10-Q: Quarterly report pursuant to Section 13 or 15(d)

Published on November 20, 2018

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________

FORM 10-Q

þ |

Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

For the quarterly period ended October 31, 2018 |

||

OR

o |

Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

For the transition period from ____________ to ____________ . |

||

Commission File Number 0-21180

(Exact name of registrant as specified in its charter)

|

Delaware

(State of incorporation)

|

77-0034661

(IRS employer identification no.)

|

|

|

2700 Coast Avenue, Mountain View, CA 94043

(Address of principal executive offices)

|

||

|

(650) 944-6000

(Registrant’s telephone number, including area code)

|

||

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated

filer

|

þ |

Accelerated filer |

o |

Non-accelerated filer |

o |

Smaller reporting

company

|

o |

Emerging growth

company

|

o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. 259,508,568 shares of Common Stock, $0.01 par value, were outstanding at November 14, 2018.

|

INTUIT INC.

FORM 10-Q

INDEX

|

Page |

|

EX-10.01 |

|

EX-10.02 |

|

EX-10.03 |

|

EX-10.04 |

|

EX-31.01 | |

EX-31.02 | |

EX-32.01 | |

EX-32.02 | |

EX-101.INS XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document | |

EX-101.SCH XBRL Taxonomy Extension Schema | |

EX-101.CAL XBRL Taxonomy Extension Calculation Linkbase | |

EX-101.LAB XBRL Taxonomy Extension Label Linkbase | |

EX-101.PRE XBRL Taxonomy Extension Presentation Linkbase | |

EX-101.DEF XBRL Taxonomy Extension Definition Linkbase | |

Intuit, the Intuit logo, QuickBooks, TurboTax, Mint, Lacerte, ProSeries, and Intuit ProConnect, among others, are registered trademarks and/or registered service marks of Intuit Inc., or one of its subsidiaries, in the United States and other countries. Other parties’ marks are the property of their respective owners.

Intuit Q1 Fiscal 2019 Form 10-Q

|

2

|

||

Forward-Looking Statements

This Quarterly Report on Form 10-Q contains forward-looking statements. All statements in this report, other than statements that are purely historical, are forward-looking statements. Words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “forecast,” “estimate,” “seek,” and similar expressions also identify forward-looking statements. In this report, forward-looking statements include, without limitation, the following:

• |

our expectations and beliefs regarding future conduct and growth of the business; |

• |

our beliefs and expectations regarding seasonality, competition and other trends that affect our business; |

• |

our expectation that we will continue to invest significant resources in our product development, marketing and sales capabilities; |

• |

our expectation regarding the impact of recent U.S. tax legislation on Intuit's business and its corporate tax rate; |

• |

our expectation that we will continue to invest significant management attention and resources in our information technology infrastructure and in our privacy and security capabilities; |

• |

our expectation that we will work with the broader industry and government to protect our customers from fraud; |

• |

our expectation that we will generate significant cash from operations; |

• |

our expectation that total service and other revenue as a percentage of our total revenue will continue to grow; |

• |

our expectations regarding the development of future products, services, business models and technology platforms and our research and development efforts; |

• |

our assumptions underlying our critical accounting policies and estimates, including our judgments and estimates regarding revenue recognition; stock volatility and other assumptions used to estimate the fair value of share-based compensation; the fair value of goodwill; and expected future amortization of acquired intangible assets; |

• |

our intention not to sell our investments and our belief that it is more likely than not that we will not be required to sell them before recovery at par; |

• |

our belief that the investments we hold are not other-than-temporarily impaired; |

• |

our belief that we take prudent measures to mitigate investment related risks; |

• |

our belief that our exposure to currency exchange fluctuation risk will not be significant in the future; |

• |

our assessments and estimates that determine our effective tax rate; |

• |

our belief that it is not reasonably possible that there will be a significant increase or decrease in our unrecognized tax benefits over the next 12 months; |

• |

our belief that our cash and cash equivalents, investments and cash generated from operations will be sufficient to meet our seasonal working capital needs, capital expenditure requirements, contractual obligations, debt service requirements and other liquidity requirements associated with our operations for at least the next 12 months; |

• |

our expectation that we will return excess cash generated by operations to our stockholders through repurchases of our common stock and the payment of cash dividends, after taking into account our operating and strategic cash needs; |

• |

our judgments and assumptions relating to our loan portfolio; |

• |

our belief that the credit facility will be available to us should we choose to borrow under it; and |

• |

our assessments and beliefs regarding the future outcome of pending legal proceedings and inquiries by regulatory authorities, the liability, if any, that Intuit may incur as a result of those proceedings and inquiries, and the impact of any potential losses associated with such proceedings or inquiries on our financial statements. |

We caution investors that forward-looking statements are only predictions based on our current expectations about future events and are not guarantees of future performance. We encourage you to read carefully all information provided in this Quarterly Report and in our other filings with the Securities and Exchange Commission before deciding to invest in our stock or to maintain or change your investment. These forward-looking statements are based on information as of the filing date of this Quarterly Report, and we undertake no obligation to revise or update any forward-looking statement for any reason.

Intuit Q1 Fiscal 2019 Form 10-Q

|

3

|

||

PART I - FINANCIAL INFORMATION |

ITEM 1 - FINANCIAL STATEMENTS |

|

INTUIT INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

| |||||||

Three Months Ended |

|||||||

(In millions, except per share amounts) |

October 31, 2018 |

October 31, 2017 |

|||||

Net revenue: |

|||||||

Product |

$ |

$ |

|||||

Service and other |

|||||||

Total net revenue |

|||||||

Costs and expenses: |

|||||||

Cost of revenue: |

|||||||

Cost of product revenue |

|||||||

Cost of service and other revenue |

|||||||

Amortization of acquired technology |

|||||||

Selling and marketing |

|||||||

Research and development |

|||||||

General and administrative |

|||||||

Amortization of other acquired intangible assets |

|||||||

Total costs and expenses |

|||||||

Operating loss |

( |

) |

( |

) |

|||

Interest expense |

( |

) |

( |

) |

|||

Interest and other income, net |

|||||||

Loss before income taxes |

( |

) |

( |

) |

|||

Income tax provision (benefit) |

( |

) |

( |

) |

|||

Net income (loss) |

$ |

$ |

( |

) |

|||

Basic net income (loss) per share |

$ |

$ |

( |

) |

|||

Shares used in basic per share calculations |

|||||||

Diluted net income (loss) per share |

$ |

$ |

( |

) |

|||

Shares used in diluted per share calculations |

|||||||

Cash dividends declared per common share |

$ |

$ |

|||||

See accompanying notes.

Intuit Q1 Fiscal 2019 Form 10-Q

|

4

|

||

|

INTUIT INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (unaudited)

| |||||||

Three Months Ended |

|||||||

(In millions) |

October 31, 2018 |

October 31, 2017 |

|||||

Net income (loss) |

$ |

$ |

( |

) |

|||

Other comprehensive loss, net of income taxes: |

|||||||

Foreign currency translation loss |

( |

) |

( |

) |

|||

Total other comprehensive loss, net |

( |

) |

( |

) |

|||

Comprehensive income (loss) |

$ |

$ |

( |

) |

|||

See accompanying notes.

Intuit Q1 Fiscal 2019 Form 10-Q

|

5

|

||

|

INTUIT INC.

CONDENSED CONSOLIDATED BALANCE SHEETS (unaudited)

| |||||||

(In millions) |

October 31, 2018 |

July 31, 2018 |

|||||

ASSETS |

|||||||

Current assets: |

|||||||

Cash and cash equivalents |

$ |

$ |

|||||

Investments |

|||||||

Accounts receivable, net |

|||||||

Income taxes receivable |

|||||||

Prepaid expenses and other current assets |

|||||||

Current assets before funds held for customers |

|||||||

Funds held for customers |

|||||||

Total current assets |

|||||||

Long-term investments |

|||||||

Property and equipment, net |

|||||||

Goodwill |

|||||||

Acquired intangible assets, net |

|||||||

Other assets |

|||||||

Total assets |

$ |

$ |

|||||

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|||||||

Current liabilities: |

|||||||

Short-term debt |

$ |

$ |

|||||

Accounts payable |

|||||||

Accrued compensation and related liabilities |

|||||||

Deferred revenue |

|||||||

Other current liabilities |

|||||||

Current liabilities before customer fund deposits |

|||||||

Customer fund deposits |

|||||||

Total current liabilities |

|||||||

Long-term debt |

|||||||

Long-term deferred income tax liabilities |

|||||||

Other long-term obligations |

|||||||

Total liabilities |

|||||||

Commitments and contingencies |

|||||||

Stockholders’ equity: |

|||||||

Preferred stock |

|||||||

Common stock and additional paid-in capital |

|||||||

Treasury stock, at cost |

( |

) |

( |

) |

|||

Accumulated other comprehensive loss |

( |

) |

( |

) |

|||

Retained earnings |

|||||||

Total stockholders’ equity |

|||||||

Total liabilities and stockholders’ equity |

$ |

$ |

|||||

See accompanying notes.

Intuit Q1 Fiscal 2019 Form 10-Q

|

6

|

||

|

INTUIT INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY (unaudited)

| ||||||||||||||||||||||

(In millions, except shares in thousands) |

Shares of

Common

Stock

|

Common

Stock and

Additional

Paid-In

Capital

|

Treasury

Stock

|

Accumulated

Other

Comprehensive

Loss

|

Retained

Earnings

|

Total

Stockholders'

Equity

|

||||||||||||||||

Balance at July 31, 2018 |

$ |

$ |

( |

) |

$ |

( |

) |

$ |

$ |

|||||||||||||

Comprehensive income |

— |

— |

— |

( |

) |

|||||||||||||||||

Issuance of stock under employee stock plans, net of shares withheld for employee taxes |

— |

— |

||||||||||||||||||||

Stock repurchases under stock repurchase programs |

( |

) |

— |

( |

) |

— |

— |

( |

) |

|||||||||||||

Dividends and dividend rights declared ($0.47 per share) |

— |

— |

— |

— |

( |

) |

( |

) |

||||||||||||||

Share-based compensation expense |

— |

— |

— |

— |

||||||||||||||||||

Balance at October 31, 2018 |

$ |

$ |

( |

) |

$ |

( |

) |

$ |

$ |

|||||||||||||

(In millions, except shares in thousands) |

Shares of

Common

Stock

|

Common

Stock and

Additional

Paid-In

Capital

|

Treasury

Stock

|

Accumulated

Other

Comprehensive

Loss

|

Retained

Earnings

|

Total

Stockholders'

Equity

|

||||||||||||||||

Balance at July 31, 2017 |

$ |

$ |

( |

) |

$ |

( |

) |

$ |

$ |

|||||||||||||

Comprehensive loss |

— |

— |

— |

( |

) |

( |

) |

( |

) |

|||||||||||||

Issuance of stock under employee stock plans, net of shares withheld for employee taxes |

— |

— |

— |

|||||||||||||||||||

Stock repurchases under stock repurchase programs |

( |

) |

— |

( |

) |

— |

— |

( |

) |

|||||||||||||

Dividends and dividend rights declared ($0.39 per share) |

— |

— |

— |

— |

( |

) |

( |

) |

||||||||||||||

Share-based compensation expense |

— |

— |

— |

— |

||||||||||||||||||

Balance at October 31, 2017 |

$ |

$ |

( |

) |

$ |

( |

) |

$ |

$ |

|||||||||||||

See accompanying notes.

Intuit Q1 Fiscal 2019 Form 10-Q

|

7

|

||

|

INTUIT INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (unaudited)

| |||||||

Three Months Ended |

|||||||

(In millions) |

October 31, 2018 |

October 31, 2017 |

|||||

Cash flows from operating activities: |

|||||||

Net income (loss) |

$ |

$ |

( |

) |

|||

Adjustments to reconcile net income (loss) to net cash used in operating activities: |

|||||||

Depreciation |

|||||||

Amortization of acquired intangible assets |

|||||||

Share-based compensation expense |

|||||||

Deferred income taxes |

( |

) |

( |

) |

|||

Other |

|||||||

Total adjustments |

|||||||

Changes in operating assets and liabilities: |

|||||||

Accounts receivable |

( |

) |

|||||

Income taxes receivable |

( |

) |

|||||

Prepaid expenses and other assets |

( |

) |

( |

) |

|||

Accounts payable |

|||||||

Accrued compensation and related liabilities |

( |

) |

( |

) |

|||

Deferred revenue |

( |

) |

( |

) |

|||

Other liabilities |

|||||||

Total changes in operating assets and liabilities |

( |

) |

( |

) |

|||

Net cash used in operating activities |

( |

) |

( |

) |

|||

Cash flows from investing activities: |

|||||||

Purchases of corporate and customer fund investments |

( |

) |

( |

) |

|||

Sales of corporate and customer fund investments |

|||||||

Maturities of corporate and customer fund investments |

|||||||

Net change in customer fund deposits |

( |

) |

|||||

Purchases of property and equipment |

( |

) |

( |

) |

|||

Originations of term loans to small businesses |

( |

) |

( |

) |

|||

Principal repayments of term loans from small businesses |

|||||||

Other |

( |

) |

|||||

Net cash provided by (used in) investing activities |

( |

) |

|||||

Cash flows from financing activities: |

|||||||

Proceeds from borrowings under revolving credit facility |

|||||||

Repayment of debt |

( |

) |

( |

) |

|||

Proceeds from issuance of stock under employee stock plans |

|||||||

Payments for employee taxes withheld upon vesting of restricted stock units |

( |

) |

( |

) |

|||

Cash paid for purchases of treasury stock |

( |

) |

( |

) |

|||

Dividends and dividend rights paid |

( |

) |

( |

) |

|||

Other |

( |

) |

|||||

Net cash provided by (used in) financing activities |

( |

) |

|||||

Effect of exchange rates on cash, cash equivalents, restricted cash, and restricted cash equivalents |

( |

) |

( |

) |

|||

Net decrease in cash, cash equivalents, restricted cash, and restricted cash equivalents |

( |

) |

( |

) |

|||

Cash, cash equivalents, restricted cash, and restricted cash equivalents at beginning of period |

|||||||

Cash, cash equivalents, restricted cash, and restricted cash equivalents at end of period |

$ |

$ |

|||||

Reconciliation of cash, cash equivalents, restricted cash, and restricted cash equivalents reported within the consolidated balance sheets to the total amounts reported on the consolidated statements of cash flows |

|||||||

Cash and cash equivalents |

$ |

$ |

|||||

Restricted cash and restricted cash equivalents included in funds held for customers |

|||||||

Total cash, cash equivalents, restricted cash, and restricted cash equivalents at end of period |

$ |

$ |

|||||

See accompanying notes.

Intuit Q1 Fiscal 2019 Form 10-Q

|

8

|

||

|

INTUIT INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (unaudited)

|

1. Description of Business and Summary of Significant Accounting Policies |

Description of Business |

Intuit helps consumers, small businesses, and the self-employed prosper by delivering financial management and compliance products and services. We also provide specialized tax products to accounting professionals, who are key partners that help us reach small business customers.

Our flagship brands, QuickBooks and TurboTax, help customers run their small businesses, pay employees and send invoices, separate business and personal expenses, track their money, and file income taxes. ProSeries and Lacerte are our leading tax preparation offerings for professional accountants. Incorporated in 1984 and headquartered in Mountain View, California, we sell our products and services primarily in the United States.

Basis of Presentation |

These condensed consolidated financial statements include the financial statements of Intuit and its wholly owned subsidiaries. We have eliminated all significant intercompany balances and transactions in consolidation. We have included all adjustments, consisting only of normal recurring items, which we considered necessary for a fair presentation of our financial results for the interim periods presented.

We acquired TSheets.com LLC, Exactor, Inc., and Applatix, Inc. in the second quarter of fiscal 2018. We have included the results of operations for these companies in our consolidated statements of operations from the dates of acquisition.

Effective August 1, 2018, we adopted the requirements of Accounting Standards Update (ASU) 2014-09, “Revenue from Contracts with Customers (Topic 606)” and ASU 2016-18, “Statement of Cash Flows (Topic 230): Restricted Cash.” All prior period amounts and disclosures set forth in this Quarterly Report on Form 10-Q have been restated to comply with these standards.

Seasonality |

Significant Accounting Policies |

We describe our significant accounting policies in Note 1 to the financial statements in Item 8 of our Annual Report on Form 10-K for the fiscal year ended July 31, 2018. See the discussion of changes to our revenue recognition policy for the adoption of Topic 606, the new revenue recognition standard, below. There have been no other changes to our significant accounting policies during the first three months of fiscal 2019.

We derive revenue from the sale of packaged software products, software subscriptions, hosted services, payroll services, merchant payment processing services, financial supplies and hardware. We enter into contracts with customers that include promises to transfer various products and services, which are generally capable of being distinct and accounted for as separate performance obligations. Revenue is recognized when the promised goods or services are transferred to customers, in an amount that reflects the consideration allocated to the respective performance obligation.

Intuit Q1 Fiscal 2019 Form 10-Q

|

9

|

||

Nature of Products and Services

Desktop Offerings

Our desktop offerings consist of our QuickBooks Desktop products, which include both packaged software products and software subscriptions, our consumer and professional tax desktop products, which include TurboTax, Lacerte and ProSeries, our desktop payroll products, and merchant payment processing services for small businesses who use our desktop offerings.

Our QuickBooks Desktop packaged software products include a perpetual software license as well as enhancements and connected services. We recognize revenue for our QuickBooks Desktop packaged software products at the time the software license is delivered. We have determined that the enhancements and connected services included in our QuickBooks Desktop packaged software products are immaterial within the context of the contract.

Our QuickBooks Desktop software subscriptions include a term software license, version protection, enhancements, support and various connected services. We recognize revenue for the software license and version protection at the time they are delivered and recognize revenue for support and connected services over the subscription term as the services are provided. We have determined that the enhancements included in our QuickBooks Desktop software subscriptions are immaterial within the context of the contract.

Our consumer and professional tax desktop products include an on-premise tax software license, related tax form updates, electronic filing service and connected services. We recognize revenue for the software license and related tax form updates, as one performance obligation, over the period the forms and updates are delivered. We recognize revenue for our electronic filings service and connected services as those services are provided.

We also sell some of our QuickBooks Desktop products and consumer tax desktop products in non-consignment and consignment arrangements to certain retailers. For non-consignment retailers, we begin recognizing revenue when control has transferred to the retailer. For consignment retailers, we begin recognizing revenue when control has transferred to the customer, at the time the end-user sale has occurred.

Our desktop payroll products are sold as software subscriptions and include a term software license with a stand-ready obligation to maintain compliance with current payroll tax laws, support and connected services. The term software license and stand-ready obligation to maintain compliance with current payroll tax laws is considered one performance obligation. Each of the performance obligations is considered distinct and control is transferred to the customer over the subscription term. As a result, revenue is recognized ratably over the subscription term as services are provided.

We offer merchant payment processing services as a separately paid connected service for our QuickBooks Desktop packaged software products and software subscriptions, and revenue is recognized as the services are provided to the customers.

Online Offerings

Our online offerings include our TurboTax Online products, ProConnect Tax Online products, QuickBooks Online products, online payroll products, and merchant payment processing services for small businesses who use our online offerings.

These online offerings provide customers with the right to use the hosted software over the contract period without taking possession of the software and are billed on either a subscription or consumption basis. Revenue related to our online offerings that are billed on a subscription basis is recognized ratably over the contract period. Revenue related to online offerings that are billed on a consumption basis, is recognized when the customer consumes the related service.

Other Solutions

Revenue from the sale of our financial supplies, such as printed check stock, and hardware, such as retail point-of-sale equipment and credit card readers for mobile phones, is recognized when control is transferred to the customer which is generally when the products are shipped.

We also have revenue-sharing and royalty arrangements with third-party partners and recognize this revenue as earned based upon reporting provided to us by our partners. In instances where we do not have reporting from our partners, we estimate revenue based on information available to us at the time.

Product Revenue and Service and Other Revenue

Product revenue includes revenue from: QuickBooks Desktop software licenses and version protection; consumer and professional tax desktop licenses and the related form updates; desktop payroll licenses and related updates; and financial supplies.

Service and other revenue includes revenue from: our online offerings discussed above; support, electronic filing services and connected services included with our desktop offerings; merchant payment processing services for our desktop offerings; and revenue-sharing and royalty arrangements.

We record revenue net of sales tax obligations. For payroll services, we generally require customers to remit payroll tax funds to us in advance of the payroll date via electronic funds transfer. We include in total net revenue the interest earned on these funds between the time that we collect them from customers and the time that we remit them to outside parties. Revenue for

Intuit Q1 Fiscal 2019 Form 10-Q

|

10

|

||

electronic payment processing services that we provide to merchants is recorded net of interchange fees charged by credit card associations.

Significant Judgments

Our contracts with customers often include promises to transfer multiple products and services to a customer. In determining how revenue should be recognized, a five-step process is used, which requires judgment and estimates. These judgments and estimates include identifying performance obligations in the contract, determining whether the performance obligations are distinct, determining the standalone sales price (SSP) for each distinct performance obligation, determining the timing of revenue recognition for distinct performance obligations and estimating the amount of variable consideration to include in the transaction price.

The functionality of the software licenses included in our consumer and professional tax and payroll desktop offerings is dependent on the related enhancements and updates included in these offerings. Judgment is required to determine whether the software license is considered distinct and accounted for separately, or not distinct and accounted for together with the related updates and recognized over time.

Our contracts with customers include promises to transfer various products and services, which are generally capable of being distinct performance obligations. In many cases SSPs for distinct performance obligations are based on directly observable pricing. In instances where the SSP is not directly observable, such as when we do not sell the product or service separately, we determine the SSP using information that may include market conditions and other observable inputs.

Our consumer and professional tax desktop products include an on-premise tax software license and related tax form updates that are recognized as the forms and updates are delivered. We measure progress towards complete satisfaction of the software license and related tax form updates using an output method based on the timing of when the tax forms are delivered.

We generally provide refunds to customers for product returns and subscription cancellations. We also provide promotional discounts and incentive rebates on retail and distribution sales. These refunds, discounts and incentive rebates are accounted for as variable consideration when estimating the amount of revenue to recognize. Refunds are estimated based on historical experience and current business and economic indicators and updated at the end of each reporting period as additional information becomes available to the extent that it is probable that a significant reversal of any incremental revenue will not occur. Discounts and incentive rebates are estimated based on distributors' and retailers' performance against the terms and conditions of the rebate programs.

Deferred Revenue

Generally, we receive payment at the time we enter into a contract with a customer. We record deferred revenue when we have entered into a contract with a customer and cash payments are received or due prior to transfer of control or satisfaction of the related performance obligation. During the three months ended October 31, 2018, we recognized revenue of $327 million that was included in deferred revenue at July 31, 2018. During the three months ended October 31, 2017, we recognized revenue of $339 million that was included in deferred revenue at July 31, 2017.

Our performance obligations are generally satisfied within 12 months of the initial contract date. As of October 31, 2018 and July 31, 2018, the deferred revenue balance related to performance obligations that will be satisfied after 12 months was $2 million and $3 million, respectively, and is included in other long-term obligations on our consolidated balance sheets.

Assets Recognized from the Costs to Obtain a Contract with a Customer

Our internal sales commissions are considered incremental costs of obtaining the contract with a customer. Internal sales commissions for subscription offerings where we expect the benefit of those costs to continue longer than one year are capitalized and amortized ratably over the period of benefit, which ranges from three to four years. Total capitalized costs to obtain a contract are included in prepaid expenses and other current assets and other assets on our consolidated balance sheets.

Intuit Q1 Fiscal 2019 Form 10-Q

|

11

|

||

Use of Estimates |

Computation of Net Income (Loss) Per Share |

We compute basic net income or loss per share using the weighted average number of common shares outstanding during the period. We compute diluted net income per share using the weighted average number of common shares and dilutive potential common shares outstanding during the period. Dilutive potential common shares consist of the shares issuable upon the exercise of stock options and upon the vesting of restricted stock units (RSUs) under the treasury stock method.

We include stock options with combined exercise prices and unrecognized compensation expense that are less than the average market price for our common stock, and RSUs with unrecognized compensation expense that is less than the average market price for our common stock, in the calculation of diluted net income per share. We exclude stock options with combined exercise prices and unrecognized compensation expense that are greater than the average market price for our common stock, and RSUs with unrecognized compensation expense that is greater than the average market price for our common stock, from the calculation of diluted net income per share because their effect is anti-dilutive. Under the treasury stock method, the amount that must be paid to exercise stock options and the amount of compensation expense for future service that we have not yet recognized for stock options and RSUs are assumed to be used to repurchase shares.

All of the RSUs we grant have dividend rights. Dividend rights are accumulated and paid when the underlying RSUs vest. Since the dividend rights are subject to the same vesting requirements as the underlying equity awards they are considered a contingent transfer of value. Consequently, the RSUs are not considered participating securities and we do not present them separately in earnings per share.

Intuit Q1 Fiscal 2019 Form 10-Q

|

12

|

||

Three Months Ended |

|||||||

(In millions, except per share amounts) |

October 31, 2018 |

October 31, 2017 |

|||||

Numerator: |

|||||||

Net income (loss) |

$ |

$ |

( |

) |

|||

Denominator: |

|||||||

Shares used in basic per share amounts: |

|||||||

Weighted average common shares outstanding |

|||||||

Shares used in diluted per share amounts: |

|||||||

Weighted average common shares outstanding |

|||||||

Dilutive common equivalent shares from stock options |

|||||||

and restricted stock awards |

|||||||

Dilutive weighted average common shares outstanding |

|||||||

Basic and diluted net income (loss) per share: |

|||||||

Basic net income (loss) per share |

$ |

$ |

( |

) |

|||

Diluted net income (loss) per share |

$ |

$ |

( |

) |

|||

Shares excluded from diluted net income (loss) per share: |

|||||||

Weighted average stock options and restricted stock units that have been excluded from dilutive common equivalent shares outstanding due to their anti-dilutive effect |

|||||||

Notes Receivable and Allowances for Loan Losses |

Concentration of Credit Risk and Significant Customers |

No customer accounted for 10% or more of total net revenue in the three months ended October 31, 2018 or October 31, 2017. No customer accounted for 10% or more of gross accounts receivable at October 31, 2018 or July 31, 2018.

Accounting Standards Recently Adopted |

Business Combinations - In January 2017 the FASB issued ASU 2017-01, “Business Combinations (Topic 805): Clarifying the Definition of a Business.” This standard clarifies the definition of a business in order to allow for the evaluation of whether transactions should be accounted for as acquisitions or disposals of assets or businesses. We adopted this standard in the first quarter of our fiscal year beginning August 1, 2018. The impact of the adoption of ASU 2017-01 on our consolidated financial statements is not material.

Statement of Cash Flows - In August 2016 the FASB issued ASU 2016-15, “Statement of Cash Flows (Topic 230): Classification of Certain Cash Receipts and Cash Payments.” This standard makes eight targeted changes to how cash receipts and cash payments are presented and classified in the statement of cash flows. We adopted this standard in the first quarter of our fiscal year beginning August 1, 2018. The impact of the adoption of ASU 2016-15 on our consolidated financial statements is not material.

Income Taxes - In October 2016, the FASB issued ASU 2016-16, “Income Taxes (Topic 740): Intra-Entity Transfers of Assets Other Than Inventory.” This standard requires an entity to recognize the income tax consequences of an intra-entity transfer of an asset, other than inventory, when the transfer occurs, as opposed to historical GAAP guidance which prohibited the

Intuit Q1 Fiscal 2019 Form 10-Q

|

13

|

||

recognition of current and deferred income taxes for an intra-entity asset transfer until the asset had been sold to an outside party. We adopted this standard in the first quarter of our fiscal year beginning August 1, 2018. The impact of the adoption of ASU 2016-16 on our consolidated financial statements is not material.

Statement of Cash Flows - In November 2016 the FASB issued ASU 2016-18, “Statement of Cash Flows (Topic 230): Restricted Cash.” This standard provides guidance on the presentation of restricted cash or restricted cash equivalents in the statement of cash flows. We adopted this standard in the first quarter of our fiscal year beginning August 1, 2018. We have modified our consolidated statements of cash flows to include restricted cash and restricted cash equivalents.

Three Months Ended October 31, 2017 |

|||||||||||

(Dollars in millions) |

As Reported |

ASU 2016-18 Adjustment |

As Adjusted |

||||||||

Net cash provided by (used in): |

|||||||||||

Operating activities |

$ |

( |

) |

$ |

$ |

( |

) |

||||

Investing activities |

( |

) |

( |

) |

( |

) |

|||||

Financing activities |

|||||||||||

Effect of exchange rates on cash, cash equivalents, restricted cash, and restricted cash equivalents |

( |

) |

( |

) |

|||||||

Net decrease in cash, cash equivalents, restricted cash, and restricted cash equivalents |

$ |

$ |

( |

) |

$ |

( |

) |

||||

Revenue from Contracts with Customers - In May 2014 the FASB issued ASU 2014-09, “Revenue from Contracts with Customers (Topic 606).” This standard superseded nearly all existing revenue recognition guidance under U.S. GAAP. Under this standard, revenue is recognized when promised goods or services are transferred to customers in an amount that reflects the consideration that is expected to be received for those goods or services. This standard also requires additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments. We adopted this standard in the first quarter of our fiscal year beginning August 1, 2018 using the full retrospective method, which requires us to restate each prior reporting period presented. We have implemented internal controls and processes to enable the preparation of financial information on adoption.

The most significant impact of the standard relates to the timing and amount of revenue recognized for our QuickBooks Desktop solutions and our consumer and professional tax desktop solutions. Our QuickBooks Desktop solutions include both packaged software products and software subscriptions.

Our QuickBooks Desktop packaged software products include a software license as well as enhancements and connected services. Under the new standard, we recognize revenue for the QuickBooks Desktop packaged software products at the time the software license is delivered rather than ratably over the period that enhancements and connected services are provided, which was approximately three years. We have determined that the enhancements and connected services included in our QuickBooks Desktop packaged software products are immaterial within the context of the contract.

Our QuickBooks Desktop software subscriptions include a software license, version protection, enhancements, support and various connected services. We recognize revenue for the software license and version protection at the time they are delivered and recognize revenue for support and connected services over the subscription term as the services are provided. Previously, we recognized revenue for our QuickBooks Desktop software subscriptions ratably over the subscription term, which is generally one year. We have determined that the enhancements included in our QuickBooks Desktop software subscriptions are immaterial within the context of the contract.

Our consumer and professional tax desktop solutions include a desktop tax preparation software license, tax form updates, electronic filing and connected services. We recognize revenue for the desktop tax preparation software license and related tax form updates as the forms and updates are delivered and recognize revenue for our electronic filing and connected services as those services are provided. Previously, we recognized all revenue related to tax desktop solutions as services were provided.

We capitalize the incremental costs of obtaining a contract with a customer if we expect the benefit of those costs to be longer than one year, which include internal sales commissions related to our subscription offerings.

The adoption of this standard resulted in a decrease in deferred revenue and long-term deferred income taxes, primarily due to the change in revenue recognition for our QuickBooks Desktop and professional tax desktop solutions. Additionally, the adoption of the standard resulted in the recognition of additional revenue and a decrease in the income tax benefit, primarily due to the net change in revenue recognition for our QuickBooks Desktop and professional tax desktop solutions. Our prepaid expenses and other current assets and other assets balances increased due to the capitalized costs to obtain a contract.

Intuit Q1 Fiscal 2019 Form 10-Q

|

14

|

||

July 31, 2018 |

|||||||||||

(In millions) |

As Reported |

Topic 606 Adjustment |

As Adjusted |

||||||||

Prepaid expenses and other current assets |

$ |

$ |

$ |

||||||||

Long-term deferred income taxes (1)

|

( |

) |

|||||||||

Other assets (1)

|

|||||||||||

Deferred revenue |

( |

) |

|||||||||

Other current liabilities |

|||||||||||

Long-term deferred revenue (2)

|

( |

) |

|||||||||

Other long-term obligations (2)

|

|||||||||||

Stockholders’ equity |

|||||||||||

(1) Long-term deferred income taxes is included in other assets on our consolidated balance sheets.

(2) Long-term deferred revenue is included in other long-term obligations on our consolidated balance sheets.

Three Months Ended October 31, 2017 |

|||||||||||

(In millions, except per share amounts) |

As Reported |

Topic 606 Adjustment |

As Adjusted |

||||||||

Net revenue |

$ |

$ |

$ |

||||||||

Selling and marketing expense |

|||||||||||

Operating loss |

( |

) |

( |

) |

|||||||

Income tax benefit |

( |

) |

( |

) |

|||||||

Net loss |

( |

) |

( |

) |

|||||||

Diluted net loss per share |

( |

) |

( |

) |

|||||||

Adoption of Topic 606 had no impact to cash from or used in operating, financing, or investing on our consolidated statements of cash flows.

Accounting Standards Not Yet Adopted |

Internal-Use Software - In August 2018 the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2018-15, “Intangibles—Goodwill and Other (Topic 350): Internal-Use Software.” This standard aligns the requirements for capitalizing implementation costs incurred in a cloud computing arrangement that is a service contract with the requirements for capitalizing implementation costs incurred to develop or obtain internal-use software. The standard is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years, which means that it will be effective for us in the first quarter of our fiscal year beginning August 1, 2019. Early adoption is permitted. We are currently evaluating the impact of our pending adoption of ASU 2018-15 on our consolidated financial statements.

Goodwill Impairment - In January 2017 the FASB issued ASU 2017-04, “Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment.” This standard eliminates Step 2 from the goodwill impairment test. Instead, an entity should compare the fair value of a reporting unit with its carrying amount and recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit's fair value, not to exceed the total amount of goodwill allocated to the reporting unit. The standard is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years, which means that it will be effective for us in the first quarter of our fiscal year beginning August 1, 2020. Early adoption is permitted. We are currently evaluating the impact of our pending adoption of ASU 2017-04 on our consolidated financial statements.

Financial Instruments - In June 2016 the FASB issued ASU 2016-13, “Financial Instruments—Credit Losses (Topic 326).” This standard requires the measurement of all expected credit losses for financial assets held at the reporting date based on historical experience, current conditions, and reasonable and supportable forecasts. The standard is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years, which means that it will be effective for us in the first quarter of our fiscal year beginning August 1, 2020. Earlier adoption is permitted in the first quarter of our fiscal year beginning August 1, 2019. We are currently evaluating the impact of our pending adoption of ASU 2016-13 on our consolidated financial statements.

Leases - In February 2016 the FASB issued ASU 2016-02, “Leases (Topic 842).” This standard amends a number of aspects of lease accounting, including requiring lessees to recognize operating leases with a term greater than one year on their balance sheet as a right-of-use asset and corresponding lease liability, measured at the present value of the lease payments. The standard is effective for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years,

Intuit Q1 Fiscal 2019 Form 10-Q

|

15

|

||

which means that it will be effective for us in the first quarter of our fiscal year beginning August 1, 2019. Early adoption is permitted. This standard is required to be adopted using a modified retrospective approach. We expect to elect certain available transitional practical expedients. In July 2018 the FASB issued ASU 2018-11, “Leases (Topic 842) Targeted Improvements," which allows for the adoption of this standard to be applied at the beginning of the most recent fiscal year as opposed to at the beginning of the earliest year presented. We plan to adopt under the provisions allowed under ASU 2018-11. While we continue to evaluate the impact of our pending adoption of ASU 2016-02 on our consolidated financial statements, we expect that the real estate and equipment leases designated as operating leases as discussed in Note 9 to the financial statements in Item 8 of our Annual Report on Form 10-K for the fiscal year ended July 31, 2018 will be recognized as right-of-use assets and corresponding lease liabilities on our consolidated balance sheets upon adoption. We do not expect the adoption of ASU 2016-02 to have a material impact on our consolidated statements of operations.

2. Fair Value Measurements |

Fair Value Hierarchy |

The authoritative guidance establishes a fair value hierarchy that is based on the extent and level of judgment used to estimate the fair value of assets and liabilities. In general, the authoritative guidance requires us to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. An asset or liability’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the measurement of its fair value. The three levels of input defined by the authoritative guidance are as follows:

• |

Level 1 uses unadjusted quoted prices that are available in active markets for identical assets or liabilities.

|

• |

Level 2 uses inputs other than quoted prices included in Level 1 that are either directly or indirectly observable through correlation with market data. These include quoted prices in active markets for similar assets or liabilities; quoted prices for identical or similar assets or liabilities in markets that are not active; and inputs to valuation models or other pricing methodologies that do not require significant judgment because the inputs used in the model, such as interest rates and volatility, can be corroborated by readily observable market data for substantially the full term of the assets or liabilities.

|

• |

Intuit Q1 Fiscal 2019 Form 10-Q

|

16

|

||

Assets and Liabilities Measured at Fair Value on a Recurring Basis |

October 31, 2018 |

July 31, 2018 |

||||||||||||||||||||||||||||||

(In millions) |

Level 1 |

Level 2 |

Level 3 |

Total

Fair Value

|

Level 1 |

Level 2 |

Level 3 |

Total

Fair Value

|

|||||||||||||||||||||||

Assets: |

|||||||||||||||||||||||||||||||

Cash equivalents, primarily money market funds and savings deposit accounts |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||||||||||

Available-for-sale debt securities: |

|||||||||||||||||||||||||||||||

Municipal bonds |

|||||||||||||||||||||||||||||||

Corporate notes |

|||||||||||||||||||||||||||||||

U.S. agency securities |

|||||||||||||||||||||||||||||||

Total available-for-sale securities |

|||||||||||||||||||||||||||||||

Total assets measured at fair value on a recurring basis |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||||||||||

October 31, 2018 |

July 31, 2018 |

||||||||||||||||||||||||||||||

(In millions) |

Level 1 |

Level 2 |

Level 3 |

Total

Fair Value

|

Level 1 |

Level 2 |

Level 3 |

Total

Fair Value

|

|||||||||||||||||||||||

Cash equivalents: |

|||||||||||||||||||||||||||||||

In cash and cash equivalents |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||||||||||

Available-for-sale debt securities: |

|||||||||||||||||||||||||||||||

In investments |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||||||||||

In funds held for customers |

|||||||||||||||||||||||||||||||

Total available-for-sale debt securities |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

|||||||||||||||||||||||

We value our Level 1 assets, consisting primarily of money market funds and savings deposit accounts, using quoted prices in active markets for identical instruments. Financial assets whose fair values we measure on a recurring basis using Level 2 inputs consist of municipal bonds, corporate notes, and U.S. agency securities. We measure the fair values of these assets with the help of a pricing service that either provides quoted market prices in active markets for identical or similar securities or uses observable inputs for their pricing without applying significant adjustments. Our fair value processes include controls that are designed to ensure that we record appropriate fair values for our Level 2 investments. These controls include comparison to pricing provided by a secondary pricing service or investment manager, validation of pricing sources and models, review of key model inputs, analysis of period-over-period price fluctuations, and independent recalculation of prices where appropriate.

3. Cash and Cash Equivalents, Investments, and Funds Held for Customers |

We consider highly liquid investments with maturities of three months or less at the date of purchase to be cash equivalents. In all periods presented, cash equivalents consist primarily of money market funds and savings deposit accounts, investments consist primarily of investment-grade available-for-sale debt securities, and funds held for customers consist of cash and cash equivalents and investment-grade available-for-sale debt securities. Except for direct obligations of the United States government, securities issued by agencies of the United States government, and money market funds, we diversify our investments in debt securities by limiting our holdings with any individual issuer.

Intuit Q1 Fiscal 2019 Form 10-Q

|

17

|

||

October 31, 2018 |

July 31, 2018 |

||||||||||||||

(In millions) |

Amortized

Cost

|

Fair Value |

Amortized

Cost

|

Fair Value |

|||||||||||

Classification on consolidated balance sheets: |

|||||||||||||||

Cash and cash equivalents |

$ |

$ |

$ |

$ |

|||||||||||

Investments |

|||||||||||||||

Funds held for customers |

|||||||||||||||

Long-term investments |

|||||||||||||||

|

Total cash and cash equivalents, investments, and funds

held for customers

|

$ |

$ |

$ |

$ |

|||||||||||

October 31, 2018 |

July 31, 2018 |

||||||||||||||

(In millions) |

Amortized

Cost

|

Fair Value |

Amortized

Cost

|

Fair Value |

|||||||||||

Type of issue: |

|||||||||||||||

|

Total cash, cash equivalents, restricted cash,

and restricted cash equivalents

|

$ |

$ |

$ |

$ |

|||||||||||

Available-for-sale debt securities: |

|||||||||||||||

Municipal bonds |

|||||||||||||||

Corporate notes |

|||||||||||||||

U.S. agency securities |

|||||||||||||||

Total available-for-sale debt securities |

|||||||||||||||

Other long-term investments |

|||||||||||||||

|

Total cash and cash equivalents, investments, and funds

held for customers

|

$ |

$ |

$ |

$ |

|||||||||||

We use the specific identification method to compute gains and losses on investments. We include realized gains and losses on our available-for-sale debt securities in interest and other income on our consolidated statements of operations. Gross realized gains and losses on our available-for-sale debt securities for the three months ended October 31, 2018 and October 31, 2017 were no t significant.

We accumulate unrealized gains and losses on our available-for-sale debt securities, net of tax, in accumulated other comprehensive loss in the stockholders’ equity section of our consolidated balance sheets. Gross unrealized gains and losses on our available-for-sale debt securities at October 31, 2018 and July 31, 2018 were no t significant.

We periodically review our investment portfolios to determine if any investment is other-than-temporarily impaired due to changes in credit risk or other potential valuation concerns. We believe that the investments we held at October 31, 2018 were not other-than-temporarily impaired. Unrealized losses on available-for-sale debt securities at October 31, 2018 were not significant and were due to changes in interest rates, including market credit spreads, and not due to increased credit risks associated with specific securities. We do not intend to sell these investments. In addition, it is more likely than not that we will not be required to sell them before recovery at par, which may be at maturity.

October 31, 2018 |

July 31, 2018 |

||||||||||||||

(In millions) |

Amortized

Cost

|

Fair Value |

Amortized

Cost

|

Fair Value |

|||||||||||

Due within one year |

$ |

$ |

$ |

$ |

|||||||||||

Due within two years |

|||||||||||||||

Due within three years |

|||||||||||||||

Due after three years |

|||||||||||||||

Total available-for-sale debt securities |

$ |

$ |

$ |

$ |

|||||||||||

Intuit Q1 Fiscal 2019 Form 10-Q

|

18

|

||

Funds held for customers represent cash held on behalf of our customers that is invested in cash and cash equivalents and investment grade available-for-sale securities, restricted for use solely for the purpose of satisfying amounts we owe on behalf of our customers, such as direct deposit payroll funds and payroll taxes.

October 31, 2018 |

July 31, 2018 |

||||||

(In millions) |

|||||||

Restricted cash and restricted cash equivalents |

$ |

$ |

|||||

Available-for-sale debt securities |

|||||||

Total funds held for customers |

$ |

$ |

|||||

October 31, 2017 |

July 31, 2017 |

||||||

(In millions) |

|||||||

Restricted cash and restricted cash equivalents |

$ |

$ |

|||||

Available-for-sale debt securities |

|||||||

Total funds held for customers |

$ |

$ |

|||||

Intuit Q1 Fiscal 2019 Form 10-Q

|

19

|

||

4. Current Liabilities |

Short-Term Debt |

On February 1, 2016 we entered into a master credit agreement with certain institutional lenders for a five-year credit facility in an aggregate principal amount of $1.5 billion. The master credit agreement includes a $500 million unsecured term loan and a $1 billion unsecured revolving credit facility. At October 31, 2018, $425 million was outstanding under the term loan, of which $50 million was classified as short-term debt. See Note 5, “Long-Term Obligations and Commitments – Long-Term Debt,” for more information regarding the term loan.

Unsecured Revolving Credit Facility |

The master credit agreement we entered into on February 1, 2016 includes a $1 billion unsecured revolving credit facility that will expire on February 1, 2021. Under the master credit agreement we may, subject to certain customary conditions, on one or more occasions increase commitments under the revolving credit facility in an amount not to exceed $250 million in the aggregate and may extend the maturity date up to two times. Advances under the revolving credit facility accrue interest at rates that are equal to, at our election, either Bank of America's alternate base rate plus a margin that ranges from 0.0 % to 0.5 % or the London Interbank Offered Rate (LIBOR) plus a margin that ranges from 0.9 % to 1.5 %. Actual margins under either election will be based on our senior debt credit ratings. The master credit agreement includes customary affirmative and negative covenants, including financial covenants that require us to maintain a ratio of total debt to annual earnings before interest, taxes, depreciation and amortization (EBITDA) of not greater than 3.25 to 1.00 as of any date and a ratio of annual EBITDA to annual interest expense of not less than 3.00 to 1.00 as of the last day of each fiscal quarter. We remained in compliance with these covenants at all times during the quarter ended October 31, 2018. At October 31, 2018 no amounts were outstanding under this revolving credit facility. We paid no amount for interest on the revolving credit facility during the three months ended October 31, 2018 and $1 million during the three months ended October 31, 2017.

Other Current Liabilities |

(In millions) |

October 31, 2018 |

July 31, 2018 |

|||||

Executive deferred compensation plan liabilities |

$ |

$ |

|||||

Reserve for promotional discounts and rebates |

|||||||

Reserve for product returns |

|||||||

Current portion of license fee payable |

|||||||

Current portion of deferred rent |

|||||||

Current portion of dividend payable |

|||||||

Other |

|||||||

Total other current liabilities |

$ |

$ |

|||||

5. Long-Term Obligations and Commitments |

Long-Term Debt |

On February 1, 2016 we entered into a master credit agreement with certain institutional lenders for a five-year credit facility in an aggregate principal amount of $1.5 billion, which includes a $500 million unsecured term loan. Under the master credit agreement we may, subject to certain customary conditions, on one or more occasions increase commitments under the term loan in an amount not to exceed $500 million in the aggregate. The term loan accrues interest at rates that are equal to, at our election, either Bank of America's alternate base rate plus a margin that ranges from 0.125 % to 0.875 % or LIBOR plus a margin that ranges from 1.125 % to 1.875 %. Actual margins under either election will be based on our senior debt credit ratings. The master credit agreement includes customary affirmative and negative covenants. See Note 4, “Current Liabilities – Unsecured Revolving Credit Facility,” for more information. The term loan is subject to quarterly principal payments, which began in July

Intuit Q1 Fiscal 2019 Form 10-Q

|

20

|

||

2017, of 2.5 % of the original loan amount, with the balance payable on February 1, 2021. At October 31, 2018, $425 million was outstanding under the term loan, of which $50 million was classified as short-term debt. The carrying value of the term loan approximates its fair value. Interest on the term loan is payable monthly. We paid $4 million for interest on the term loan during the three months ended October 31, 2018 and $3 million during the three months ended October 31, 2017.

Other Long-Term Obligations |

(In millions) |

October 31, 2018 |

July 31, 2018 |

|||||

Total deferred rent |

$ |

$ |

|||||

Long-term income tax liabilities |

|||||||

Total license fee payable |

|||||||

Total dividend payable |

|||||||

Other |

|||||||

Total long-term obligations |

|||||||

Less current portion (included in other current liabilities) |

( |

) |

( |

) |

|||

Long-term obligations due after one year |

$ |

$ |

|||||

Operating Lease Commitments and Unconditional Purchase Obligations |

6. Income Taxes |

Effective Tax Rate |

We compute our provision for or benefit from income taxes by applying the estimated annual effective tax rate to income or loss from recurring operations and adding the effects of any discrete income tax items specific to the period. Our effective tax rate for the three months ended October 31, 2017 has been restated to reflect the full retrospective application of ASU 2014-09, “Revenue from Contracts with Customers (Topic 606).” See Note 1, “Description of Business and Summary of Significant Accounting Policies – Accounting Standards Recently Adopted,” for more information.

The Tax Cuts and Jobs Act (2017 Tax Act) was enacted on December 22, 2017 and reduced the U.S. statutory federal corporate tax rate from 35% to 21%. The effective date of the tax rate change was January 1, 2018. The change resulted in a blended lower U.S. statutory federal rate of 26.9 % for fiscal 2018. Our first quarter of fiscal 2018 reflects tax effects at the pre-enactment U.S. statutory federal rate of 35%. In fiscal 2019, we fully benefit from the enacted lower tax rate of 21 %.

On December 22, 2017 the SEC issued Staff Accounting Bulletin No. 118 (SAB 118), which provides guidance for companies that are not able to complete their accounting for the income tax effects of the Act in the period of enactment. The guidance allows us to record provisional amounts to the extent a reasonable estimate can be made and provides us with up to one year from enactment date to finalize accounting for the impacts of the 2017 Tax Act. Since the 2017 Tax Act was passed in our second quarter of fiscal 2018, the deferred tax re-measurements and other items are considered provisional due to the forthcoming guidance and ongoing analysis of the final year-end data and tax positions. As of October 31, 2018, we have not fully completed our accounting for the tax effects of enactment of the 2017 Tax Act. We did not record any significant adjustments to prior period estimates during the three months ended October 31, 2018. We expect to complete our analysis within the 12-month measurement period in accordance with SAB 118.

We recognized excess tax benefits on share-based compensation of $41 million and $25 million in our provision for income taxes for the three months ended October 31, 2018 and 2017, respectively.

We recorded a $48 million tax benefit on a pretax loss of $14 million for the three months ended October 31, 2018. Excluding discrete tax items primarily related to share-based compensation tax benefits, our effective tax rate for the period was 23 % and did not differ significantly from the federal statutory rate of 21 %. The tax expense related to state income taxes and nondeductible share-based compensation were partially offset by the tax benefit we received from the federal research and experimentation credit.

Intuit Q1 Fiscal 2019 Form 10-Q

|

21

|

||

Our effective tax rate for the three months ended October 31, 2017 was approximately 95 %. Excluding discrete tax items primarily related to share-based compensation tax benefits, our effective tax rate for the period was 33 % and did not differ significantly from the federal statutory rate of 35%. The tax benefit we received from the domestic production activities deduction and the federal research and experimentation credit were partially offset by the tax expense related to state income taxes and nondeductible share-based compensation.

Unrecognized Tax Benefits and Other Considerations |

7. Stockholders’ Equity |

Stock Repurchase Programs and Treasury Shares |

Intuit’s Board of Directors has authorized a series of common stock repurchase programs. Shares of common stock repurchased under these programs become treasury shares. We repurchased 467,000 shares for $101 million under these programs during the three months ended October 31, 2018. Included in this amount were $6 million of repurchases which occurred in late October 2018 and were settled in early November 2018. At October 31, 2018, we had authorization from our Board of Directors to expend up to an additional $3.1 billion for stock repurchases. Future stock repurchases under the current programs are at the discretion of management, and authorization of future stock repurchase programs is subject to the final determination of our Board of Directors.

Our treasury shares are repurchased at the market price on the trade date; accordingly, all amounts paid to reacquire these shares have been recorded as treasury stock on our consolidated balance sheets. Repurchased shares of our common stock are held as treasury shares until they are reissued or retired. When we reissue treasury stock, if the proceeds from the sale are more than the average price we paid to acquire the shares we record an increase in additional paid-in capital. Conversely, if the proceeds from the sale are less than the average price we paid to acquire the shares, we record a decrease in additional paid-in capital to the extent of increases previously recorded for similar transactions and a decrease in retained earnings for any remaining amount.

In the past we have satisfied option exercises and restricted stock unit vesting under our employee equity incentive plans by reissuing treasury shares, and we may do so again in the future. During the second quarter of fiscal 2014 we began issuing new shares of common stock to satisfy option exercises and RSU vesting under our 2005 Equity Incentive Plan. We have not yet determined the ultimate disposition of the shares that we have repurchased in the past, and consequently we continue to hold them as treasury shares.

Dividends on Common Stock |

During the three months ended October 31, 2018 we declared and paid a quarterly cash dividend of $0.47 per share of outstanding common stock for a total of $129 million. In November 2018 our Board of Directors declared a quarterly cash dividend of $0.47 per share of outstanding common stock payable on January 18, 2019 to stockholders of record at the close of business on January 10, 2019. Future declarations of dividends and the establishment of future record dates and payment dates are subject to the final determination of our Board of Directors.

Intuit Q1 Fiscal 2019 Form 10-Q

|

22

|

||

Share-Based Compensation Expense |

Three Months Ended |

|||||||

(In millions) |

October 31, 2018 |

October 31, 2017 |

|||||

Cost of revenue |

$ |

$ |

|||||

Selling and marketing |

|||||||

Research and development |

|||||||

General and administrative |

|||||||

Total share-based compensation expense |

$ |

$ |

|||||

We capitalized $1 million in share-based compensation related to internal use software projects during the three months ended October 31, 2018 and $1 million during the three months ended October 31, 2017.

Share-Based Awards Available for Grant |

(Shares in thousands) |

Shares

Available

for Grant

|

|

Balance at July 31, 2018 |

||

Options granted |

( |

) |

Restricted stock units granted (1)

|

( |

) |

Share-based awards canceled/forfeited/expired (1) (2)

|

||

Balance at October 31, 2018 |

||

(1) |

(2) |

Stock Option Activity and Related Share-Based Compensation Expense |

Options Outstanding |

||||||

(Shares in thousands) |

Number

of Shares

|

Weighted

Average

Exercise

Price

Per Share

|

||||

Balance at July 31, 2018 |

$ |

|||||

Granted |

||||||

Exercised |

( |

) |

||||

Canceled or expired |

( |

) |

||||

Balance at October 31, 2018 |

$ |

|||||

Exercisable at October 31, 2018 |

$ |

|||||

At October 31, 2018, there was approximately $54 million of unrecognized compensation cost related to non-vested stock options with a weighted average vesting period of 2.4 years. We will adjust unrecognized compensation cost for actual forfeitures as they occur.

Intuit Q1 Fiscal 2019 Form 10-Q

|

23

|

||

Restricted Stock Unit Activity and Related Share-Based Compensation Expense |

Restricted Stock Units |

||||||

(Shares in thousands) |

Number

of Shares

|

Weighted

Average

Grant Date

Fair Value

|

||||

Nonvested at July 31, 2018 |

$ |

|||||

Granted |

||||||

Vested |

( |

) |

||||

Forfeited |

( |

) |

||||

Nonvested at October 31, 2018 |

$ |

|||||

8. Litigation |

In fiscal 2015 Intuit was contacted by certain state and federal regulatory authorities in connection with inquiries regarding an increase during the 2015 tax season in attempts by criminals using stolen identity information to file fraudulent tax returns and claim refunds. Intuit provided information in response to those inquiries and now believes those inquiries are resolved.

A consolidated putative class action lawsuit was filed by individuals who claim to have suffered damages in connection with the 2015 events. On May 23, 2018, the parties reached a settlement in principle of this matter. The settlement has been preliminarily approved and remains subject to final approval by the court. The terms of the settlement are not material to our consolidated financial statements. In the event the settlement does not receive final approval by the court, the litigation may resume and we may not be able to predict the outcome of such lawsuit. We continue to believe that the allegations in this lawsuit are without merit.

9. Segment Information |

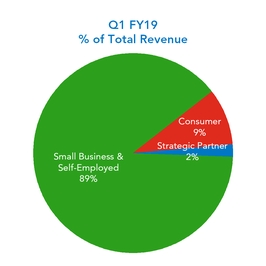

We have defined our three reportable segments, described below, based on factors such as how we manage our operations and how our chief operating decision maker views results. We define the chief operating decision maker as our Chief Executive Officer and our Chief Financial Officer. Our chief operating decision maker organizes and manages our business primarily on the basis of product and service offerings.

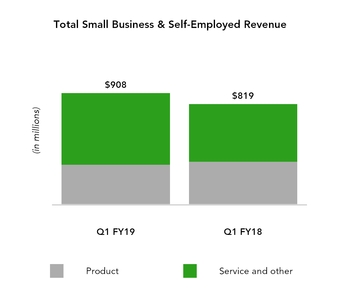

|

Small Business & Self-Employed: This segment targets small businesses and the self-employed around the world, and the accounting professionals who serve and advise them. Our offerings include QuickBooks financial and business management online services and desktop software, payroll solutions, merchant payment processing solutions, and financing for small businesses.

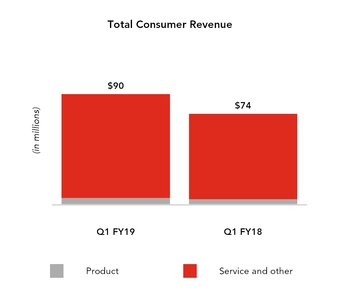

Consumer: This segment targets consumers and includes do-it-yourself and assisted TurboTax income tax preparation products and services sold in the U.S. and Canada. Our Mint and Turbo offerings target consumers and help them understand and improve their financial lives by offering a view of their financial health.

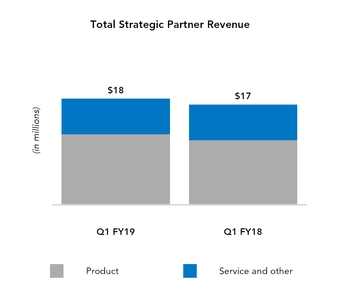

Strategic Partner: This segment targets professional accountants in the U.S. and Canada, who are essential to both small business success and tax preparation and filing. Our professional tax offerings include Lacerte, ProSeries, ProFile, and ProConnect Tax Online.

|

All of our segments operate primarily in the United States and sell primarily to customers in the United States. International total net revenue was less than 5 % of consolidated total net revenue for all periods presented.

Intuit Q1 Fiscal 2019 Form 10-Q

|

24

|

||

We include expenses such as corporate selling and marketing, product development, general and administrative, and share-based compensation, which are not allocated to specific segments, in unallocated corporate items. Unallocated corporate items also include amortization of acquired technology, amortization of other acquired intangible assets, and goodwill and intangible asset impairment charges.

The accounting policies of our reportable segments are the same as those described in the summary of significant accounting policies in Note 1 to the financial statements in Item 8 of our Annual Report on Form 10-K for the fiscal year ended July 31, 2018 and in Note 1, "Description of Business and Summary of Significant Accounting Policies – Significant Accounting Policies" in this Quarterly Report on Form 10-Q. Except for goodwill and purchased intangible assets, we do not generally track assets by reportable segment and, consequently, we do not disclose total assets by reportable segment.

Three Months Ended |

|||||||

(In millions) |

October 31, 2018 |

October 31, 2017 |

|||||

Net revenue: |

|||||||