425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on February 24, 2020

Filed by Intuit Inc.

pursuant to Rule 425 under the Securities Act of 1933, as amended

Subject Companies: Intuit Inc. and Credit Karma, Inc.

This filing relates to a proposed business combination involving

Intuit Inc. and Credit Karma, Inc.

(Subject Company Commission File No.: 000-21180)

The following investor slide deck was made available on February 24, 2020.

Intuits Acquisition of Credit Karma February 24, 2020

INTUIT + CREDIT KARMA Cautions about forward looking statements This communication contains forward-looking statements within the meaning of applicable securities laws. Forward-looking statements and information usually relate to future events and anticipated revenues, earnings, cash flows or other aspects of our operations or operating results. Forward-looking statements are often identified by the words believe, expect, anticipate, plan, intend, foresee, should, would, could, may, estimate, outlook and similar expressions, including the negative thereof. The absence of these words, however, does not mean that the statements are not forward-looking. Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from the expectations expressed in the forward-looking statements. These factors include, without limitation, the following: failure to obtain required regulatory approvals in a timely manner or otherwise; failure to satisfy any closing conditions to the proposed acquisition of Credit Karma, Inc.; risks associated with tax liabilities or changes in U.S. federal tax laws or interpretations to which the proposed transaction with Credit Karma, Inc. or parties thereto are subject; failure to successfully integrate any new business; failure to realize anticipated benefits of any combined operations; unanticipated costs of acquiring or integrating Credit Karma, Inc.; potential impact of announcement or consummation of the proposed acquisition on relationships with third parties, including employees, customers, partners and competitors; inability to retain key personnel; changes in legislation or government regulations affecting the acquisition or the parties; and economic, social or political conditions that could adversely affect the acquisition or the parties. More details about these and other risks that may impact our business are included in our Form 10-K for fiscal 2019 and in our other SEC filings. You can locate these reports through our website at http://investors.intuit.com. We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date hereof. We do not undertake any duty to update any forward-looking statement or other information in this communication, except to the extent required by law. No Offer or Solicitation This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction. Additional Information Important Additional Information Will be Filed with the SEC Intuit will file with the SEC a registration statement on Form S-4, which will include the prospectus of Intuit (the prospectus). INVESTORS AND SHAREHOLDERS ARE URGED TO CAREFULLY READ THE PROSPECTUS, AND OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC, IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT INTUIT, CREDIT KARMA, INC., THE PROPOSED TRANSACTIONS AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the prospectus and other documents filed with the SEC by the parties through the website maintained by the SEC at www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the prospectus and other documents filed with the SEC on Intuits website at http://investors.intuit.com. 2

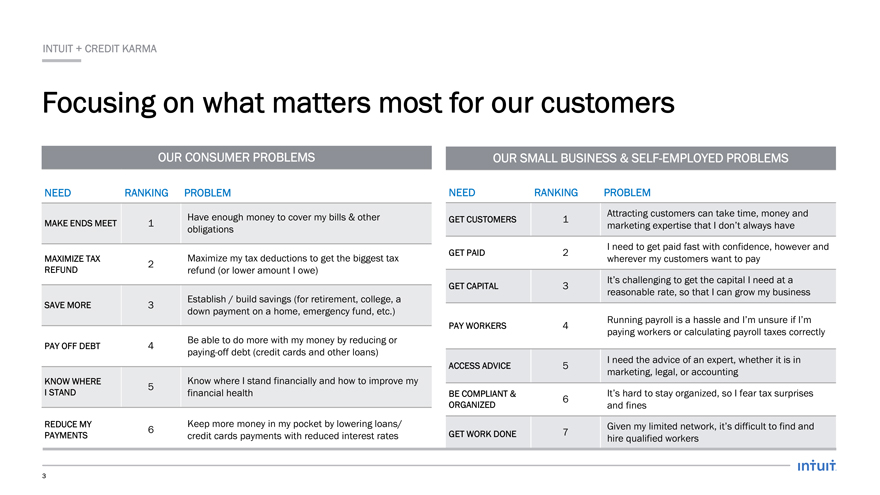

INTUIT + CREDIT KARMA Focusing on what matters most for our customers OUR CONSUMER PROBLEMS OUR SMALL BUSINESS & SELF-EMPLOYED PROBLEMS NEED RANKING PROBLEM NEED RANKING PROBLEM Have enough money to cover my bills & other Attracting customers can take time, money and MAKE ENDS MEET 1 GET CUSTOMERS 1 obligations marketing expertise that I dont always have I need to get paid fast with confidence, however and GET PAID 2 MAXIMIZE TAX Maximize my tax deductions to get the biggest tax wherever my customers want to pay 2 REFUND refund (or lower amount I owe) Its challenging to get the capital I need at a GET CAPITAL 3 reasonable rate, so that I can grow my business Establish / build savings (for retirement, college, a SAVE MORE 3 down payment on a home, emergency fund, etc.) Running payroll is a hassle and Im unsure if Im PAY WORKERS 4 paying workers or calculating payroll taxes correctly Be able to do more with my money by reducing or PAY OFF DEBT 4 paying-off debt (credit cards and other loans) I need the advice of an expert, whether it is in ACCESS ADVICE 5 Know where I stand financially and how to improve my marketing, legal, or accounting KNOW WHERE 5 I STAND financial health BE COMPLIANT & Its hard to stay organized, so I fear tax surprises 6 ORGANIZED and fines REDUCE MY Keep more money in my pocket by lowering loans/ Given my limited network, its difficult to find and 6 GET WORK DONE 7 PAYMENTS credit cards payments with reduced interest rates hire qualified workers 3

Powering Prosperity Around the World

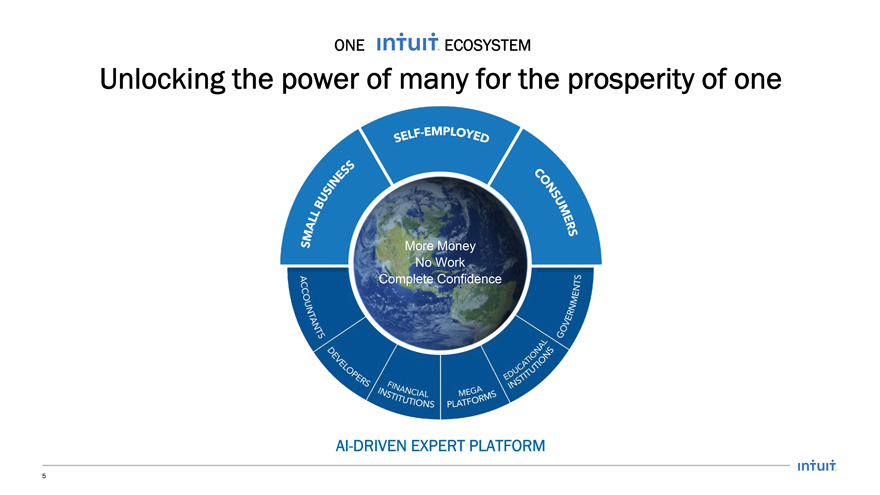

ONE ECOSYSTEM Unlocking the power of many for the prosperity of one More Money No Work Complete Confidence AI-DRIVEN EXPERT PLATFORM 5

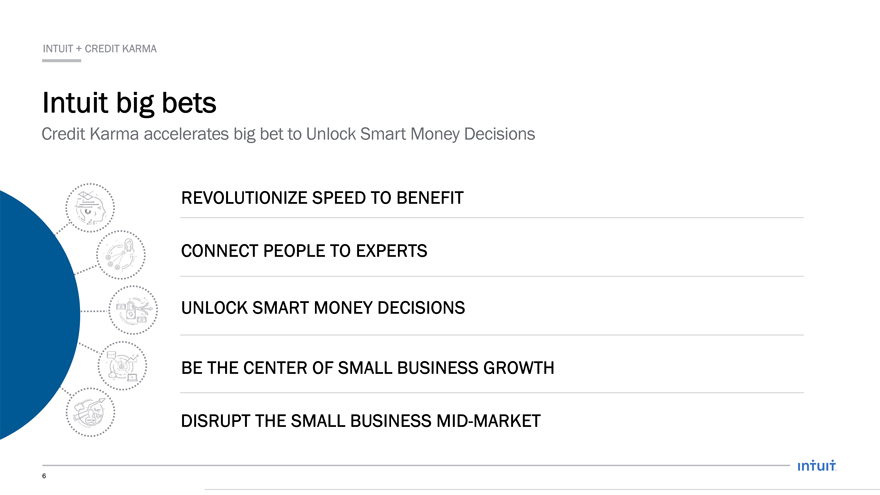

INTUIT + CREDIT KARMA Intuit big bets Credit Karma accelerates big bet to Unlock Smart Money Decisions REVOLUTIONIZE SPEED TO BENEFIT CONNECT PEOPLE TO EXPERTS UNLOCK SMART MONEY DECISIONS BE THE CENTER OF SMALL BUSINESS GROWTH DISRUPT THE SMALL BUSINESS MID-MARKET 6

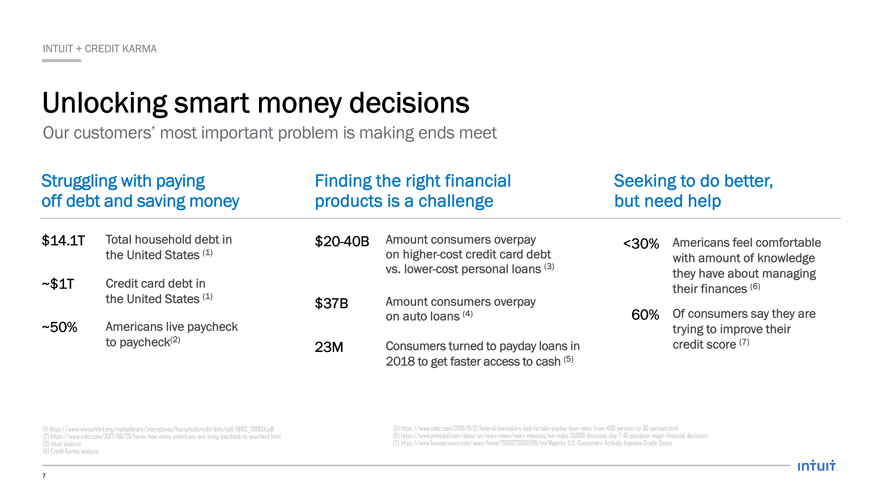

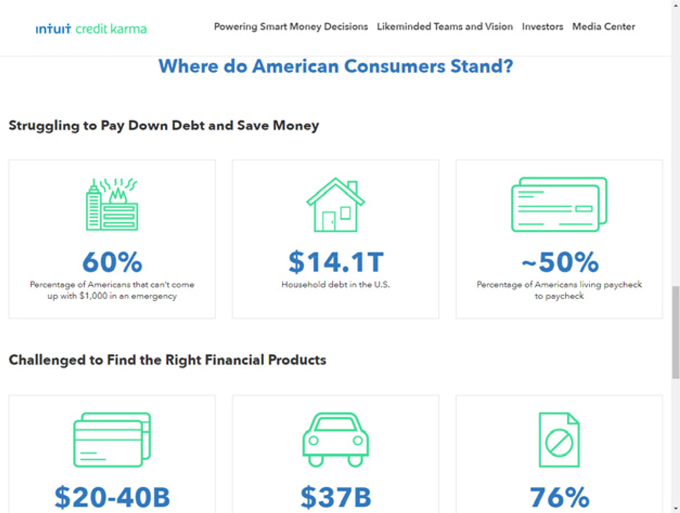

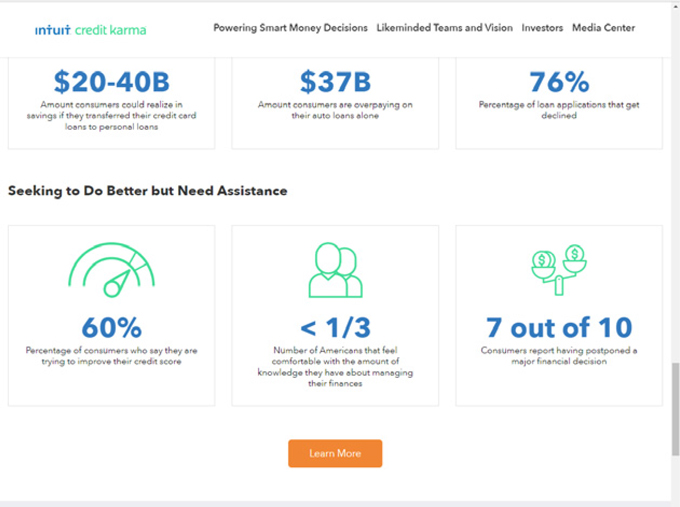

INTUIT + CREDIT KARMA Finding the right financial products is a challenge $20-40B Amount consumers overpay on

higher-cost credit card debt vs. lower-cost personal loans (3) $37B Amount consumers overpay

on auto loans (4) 23M Consumers turned to payday loans in 2018 to get

faster access to cash (5) Seeking to do better, but need help <30% Americans feel comfortable

with amount of knowledge

they have about managing

their finances (6) 60% Of consumers say they are

trying to improve their

credit score (7) Struggling with paying

off debt and saving money $14.1T Total household debt in

the United States (1) ~$1T Credit

card debt in

the United States (1) ~50% Americans live paycheck

to

paycheck(2) Unlocking smart money decisions Our customers most important problem is making ends meet

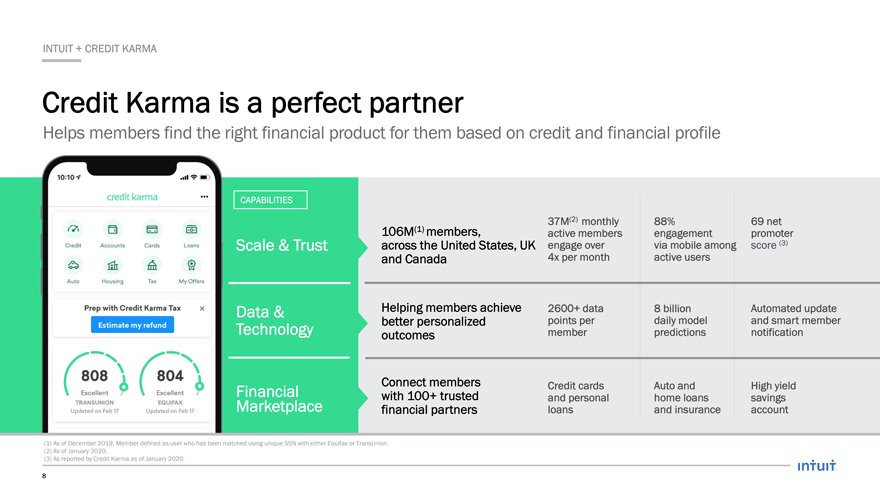

INTUIT + CREDIT KARMA Credit Karma is a perfect partner Helps members find the right financial product for them based on credit and financial profile CAPABILITIES 37M(2) monthly 88% 69 net 106M(1) members, active members engagement promoter Scale & Trust across the United States, UK engage over via mobile among score (3) and Canada 4x per month active users Data & Helping members z achieve 2600+ data 8 billion Automated update better personalized points per daily model and smart member Technology outcomes member predictions notification Connect members Credit cards Auto and High yield Financial Marketplace with 100+ trusted and personal home loans savings financial partners loans and insurance account (1) As of December 2019. Member defined as user who has been matched using unique SSN with either Equifax or TransUnion. (2) As of January 2020. (3) As reported by Credit Karma as of January 2020. 8

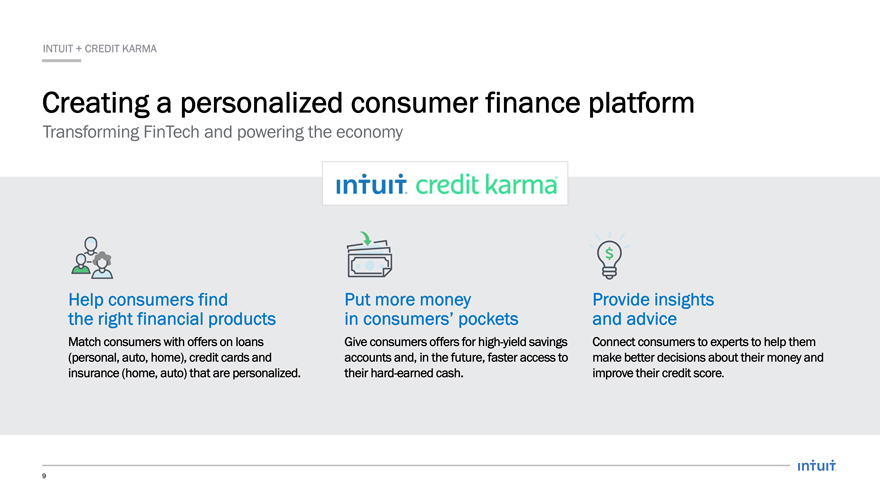

INTUIT + CREDIT KARMA Creating a personalized consumer finance platform Transforming FinTech and powering the economy Help consumers find Put more money Provide insights the right financial products in consumers pockets and advice Match consumers with offers on loans Give consumers offers for high-yield savings Connect consumers to experts to help them (personal, auto, home), credit cards and accounts and, in the future, faster access to make better decisions about their money and insurance (home, auto) that are personalized. their hard-earned cash. improve their credit score. 9

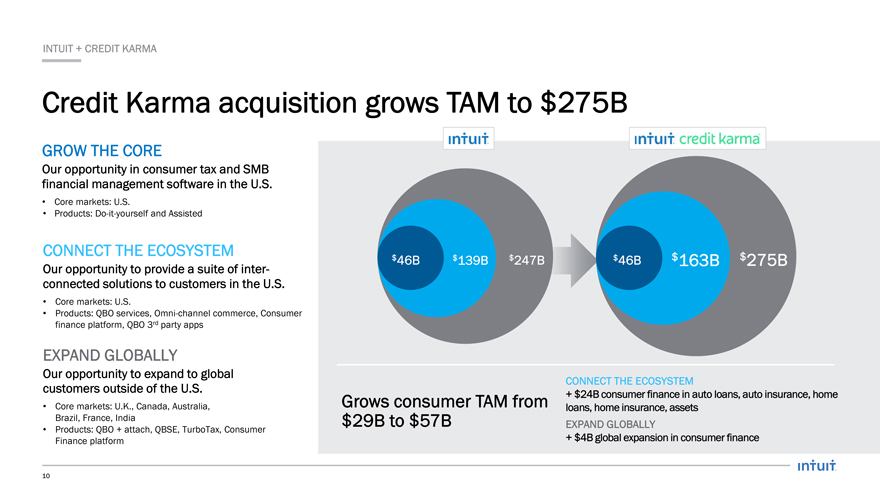

INTUIT + CREDIT KARMA Credit Karma acquisition grows TAM to $275B GROW THE CORE Our opportunity in consumer tax and SMB financial management software in the U.S. Core markets: U.S. Products: Do-it-yourself and Assisted CONNECT THE ECOSYSTEM $ $46B $139B $247B $46B $163B 275B Our opportunity to provide a suite of interconnected solutions to customers in the U.S. Core markets: U.S. Products: QBO services, Omni-channel commerce, Consumer finance platform, QBO 3rd party apps EXPAND GLOBALLY Our opportunity to expand to global CONNECT THE ECOSYSTEM customers outside of the U.S. Grows consumer TAM from + $24B consumer finance in auto loans, auto insurance, home Core markets: U.K., Canada, Australia, loans, home insurance, assets Brazil, France, India $29B to $57B EXPAND GLOBALLY Products: QBO + attach, QBSE, TurboTax, Consumer Finance platform + $4B global expansion in consumer finance 10

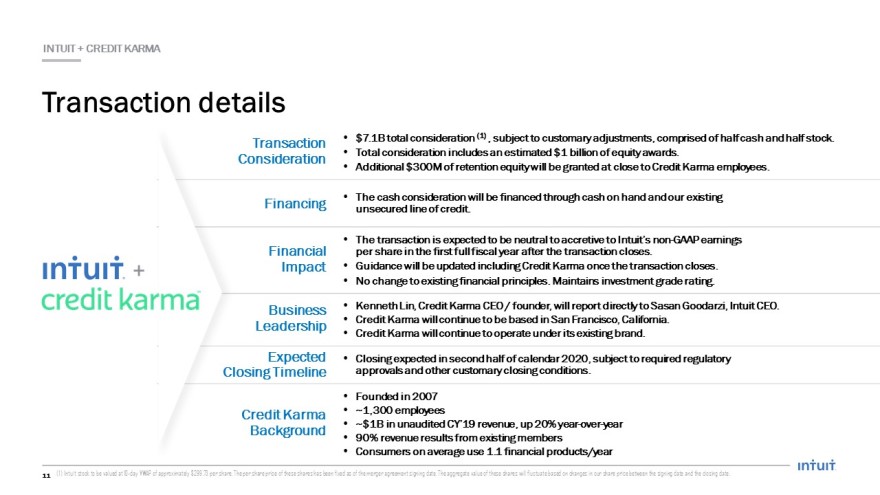

INTUIT + CREDIT KARMA Transaction details Transaction $7.1B total consideration (1) , subject to customary adjustments, comprised of half cash and half stock. Consideration Total consideration includes an estimated $1 billion of equity awards. Additional $300M of retention equity will be granted at close to Credit Karma employees. Financing The cash consideration will be financed through cash on hand and our existing unsecured line of credit. The transaction is expected to be neutral to accretive to Intuits non-GAAP earnings Financial per share in the first full fiscal year after the transaction closes. + Impact Guidance will be updated including Credit Karma once the transaction closes. No change to existing financial principles. Maintains investment grade rating. Business Kenneth Lin, Credit Karma CEO / founder, will report directly to Sasan Goodarzi, Intuit CEO. Leadership Credit Karma will continue to be based in San Francisco, California. Credit Karma will continue to operate under its existing brand. Expected Closing expected in second half of calendar 2020, subject to required regulatory Closing Timeline approvals and other customary closing conditions. Founded in 2007 Credit Karma ~1,300 employees Background ~$1B in unaudited CY19 revenue, up 20% year-over-year 90% revenue results from existing members Consumers on average use 1.1 financial products/year 11 (1) Intuit stock to be valued at 10-day VWAP of approximately $299.73 per share. The per share price of these shares has been fixed as of the merger agreement signing date. The aggregate value of these shares will fluctuate based on changes in our share price between the signing date and the closing date.

Thank you

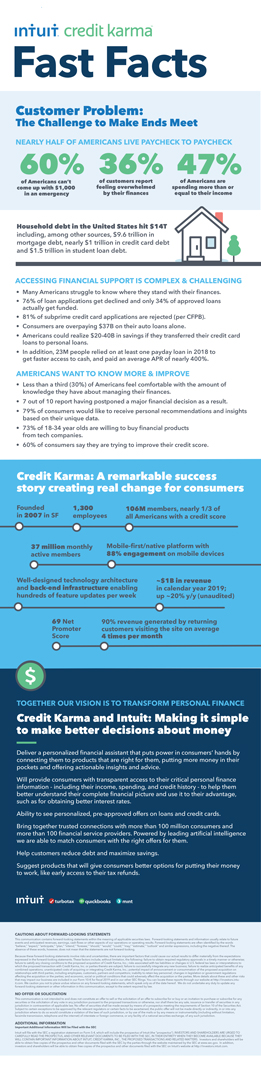

The following infograph was distributed on February 24, 2020.

The following social copy was posted on Intuits various social medial accounts listed below:

| | Channels: Twitter, LinkedIn, Facebook, LinkedIn Elevate |

| | Social Copy: Were excited to announce that were coming together with @creditkarma to transform #personalfinance. We believe that together we can do more to help empower consumers to reduce debt, maximize savings and put more money in their pockets. More info: smartmoneydecisions.com |

| | Creative: Animated Video (screenshots provided): |

The following social copy was posted on Intuits various social medial accounts listed below:

| | Channels: Facebook, Twitter, LinkedIn, LinkedIn Elevate |

| | Social Copy: Were excited to share were joining forces with @creditkarma. We also reported Q2 earnings and delivered another strong quarter. Our $INTU revenue grew 13% and @QuickBooks Online Ecosystem revenue grew 35%. More info: smartmoneydecisions.com |

| | Link: smartmoneydecisions.com |

The following social copy was posted by Intuits CEO Sasan Goodarzis various social media accdounts. Sasan Goodarzi re-tweeted both Intuit announcements listed above and provided additional social copy, listed below.

| | Social channels: LinkedIn, Twitter, and Facebook |

| | Social copy for LinkedIn, Twitter, and Facebook: Today is a momentous day. Moments ago, we announced that @Intuit and @creditkarma will join forces. Together, we believe we can empower consumers to reduce debt, maximize savings and put more money in their pockets. Read more: smartmoneydecisions.com |

| | Creative: A social media cut of the Joint CEO video is included. The following portion of the script is covered in this social media cut: |

Social Media cut of joint CEO Video Script

Kenneth Lin:

Hi, Im Kenneth Lin, CEO of Credit Karma.

Sasan Goodarzi:

And Im Sasan Goodarzi, CEO of Intuit. Ken and I are here together to share some exciting news for consumers around the globe.

Sasan Goodarzi:

Were very excited to announce that Intuit has agreed to acquire Credit Karma. Our companies will be joining forces to create a consumer finance platform that works like a personalized financial assistant for consumers. Were confident that together we can empower consumers to reduce debt, maximize savings and put more money in their pockets.

Kenneth Lin:

Like Intuit, we embrace a culture of customer obsession and technology-driven innovation.

Our combined expertise will embody our shared values the process will be transparent so consumers can see all of the products that they are eligible for. With a tech-forward approach to improving access to information, we will put the power in the hands of consumers.

Sasan Goodarzi:

At the end of the day, both companies are driven by a common goal: empowering consumers to make smart decisions about their money. We will remain deeply committed to this as we move forward together, after the closing of the acquisition, as one team.

The following microsite was made available to the public on February 24, 2020.

Joint CEO Video Script

Kenneth Lin:

Hi, Im Kenneth Lin, CEO of Credit Karma.

Sasan Goodarzi:

And Im Sasan Goodarzi, CEO of Intuit. Ken and I are here together to share some exciting news for consumers around the globe.

Were very excited to announce that Intuit has agreed to acquire Credit Karma. Our companies will be joining forces to create a consumer finance platform that works like a personalized financial assistant for consumers. Were confident that together we can empower consumers to reduce debt, maximize savings and put more money in their pockets.

Kenneth Lin:

Intuits and Credit Karmas vision is to make it extremely simple for consumers to improve their financial lives to help them to make financial progress. We will work together to address a critical consumer challenge how to better manage money, easily. With so many decisions to make, and products and tools to choose from, its often difficult to keep track of your personal finances. Today, household debt has reached $14 trillion and consumers are missing out on more than $50 billion in savings from lower interest rate loans. To solve for this, we are creating a consumer finance platform that works like a personalized assistant. It uses data and AI to match consumers with the products that are right for them, to put more money in their pockets and offer actionable insights and advice.

Sasan Goodarzi:

Together, our platform will offer access to products and services from 100 financial service providers.

Consumers can decide to use their data to engage with our financial institution partners so that these partners can provide them with better offers and transparent, friction-free interactions.

Kenneth Lin:

Credit Karmas mission of financial progress has always been centered around transparency, simplicity and certainty. Like Intuit, we embrace a culture of customer obsession and technology-driven innovation.

Our combined expertise will embody our shared values the process will be transparent so consumers can see all of the products that they are eligible for. With a tech-forward approach to improving access to information, we will put the power in the hands of consumers.

Sasan Goodarzi:

With this platform, we believe our companies can transform FinTech. By leveraging our shared technological capabilities and best-in-class talent, our combined company will offer more solutions and more value to both consumers and the financial partners who compete for their business. And while the fintech industry is ripe with innovation and investment, our platform will be the first personalized financial assistant that helps consumers take control of their financial lives.

I have long admired Ken and have an immense amount of respect for what he and his extraordinary team have accomplished since the company started in 2007. Beyond its well-established consumer technology platform, we look forward to learning from Credit Karmas best-in-class talent when it comes to mobile engagement.

Kenneth Lin:

I am extremely proud of the team and the entrepreneurial culture weve developed at Credit Karma and the trust weve earned from our members over the last 12 years. With Intuit, Credit Karma will gain access to Intuits proven experience with consumers and financial institutions, their risk and fraud capabilities, and its AI-driven expert platform.

Kenneth Lin:

Upon closing, I will continue to lead the Credit Karma team. And Credit Karma will keep its headquarters in San Francisco, California. Credit Karma is thrilled to take this step with Intuit. And I truly believe that our companies are going to do something very special together.

Sasan Goodarzi:

And we are excited to learn from each companys strengths, share ideas, and develop our talent to ultimately lead the industry in developing products that deliver more value for consumers.

As you can tell, were both excited about this announcement as we create a new value proposition as a combined company.

At the end of the day, both companies are driven by a common goal: empowering consumers to make smart decisions about their money. We will remain deeply committed to this as we move forward together, after the closing of the acquisition, as one team.

Important Information for Investors and Securityholders

Forward-Looking Statements

This communication contains forward-looking statements within the meaning of applicable securities laws. Forward-looking statements and information usually relate to future events and anticipated revenues, earnings, cash flows or other aspects of our operations or operating results. Forward-looking statements are often identified by the words believe, expect, anticipate, plan, intend, foresee, should, would, could, may, estimate, outlook and similar expressions, including the negative thereof. The absence of these words, however, does not mean that the statements are not forward-looking.

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from the expectations expressed in the forward-looking statements. These factors include, without limitation, the following: failure to obtain required regulatory approvals in a timely manner or otherwise; failure to satisfy any closing conditions to the proposed acquisition of Credit Karma, Inc.; risks associated with tax liabilities or changes in U.S. federal tax laws or interpretations to which the proposed transaction with Credit Karma, Inc. or parties thereto are subject; failure to successfully integrate any new business; failure to realize anticipated benefits of any combined operations; unanticipated costs of acquiring or integrating Credit Karma, Inc.; potential impact of announcement or consummation of the proposed acquisition on relationships with third parties, including employees, customers, partners and competitors; inability to retain key personnel; changes in legislation or government regulations affecting the acquisition or the parties; and economic, social or political conditions that could adversely affect the acquisition or the parties. More details about these and other risks that may impact our business are included in our Form 10-K for fiscal 2019 and in our other SEC filings. You can locate these reports through our website at http://investors.intuit.com. We caution you not to place undue reliance on any forward-looking statements, which speak only as of the date hereof. We do not undertake any duty to update any forward-looking statement or other information in this communication, except to the extent required by law.

No Offer or Solicitation

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by

any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

Additional Information

Important Additional Information Will be Filed with the SEC

Intuit will file with the SEC a registration statement on Form S-4, which will include the prospectus of Intuit (the prospectus). INVESTORS AND SHAREHOLDERS ARE URGED TO CAREFULLY READ THE PROSPECTUS, AND OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC, IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT INTUIT, CREDIT KARMA, THE PROPOSED TRANSACTIONS AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the prospectus and other documents filed with the SEC by the parties through the website maintained by the SEC at www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the prospectus and other documents filed with the SEC on Intuits website at http://investors.intuit.com.