EX-99.2

Published on May 1, 2020

Form of

Letter of Transmittal

for Securities of

Credit Karma, Inc.

Surrendered for Payment

Pursuant to the Agreement and Plan of Merger

by and among

Intuit Inc.,

Halo Merger Sub I, Inc.,

Halo Merger Sub II, LLC,

Credit Karma, Inc., and

the Securityholder Representative referred to therein

The Exchange Agent for the Merger is: Acquiom Financial LLC

DELIVERY INSTRUCTIONS

[●]

Attn: [●]

[●]

[●]

For information please email: [●]

or call: [●]

THE INSTRUCTIONS ACCOMPANYING THIS LETTER OF TRANSMITTAL SHOULD BE READ CAREFULLY BEFORE THIS LETTER OF TRANSMITTAL IS COMPLETED. IF SECURITIES ARE REGISTERED IN MORE THAN ONE NAME, A SEPARATE LETTER OF TRANSMITTAL MUST BE SUBMITTED FOR EACH SEPARATE REGISTERED HOLDER OF SUCH SECURITIES.

BY SIGNING THIS LETTER OF TRANSMITTAL, YOU AGREE TO THE PROVISIONS CONTAINED HEREIN AND MAKE THE ACKNOWLEDGEMENTS AND REPRESENTATIONS PROVIDED HEREIN.

Ladies and Gentlemen:

Reference is hereby made to that certain Agreement and Plan of Merger, dated as of February 24, 2020 (the Merger Agreement), by and among (i) Intuit Inc., a Delaware corporation (Parent), (ii) Halo Merger Sub I, Inc. a Delaware corporation and a direct, wholly owned Subsidiary of Parent (Merger Sub), (iii) Halo Merger Sub II, LLC, a Delaware limited liability company and a direct, wholly owned Subsidiary of Parent (Merger Sub II), (iv) Credit Karma, Inc., a Delaware corporation (the Company), and (iv) Shareholder Representative Services LLC, a Colorado limited liability company, solely it its capacity as the Securityholder Representative (the Securityholder Representative). Capitalized terms used herein without definition shall have the meanings specified in the Merger Agreement.

The Merger Consideration

Pursuant to the Merger Agreement, the Parties intend to effect a business combination through (a) the merger of Merger Sub with and into the Company (the First Merger), with the Company continuing as the Surviving Corporation in the First Merger and (b) immediately following the First Merger, the merger of the Surviving Corporation, with and into Merger Sub II (the Second Merger, and, together with the First Merger, the Mergers), with Merger Sub II continuing as the Surviving Company in the Second Merger.

At the Effective Time, by virtue of the First Merger and without any further action on the part of the Parties, any Securityholder or any other Person, subject to any applicable withholding pursuant to the Merger Agreement, each share of Company Capital Stock issued and outstanding immediately prior to the Effective Time (other than Canceled Shares) shall be automatically converted into the right to receive, upon delivery of this properly completed and duly executed Letter of Transmittal (together with duly executed IRS Form(s) W-8 (and any attachments thereto) and/or W-9, as applicable): (i) the Per Share Closing Consideration, (ii) the right to receive a portion of the Adjustment Amount, if any, payable in accordance with Section 2.08(b)(vii) of the Merger Agreement, (iii) the right to receive distributions, if any, from the Indemnity Escrow Fund in accordance with Article 10 of the Merger Agreement and the Escrow Agreement, and (iv) the right to receive distributions, if any, of the Securityholder Expense Fund pursuant to Section 11.01(c) of the Merger Agreement (the Merger Consideration).

The undersigned hereby acknowledges and agrees that all descriptions of the payment of the Merger Consideration and other matters related to the Mergers and the other transactions contemplated by the Merger Agreement are set forth in summary form in this Letter of Transmittal for the undersigneds convenience only and are qualified in their entirety by the terms of the Merger Agreement. For the avoidance of doubt, the undersigned hereby acknowledges and agrees that his, her or its agreements, acknowledgements and covenants herein are supplemental to and are not intended to call into doubt the existing validity or effectiveness of any of the matters set forth herein by virtue of the prior adoption of the Merger Agreement and approval of the Mergers and the other transactions contemplated by the Merger Agreement by the requisite stockholders of the Company and other actions and operation of Applicable Law.

Without limitation to the matters set forth in this Letter of Transmittal or the Merger Agreement, the undersigned hereby acknowledges and agrees that (i) the undersigned has received a copy of the Merger Agreement and has reviewed and understands the matters set forth therein, and (ii) the undersigned has been urged to and has been given the opportunity to consult with the undersigneds legal and tax advisors regarding the legal and tax consequences of the transactions contemplated by the Merger Agreement.

For the avoidance of doubt and without limitation of the foregoing, the undersigned hereby acknowledges and agrees that any payments made to the undersigned pursuant to the Merger Agreement shall be final and in no event shall Parent or the Surviving Company or any of their respective Affiliates have any liability to the undersigned for payment or disbursement by any Person (including Parent and the Surviving Company and their respective Affiliates and representatives (including the Exchange Agent and the Escrow Agent)) in accordance with the Merger Agreement. For the avoidance of doubt, the undersigned hereby acknowledges and agrees that the undersigned shall bear liability for any stock transfer taxes applicable to the delivery of the portion of the Merger Consideration due and payable to the undersigned pursuant to the Merger Agreement in exchange for the Surrendered Securities (defined below).

The undersigned acknowledges that the Exchange Agent or Parent, as applicable, may not deliver the applicable portion of the Merger Consideration otherwise due and payable to the undersigned pursuant to the Merger Agreement unless the undersigned delivers to the Exchange Agent:

2

| | this Letter of Transmittal properly completed and executed by the undersigned; |

| | the United States Internal Revenue Service (IRS) Form W-9 (which is enclosed with this Letter of Transmittal), or an IRS Form W-8BEN or other applicable Form W-8 executed by the undersigned, as applicable; and |

| | in the case of certificated shares, a Company Stock Certificate representing such shares for cancellation. |

The undersigned further acknowledges that any amounts otherwise payable to the undersigned in connection with the Merger may be subject to additional withholding in the event that the Company fails to deliver a FIRPTA Certificate, as required by Section 6.08 of the Merger Agreement.

The undersigned therefore hereby delivers to the Exchange Agent, for the benefit of Parent, the securities of the Company set forth on Form 3 below to be surrendered pursuant to this Letter of Transmittal (Surrendered Securities), upon the terms and subject to the conditions set forth in the Merger Agreement, the Escrow Agreement and this Letter of Transmittal, receipt of which is hereby acknowledged by the Exchange Agent.

The undersigned hereby represents and warrants that (a) if the undersigned is not a natural person, the undersigned is a legal entity duly organized, validly existing and in good standing under the law of its jurisdiction of organization, (b) the undersigned has all legal right, power, authority and capacity to execute and deliver this Letter of Transmittal, to perform each of his, her or its obligations hereunder, and to consummate the transactions contemplated hereby and to participate in the implementation and consummation of the transactions contemplated by the Merger Agreement and (c) this Letter of Transmittal has been duly and validly executed and delivered by or on behalf of the undersigned and constitutes a legal, valid and binding obligation of the undersigned, enforceable against the undersigned in accordance with its terms, subject to (i) laws of general application relating to bankruptcy, reorganization insolvency, relief of debtors and other similar laws affecting the enforcement of creditors rights generally and (ii) rules of law governing specific performance, injunctive relief and other equitable remedies.

The undersigned hereby represents and warrants that the undersigned (together with the undersigneds spouse if the undersigned is an individual, married and Surrendered Securities previously held by the undersigned constitute community property under Applicable Law) (a) is the sole record and beneficial owner of the Surrendered Securities described in this Letter of Transmittal, (b) has good and valid title to all such Surrendered Securities, free and clear of all Liens, other than restrictions on transfer imposed by applicable U.S. federal and state securities laws and (c) has sole power to transfer, sole voting power, sole power of conversion, exchange or exercise, sole power to demand appraisal rights and sole power to agree to all of the matters set forth in this Letter of Transmittal and the Merger Agreement, in each case with respect to all of the undersigneds Surrendered Securities with no limitations, qualifications or restrictions on such rights, subject to the applicable U.S. federal and state securities laws that restrict the transfer of the undersigneds Surrendered Securities.

In connection with the Surrendered Securities, the undersigned hereby waives all dissenters appraisal rights or similar rights or remedies to which he, she or it may be entitled or otherwise available to the undersigned under any Applicable Law in connection with the Mergers and the transactions contemplated by the Merger Agreement.

The undersigned hereby represents and warrants that the mailing address, wire transfer information, or information provided for special payment or delivery, as applicable, set forth in this Letter of Transmittal is true, correct and complete, and the undersigned hereby agrees to indemnify and hold harmless Parent,

3

the Company, the Surviving Company, the Exchange Agent, the Escrow Agent and their respective agents and representatives from any claims by any person, including the undersigned, relating to the delivery to such address or bank account, or pursuant to such special payment or delivery information, of any Merger Consideration to be paid to the undersigned or on behalf of the undersigned, in respect of the undersigneds Surrendered Securities. The undersigned agrees to notify the Exchange Agent of any change to the address, wire instructions or special payment or delivery information set forth herein.

The undersigned (a) hereby directs the Exchange Agent to issue any cash payment, by wire transfer or check as set forth below, for the portion of such consideration payable in respect of the Surrendered Securities and as may be due pursuant to the terms of the Merger Agreement (including any distributions from the Indemnity Escrow Fund pursuant to the Merger Agreement and the Escrow Agreement) in the name(s) of the registered holder(s) appearing at the address set forth below, (b) agrees to reasonably promptly inform Parent and the Exchange Agent as to any change in address set forth below and (c) acknowledges that, upon delivery of the items identified above by the undersigned to the Exchange Agent, the Exchange Agent shall issue to the undersigned the applicable portion of the Merger Consideration in respect of the undersigneds Surrendered Securities.

IRS Form W-9 or IRS Form W-8

Under U.S. federal income tax laws, the Exchange Agent may be required to backup withhold a portion of the amount of any payments made to certain Securityholders, as applicable. To avoid such backup withholding, each Securityholder that is a United States person (for U.S. federal income tax purposes), must provide the Exchange Agent with such Securityholders correct taxpayer identification number (TIN) and certify that such Securityholder is not subject to such backup withholding by completing the attached IRS Form W-9. In general, if a Securityholder is an individual, the TIN is the Social Security number of such individual. If the Exchange Agent is not provided with the correct TIN, the Securityholder may be subject to a penalty imposed by the IRS. For further information concerning backup withholding and instructions for completing the IRS Form W-9 (including how to obtain a TIN if you do not have one and how to complete the IRS Form W-9 if the Stock Certificates are held in more than one name), consult the enclosed IRS Form W-9 and the instructions thereto.

Certain Securityholders (including, among others, certain corporations, non-resident foreign individuals and foreign entities) are not subject to these backup withholding and reporting requirements, but such Securityholders should certify their exemption by completing either the IRS Form W-9 or the appropriate IRS Form W-8, as applicable. A Securityholder who is a foreign individual or a foreign entity should complete, sign and submit to the Exchange Agent the appropriate IRS Form W-8. An IRS Form W-8BEN or W-8BEN-E or other applicable IRS Form W-8 may be obtained from the Exchange Agent or downloaded from the IRSs website at the following address: http://www.irs.gov. Failure to complete the IRS Form W-9 or applicable IRS Form W-8 may require the Exchange Agent to withhold a portion of the amount of any payments made to a Securityholder.

If backup withholding applies under Applicable Law, the Exchange Agent is required to withhold a portion of any payments of the purchase price made to the Securityholder. Backup withholding is not an additional tax. Rather, the tax liability of persons subject to backup withholding will be reduced by the amount of tax withheld. If withholding results in an overpayment of taxes, a refund or credit may be obtained from the IRS provided that the required information is furnished to the IRS.

Please consult your accountant or tax advisor for further guidance regarding the completion of the IRS Form W-9 or the appropriate IRS Form W-8, as applicable, to claim exemption from backup withholding or contact the Exchange Agent.

4

FAILURE TO COMPLETE AND RETURN THE IRS FORM W-9 OR AN APPLICABLE IRS FORM W-8 MAY RESULT IN BACKUP WITHHOLDING OF A PORTION OF THE PAYMENTS MADE TO YOU. PLEASE REVIEW THE ENCLOSED IRS FORM W-9 AND THE INSTRUCTIONS THERETO FOR ADDITIONAL DETAILS.

Securityholder Representative

The undersigned hereby irrevocably constitutes and appoints Shareholder Representative Services LLC as the true, exclusive and lawful agent and attorney-in-fact of the undersigned to act in the name, place and stead of the undersigned solely in connection with the transactions contemplated by the Merger Agreement, in accordance with the terms and provisions of the Merger Agreement, and to act on behalf of the undersigned, to do or refrain from doing all such further acts and things, and to execute all such documents as the Securityholder Representative shall deem necessary or appropriate in connection with the transactions contemplated by the Merger Agreement, including the power, in each case subject to the limitations set forth in the Merger Agreement:

| | to act for the Securityholders with regard to matters pertaining to indemnification referred to in the Merger Agreement, including the power to compromise any indemnity claim on behalf of the Securityholders and to transact matters of litigation or other Proceedings, with respect to any funds to be released from the Indemnity Escrow Fund (but, for clarity, not including any Damages in excess of funds then remaining in the Indemnity Escrow Fund); |

| | to execute and deliver all amendments, waivers, ancillary agreements, stock powers, certificates and documents that the Securityholder Representative deems necessary or appropriate in connection with the consummation of the Transactions; |

| | to execute and deliver all amendments and waivers to the Merger Agreement that the Securityholder Representative deems necessary or appropriate, whether prior to, at or after the Closing; |

| | to receive funds for the payment of expenses of the Securityholders and apply such funds in payment for such expenses; |

| | to do or refrain from doing any further act or deed on behalf of the Securityholders that the Securityholder Representative deems necessary or appropriate in its sole discretion relating to the subject matter of the Merger Agreement as fully and completely as the Securityholders could do if personally present; and |

| | to receive service of process in connection with any claims under the Merger Agreement. |

The undersigned acknowledges that the Securityholder Representative may be removed or replaced only upon delivery of written notice to the Surviving Company by the Company Stockholders holding at least a majority of outstanding shares of Company Common Stock (on an as-converted to Company Common Stock basis) as of immediately prior to the Effective Time. The undersigned further acknowledges that the Securityholder Representative shall act for the undersigned on all of the matters set forth in the Merger Agreement in the manner the Securityholder Representative believes to be in the best interest of the undersigned and the other Securityholders and consistent with the obligations under the Merger Agreement, but the Securityholder Representative shall not be responsible to the undersigned or the other Securityholders for any Damages the undersigned or the Securityholders may suffer by the performance of its duties under the Merger Agreement, other than Damages arising from willful violation of the law or gross negligence in the performance of its duties under the Merger Agreement.

5

The undersigned hereby acknowledges and agrees that a portion of the Merger Consideration will be held back at Closing and paid into the Securityholder Expense Fund to be used to settle expenses of the Securityholder Representative. Any portion of the Securityholder Expense Fund that remains undeliverable or unclaimed after six (6) months of the initial delivery attempt shall promptly be paid to Parent and the Indemnitors to whom such amounts may be owed shall thereafter look only to Parent for satisfaction of their claims for any such amounts, without any interest thereon.

The undersigned shall execute and/or cause to be delivered to Parent and the Securityholder Representative such instruments and other documents, and shall take such other actions, as Parent and the Securityholder Representative may reasonably request in a writing for the purpose of carrying out or evidencing any of the provisions of this Letter of Transmittal or the Merger Agreement, in each case, at Parents or the Securityholder Representatives, respectively, sole cost and expense.

Potential Reduction of Merger Consideration

The undersigned agrees and acknowledges that the Merger Consideration otherwise payable to the undersigned pursuant to the Merger Agreement may be reduced or otherwise recoverable pursuant to (i) the release, if any, of amounts from the Indemnity Escrow Fund pursuant to the Escrow Agreement and Section 2.08(b) or Article 10 of the Merger Agreement, (ii) the indemnification provisions of Article 10 and (iii) the release, if any, of amounts from the Securityholder Expense Fund pursuant to Section 11.01 of the Merger Agreement.

Waiver of Notice

In consideration for, and in light of, the payment of the Merger Consideration, the undersigned hereby irrevocably and unconditionally waives any and all preemptive rights, restrictions on transfer, rights of first refusal, tag along rights, rights to notice, registration rights, valuation rights, consent or voting rights, information rights, rights to any liquidation preference and similar rights and benefits to which the undersigned may be entitled pursuant to the Company Charter or Company Bylaws, any agreements among the Company and any or all of the Company Securityholders (including the undersigned) and Applicable Law.

Release

The undersigned further acknowledges and agrees as follows:

From and after (and effective upon) the Effective Time, the undersigned, on behalf of himself, herself or itself and each of his, her or its predecessors, successors, executors, administrators, trusts, spouse, heirs, estate, directors, officers, employees, managers, principals, advisors, stockholders, investors, subsidiaries, partners, members and Affiliates and past, present and future assigns and agents (collectively, the Releasors), hereby irrevocably releases and forever discharges each of Parent and the Company and each of their respective past and present Subsidiaries, Affiliates, predecessors, officers, directors, stockholders, members, agents, representatives, successors and assigns (individually, a Releasee and, collectively, the Releasees) from any and all past, present and future disputes, claims, counter-claims, controversies, demands, rights, obligations, promises, agreements, contracts, liabilities, debts, encumbrances, costs (including attorneys fees and costs incurred), expenses, judgments, damages, losses, Proceedings, actions and causes of action of every kind and nature, whether arising or pleaded in law or in equity, under contract, statute, tort or otherwise (Claims), which the undersigned or any of the Releasors now have, may ever have had in the past or may have in the future against any of the Releasees, in each

6

case, to the extent related to the period prior to the date hereof, in any way arising out of or relating to, directly or indirectly, the undersigneds capacity as a stockholder of the Company (including in respect of rights of contribution or indemnification), including, but not limited to, (i) the undersigneds ownership or purported ownership of the Surrendered Securities or (ii) the transactions contemplated by the Merger Agreement or the Ancillary Documents, including, without limitation, any and all Claims that the Releasors may have against any of the Releasees with respect to any contract, agreement or other arrangement (whether written or verbal), breach or alleged breach of fiduciary duty or otherwise; provided, that the foregoing shall not cover Claims (i) arising from rights of any Releasor under or to (A) the Merger Agreement or any Ancillary Document to which such Releasor is a party, (B) any indemnification, exculpation or advancement of expenses provisions for the benefit of directors, managers, officers, employees or other individuals contained in the Company Charter, the Company Bylaws or the equivalent constituent documents of the Companys Subsidiaries or (C) if such Releasor is a current or former officer, employee or service provider of the Company or any of its Subsidiaries, any claims with respect to salaries, wages, compensation, severance, reimbursable expenses or other health, welfare, retirement or similar benefits that, as of immediately prior to the Closing or thereafter, are due, owing, vested and outstanding (including any applicable acceleration rights) or payable or otherwise required to be made available to Releasor in respect of services provided by Releasor to the Company or its Subsidiaries or (ii) which cannot be waived as a matter of law (collectively, the Unreleased Claims). The undersigned (for itself and each of the Releasors) hereby irrevocably covenants to refrain from, directly or indirectly, asserting any claim or demand, or commencing, instituting or causing to be commenced, any claim, suit, action or proceeding of any kind against any Releasee based upon any Claim released or purported to be released pursuant to the foregoing. If the undersigned (or any of the Releasors) brings any claim, suit, action or proceeding against any Releasee with respect to any Claim released or purported to be released pursuant to the foregoing, then the undersigned shall indemnify such Releasee in the amount or value of any judgment or settlement (monetary or other) and any related costs or expenses (including without limitation reasonable legal fees) entered against, paid or incurred by the Releasee.

The undersigned (a) represents, warrants and acknowledges that the undersigned has been fully advised by the undersigneds attorney of the contents of Section 1542 of the Civil Code of the State of California, and (b) hereby expressly waives the benefits thereof and any rights that the undersigned may have thereunder. Section 1542 of the Civil Code of the State of California provides as follows:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS THAT THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE AND THAT, IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY.

The undersigned also hereby waives the benefits of, and any rights that the undersigned may have under, any statute or common law principle of similar effect in any jurisdiction. The undersigned understands and acknowledges (for itself and each of the Releasors) that it may discover facts different from, or in addition to, those which it knows or believes to be true with respect to the Claims released herein, and agrees that (i) it is the intention of the undersigned to fully, finally and forever waive, release and relinquish all Claims against any Releasee (other than Unreleased Claims), and (ii) this release shall be and remain effective in all respects notwithstanding any subsequent discovery of different and/or additional facts.

The undersigned represents and acknowledges that he, she or it has read this release and understands its terms and has been given an opportunity to ask questions of Parents or the Companys representatives. The undersigned further represents that in signing this release he, she or it does not rely,

7

and has not relied, on any representation or statement not set forth in this release made by any representative of Parent or the Company or anyone else with regard to the subject matter, basis or effect of this release or otherwise.

Confidentiality

The undersigned hereby agrees that all confidential and/or proprietary information of the Company (to the extent such information has not been made available to the general public) obtained by the undersigned prior to the Effective Time, as well as the terms of this Letter of Transmittal, the Merger Agreement and any Ancillary Document to which the undersigned is or shall become a party, shall be kept confidential by the undersigned and the undersigned shall not, directly or indirectly, misuse or misappropriate any such information in any way; provided, however, that (i) the undersigned may disclose such information or terms if required to do so by Applicable Law, provided that the undersigned promptly notifies Parent in advance of disclosing such information and takes reasonable steps to minimize the extent of any such required disclosure; (ii) the undersigned may disclose the terms of the Merger Agreement that are disclosed by Parent in any public announcements or filings with the SEC; (iii) the undersigned may disclose such information or terms to the extent they become generally available to the public other than by virtue of a breach of this provision by the undersigned or its Affiliates; and (iv) the undersigned may disclose such information or terms to his, her or its Affiliates or Representatives who: (A) need to know such information; and (B) agree to keep it confidential. The undersigned shall be responsible for any action taken by his, her or its Affiliates or Representatives that, if such action had been taken by the undersigned, would have constituted a breach of this Letter of Transmittal.

Acknowledgement

The undersigned acknowledges and agrees that, upon the execution of the Merger Agreement, Sections 2.04, 2.08, 2.09, 2.11, 2.14, 11.01 and 11.05, and Articles 7 and 10 of the Merger Agreement shall be binding upon the undersigned as fully as though he, she or it were a signatory thereto, notwithstanding the fact that the undersigned is not a direct signatory to the Merger Agreement. The undersigned further acknowledges and agrees that, upon the execution of the Merger Agreement, he, she or it is an Indemnitor for purposes of Article 10 of the Merger Agreement and, accordingly, agrees to be bound thereby, solely in his, her or its capacity as such Indemnitor and as fully as though he, she or it were a signatory thereto, notwithstanding the fact that the undersigned is not a direct signatory to the Merger Agreement.

Miscellaneous

Unless agreed in writing by Parent, the representations, warranties, acknowledgements, agreements, waivers and covenants of the undersigned set forth in this Letter of Transmittal will remain in full force and effect pursuant to its terms. Any modification to any term of this Letter of Transmittal requires the prior written consent of both the undersigned and Parent.

No authority herein conferred or agreed to be conferred shall be affected by, and all such authority shall survive, the death or incapacity of the undersigned. All obligations of the undersigned hereunder shall be binding upon the heirs, executors, administrators, legal representatives, successors and permitted assigns of the undersigned.

The undersigned hereby acknowledges and agrees that Parent and its Affiliates (including the Surviving Company) are third-party beneficiaries of this Letter of Transmittal, and any representations, warranties, acknowledgements, agreements, waivers and covenants are made to and for the benefit of each of Parent, its Affiliates (including the Surviving Company) and the Exchange Agent severally and shall be enforceable by each of Parent, its Affiliates (including the Surviving Company) and the Exchange Agent severally; provided, that the provisions hereof applicable to the Escrow Agent and the Securityholder Representative are intended, and shall be, for the benefit of each of them as third party beneficiaries.

8

This Letter of Transmittal shall be governed by and construed in accordance with the laws of the State of Delaware, without giving effect to principles of conflicts of laws that would require the application of the laws of any other jurisdiction.

The undersigned hereby agrees that any Proceeding seeking to enforce any provision of, or based on any matter arising out of or in connection with, this Letter of Transmittal or the Merger Agreement or the transactions contemplated hereby or thereby shall be brought in any federal or state court located in the State of Delaware, and the undersigned hereby irrevocably consents to the jurisdiction of such courts (and of the appropriate appellate courts therefrom) in any such Proceeding and irrevocably waives, to the fullest extent permitted by law, any objection that he, she or it may now or hereafter have to the laying of the venue of any such Proceeding in any such court or that any such Proceeding brought in any such court has been brought in an inconvenient forum.

THE UNDERSIGNED HEREBY AND PURSUANT TO SECTION 11.10 OF THE MERGER AGREEMENT IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY PROCEEDING ARISING OUT OF OR RELATED TO THIS LETTER OF TRANSMITTAL OR THE MERGER AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY.

Wherever possible, each provision hereof shall be interpreted in such manner as to be effective and valid under Applicable Law. If any term or provision of this Letter of Transmittal shall for any reason and to any extent be invalid, illegal or unenforceable in any jurisdiction, such invalidity, illegality or unenforceability shall not affect any other term or provision of this Letter of Transmittal or invalidate or render unenforceable such term or provision in any other jurisdiction. Upon such determination that any term or other provision is invalid, illegal or unenforceable, Parent shall, upon written notice to the undersigned, modify this Letter of Transmittal so that the transactions contemplated by this Letter of Transmittal and the Merger Agreement be consummated as originally contemplated to the greatest extent possible.

(Remainder of Page Intentionally Left Blank)

9

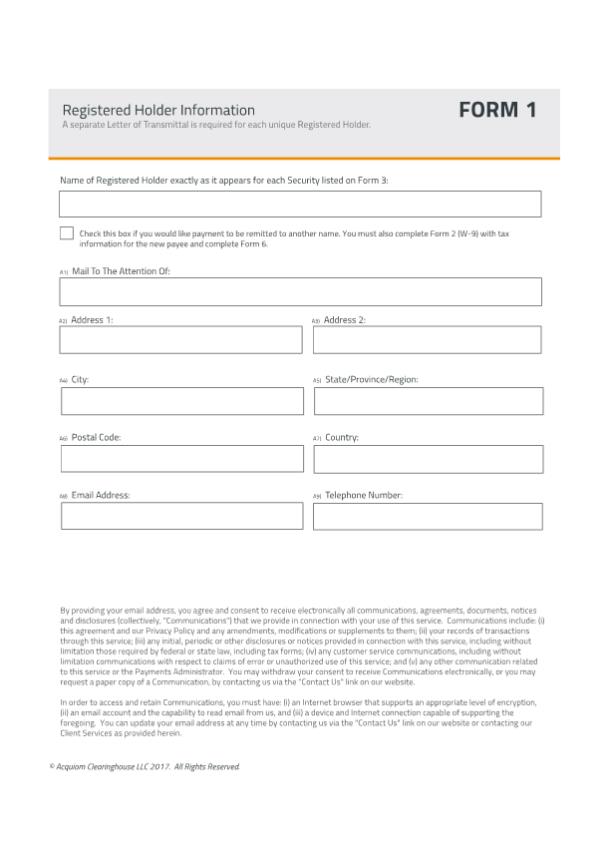

Registered Holder Information FORM 1

A separate

Letter of Transmittal is required for each unique Registered Holder.

Name of Registered Holder exactly as it appears for each Security listed on Form 3:

Check this box if you would like payment to be remitted to another name. You must also complete Form 2 (W-9) with tax information for the new payee and complete

Form 6.

A1) Mail To The Attention Of:

A2) Address 1: A3) Address 2:

A4) City: A5) State/Province/Region:

A6) Postal Code: A7) Country:

A8) Email Address: A9) Telephone Number:

By providing your email address, you

agree and consent to receive electronically all communications, agreements, documents, notices and disclosures (collectively, Communications) that we provide in connection with your use of this service. Communications include: (i) this

agreement and our Privacy Policy and any amendments, modifications or supplements to them; (ii) your records of transactions through this service; (iii) any initial, periodic or other disclosures or notices provided in connection with this service,

including without limitation those required by federal or state law, including tax forms; (iv) any customer service communications, including without limitation communications with respect to claims of error or unauthorized use of this service; and

(v) any other communication related to this service or the Payments Administrator. You may withdraw your consent to receive Communications electronically, or you may request a paper copy of a Communication, by contacting us via the Contact

Us link on our website.

In order to access and retain Communications, you must have: (i) an Internet browser that supports an appropriate level of

encryption, (ii) an email account and the capability to read email from us, and (iii) a device and Internet connection capable of supporting the foregoing. You can update your email address at any time by contacting us via the Contact Us

link on our website or contacting our Client Services as provided herein.

© Acquiom Clearinghouse LLC 2017, All Rights Reserved.

10

| Form W-9

(Rev. October 2018) Department of the Treasury Internal Revenue Service |

Request for Taxpayer Identification Number and Certification

u Go to www.irs.gov/FormW9 for instructions and the latest information. |

Give Form to the requester. Do not send to the IRS.

|

||

| Print or type See Specific Instructions on page 3.

|

1 Name (as shown on your income tax return). Name is required on this line; do not leave this line blank.

|

|||||||||||||||||||||

|

2 Business name/disregarded entity name, if different from above

|

||||||||||||||||||||||

| 3 Check appropriate box for federal tax classification of the

person whose name is entered on line 1. Check only one of the

|

4 Exemptions (codes apply only to

Exempt payee code (if any)

Exemption from FATCA reporting code (if any)

(Applies to accounts maintained outside the U.S.)

|

|||||||||||||||||||||

|

☐ Individual/sole proprietor or single-member LLC

|

☐ | C Corporation | ☐ | S Corporation | ☐ | Partnership | ☐ | Trust/estate | ||||||||||||||

| ☐ Limited liability company. Enter the tax classification (C=C corporation, S=S corporation, P=Partnership) u

Note: Check the appropriate box in the line above for the tax classification of the single-member owner. Do not check LLC

☐ Other (see instructions) u

|

||||||||||||||||||||||

|

5 Address (number, street, and apt. or suite no.) See instructions.

|

Requesters name and address (optional) |

|||||||||||||||||||||

|

6 City, state, and ZIP code

|

||||||||||||||||||||||

|

7 List account number(s) here (optional)

|

||||||||||||||||||||||

|

Part I |

Taxpayer Identification Number (TIN) |

|

| Enter your TIN in the appropriate box. The TIN provided must match the name given on line 1 to avoid backup withholding. For individuals, this is generally your social security number (SSN). However, for a resident alien, sole proprietor, or disregarded entity, see the instructions for Part I, later. For other entities, it is your employer identification number (EIN). If you do not have a number, see How to get a TIN, later.

|

|

Social security number

|

||||||||||||||||||||||

| - |

- | |||||||||||||||||||||||

| or | ||||||||||||||||||||||||

| Note: If the account is in more than one name, see the instructions for line 1. Also see What Name and Number To Give the Requester for guidelines on whose number to enter. |

Employer identification number |

|||||||||||||||||||||||||

| - |

||||||||||||||||||||||||||

| Part II | Certification |

Under penalties of perjury, I certify that:

| 1. | The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); and |

| 2. | I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and |

| 3. | I am a U.S. citizen or other U.S. person (defined below); and |

| 4. | The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. |

Certification instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends, you are not required to sign the certification, but you must provide your correct TIN. See the instructions for Part II, later.

| Sign Here |

Signature of U.S. person u |

Date u |

| Cat. No. 10231X | Form W-9 (Rev. 10-2018) |

|||

| Form W-9 (Rev. 10-2018) |

Page 2 |

| Form W-9 (Rev. 10-2018) |

Page 3 |

| Form W-9 (Rev. 10-2018) |

Page 4 |

| Form W-9 (Rev. 10-2018) |

Page 5 |

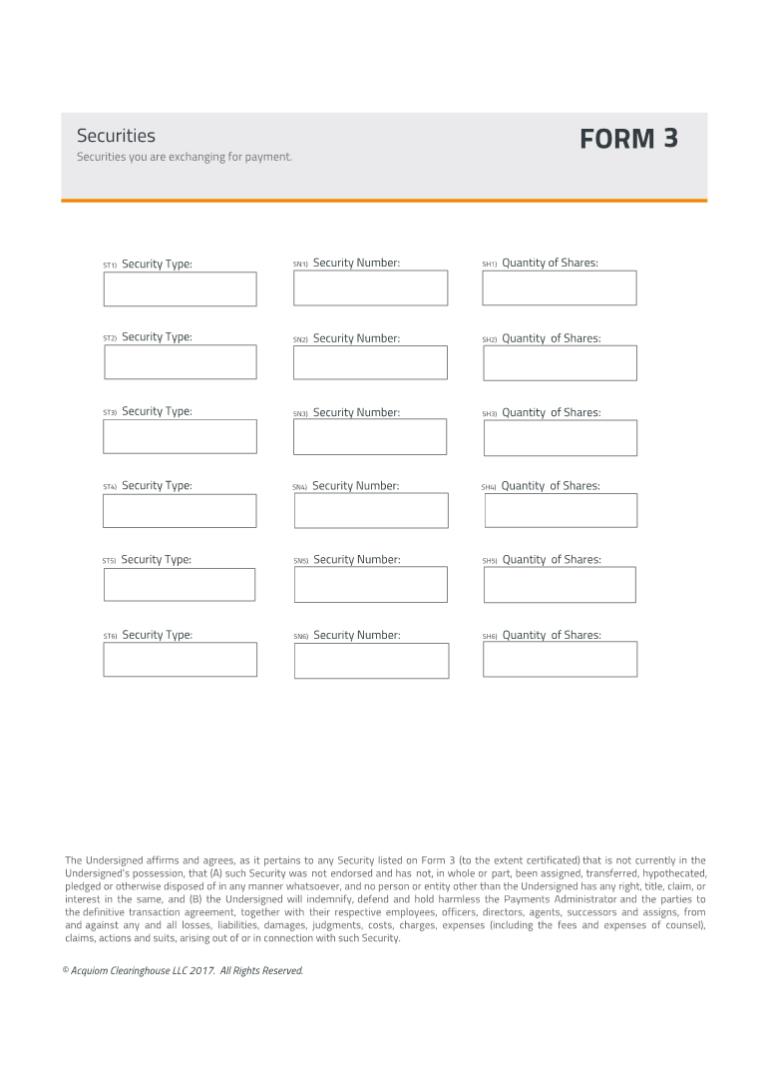

Securities

FORM 3

Securities you are exchanging for payment.

ST1) Security Type: SN1) Security Number: SH1)

Quantity of Shares:

ST2) Security Type: SN2) Security Number: SH2) Quantity of Shares:

ST3) Security Type: SN3) Security Number: SH3) Quantity of Shares:

ST4) Security Type: SN4)

Security Number: SH4) Quantity of Shares:

ST5) Security Type: SN5) Security Number: SH5) Quantity of Shares:

ST6) Security Type: SN6) Security Number: SH6) Quantity of Shares:

The Undersigned affirms and

agrees, as it pertains to any Security listed on Form 3 (to the extent certificated) that is not currently in the Undersigneds possession, that (A) such Security was not endorsed and has not, in whole or part, been assigned, transferred,

hypothecated, pledged or otherwise disposed of in any manner whatsoever, and no person or entity other than the Undersigned has any right, title, claim, or interest in the same, and (B) the Undersigned will indemnify, defend and hold harmless the

Payments Administrator and the parties to the definitive transaction agreement, together with their respective employees, officers, directors, agents, successors and assigns, from and against any and all loss, liabilities, damages judgments, costs,

charges, expenses (including the fees and expenses of counsel), claims, actions and suits, arising out of or in connection with such Security.

© Acquiom

Clearinghouse LLC 2017. All Rights Reserved.

17

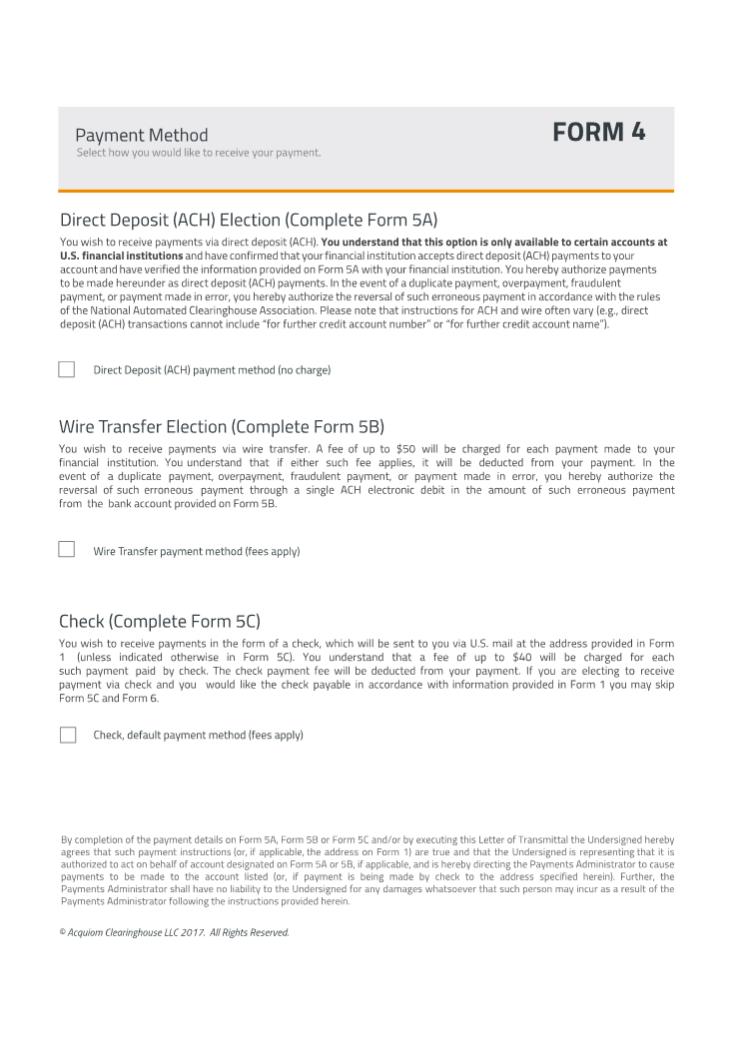

Payment Method Form 4

Select how you would like to

receive your payment.

Direct Deposit (ACH) Election (Complete Form 5A)

You

wish to receive payments via direct deposit (ACH). You understand that this option is only available to certain accounts at U.S. financial institutions and have confirmed that your financial institution accepts direct deposit (ACH) payments to your

account and have verified the information provided on Form 5A with your financial institution. You hereby authorize payments to be made hereunder as direct deposit (ACH) payments. In the event of a duplicate payment, overpayment, fraudulent payment,

or payment made in error, you hereby authorize the reversal of such erroneous payment in accordance with the rules of the National Automated Clearinghouse Association. Please note that instructions for ACH and wire often vary (e.g., direct deposit

(ACH) transactions cannot include for further credit account number or for further credit account name).

Direct Deposit (ACH) payment

method (no charge)

Wire Transfer Election (Complete Form 5B)

You wish to

receive payments via wire transfer. A fee of up to $50 will be charged for each payment made to your financial institution. You understand that if either such fee applies it will be deducted from your payment. In the event of a duplicate payment,

overpayment, fraudulent payment, or payment made in error, you hereby authorize the reversal of such erroneous payment through a single ACH electronic debit in the amount of such erroneous payment from the bank account provided on Form 5B.

Wire Transfer payment method (fees apply)

Check (Complete Form 5C)

You wish to receive payments in the form of a check, which will be sent to you via U.S. mail at the address provided in Form 1 (unless indicated otherwise in Form

5C). You understand that a fee of up to $40 will be charged for each such payment paid by check. The check payment fee will be deducted from your payment. If you are electing to receive payment via check and you would like the check payable in

accordance with information provided in Form 1 you may skip Form 5C and Form 6.

Check, default payment method (fees apply)

By completion of the payment details on Form 5A, Form 5B and Form 5C and/or by executing this Letter of Transmittal the Undersigned hereby agrees that such payment instructions

(or, if applicable, the address on Form 1) are true and that the Undersigned is representing that it is authorized to act on behalf of account designated on Form 5A or 5B, if applicable, and is hereby directing the Payments Administrator to cause

payments to be made to the account listed (or, if payment is being made by check to the address specified herein). Further, the Payments Administrator shall have no liability to the Undersigned for any damages whatsoever that such person may incur

as a result of the Payments Administrator following the instructions provided herein.

© Acquiom Clearinghouse LLC 2017. All Rights Reserved.

18

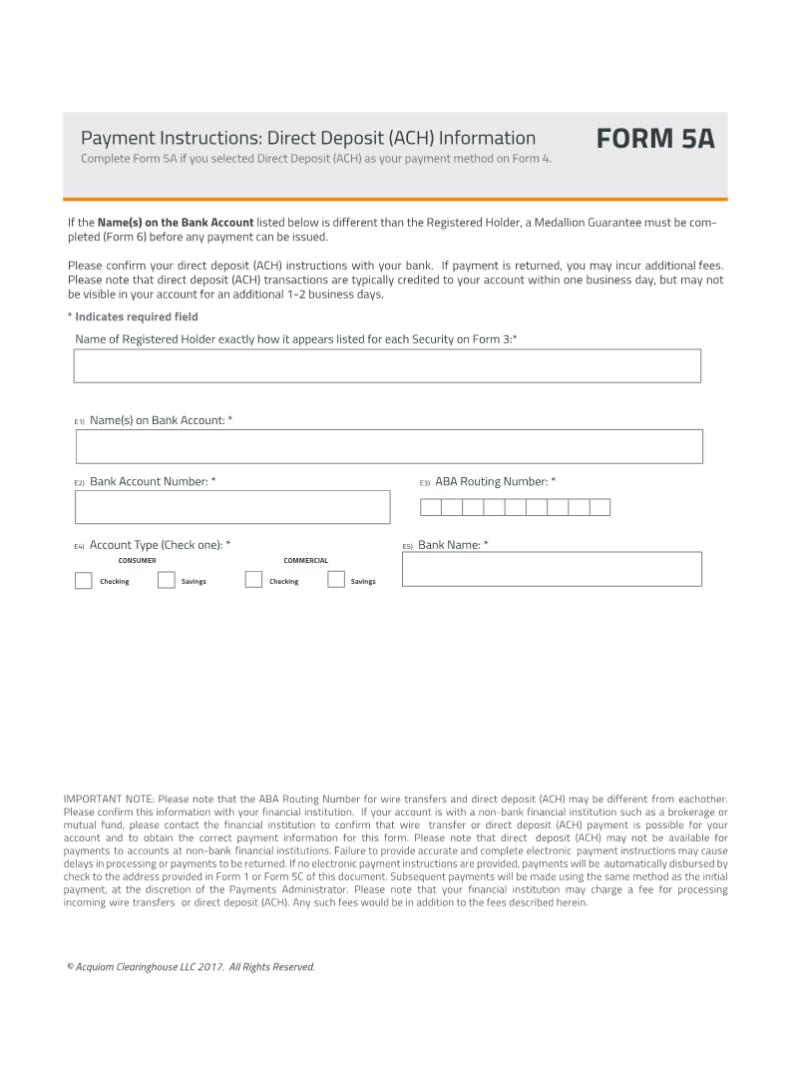

Payment Instructions: Direct Deposit (ACH) Information FORM 5A

Complete Form 5A if you selected Direct Deposit (ACH) as your payment method on Form 4.

If the

Name(s) on the Bank Account listed below is different than the Registered Holder, a Medallion Guarantee must be completed (Form 6) before any payment can be issued.

Please confirm your direct deposit (ACH) instructions with your bank. If payment is returned, you may incur additional fees. Please note that direct deposit (ACH)

transactions are typically credited to your account within one business day, but may not be visible in your account for an additional 1-2 business days.

*

Indicates required field

Name of Registered Holder exactly how it appears listed for each Security on Form 3:*

E1) Name(s) on Bank Account: *

E2) Bank Account Number: * E3) ABA Routing Number: *

E4) Account Type (Check one): * E5) Bank Name: *

CONSUMER Checking Savings

COMMERCIAL Checking Savings

IMPORTANT NOTE: Please note that the ABA Routing Number for wire transfers and direct deposit (ACH) may be different from eachother.

Please confirm this information with your financial institution. If your account is with a non-bank financial institution such as a brokerage or mutual fund, please contract the financial institution to confirm that wire transfer or direct deposit

(ACH) payment is possible for your account and to obtain the correct payment information for this form. Please note that direct deposit (ACH) may not be available for payments to accounts at non-bank financial institutions. Failure to provide

accurate and complete electronic payment instructions may cause delays in processing or payments to be returned. If no electronic payment instructions are provided, payments will be automatically disbursed by check to the address provided in Form 1

or Form 5C of this document. Subsequent payments will be made using the same methods as the initial payment, at the discretion of the Payments Administrator. Please note that your financial institution may charge a fee for processing incoming wire

transfers or direct deposit (ACH). Any such fees would be addition to the fees described herein.

© Acquiom Clearinghouse LLC 2017. All Rights Reserved.

19

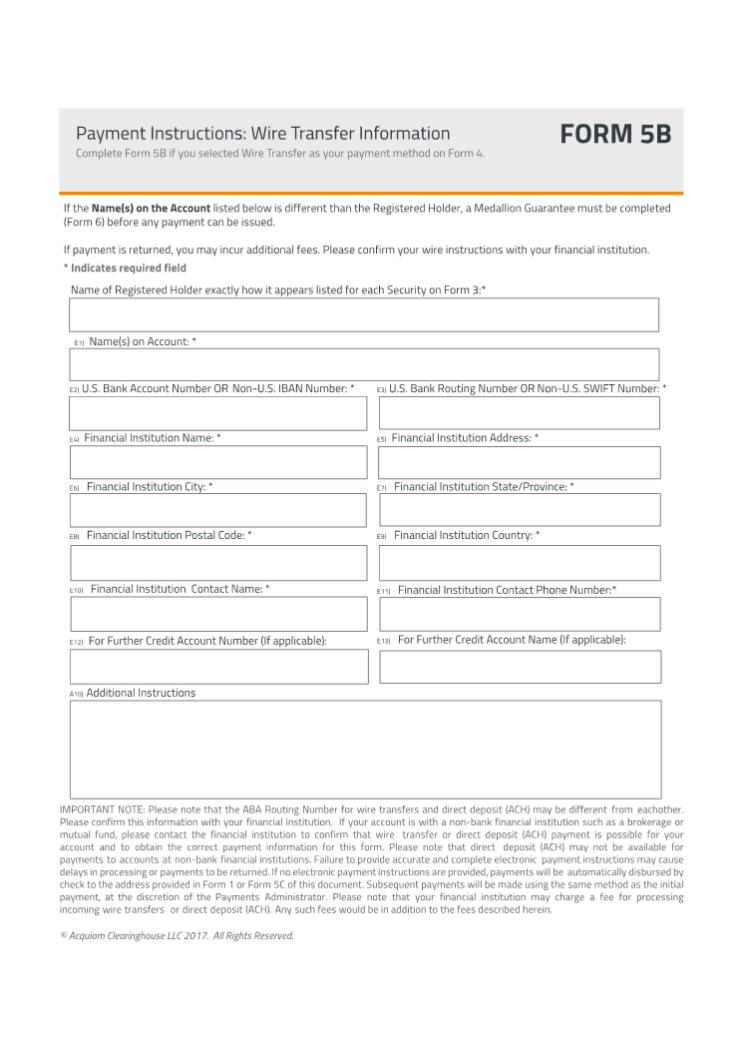

Payment Instructions: Wire Transfer Information

FORM 5B

Complete Form 5B if you selected Wire Transfer as your payment method

on Form 4.

If the Name(s) on the Account listed below is different than the Registered Holder, a Medallion Guarantee must be completed (Form 6) before any payment

can be issued.

If payment is returned, you may incur additional fees. Please confirm your wire instructions with your financial institution.

* Indicates required field

Name of Registered Holder exactly how it appears listed for each

Security on Form 3:*

E1) Name(s) on Account: *

E2) U.S. Bank Account Number

OR Non-U.S. IBAN Number: *

E3) U.S. Bank Routing Number OR Non-U.S. SWIFT Number: *

E4) Financial Institution Name: *

E5) Financial Institution Address: *

E6) Financial Institution City: *

E7) Financial Institution State/Province: *

E8) Financial Institution Postal Code: *

E9) Financial Institution Country: *

E10) Financial Institution Contact Name: *

E11) Financial Institution Contact Phone Number: *

E12) For Further Credit Account Number (If applicable):

E13) For Further

Credit Account Name (If applicable):

A10) Additional Instructions

IMPORTANT

NOTE: Please note that the ABA Routing Number for wire transfers and direct deposit (ACH) may be different form eachother. Please confirm this information with your financial institution. If your account is with a non-bank financial institution such

as a brokerage or mutual fund, please contact the financial institution to confirm that wire transfer or direct deposit (ACH) payment is possible for your account and to obtain the correct payment information for this form. Please note that direct

deposit (ACH) may not be available for payments to accounts at non-bank financial institutions. Failure to provide accurate and complete electronic payment instructions may cause delays in processing or payments to be returned. If no electronic

payment instructions are provided, payments will be automatically disbursed by check to the address provided in Form 1 or Form 5C of this document. Subsequent payments will be made using the same method as the initial payment, at the discretion of

the Payments Administrator. Please note that your financial institution may charge a fee for processing incoming wire transfers or direct deposit (ACH). Any such fees would be in addition to the fees described herein.

©Acquiom Clearinghouse LLC 2017. All Rights Reserved.

20

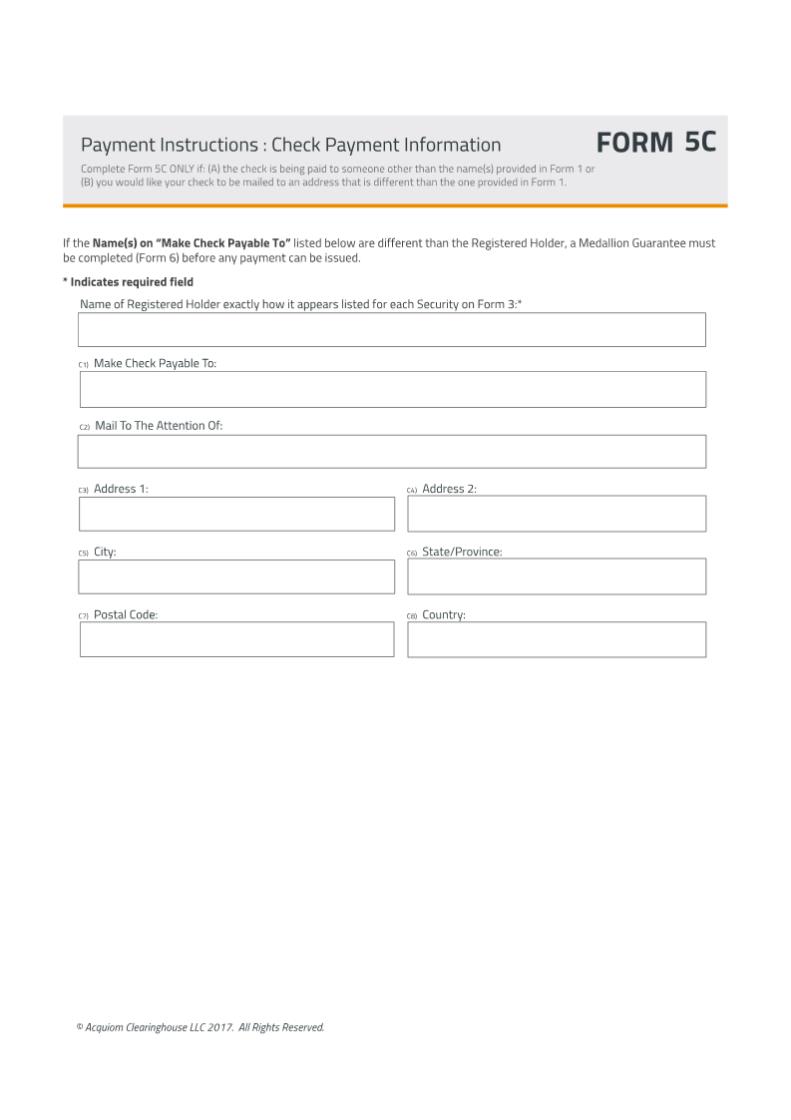

Payment Instructions : Check Payment Information

Complete Form 5C ONLY if: (A) the check is being paid to someone other than the name(s) provided in Form 1 or (B) you would like your check to be mailed to an

address that is different than the one provided in Form 1.

If the Name(s) on Make Check Payable To listed below are different than the Registered

Holder, a Medallion Guarantee must be competed (Form 6) before any payment can be issued.

* Indicates required field

Name of Registered Holder exactly how it appears listed for each Security on Form 3:*

C1) Make

Check Payable To:

C2) Mail To The Attention Of:

C3) Address 1:

C4) Address 2:

C5) City:

C6) State/Province:

C7) Postal Code:

C8) Country:

© Acquiom Clearinghouse LLC 2017. All Rights Reserved.

21

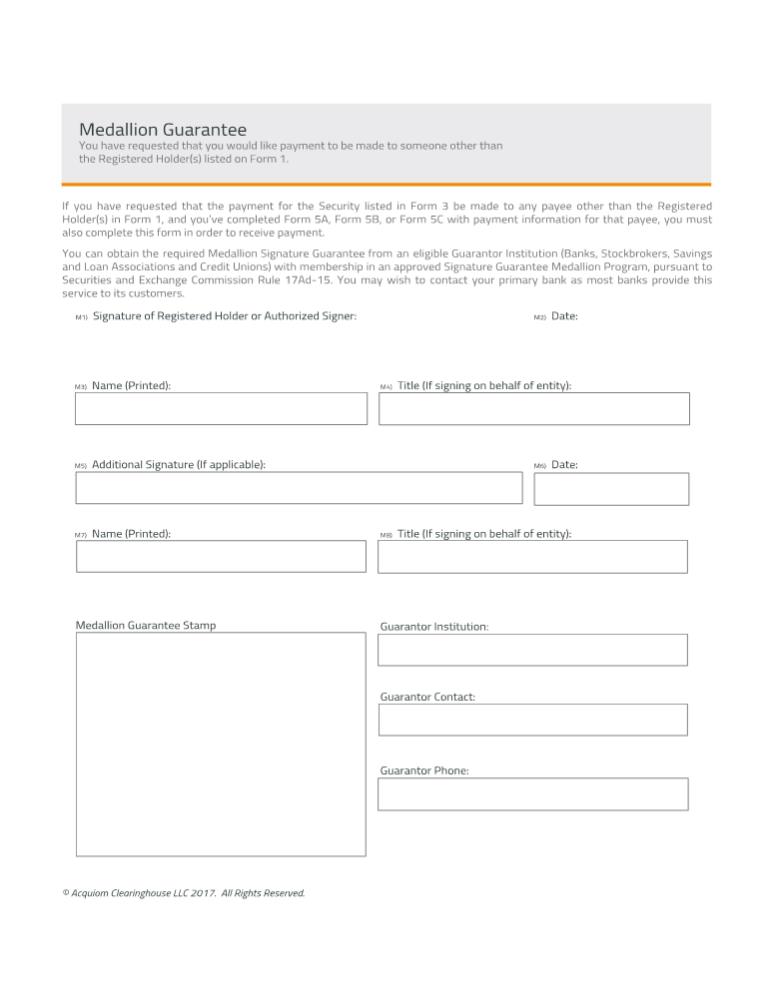

Medallion Guarantee

You have requested that you

would like payment to be made to someone other than the Registered Holder(s) listed on Form 1.

If you have requested that the payment for the Security listed in

Form 3 be made to any payee other than the Registered Holder(s) in Form 1, and youve completed Form 5A, Form 5B, or Form 5C with payment information for that payee, you must also complete this form in order to receive payment.

You can obtain the required Medallion Signature Guarantee from an eligible Guarantor Institution (Banks, Stockbrokers, Savings and Loan Associations and Credit Unions) with

membership in an approved Signature Guarantee Medallion Program, pursuant to Securities and Exchange Commission Rule 17Ad-15. You may wish to contact your primary bank as most banks provide this service to its customers.

M1) Signature of Registered Holder or Authorized Signer:

M2) Date:

M3) Name (Printed):

M4) Title (If signing on behalf of entity):

M5) Additional Signature (If applicable):

M6) Date:

M7) Name (Printed):

M8) Title (If signing on behalf of entity):

Medallion Guarantee Stamp

Guarantor Institution:

Guarantor Contact:

Guarantor Phone:

© Acquiom Clearinghouse LLC 2017. All Rights Reserved.

22

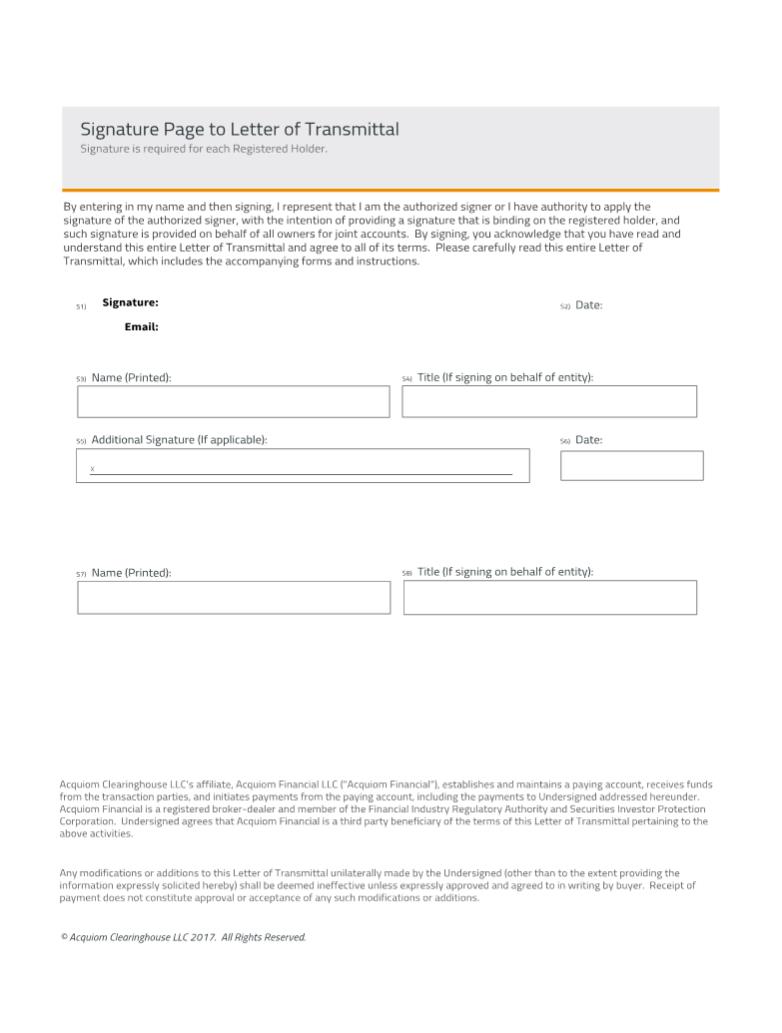

Signature Page to Letter of Transmittal

Signature

is required for each Registered Holder.

By entering in my name and then signing, I represent that I am the authorized signer or I have authority to apply the

signature of the authorized signer, with the intention of providing a signature that is binding on the registered holder, and such signature is provided on behalf of all owners for joint accounts. By signing, you acknowledge that you have read and

Transmittal, which includes the accompanying forms and instructions.

S1) Signature:

Email:

S2) Date:

S3) Name (Printed):

S4) Title (If signing on behalf of entity):

S5) Additional signature (If applicable):

x

S6) Date:

S7) Name (Printed):

S8) Title (If signing on behalf of entity):

Acquiom Clearinghouse LLCs affiliate,

Acquiom Financial LLC (Acquiom Financial), establishes and maintains a paying account, receives funds from the transaction parties, and initiates payments from the paying account, including the payments to Undersigned addressed

hereunder. Acquiom Financial is a registered broker-dealer and member of the Financial Industry Regulatory Authority and Securities Investor Protection Corporation. Undersigned agrees that Acquiom Financial is a third party beneficiary of the terms

of this Letter of Transmittal pertaining to the above activities.

Any modifications or additions to this Letter of Transmittal unilaterally made by the Undersigned

(other than to the extent providing the information expressly solicited hereby) shall be deemed ineffective unless expressly approved and agreed to in writing by buyer. Receipt of payment does not constitute approval or acceptance of any such

modifications or additions.

© Acquiom Clearinghouse LLC 2017. All Rights Reserved.

23