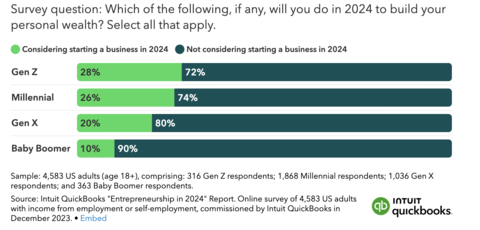

MOUNTAIN VIEW, Calif.--(BUSINESS WIRE)-- Intuit Inc. (Nasdaq: INTU), the global technology platform that makes Intuit QuickBooks, TurboTax, Credit Karma, and Mailchimp, today announced the findings of the Intuit QuickBooks Entrepreneurship in 2024 Report. According to a survey of more than 4,500 U.S. adults, inflation and interest rates are the greatest threats to the ability to build personal wealth in 2024 and 66% believe starting a business is a better path to building personal wealth than buying a house. As a result, 23% are considering starting a business in the new year, with Gen Z showing the most interest in entrepreneurship.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231219808087/en/

28% of Gen Zers say they’re considering starting a business in 2024. (Graphic: Business Wire)

Greatest Impact on Business Formation and Growth

Despite the increased interest in AI, hiring skilled workers was rated as the number one way to drive growth by respondents who were small business owners, followed by investing in social media and ecommerce. Interestingly, these came ahead of securing financing or loans – often perceived as a key to business growth. Other key findings that could influence business formation and growth include:

- Tax returns turning into businesses: Nearly a third (32%) of small businesses created since 2020 were funded in part by tax refunds. Given this, the size of 2024 tax refunds will likely impact business growth and formation, with 65% of respondents saying a smaller return will make it harder for them to start a business or side hustle.

- Inflation’s ongoing impact: Over the past three years, more than half (57%) of respondents who started a business said boosting their income amid inflation influenced their decision to launch a business venture – equal to the amount who cited the COVID-19 pandemic as a reason. Additionally, respondents noted that inflation is the number one challenge to small business growth in 2024 followed by higher interest rates which make it more expensive to borrow money.

- Generational differences in investment: The data show that younger entrepreneurs are more likely to invest for growth in 2024 than older generations, with 88% of Gen Z small business owners looking to expand ecommerce or physical locations to boost revenue in 2024 compared to 66% of Gen X and Baby Boomers. Additionally, 76% of Gen Z small business owners and 80% of Millennial small business owners want to hire in the new year compared to just 58% of Gen X and Baby Boomers.

Credit Cards Critical to Small Business Cash Flow

The survey reinforced recent findings from the 2023 Intuit QuickBooks Small Business Index Annual Report, which demonstrated the reliance small businesses increasingly have on credit cards to manage cash flow. Of small businesses surveyed, 83% said they have relied on a credit card to manage their business finances this year. Overall credit card usage trends show the importance of credit to small businesses as well as potential issues:

- Emergency funding is the primary use of credit cards: Among all small business owners surveyed who are currently using credit cards, 59% say this is “an emergency or temporary source of funding.”

- Credit card balances a concern in 2024: Overall, almost one in four (24%) small businesses don’t believe they will be able to pay off their credit card balances in 2024 without paying interest.

- High open credit utilization and interest rates: More than half (51%) have used 50% or more of their available credit limit and 76% have used 30% or more of available credit. Over 40% of respondents indicated the APR on their business credit cards was 20% or higher.

- Business vs. personal card usage trends: In general, personal credit cards are more popular than business credit cards, with 70% of respondents revealing they use them. Personal credit cards are most popular among freelancers and solopreneurs, while small businesses with employees are more likely to use business credit cards.

Defining Success in 2024

The report also reveals what success looks like in 2024 amid inflation concerns and what financial thresholds small business owners need to reach to feel successful. The survey showed that 41% of Americans would feel successful earning $75,000 in 2024. Other insights on how small businesses measure success include:

- Success means increasing revenue for small businesses: Among small business owners, 42% said that increasing revenue is their primary goal in the year ahead, indicating the importance that financial growth has for small businesses.

- A high bar to quit day jobs: Of the 1,000 side-hustle business owners surveyed, nearly two-thirds (62%) would quit their day job if they were able to earn $100,000 a year. The primary reason for keeping their day job before they hit that mark is the concern of having a stable income. This was almost twice as important as having access to healthcare benefits from W2 employment.

- Millennials put a higher price on success: By generation, Millennial respondents have the highest bar for success in 2024, saying they will need to earn $288,000, on average, to feel successful. At the other end of the scale, Baby Boomers would be satisfied with less than half that amount, at $126,000 on average.

The full report and additional data insights from Intuit QuickBooks are available here.

About Intuit

Intuit is the global financial technology platform that powers prosperity for the people and communities we serve. With 100 million customers worldwide using TurboTax, Credit Karma, QuickBooks, and Mailchimp, we believe that everyone should have the opportunity to prosper. We never stop working to find new, innovative ways to make that possible. Please visit us at Intuit.com and find us on social for the latest information about Intuit and our products and services.

View source version on businesswire.com: https://www.businesswire.com/news/home/20231219808087/en/

Intuit QuickBooks:

Dan Mahoney

dan_mahoney@intuit.com

Jen Garcia

Jeng@accesstheagency.com

Source: Intuit Inc.

Released December 19, 2023