PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on November 15, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant þ

Filed by a party other than the Registrant ¨

| Check the appropriate box: | ||||||||

| þ | Preliminary Proxy Statement |

|||||||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|||||||

| ¨ | Definitive Proxy Statement |

|||||||

| ¨ | Definitive Additional Materials |

|||||||

| ¨ | Soliciting Material under § 240.14a-12 |

|||||||

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| þ | No fee required. | |||||||||||||

| ¨ | Fee paid previously with preliminary materials. | |||||||||||||

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||||||||||||

MISSION |

Powering Prosperity Around the World

|

||||

VALUES |

Integrity Without Compromise |

Courage |

Customer Obsession |

Stronger Together |

We Care and Give Back |

||||||||||||

|

BOLD 2030

GOALS

|

Prosperity

Double household savings rate and improve business success rate >20 points versus industry

|

Reputation

Best-in-class Most Trusted Company

|

Growth

200M+ customers and accelerating revenue growth

|

||||||||

|

TRUE

NORTH

GOALS

|

Employees

Empower the world's top talent to do the best work of their lives

|

Customers

Delight customers by solving the problems that matter most

|

Communities

Make a difference in the communities we serve

|

Shareholders

Drive long-term growth, increasing shareholder value

|

||||||||||

STRATEGY |

Al-Driven Expert Platform

More Money. No Work. Complete Confidence.

|

||||

BIG BETS |

Revolutionize speed to benefit |

Connect people to experts |

Unlock smart money decisions |

Be the center of small business growth | Disrupt the mid-market |

||||||||||||

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION

Notice of 2025 Annual Meeting of Stockholders

Agenda and Board Recommendations

0

|

DATE AND TIME

Thursday, January 23, 2025

8:00 a.m. Pacific Standard Time

|

||||||||||||||||||||||

| 1 | Election of 13 directors |

FOR

(all nominees)

|

|||||||||||||||||||||

|

LOCATION

Live audio webcast

www.virtualshareholdermeeting.com/INTU2025

|

||||||||||||||||||||||

| 2 | Advisory vote to approve Intuit’s executive compensation (say on-pay) |

FOR

|

|||||||||||||||||||||

| 3 | Ratification of selection of Ernst & Young LLP as Intuit’s independent registered public accounting firm |

FOR

|

|||||||||||||||||||||

|

RECORD DATE

November 25, 2024

|

||||||||||||||||||||||

| 4 | Approval of an amendment to our Certificate of Incorporation to limit the liability of certain officers in accordance with recent Delaware law amendments |

FOR

|

|||||||||||||||||||||

|

How to Vote

Online at the Meeting: Attend the Meeting virtually at www.virtualshareholdermeeting.com/INTU2025 and follow the instructions on the website

Online Before the Meeting: Visit www.proxyvote.com

Mail: Sign, date, and return your proxy card in the enclosed envelope

Telephone: Call the telephone number on your proxy card

Note for Street-Name Holders: If you hold your shares through a broker, bank or other nominee, you must instruct your nominee how to vote the shares held in your account. The nominee will give you a Notice of Internet Availability or voting instruction form. If you do not provide voting instructions, your nominee will not be permitted to vote on certain proposals and may elect not to vote on any of the proposals. Voting your shares will help to ensure that your interests are represented at the Meeting.

|

|||||||||||||||||||||||

|

We also will consider any other matters that may properly be brought before the 2025 Annual Meeting of Stockholders (“Meeting”) (and any postponements or adjournments of the Meeting). As of the date of this proxy statement, we have not received notice of any such matters.

Annual Meeting of Stockholders

Thursday, January 23, 2025

8:00 a.m. Pacific Standard Time

We invite you to attend the Meeting of Intuit Inc. The Meeting will be conducted virtually via live audio webcast. There will not be a physical location for our Meeting. To attend, vote or submit questions, stockholders of record should go to www.virtualshareholdermeeting.com/INTU2025 and log in using the control number on their Notice of Internet Availability or proxy card. Beneficial owners of shares held by a broker, bank or other nominee (“street-name holders”) should review these proxy materials and their Notice of Internet Availability or voting instruction form for how to vote in advance of and participate in the Meeting. We encourage you to join the Meeting 15 minutes before the start time.

A recording of the webcast will be available on our investor relations website for at least 60 days following the Meeting.

Stockholders at the close of business on November 25, 2024, are entitled to receive notice of, and to vote at, the Meeting and any and all adjournments, continuations or postponements thereof. If we experience a technical malfunction or other situation that the Meeting chair determines may affect our ability to satisfy the requirements for a virtual meeting of stockholders under the Delaware General Corporation Law, or that otherwise makes it advisable to adjourn the Meeting, the Chair of the Meeting will convene the Meeting at 9:00 a.m. Pacific Standard Time on January 23, 2025, and at our principal executive offices, solely for the purpose of adjourning the Meeting to reconvene at a date, time and physical or virtual location to be announced. If we adjourn the Meeting, we will post information regarding the rescheduled Meeting on the investor relations section of our website at investors.intuit.com.

Your vote is important. Please vote as promptly as possible.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to Be Held on January 23, 2025: Both the proxy statement and Intuit’s Annual Report on Form 10-K for the fiscal year ended July 31, 2024, are available electronically at https://investors.intuit.com/sec-filings and www.proxyvote.com.

This Notice of Annual Meeting, the Internet Availability of Proxy Materials and the Proxy Statement and Annual Report on Form 10-K of Intuit are being distributed or made available, as the case may be, on or about November 27, 2024.

By order of the Board of Directors,

Kerry J. McLean

Executive Vice President, General Counsel and Corporate Secretary

Mountain View, California

November 27, 2024

|

|||||||||||||||||||||||

A Letter to Our Stockholders

a

|

November [•], 2024

Dear fellow Intuit stockholders:

Artificial Intelligence (AI) is changing the world at an incredible pace and igniting innovation across all sectors. Soon, everything we do will be powered by AI, from buying groceries and driving cars, to getting medical care and completing work tasks. The impact of AI on our financial lives will also be transformative—and it's already changing how Intuit serves customers, enabling them to make more money with less work and have complete confidence in every financial decision they make.

Intuit is at a critical moment in our history. We have consistently disrupted and reinvented ourselves, evolving Intuit’s strategy to be a global AI-driven expert platform. We bet early on AI, and today our scale of data and AI capabilities, network of experts, and robust ecosystem of products and services are Intuit’s unique advantage. With the introduction of generative AI (GenAI), we’re transforming how we serve our customers, delivering done-for-you experiences where we do the hard work for them and provide access to AI-powered expertise to fuel their success. Our strong performance in FY24 reflects Intuit’s transformation from a tax and accounting company to a global financial technology platform that’s driving durable growth at scale. We grew full-year revenue 13%, demonstrating that our strategy and five Big Bets are solving our customers’ biggest problems and delivering on our mission to power prosperity around the world.

Intuit is in a position of strength; we have the strategy and momentum we need to succeed. We’re accelerating innovation and investments in the areas that are most important to our future success. By bringing professional-grade experiences to small businesses and expanding our mid-market offerings to serve larger and more complex businesses, we are creating significant new growth opportunities for Intuit. We’re delivering a seamless, connected consumer financial platform that customers can benefit from year-round, not just at tax time. And we’re extending our relationships and engagement across product lines to better serve customers and scale our penetration of key growth segments.

At Intuit, we believe everyone deserves the opportunity to prosper and we hold ourselves accountable by setting measurable True North Goals. We provide economic opportunities to underserved communities through our job creation and job readiness initiatives. We continue to invest in opportunities to make a positive impact on climate for the communities we serve. And we’re proud of our commitment and progress over time to attract, retain, and develop a workforce that reflects the diversity of our customers.

Every day, our more than 18,000 global employees bring a passion for solving the problems that matter most to our customers. With a massive runway ahead, there’s no limit to how far we’ll go.

Sasan K. Goodarzi

President and Chief Executive Officer

Intuit Inc. |

|||||||

Table of Contents

A-1 |

|||||||||||

All statements made in this document, other than statements of historical or current facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this document address our plans and goals, including those relating to our strategies, plans, and progress regarding our climate, workforce diversity, job creation, and job readiness initiatives. The fact that we included such information does not indicate that these contents are necessarily material to investors or required to be disclosed in our filings with the Securities and Exchange Commission. We use words such as “anticipates,” “believes,” “expects,” “future,” “potential,” “intends,” “design,” “will,” “may,” “can,” “should” and similar expressions to identify forward-looking statements. Forward-looking statements are based on management’s current expectations and assumptions that are subject to change in the future. In addition, forward-looking sustainability-related statements may be based on standards for measuring progress that are still developing and internal controls and processes that continue to evolve. Actual results could differ materially for a variety of reasons. Risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in our Annual Report on Form 10-K for the fiscal year ended July 31, 2024. Except as may be required by law, we undertake no obligation to update any forward-looking statements, whether because of new information, future events, or otherwise.

Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

Proxy Summary

Intuit at a Glance

Intuit helps consumers and small and mid-market businesses prosper by delivering financial management, compliance, and marketing products and services. We also provide specialized tax products to accounting professionals, who are key partners that help us serve small and mid-market business customers. Across our platform, we use the power of data and artificial intelligence (“AI”) to deliver three core benefits to our customers: helping put more money in their pockets, saving them time by eliminating work, and ensuring that they have complete confidence in every financial decision they make. Our global financial technology platform includes TurboTax, Credit Karma, QuickBooks, and Mailchimp.

Fiscal 2024 Performance Highlights

We delivered strong results in fiscal 2024. Key highlights include the following.

|

Total

revenue

|

Combined platform revenue |

GAAP operating income |

GAAP diluted EPS

$10.43

up 24% from $8.42 in FY23

|

||||||||||||||||||||||||||||||||

|

$16.3 billion

up 13% from FY23

Global Business Solutions Group up 19% from FY23

with Online Ecosystem up 20% from FY23

Consumer Group up 7% from FY23

Credit Karma up 5% from FY23

|

$12.5 billion

up 14% from FY23 includes Global Business Solutions Group Online Ecosystem, TurboTax Online, and Credit Karma

|

$3.6 billion up 16% from FY23

|

|||||||||||||||||||||||||||||||||

|

Repurchased

$2.0 billion of shares and increased dividend 15% to $3.60 per share

|

Non-GAAP operating income

$6.4 billion

up 16% from FY23

|

Non-GAAP diluted EPS

$16.94 up 18% from $14.40 in FY23

|

|||||||||||||||||||||||||||||||||

See Appendix A to this proxy statement for information regarding non-GAAP financial measures, including a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures.

On August 1, 2024, we renamed our Small Business & Self-Employed segment as the Global Business Solutions segment. This segment continues to serve small and mid-market businesses.

INTUIT’S FINANCIAL PRINCIPLES |

||||||||||||||||||||||||||||||||||||||

Intuit has a track record of disciplined capital allocation and shareholder returns driven by the following financial principles. |

||||||||||||||||||||||||||||||||||||||

| Grow organic revenue double digits | Operating income dollars grow faster than revenue | Deploy cash to the highest-yield opportunities | Return excess cash to shareholders via dividend and share repurchase | Maintain a strong balance sheet | ||||||||||||||||||||||||||||||||||

Proxy Summary |

INTUIT 2025 Proxy Statement

|

1 |

||||||

Our Big Bets

Intuit is a global financial technology platform with a mission to power prosperity around the world. Our platform helps consumers and small and mid-market businesses prosper by delivering financial management, compliance, and marketing products and services. We also provide specialized tax products to accounting professionals.

Across our platform, we use the power of data and AI to deliver three core benefits to our customers: helping put more money in their pockets, saving them time by eliminating work, and ensuring that they have complete confidence in every financial decision they make. We help consumers do their taxes with ease and confidence, understand their financial picture, build credit, save more to make ends meet, get their largest tax refund, pay off debt, and receive personalized suggestions on how to grow their money. We help small and mid-market businesses grow and run their business all in one place, including bookkeeping, getting paid, accessing capital, paying employees, getting and retaining customers, and managing their customer relationships. We do this through our global AI-driven expert platform strategy and our offerings, including TurboTax, Credit Karma, QuickBooks, and Mailchimp. As we execute our global AI-driven expert platform strategy, we prioritize resources on our five Big Bets across the company. These priorities focus on solving the problems that matter most to customers.

| 1 | Revolutionizing speed to benefit |

||||||||||

When customers use our products and services, we use the power of AI to deliver value instantly and aim to make interactions with our offerings frictionless, without the need for customers to manually enter data. We are accelerating the application of AI to deliver breakthrough “done for you” innovations to customers. This priority is foundational across our business, and execution against it positions us to succeed with our other four strategic priorities. |

|||||||||||

| 2 | Connecting people to experts |

||||||||||

The largest problem our customers face is lack of confidence to file their own taxes or to manage their books. To build their confidence, we connect our customers to experts. We offer customers access to experts to help them make important decisions — and experts, such as accountants, gain access to new customers so they can grow their businesses. We are also expanding our virtual expert network and broadening the segments we serve beyond tax and accounting, to play a more meaningful role in our customers’ financial lives. |

|||||||||||

| 3 | Unlocking smart money decisions |

||||||||||

To address the challenges of high-cost debt and lack of savings, we are creating a comprehensive, self-driving financial platform with Credit Karma that propels our members forward wherever they are on their financial journey, so they can understand their financial picture, make smart financial decisions, and stick to their financial plan in the near and long term. |

|||||||||||

| 4 | Being the center of small business growth |

||||||||||

Globally, we are focused on helping customers grow their businesses by offering a broad, seamless set of tools that are designed to help them get and retain customers, get paid faster, manage and get access to capital, pay employees with confidence, and use third-party apps to help run their businesses. Our money solutions enable customers to manage their money end-to-end and improve cash flow. This is an important driver to improving the success rate of our small and mid-market business customers. |

|||||||||||

| 5 | Disrupting the mid-market |

||||||||||

We aim to disrupt the mid-market with a tailor-made platform for business, which includes our QuickBooks offerings, as well as our workforce solutions and money offerings. These solutions are designed to address the more complex needs of larger mid-market businesses. Mailchimp’s marketing offerings enable mid-market businesses to digitally promote their business across email, social media, landing pages, ads, websites, and more, all from one place. These offerings enable us to increase retention of these larger customers and accelerate mid-market demand. |

|||||||||||

We believe our Big Bets enable us to deliver a QuickBooks and Mailchimp platform that serves as the source of truth for small and mid-market business customers, providing end-to-end solutions to increase their revenue and profitability, fueling their business success. For consumers, we're creating seamless, end-to-end experiences that customers benefit from year-round with TurboTax and Credit Karma, helping them make ends meet, maximize their tax refund, save more, pay off debt, and take steps to improve their financial health year-round.

As the external environment evolves, we continue to innovate and adapt our strategy and anticipate our customers’ needs. For more than 40 years, we have been dedicated to developing innovative solutions that are designed to solve our customers' most important financial problems. At Intuit, we believe that everyone should have the opportunity to prosper, and we never stop working to find new, innovative ways to make that possible.

2 |

INTUIT 2025 Proxy Statement

|

Proxy Summary |

||||||

True North Goals Highlights

At Intuit, a way we hold ourselves accountable to our mission to power prosperity around the world is to set measurable True North Goals to deliver for our employees, customers, communities, and shareholders. We set ambitious True North Goals to deliver for the communities we serve through job creation, job readiness and sustainability initiatives. We also set True North Goals to help us attract, retain, and develop a workforce that reflects the diversity of our customers. A summary of our progress in fiscal 2024 is below.

|

Job Creation and Readiness |  |

Positive Impact on Climate |  |

Diversity, Equity and Inclusion | |||||||||||||||||||||||||||||||||||||||||||||

|

• Over 4.7 million students better prepared for jobs and their financial futures since fiscal 2020, exceeding our fiscal 2024 goal

•Supported approximately 18,200 seasonal and year-round jobs in underserved communities, which generated $202 million of economic impact to underserved communities since 2016 through our Prosperity Hub Program

|

•Committed to reach net-zero greenhouse gas emissions across our operations and supply chain by fiscal 2040

•Helped reduce carbon emissions in communities, many of which are underserved, by 611,000 metric tonnes (since fiscal 2020), exceeding our fiscal 2024 Climate Positive program goal

|

•Maintained industry-leading representation of women in our global technology roles and steadily increased the percentage of our U.S. workers from underrepresented racial groups, but fell short of our ambitious fiscal 2024 goals

•Perform pay equity analyses twice a year using an independent third party to ensure our compensation is fair and equitable across gender, race and ethnicity

|

||||||||||||||||||||||||||||||||||||||||||||||||

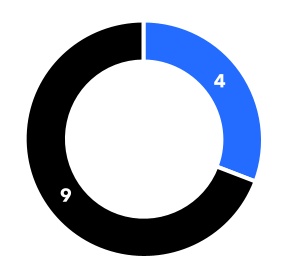

Stockholder Engagement

We regularly assess our corporate governance and compensation practices. As part of this assessment, we proactively engage with our stockholders to ensure their perspectives are considered by the Board.

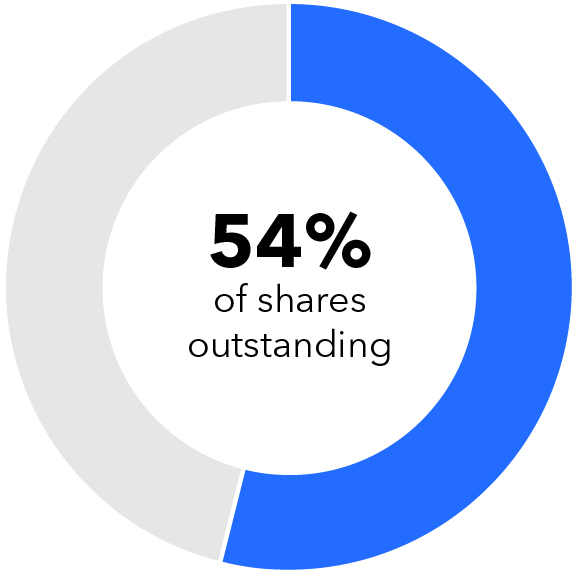

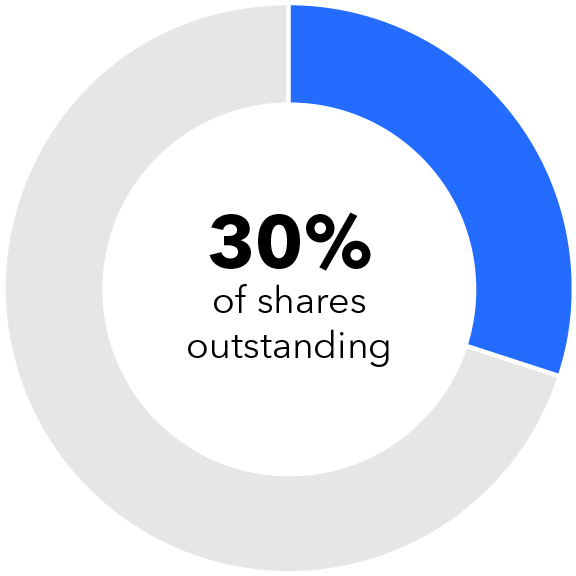

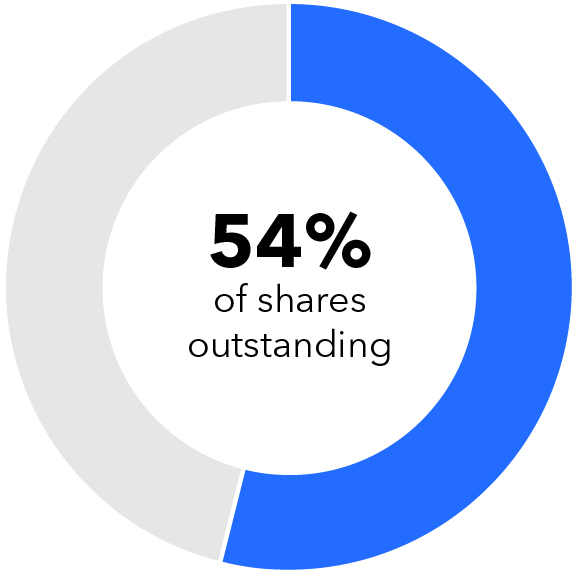

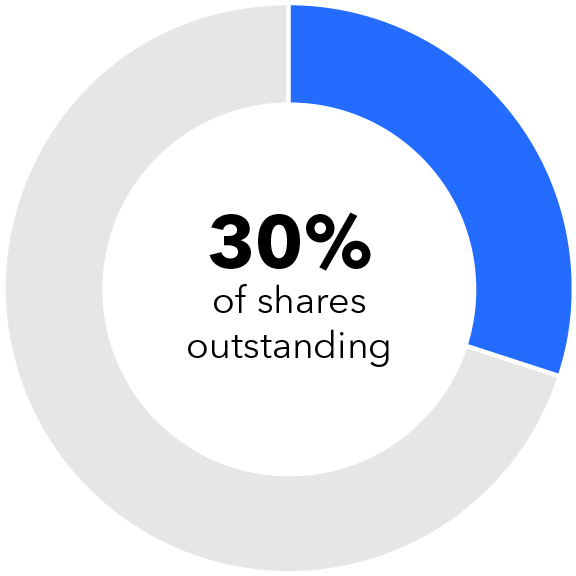

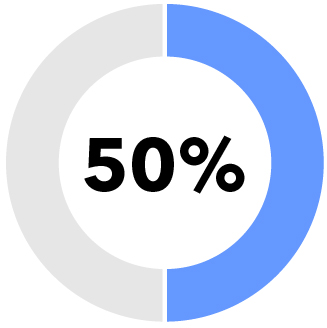

| We invited shareholders representing approximately | We met with shareholders representing approximately |

|||||||

|

|

|

||||||

Since our 2024 Annual Meeting, we invited the holders of approximately 54%* of our shares to meet with us to discuss, among other things, our corporate governance, executive compensation practices and environmental, social and governance progress. |

Investors holding approximately 30%* of our outstanding shares accepted the invitation to meet with our management team to discuss these important matters. |

|||||||

*As of June 30, 2024 |

||||||||

For more about our stockholder engagement and the topics discussed, see page 20 of this proxy statement.

Proxy Summary |

INTUIT 2025 Proxy Statement

|

3 |

||||||

Stockholder Value Delivered

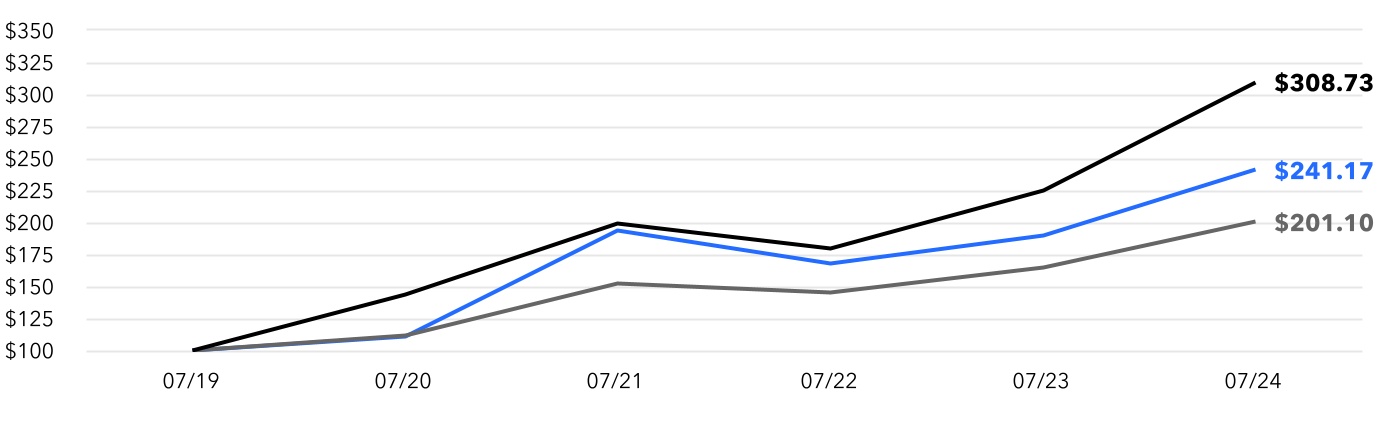

The graph below compares the cumulative total stockholder return (“TSR”) on Intuit common stock for the last five full fiscal years with the cumulative total returns on the S&P 500 Index and the Morgan Stanley Technology Index for the same period.

The graph assumes that $100 was invested in Intuit common stock and in each of the other indices on July 31, 2019, and that all dividends were reinvested. The comparisons in the graph below are based on historical data – with Intuit common stock prices based on the closing price on the dates indicated – and are not intended to forecast the possible future performance of Intuit’s common stock.

Comparison of 5 Year Cumulative Total Return*

Among Intuit Inc., the S&P 500 Index, and Morgan Stanley Technology Index

Among Intuit Inc., the S&P 500 Index, and Morgan Stanley Technology Index

|

Intuit Inc. |  |

S&P 500 |  |

Morgan Stanley Technology Index | ||||||||||||

* $100 invested on 7/31/19 in stock or index, including reinvestment of dividends. Fiscal year ending July 31.

Copyright © 2024 Standard and Poor’s, a division of S&P Global. All rights reserved.

4 |

INTUIT 2025 Proxy Statement

|

Proxy Summary |

||||||

Voting Roadmap

SUMMARY OF PROPOSAL 1 |

||||||||||||||||||||

|

Election of Directors

The Board currently consists of 13 directors, all of whom are standing for re-election to the Board at the Meeting. The nominees bring a wealth of diverse experience and proven leadership across a range of industries. The slate of nominees reflects a balance between Intuit’s commitment to thoughtful Board refreshment and the value of the experience that our longer-tenured directors bring.

|

||||||||||||||||||||

|

The Board recommends that you vote FOR the election of each of the director nominees.

|

|||||||||||||||||||

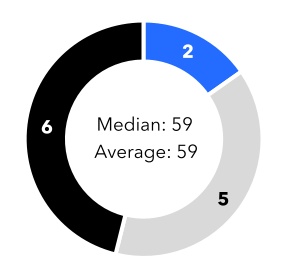

Board Highlights

Board Diversity

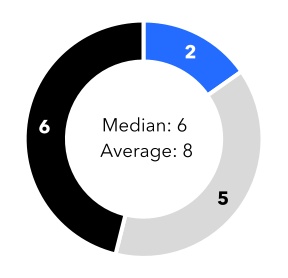

The following charts reflect the tenure, age, gender, and self-identified race/ethnicity of our director nominees.

Tenure

|

11+ Yrs | ||||

|

6-10 Yrs | ||||

|

0-5 Yrs | ||||

Age

|

≤50 | ||||

|

51-60 | ||||

|

61+ | ||||

Gender

|

Women | ||||

|

Men | ||||

Race/Ethnicity

|

Diverse(1)

|

||||

|

Other | ||||

(1)As self-identified, Mr. Goodarzi is Middle Eastern, Ms. Liu is Asian, Ms. Mawakana is Black/African American, Mr. Prabhu is Asian, Mr. Vazquez is Latino/Hispanic, and Mr. Yuan is Asian.

Proxy Summary |

INTUIT 2025 Proxy Statement

|

5 |

||||||

Director Nominees

The following table provides summary information about each director nominee.

|

Independent Director Nominee | ||||

|

Eve Burton, 66

Executive Vice President and Chief Legal Officer, The Hearst Corporation

|

|

Scott D. Cook, 72

Founder, Intuit Inc.

|

|

Richard L. Dalzell, 67

Former Senior Vice President and Chief Information Officer, Amazon.com, Inc.

|

|||||||||||||||||||||

|

Director Since: 2016

Other Public Company Boards: 0

Committees: ARC, NGC (Chair)

|

Director Since: 1984

Other Public Company Boards: 0

Committees: None

|

Director Since: 2015

Other Public Company Boards: 0

Committees: AC (Chair), ARC

|

||||||||||||||||||||||||

|

Sasan K. Goodarzi, 56

President and Chief Executive Officer, Intuit Inc.

|

|

Deborah Liu, 48

President, Chief Executive Officer and Director, Ancestry.com LLC

|

|

Tekedra Mawakana, 53

Co-Chief Executive Officer and Director, Waymo LLC

|

|||||||||||||||||||||

|

Director Since: 2019

Other Public Company Boards: 1

Committees: None

|

Director Since: 2017

Other Public Company Boards: 0

Committees: AC, CODC

|

Director Since: 2020

Other Public Company Boards: 0

Committees: CODC, NGC

|

||||||||||||||||||||||||

|

Suzanne Nora Johnson, 67

Former Vice Chairman, The Goldman Sachs Group

|

|

NEW

Forrest Norrod, 59

Executive Vice President and General Manager of the Data Center Solutions Business Group, Advanced Micro Devices, Inc.

|

|

NEW

Vasant Prabhu, 64

Former Chief Financial Officer and Vice Chairman, Visa, Inc.

|

|||||||||||||||||||||

|

Independent Board Chair

Director Since: 2007

Other Public Company Boards: 1

Committees: CODC (Chair), NGC

|

||||||||||||||||||||||||||

|

Director Since: 2024

Other Public Company Boards: 0

Committees: AC, ARC

|

Director Since: 2024

Other Public Company Boards: 2

Committees: AC, ARC

|

|||||||||||||||||||||||||

|

Ryan Roslansky, 46

Chief Executive Officer, LinkedIn Corporation

|

|

Thomas Szkutak, 63

Former Senior Vice President and Chief Financial Officer, Amazon.com, Inc.

|

|

Raul Vazquez, 53

Chief Executive Officer and Director, Oportun Financial Corporation

|

|||||||||||||||||||||

|

Director Since: 2023

Other Public Company Boards: 0

Committees: AC, CODC

|

Director Since: 2018

Other Public Company Boards: 0

Committees: ARC (Chair), NGC

|

Director Since: 2016

Other Public Company Boards: 1

Committees: AC, ARC

|

||||||||||||||||||||||||

|

Eric S. Yuan, 54

Chief Executive Officer and Director, Zoom Video Communications, Inc.

|

Number of meetings in fiscal 2024 |

||||||||||||||||||||||||

| 4 | AC |

Acquisition Committee |

||||||||||||||||||||||||

| 9 | ARC |

Audit and Risk Committee |

||||||||||||||||||||||||

|

Director Since: 2023

Other Public Company Boards: 1

Committees: ARC, NGC

|

6 | CODC |

Compensation and Organizational Development Committee |

|||||||||||||||||||||||

| 4 | NGC |

Nominating and Governance Committee |

||||||||||||||||||||||||

6 |

INTUIT 2025 Proxy Statement

|

Proxy Summary |

||||||

Board Skills and Expertise

Our Board is committed to excellence in its governance practices, including with respect to the Board’s composition. The Board and its Nominating and Governance Committee believe that a diverse and experienced board is important for reaching sound decisions that drive stockholder value. Our Board has undergone significant refreshment in recent years to include a diversity of backgrounds, perspectives, and skill sets. In the past year, our Board has appointed two new directors, Vasant Prabhu and Forrest Norrod. Mr. Prabhu is the former CFO and Vice Chairman of Visa Inc., a global digital payments company, and is recognized for his strong financial acumen and deep expertise in financial services innovation, building a global technology and payments platform, and scaling businesses internationally, which the Board believes will be helpful in guiding Intuit's next chapter of growth. Mr. Norrod is the Executive Vice President and General Manager of the Data Center Solutions Business Group at Advanced Micro Devices, Inc., an adaptive computing company, where he has helped lead the company’s AI initiatives, driving the company’s data center growth and open AI ecosystem strategy. He brings to our Board deep experience in AI and data engineering, which are key skills to enhance the Board’s oversight of our strategy to be a global AI-driven expert platform. Our 13 director nominees represent a broad range of tenures, ages, genders, racial/ethnic backgrounds, expertise, and professional experience.

The following chart reflects the experience and expertise of the 13 director nominees for our Board. These are the skills and qualifications our Board considers important for our directors in light of our current business and structure.

|

Customer domain expertise - consumer and small and mid-market

10 director nominees

|

|

Go-to-market, digital marketing, partnerships and international expertise

13 director nominees

|

|

Public company board experience (current and former)

12 director nominees

|

|||||||||||||||||||||||||||||||||

|

Product domain expertise - SaaS, mobile, services and money innovation

11 director nominees

|

|

Public policy/government relations

5 director nominees

|

|

Financial acumen or expertise, including CEO/CFO or audit committee experience

13 director nominees

|

|||||||||||||||||||||||||||||||||

|

Technology domain expertise - software development, cloud, data, AI, platform and cybersecurity

11 director nominees

|

|

C-suite experience (current and former)

13 director nominees

|

|

Proven business acumen, collaboration and industry engagement

13 director nominees

|

|||||||||||||||||||||||||||||||||

SUMMARY OF PROPOSAL 2 |

||||||||||||||||||||

|

Advisory Vote to Approve Executive Compensation (Say-on-Pay)

In accordance with Section 14A of the Securities Exchange Act of 1934 (the “Exchange Act”), we are asking stockholders to vote, on an advisory basis, to approve Intuit’s executive compensation for our Named Executive Officers (“NEOs”).

|

||||||||||||||||||||

|

The Board recommends that you vote FOR approval, on an advisory basis, of the compensation of our NEOs.

|

|||||||||||||||||||

Proxy Summary |

INTUIT 2025 Proxy Statement

|

7 |

||||||

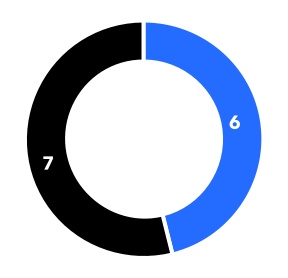

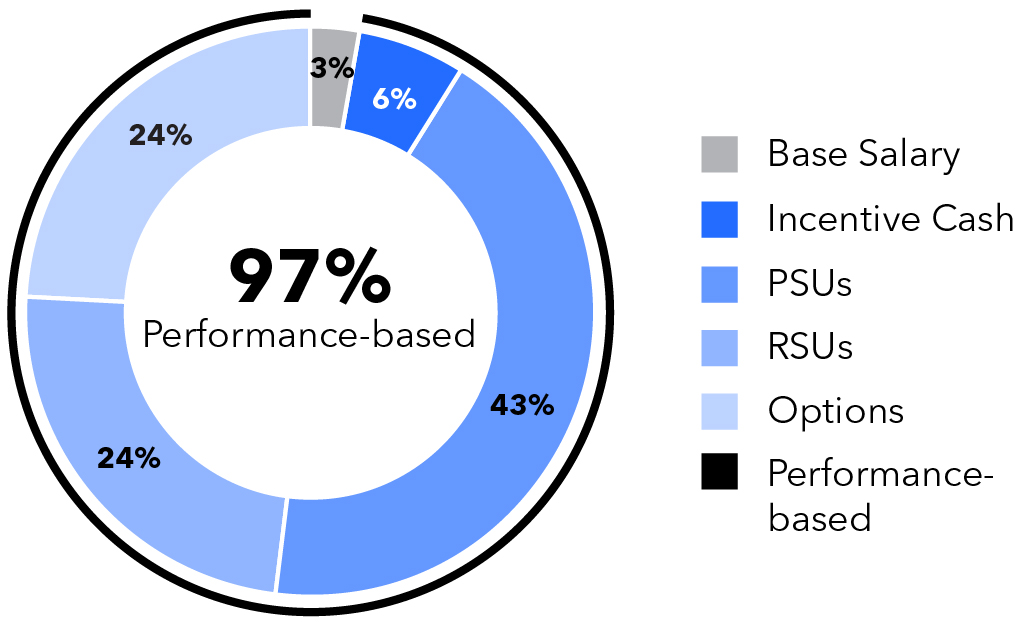

Executive Compensation Highlights

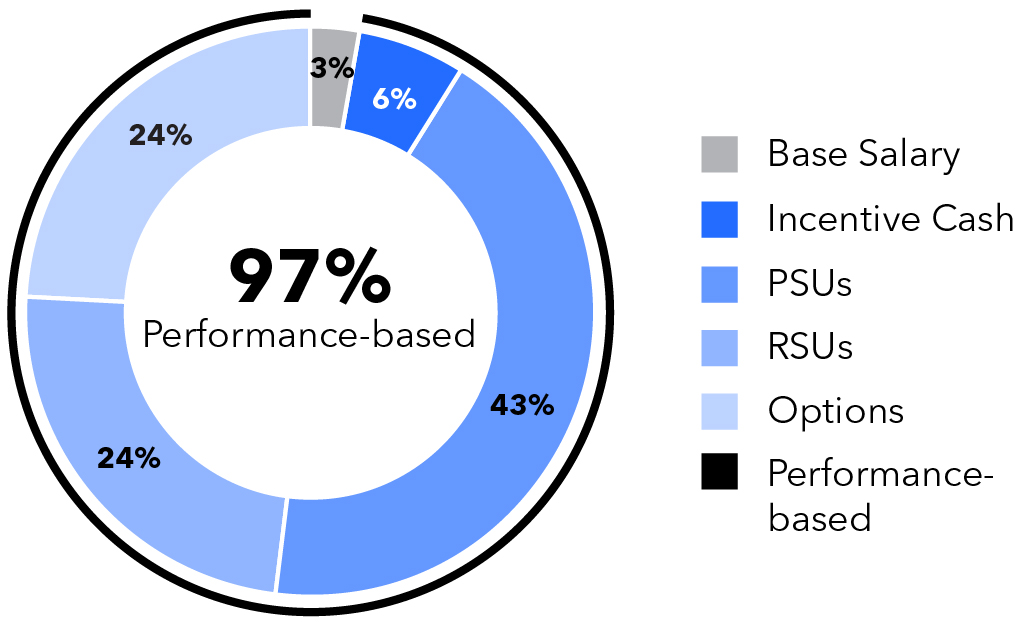

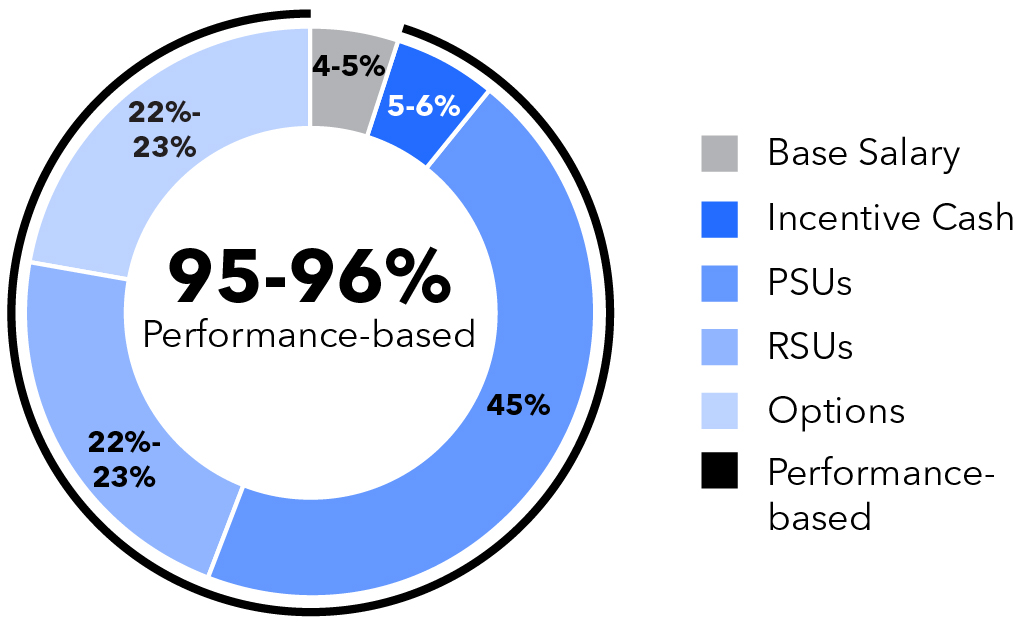

Performance-based Payouts

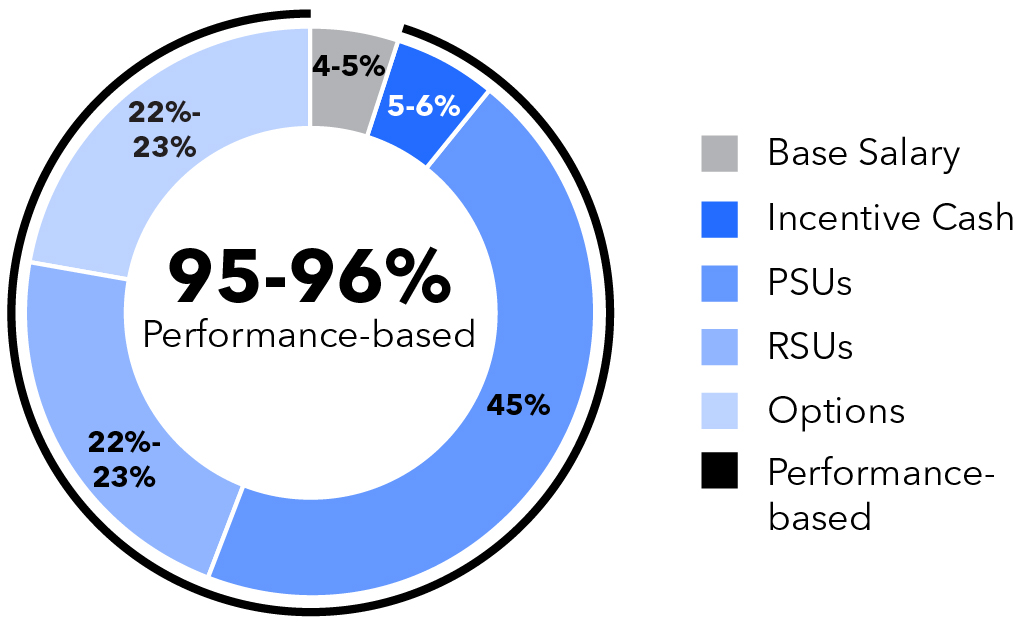

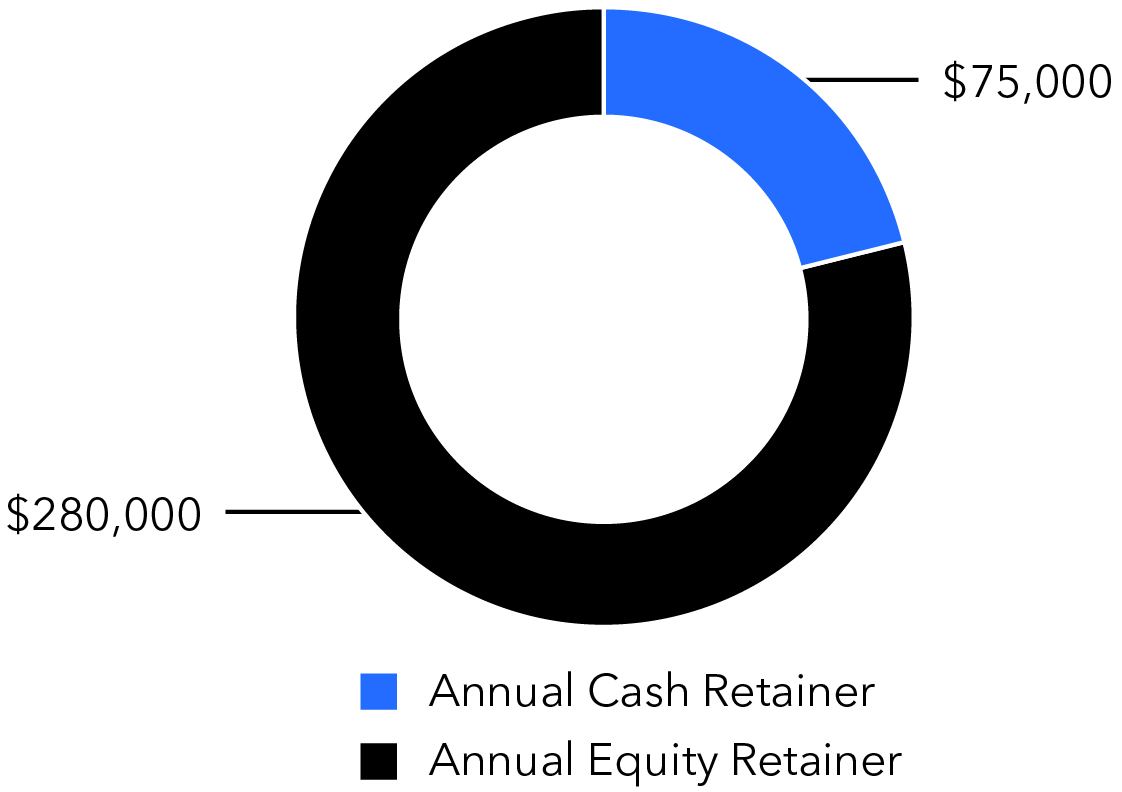

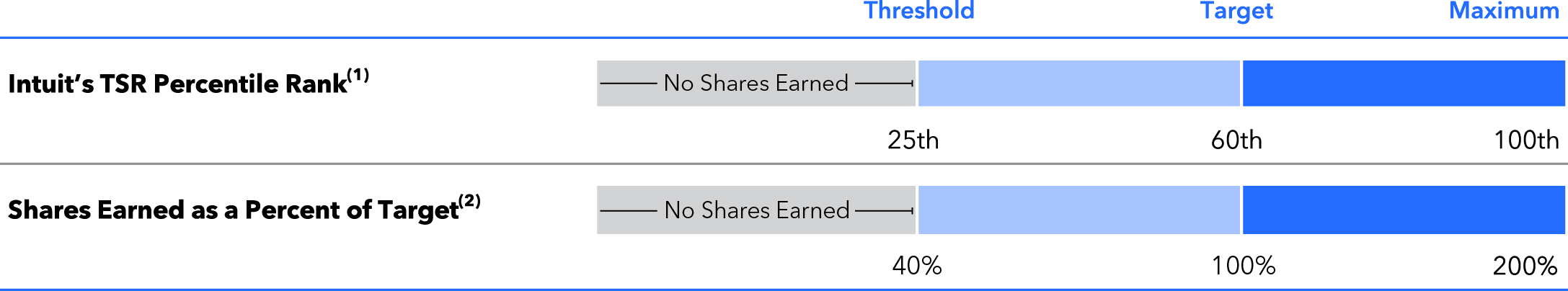

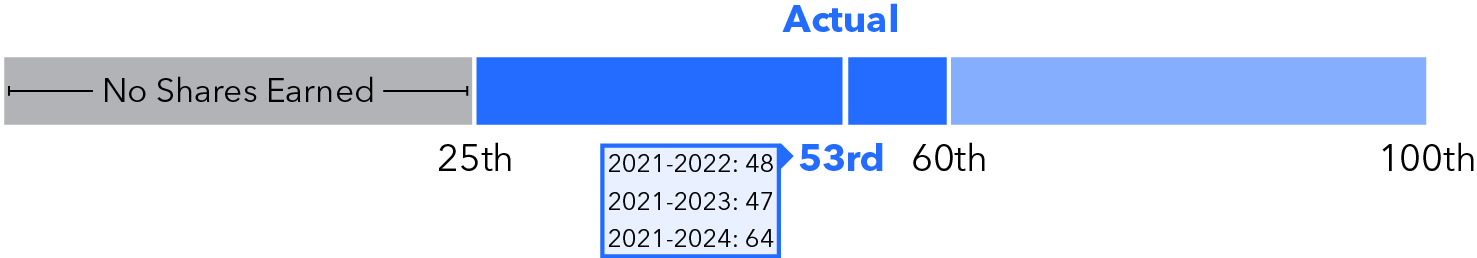

Our executive compensation programs are designed to reward both short- and long-term growth in the revenue and profitability of our business, TSR that compares favorably to the TSR of certain peer companies, and progress on goals to deliver for our True North stakeholders, including environmental, social, and governance (“ESG”) goals. As shown below, the vast majority of fiscal 2024 compensation for our NEOs was performance-based.

CEO Total Direct Compensation(1)

Other NEOs Total Direct Compensation(1)

(1)Total direct compensation reflects base salary, actual bonus payout, and equity awards granted during fiscal 2024. Consistent with disclosure in the Fiscal Year 2024 Summary Compensation Table, equity awards are reported at grant date fair value (which, for the PSUs, is based on the probable outcome of achievement of the performance goals using a widely accepted probability model), and salary and incentive cash are reported based on the actual amounts earned with respect to fiscal 2024.

Consistent with our compensation objectives, our NEOs were provided the following base salaries, cash incentives, and equity incentives in fiscal 2024:

Long-Term Equity Incentives |

|||||||||||||||||||||||

| Name and Position | Salary ($) |

Cash Incentive ($) |

Option

Awards

($)

|

RSUs

($)

|

PSUs ($) |

Total ($) |

|||||||||||||||||

|

Sasan K. Goodarzi

President and Chief Executive Officer

|

1,200,000 | 2,280,000 | 8,650,027 | 8,650,106 | 15,597,283 | 36,377,416 | |||||||||||||||||

|

Sandeep S. Aujla

Executive Vice President and Chief Financial Officer

|

770,000 | 877,800 | 3,500,057 | 3,500,503 | 7,000,351 | 15,648,711 | |||||||||||||||||

|

Laura A. Fennell

Executive Vice President and Chief People & Places Officer

|

770,000 | 877,800 | 3,500,057 | 3,500,503 | 7,000,351 | 15,648,711 | |||||||||||||||||

|

Mark Notarainni

Executive Vice President and General Manager, Consumer Group

|

725,000 | 688,750 | 3,375,055 | 3,375,238 | 6,750,201 | 14,914,244 | |||||||||||||||||

|

Marianna Tessel

Executive Vice President and General Manager, Global Business Solutions Group

|

770,000 | 877,800 | 4,125,067 | 4,125,570 | 8,250,460 | 18,148,897 | |||||||||||||||||

The table above excludes the grant date fair value of matching restricted stock units (“RSUs”) granted to executive officers under the Management Stock Purchase Program. It also excludes certain items that are reflected as “All Other Compensation” in the Fiscal Year 2024 Summary Compensation Table. These items are not typically considered in the Compensation and Organizational Development Committee’s (“Compensation Committee”) deliberations regarding annual compensation for our senior executives because (i) the amounts are non-recurring, not material, or not considered to be core elements of compensation by the committee, or (ii) the benefits are available to a large group of employees. For a complete discussion of our executive compensation program, see Compensation Discussion and Analysis and the Executive Compensation Tables below.

8 |

INTUIT 2025 Proxy Statement

|

Proxy Summary |

||||||

SUMMARY OF PROPOSAL 3 |

||||||||||||||||||||

|

Ratification of Selection of Ernst & Young LLP as Intuit’s Independent Registered Public Accounting Firm

The Audit and Risk Committee has selected Ernst & Young LLP as the independent registered public accounting firm to perform the audit of Intuit’s consolidated financial statements and the effectiveness of our internal control over financial reporting for the fiscal year ending July 31, 2025.

The Audit and Risk Committee made this selection based on Ernst & Young LLP’s independence, performance, and extensive knowledge of our business, controls, and processes.

|

||||||||||||||||||||

|

The Board recommends that you vote FOR the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2025.

|

|||||||||||||||||||

SUMMARY OF PROPOSAL 4 |

||||||||||||||||||||

|

Approval of an Amendment to Our Certificate of Incorporation to Limit the Liability of Certain Officers in Accordance with Recent Delaware Law Amendments

Delaware recently enacted legislation allowing Delaware corporations to amend their certificates of incorporation to eliminate the monetary liability of certain officers for a breach of fiduciary duty under certain circumstances. We are seeking stockholder approval to amend our Certificate of Incorporation to provide this protection to certain officers and align officer protections with those of our directors, promoting better decision-making and long-term stockholder value. It would also enhance Intuit's ability to attract and retain top talent.

|

||||||||||||||||||||

|

The Board recommends that you vote FOR the proposal to amend our Certificate of Incorporation to limit the liability of certain officers in accordance with recent Delaware law amendments.

|

|||||||||||||||||||

Proxy Summary |

INTUIT 2025 Proxy Statement

|

9 |

||||||

Corporate Governance

Corporate Governance Practices

Intuit is committed to excellence in corporate governance. We maintain numerous policies and practices that demonstrate this commitment, including those summarized below.

|

Independence |

|

Stockholder Engagement | |||||||||||||||||

|

•Independent Board Chair

•All non-employee directors are independent

•Independent directors meet regularly in executive session

•All members of the Board’s four standing committees are independent

•Commitment to Board refreshment, with two new independent directors added in the last fiscal year

|

•Long-standing, proactive and robust stockholder engagement program, including director participation

•Our bylaws provide stockholders with a proxy access right

•Stockholders may act by written consent

|

|||||||||||||||||||

|

Accountability |

|

Alignment with Stockholder Interests | |||||||||||||||||

|

•Annual election of all directors and majority voting in uncontested elections

•Annual stockholder advisory vote to approve Named Executive Officer compensation

•Annual Board evaluation of CEO performance

•Cash bonuses and equity awards are subject to clawback

|

•Pay-for-performance executive compensation program

•Robust stock ownership requirements for senior executive officers and non-employee directors, including 10x salary for the CEO and 10x annual cash retainer for non-employee directors

•Prohibition against director and employee (including officer) hedging and pledging of Intuit stock

•Single class of stock with equal voting rights

|

|||||||||||||||||||

|

Board Practices |

|

Ethics Practices | |||||||||||||||||

|

•Board Chair and CEO roles held by two different people

•Corporate Governance Principles that are publicly available and reviewed annually

•Board composition reflects diversity of gender, race, ethnicity, skills, tenure, and experience

•Director recruitment process requires a pool of candidates with a diversity of gender, race, and ethnicity, among other backgrounds and experiences

•Rigorous annual Board and committee self-evaluation process

•Annual review of management succession planning

•Regular review of cybersecurity and other significant risks to Intuit

|

•Code of Conduct & Ethics for employees that is monitored by Intuit’s ethics office and overseen by the General Counsel

•Code of Ethics that applies to all Board members

•Ethics hotline that is available to all employees as well as third parties

•Non-retaliation policy for reporting ethics concerns

•Audit and Risk Committee reviews complaints regarding accounting, internal accounting controls, auditing, and federal securities law matters

|

|||||||||||||||||||

|

Transparency and Responsibility | |||||||||||||

|

•Nominating and Governance Committee oversees corporate responsibility and reviews ESG matters

•Compensation and Organizational Development Committee oversees diversity, equity, and inclusion (“DEI”) initiatives in support of organizational development

•Annual stakeholder impact report (reporting under Global Reporting Initiative, Sustainability Accounting and Standards Board frameworks) and dedicated website disclosing ESG practices, including with respect to job creation and job readiness, positive impact on climate, and pay and promotion equity (https://www.intuit.com/company/corporate-responsibility/)

•DEI website disclosing DEI matters (https://www.intuit.com/company/diversity/)

•Detailed financial reporting and proxy statement disclosure designed to be clear and understandable

|

•Dedicated website disclosing responsible AI principles that guide how we operate and scale our AI-driven expert platform responsibly (https://www.intuit.com/privacy/responsible-ai/)

•Public disclosure of Corporate Governance Principles, Board Code of Ethics, Bylaws, Board committee charters, Code of Conduct & Ethics, EEO-1 forms, CDP climate questionnaires, corporate tax policy, global human rights policy, and other documents (https://investors.intuit.com/corporate-governance/governance-documents)

•Voluntary website disclosure regarding Intuit’s political expenditures, political accountability policy and positions on public policy issues that impact the way we serve our customers (https://investors.intuit.com/corporate-governance/political-accountability)

|

|||||||||||||

10 |

INTUIT 2025 Proxy Statement

|

Corporate Governance |

Corporate Governance Practices |

||||||||

Board Responsibilities and Structure

The Board’s Role

The Board oversees management’s performance on behalf of Intuit’s stockholders. The Board’s primary responsibilities include the following.

Monitor management’s performance to assess whether Intuit is operating in an effective, efficient, and ethical manner in order to create value for Intuit’s stockholders |

Periodically review Intuit’s long-range strategic plan, business initiatives, enterprise risk management, capital projects, and budget matters |

Oversee long-term succession planning, select the CEO, and determine CEO compensation |

||||||

Board’s Role in Strategy

Our Board recognizes the importance of designing our overall business strategy to create long-term, sustainable value for Intuit stockholders. As a result, the Board maintains an active oversight role in helping management formulate, plan, and implement Intuit’s strategy. Specifically, the Board has a robust annual strategic planning process that includes reviewing our business and financial plans, strategies, and near- and long-term initiatives. This annual process includes a full-day Board session to review Intuit’s overall strategy with our senior leadership team and quarterly meetings to review progress against that strategy. In addition, every year, the Board reviews Intuit’s three-year financial plan, which serves as the basis for the annual operating plan for the upcoming year.

The Board considers the progress of and challenges to Intuit’s strategy, as well as related risks, throughout the year. At each regularly scheduled Board meeting, the CEO has an executive session with the Board to discuss strategic and other significant business developments since the last meeting.

Board’s Oversight of Risk

The full Board regularly reviews Intuit’s significant risks, oversees our risk management program and delegates certain risk oversight responsibilities to Board committees. Management is responsible for balancing risk and opportunity in support of Intuit’s objectives, and carries out the daily processes, controls, and practices of our risk management program - many of which are embedded in our operations, including our disclosure controls and procedures.

Our Enterprise Risk Management (“ERM”) program is intended to review and address Intuit’s critical enterprise risks, including strategic, technology, financial, compliance and operational risks. Intuit’s Chief Compliance Officer, who reports to our General Counsel, facilitates the ERM program. As part of our ERM process, management annually identifies, assesses, prioritizes, and develops mitigation plans for Intuit’s top risks over short- and longer-term time horizons. These plans are reviewed annually with the full Board and the Audit and Risk Committee and, throughout the year, the standing committees of the Board review the risk management activities under their purview and report to the full Board as appropriate. From time to time, the Board, its committees or management consult with third-party advisors on particular risks.

Board Responsibilities and Structure |

Corporate Governance |

INTUIT 2025 Proxy Statement

|

11 |

||||||||

The Board and its Committees |

|||||||||||||||||||||||||||||||||||||||||

|

•The Board maintains direct oversight of our strategic risk exposure as part of its responsibility to oversee corporate strategy. The Board believes it currently benefits from review and discussion of this risk exposure among all directors and that this oversight role is appropriate given the collective breadth and depth of experience of our Board members.

•The Board regularly reviews and discusses significant risks with management, including through the annual strategic planning process and reviews of annual operating plans, financial performance, merger and acquisition opportunities, market environment updates, legal and regulatory developments, and presentations on specific risks.

•The Board also reviews reports from each committee regarding risk matters under its purview.

|

|||||||||||||||||||||||||||||||||||||||||

| Acquisition Committee | Audit and Risk Committee |

Compensation and Organizational Development Committee |

Nominating and Governance Committee |

||||||||||||||||||||||||||||||||||||||

|

Meetings in Fiscal 2024

4

|

Meetings in Fiscal 2024

9

|

Meetings in Fiscal 2024

6

|

Meetings in Fiscal 2024

4

|

||||||||||||||||||||||||||||||||||||||

|

Areas of Risk Oversight

•Reviews risks associated with Intuit’s acquisition, divestiture and strategic investment activities, and the strategy and business models of acquisition candidates

•Oversees the performance of Intuit’s completed acquisitions, divestitures and strategic investment transactions

|

Areas of Risk Oversight

•Has primary responsibility for overseeing our ERM program

•Receives a quarterly report from the Chief Compliance Officer on Intuit’s top risk areas and the progress of the ERM program

•Oversees particular risks, such as financial management, privacy, cybersecurity and fraud

•Annually reviews our ERM policies and processes, and from time to time separately reviews the Board’s approach to risk oversight

•Oversees our ethics and compliance programs, including our Code of Conduct & Ethics, the Board Code of Ethics, and responsible AI

•Oversees litigation risks

|

Areas of Risk Oversight

•Reviews risks associated with our compensation programs, policies and practices, both for executives in particular and for employees generally

•Assists the Board in its oversight of stockholder engagement on executive compensation matters

•Oversees succession planning and senior leadership development

•Oversees organizational development activities and human capital management, including management depth and strength assessment; leadership development; company-wide organization and talent assessment; employee recruitment, engagement and retention; workplace environment and culture; employee health and safety; DEI initiatives; and pay equity

|

Areas of Risk Oversight

•Reviews risks associated with corporate governance

•Oversees overall board effectiveness, including identifying and recruiting diverse members with appropriate skills, experience and characteristics

•Annually reviews and approves our Political Accountability Policy

•Oversees our corporate responsibility risks and practices and discusses with management periodic reports on the company’s (i) progress on ESG matters and (ii) communications with stockholders and other stakeholders regarding these matters

•Assists the Board in its oversight of our engagement with stockholders

|

||||||||||||||||||||||||||||||||||||||

|

Regular Reports From

•Chief Corporate Strategy & Development Officer

•General Counsel

•Other Senior Business Leaders

|

Regular Reports From

•Chief Financial Officer

•Chief Accounting Officer

•Chief Audit Executive

•Chief Information Security & Fraud Prevention Officer

•General Counsel

•Chief Compliance Officer

•Chief Data Officer

•Head of Investor Relations

•Other Senior Business Leaders

|

Regular Reports From

•Chief People & Places Officer

•Head of Total Rewards

•Chief Diversity, Equity & Inclusion Officer

•Head of Investor Relations

•General Counsel or Deputy General Counsel

•Other Senior Business Leaders

|

Regular Reports From

•Chief Corporate Affairs Officer

•Head of Corporate Responsibility

•Head of Investor Relations

•General Counsel or Deputy General Counsel

•Other Senior Business Leaders

|

||||||||||||||||||||||||||||||||||||||

12 |

INTUIT 2025 Proxy Statement

|

Corporate Governance |

Board Responsibilities and Structure |

||||||||

Oversight of Cybersecurity Risks |

|||||

Our full Board of Directors (“Board”) provides ultimate oversight for the cybersecurity program and has delegated to the Audit and Risk Committee primary oversight of cybersecurity risks. The Audit and Risk Committee receives regular, quarterly reports from our Chief Information Security and Fraud Prevention Officer (“CISO”) and a cross-functional cybersecurity, compliance, risk, and fraud team. These reports include cybersecurity and anti-fraud efforts, including updates, metrics, and trends, such as the status of prior security events, existing and emerging threat landscapes, the results of audits or assessments, fraud prevention efforts, vulnerability detection and disclosure changes, and the status of projects to strengthen our security systems and improve incident readiness, and how these may affect broader enterprise risk management. Under our incident response processes, the CISO, or other management, reports certain incidents to the Audit and Risk Committee or the full Board, as appropriate.

Oversight of Environmental, Social, and Governance Risks |

|||||

The Board has been highly engaged with management on the evolution of Intuit’s ESG practices and reporting. The Board oversees the assessment of ESG risks as part of the development of our overall long-term strategy. Given our cross-functional approach to ESG, ESG oversight responsibility is allocated across the Board’s committees based on their areas of expertise.

|

Compensation and Organizational Development Committee

Oversees our DEI initiatives in support of organizational development, including pay equity, and considers our True North Goals relating to workforce diversity in making executive compensation decisions

|

Nominating and Governance Committee

Oversees our corporate responsibility strategy and goals, including environmental, sustainability and social matters

|

Audit and Risk Committee

Oversees our cybersecurity and anti-fraud practices, as well as our disclosure practices relating to ESG

|

||||||

Oversight of AI Risks |

|||||

The Audit and Risk Committee oversees our compliance programs, including our responsible AI governance framework that supports how we responsibly develop, operate, and scale our AI-driven expert platform. This framework helps us to proactively identify and mitigate potential negative unintended consequences that could result from our AI systems. As part of this responsibility, the committee receives regular reports from the company’s cross-functional AI Governance Committee, the executive level committee that oversees the company’s deployment of AI across its offerings.

Oversight of Management Succession Planning |

|||||

The Board’s oversight of management succession planning is key to ensure the company’s continuing ability to solve the most pressing problems of its customers in the future. Our thoughtful and orderly approach to long-term leadership development and succession planning of management is overseen by our Compensation Committee and discussed by the full Board on at least an annual basis. This process includes discussions about the succession process and timeline, assessments of successor candidates for the CEO and other senior leadership positions, the leadership pipeline and development plans for the next generation of senior leadership, and organizational development. The Compensation Committee also oversees crisis succession plans.

Board Responsibilities and Structure |

Corporate Governance |

INTUIT 2025 Proxy Statement

|

13 |

||||||||

Board Leadership Structure

Each year, the Board reviews its leadership structure and determines whether, at the time, it is in the best interests of Intuit and our stockholders for the roles of Board Chair and CEO to be held by the same person or by different people. When the same person serves as both Board Chair and CEO, our Corporate Governance Principles require the independent directors to appoint a Lead Independent Director. When the roles are separated and the Board Chair is not independent, the independent directors may appoint a Lead Independent Director.

Currently, the roles of Board Chair and CEO are separated, and the Board Chair is an independent director. While separation of the Board Chair and CEO roles is not required under our bylaws or Corporate Governance Principles, the Board believes that at this time this leadership structure is appropriate for us and in the best interests of Intuit and our stockholders. In particular, the Board believes this structure provides an effective balance between strong company leadership and oversight by independent directors with expertise from outside the company, and enables Mr. Goodarzi to focus his attention on executing our business strategy and leading our operations.

In October 2024, Ms. Nora Johnson was re-appointed as Board Chair. At this time, the Board has determined that it is not necessary to appoint a Lead Independent Director given that Ms. Nora Johnson is an independent director.

| Role of the Board Chair | ||||||||

|

As Board Chair, Ms. Nora Johnson’s responsibilities include the following.

•Presiding at meetings of the Board, including executive sessions of the independent directors, which occur at least quarterly

•Approving the agenda for Board meetings (in consultation with the CEO) and the schedule for Board meetings to provide sufficient time for discussion of all agenda items

•Ensuring the Board receives adequate and timely information

•Conducting the annual board evaluation with an independent third-party at the direction of the Nominating and Governance Committee

•Being available for consultations and communications with stockholders as appropriate

•Calling executive sessions of the independent directors

•Facilitating the critical flow of information between the Board and senior management

•Calling special meetings of the Board and stockholders

|

|||||||

Board, Committee, and Annual Stockholder Meetings

The Board and its committees hold regular meetings throughout the year on a set schedule, and also hold special meetings and act by written consent from time to time, as appropriate. The Board held four meetings during fiscal 2024.

The Board expects that all directors will prepare for, attend and participate in all Board and applicable committee meetings, and will see that other commitments do not materially interfere with their service on the Board. During fiscal 2024, all current directors attended at least 75% of the aggregate number of meetings of the Board and the committees on which they served.

Our Corporate Governance Principles encourage all directors to attend our Annual Meeting of Stockholders. Nine of the 11 directors who were serving at the time of the 2024 Annual Meeting of Stockholders attended that meeting.

The Board regularly convenes executive sessions among all Board members, and at every regular Board meeting, the independent directors meet separately. | ||

14 |

INTUIT 2025 Proxy Statement

|

Corporate Governance |

Board Responsibilities and Structure |

||||||||

Director Orientation and Continuing Education

New directors receive orientation that includes written materials, briefings, and educational opportunities designed to permit them to become familiar with the Company and enable them to better perform their duties. In addition, the Board receives periodic updates on regulatory and other developments relevant to the Board from management and outside experts. Board members are also encouraged to attend outside director education programs and we reimburse them for the associated costs and expenses.

Board Composition

Director Independence

To be considered independent under the Nasdaq rules, a director must meet several bright-line tests, including that the director is not, and for the last three years has not been, employed by Intuit and that neither the director nor any of his or her family members has engaged in certain types of business dealings with Intuit. The Nominating and Governance Committee and the full Board annually review relevant transactions, relationships and arrangements that may affect the independence of our Board members. As required by Nasdaq rules, the Board also makes a determination that, in its opinion, no relationship exists that would interfere with any independent director’s exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the Board reviews and discusses information provided by the directors and by Intuit with regard to each director’s business and personal activities as they relate to Intuit, Intuit’s management and the Board.

The Board also considers the tenure of a director and whether the duration of service could impact the director’s independence from management, including the director’s engagement with management and the effectiveness of the director’s participation in Board and committee deliberations. The Board believes that a balanced mix of board tenure is effective in providing oversight and that our longer-serving directors with extensive relevant experience and institutional knowledge of Intuit bring critical skills to the boardroom. In particular, the Board believes that given the size of our company, the breadth of our offerings, and the increasing regulatory complexity that we face (in critical areas like financial services), our longer-tenured directors bring a deeper understanding of the company and the risks that we face.

Upon review of these relationships and other information provided by our director nominees, the Board determined that there are no relationships that would interfere with the exercise of independent judgment by Intuit’s independent directors in carrying out their responsibilities as directors, and that the following director nominees are independent: Ms. Burton, Mr. Dalzell, Ms. Liu, Ms. Mawakana, Ms. Nora Johnson, Mr. Norrod, Mr. Prabhu, Mr. Roslansky, Mr. Szkutak, Mr. Vazquez, and Mr. Yuan.

At each regularly scheduled meeting of the Board and its committees, independent Board members meet in closed session without any company management present. The independent Board members also meet to review the CEO’s performance evaluation and compensation decisions, at the direction of the Compensation Committee.

Qualifications of Directors

The Nominating and Governance Committee believes that all nominees for Board membership should possess the following.

•The highest ethics, integrity, and values

•An inquisitive and objective perspective, practical wisdom, and mature judgment

•Broad, high-level experience in business, technology, government, education, or public policy

•A commitment to representing the long-term interests of Intuit’s stockholders

•Sufficient time to carry out the duties of an Intuit director

When evaluating candidates for director, the Nominating and Governance Committee considers the full range of skills it has determined should be represented on the Board, as shown in Proposal 1. The committee also considers other factors, such as independence, diversity, expertise, specific skills, and other qualities that may contribute to the Board’s overall effectiveness. The committee may engage third-party search firms to assist in identifying and evaluating director candidates.

The Board and the Nominating and Governance Committee seek nominees with a diverse set of skills and personal characteristics that will complement the skills, personal characteristics and experience of our existing directors and provide an overall balance of perspectives and backgrounds. The committee will include in the initial pool of candidates for nomination as a new director individuals with a diversity of gender, race, and ethnicity, among other backgrounds and experiences. In selecting nominees, the committee looks for individuals with varied professional experience, backgrounds, knowledge, skills, and viewpoints in order to build and maintain a board that, as a whole, provides effective oversight of management. As part of its annual evaluation process, the committee assesses its ability to build an effective and diverse board.

Board Composition |

Corporate Governance |

INTUIT 2025 Proxy Statement

|

15 |

||||||||

Stockholder Recommendations of Director Candidates

Our Nominating and Governance Committee will consider director candidates recommended by stockholders. You may find our Corporate Governance Principles, which outline our Board membership criteria, at https://investors.intuit.com/corporate-governance/conduct-and-guidelines/default.aspx. Any stockholder who wishes to recommend a candidate for the committee’s consideration should submit the candidate’s name and qualifications via our website at https://investors.intuit.com/corporate-governance/conduct-and-guidelines/contact-the-board/default.aspx or by mail to the Nominating and Governance Committee, c/o Corporate Secretary, Intuit Inc., P.O. Box 7850, Mail Stop 2700, Mountain View, California 94039-7850. For faster delivery, we suggest that any communications be made via our website. The committee’s policy is to evaluate candidates properly recommended by stockholders in the same manner it evaluates candidates recommended by management or current Board members. Recommendations for director nomination received by the Corporate Secretary that satisfy our bylaw requirements will be presented to the Nominating and Governance Committee for its consideration.

In addition, our bylaws permit stockholders (either individually or in a group of up to 20 stockholders) that have owned 3% or more of Intuit’s outstanding shares continuously for at least three years to submit director nominees (the greater of two directors or up to 20% of our Board) for inclusion in our proxy materials. For additional information, see Stockholder Proposals and Nominations for the 2026 Annual Meeting of Stockholders.

Service on Other Boards and Job Changes

Each director is expected to see that their other existing and planned future commitments do not materially interfere with their service on the Board. Directors generally may not serve on the boards of more than five public companies, including Intuit’s Board. In fiscal 2024, none of our directors served on more than two other public company boards at the same time that they served on our Board. We annually review each director’s compliance with the policy.

Any director who has a principal job change, including retirement, must offer to submit a letter of resignation to the Board Chair. The Board, in consultation with the Nominating and Governance Committee, will determine whether to accept or reject any such resignation offer after considering whether the composition of the Board remains appropriate under the new circumstances.

Board Committees and Charters

The Board has delegated certain responsibilities and authority to its four standing committees: Acquisition Committee, Audit and Risk Committee, Compensation Committee, and Nominating and Governance Committee. Committees report regularly to the full Board on their activities and actions.

Each committee has a charter that it reviews annually, making recommendations to the Board for any charter revisions that might be needed to reflect evolving best practices and stock exchange or other requirements. All four committee charters are available on our website at https://investors.intuit.com/corporate-governance/committee-composition/default.aspx. The members of each committee are independent and appointed by the Board based on recommendations of the Nominating and Governance Committee. Committee members have the opportunity to meet in closed session, without management present, during each committee meeting.

16 |

INTUIT 2025 Proxy Statement

|

Corporate Governance |

Board Committees and Charters |

||||||||

AC |

|||||||||||||||||

|

Acquisition Committee

Meetings in fiscal 2024: 4

Chair: Richard L. Dalzell

Other Members:

Deborah Liu

Forrest Norrod

Vasant Prabhu

Ryan Roslansky

Raul Vazquez

|

Key Responsibilities

•Reviewing and approving acquisition, divestiture and strategic investment transactions proposed by Intuit’s management if the total amount to be paid or received by Intuit meets certain Board-established requirements, which the Board periodically revisits.

•Regularly reporting to the Board the committee’s activities and actions relating to acquisitions, divestiture and strategic investment transactions, including ongoing assessments of completed transactions.

|

||||||||||||||||

ARC |

|||||||||||||||||

|

Audit and Risk Committee

Meetings in fiscal 2024: 9

Chair: Thomas Szkutak

Other Members:

Eve Burton

Richard L. Dalzell

Forrest Norrod

Vasant Prabhu

Raul Vazquez

Eric S. Yuan

|

Key Responsibilities

•Representing and assisting the Board in its oversight of Intuit’s financial reporting, internal controls and audit functions.

•Selecting, evaluating, retaining, compensating and overseeing Intuit’s independent registered public accounting firm.

•Overseeing cybersecurity and other risks relevant to our information technology environment, including by receiving regular cybersecurity updates from Intuit’s management team.

•Receiving and reviewing periodic reports from management regarding Intuit’s ethics and compliance programs.

|

||||||||||||||||

|

Our Board has determined that each member of the Audit and Risk Committee is both independent (as defined under applicable Nasdaq listing standards and SEC rules related to audit committee members) and financially literate (as required by Nasdaq listing standards). The Board also has determined that each of Mr. Prabhu, Mr. Szkutak, Mr. Vazquez, and Mr. Yuan qualifies as an “audit committee financial expert” as defined by SEC rules, and has “financial sophistication” in accordance with Nasdaq listing standards.

The Audit and Risk Committee held closed sessions with our independent registered public accounting firm, Ernst & Young LLP, during all of its regularly scheduled meetings in fiscal 2024.

|

|||||||||||||||||

Board Committees and Charters |

Corporate Governance |

INTUIT 2025 Proxy Statement

|

17 |

||||||||

|

CODC

|

|||||||||||||||||

|

Compensation and Organizational Development Committee

Meetings in fiscal 2024: 6

Chair: Suzanne Nora Johnson

Other Members:

Deborah Liu

Tekedra Mawakana

Ryan Roslansky

|

Key Responsibilities

•Assisting the Board in reviewing and approving executive compensation and in overseeing organizational and management development for executive officers and other Intuit employees.

•Together with the CEO and the Chief People & Places Officer, periodically reviewing Intuit’s key management personnel from the perspectives of leadership development, organizational development, and succession planning.

•Evaluating Intuit’s strategies for hiring, developing and retaining executives in an increasingly competitive environment, with the goal of creating and growing Intuit’s “bench strength” at senior executive levels.

•Annually reviewing our non-employee director compensation programs and making recommendations on the programs to the Board.

•Overseeing our stock compensation programs.

•Overseeing broader organizational development activities and human capital management, including management depth and strength assessment; company-wide organization and talent assessment; employee recruitment, engagement and retention; workplace environment and culture; employee health and safety; and pay equity.

•Overseeing our DEI initiatives in support of organizational development.

|

||||||||||||||||

|

For more information on the responsibilities and activities of the Compensation Committee, including its processes for determining executive compensation, see the Compensation and Organizational Development Committee Report and Compensation Discussion and Analysis below, particularly the discussion of the Role of Compensation Consultants, Executive Officers and the Board in Compensation Determinations. The Compensation Committee may delegate any of its responsibilities to subcommittees or to management as the committee may deem appropriate in its sole discretion.

Our Board has determined that each member of the Compensation Committee is independent under Nasdaq listing standards applicable to compensation committee members and a “Non-Employee Director,” as defined in Rule 16b-3 of the Exchange Act. During fiscal 2024, the Compensation Committee held closed sessions with the independent compensation consultant during all of its regularly scheduled meetings.

|

|||||||||||||||||

NGC |

|||||||||||||||||

|

Nominating and Governance Committee

Meetings in fiscal 2024: 4

Chair: Eve Burton

Other Members:

Tekedra Mawakana

Suzanne Nora Johnson

Thomas Szkutak

Eric S. Yuan

|

Key Responsibilities

•Reviewing and making recommendations to the Board regarding Board composition and our governance standards.

•Evaluating the skills, experience, diversity and other characteristics that are appropriate to promote the effectiveness of the Board.

•Identifying and evaluating candidates for director.

•Overseeing our Political Accountability Policy, Corporate Governance Principles, and Board Code of Ethics, and reviewing each of these documents on an annual basis.

•Overseeing Intuit’s practices relating to corporate responsibility, including environmental, sustainability, and social matters, and discussing with management periodic reports on the company’s (i) progress on ESG matters and (ii) communications with stockholders and other stakeholders regarding these matters.

•Overseeing orientation and continuing education for directors.

•Assisting the Board’s oversight of the company’s engagement with stockholders.

|

||||||||||||||||

|

From time to time, the committee retains a third-party search firm to help identify potential director candidates.

Our Board has determined that each member of the Nominating and Governance Committee is independent, as defined under applicable Nasdaq listing standards.

|

|||||||||||||||||

18 |

INTUIT 2025 Proxy Statement

|

Corporate Governance |

Board Committees and Charters |

||||||||

Annual Board Evaluation

The Nominating and Governance Committee oversees this process, which is led by the Board Chair and facilitated by an independent third party.

| The evaluation process | How results are used | |||||||||||||||||||||||||

| 1 |

Each Board member assesses the performance of the Board as a whole and the other directors.

|

by the Board, to identify skills, expertise, experience, or other characteristics that may be desirable in new Board candidates

|

||||||||||||||||||||||||

| 2 |

Each Board member assesses the performance of the committees, including how well each committee keeps the full Board informed.

|

by the Board, to identify each director’s strengths and areas of opportunity and to provide insight into how each Board member can be most valuable to Intuit

|

||||||||||||||||||||||||

| 3 |

Each committee member assesses the performance of each committee on which he or she sits, including by evaluating the specific areas over which the committee has oversight responsibility.

|

by the Board, to continually improve governance processes, including the flow of information from committees to the Board and the evaluation process itself

|

||||||||||||||||||||||||

| 4 |

Board members meet individually with the Board Chair and the independent third party to discuss their assessments and to provide further feedback.

|

by all Board committees, to evolve meeting agendas so the information they receive enables them to effectively address the issues they consider most critical

|

||||||||||||||||||||||||

| 5 |

The Board Chair and the independent third party share feedback received with individual directors, the Nominating and Governance Committee, and the full Board.

|

by the Nominating and Governance Committee, as part of its annual review of each director’s performance when considering whether to nominate the director for re-election to the Board

|

||||||||||||||||||||||||

| 6 | The full Board reviews and discusses the feedback. |

|||||||||||||||||||||||||

Each year, our Board members assess the performance of the Board and its committees, including evaluation of the following. | ||||||||||||||||||||||||||||||||||||||

|

Topics covered by the Board during the year

Board members evaluate the broad and evolving range of focus areas in order to assess the board’s effectiveness.

|

Board culture and structure

Board members evaluate the board’s ability to have candid discussions, the rigor of the decision making, and the board’s composition.

|

Board processes

The Board considers, among other things, the number of meetings, allocation of time for discussions, and Board performance.

|

Information and resources received by the Board

Board members assess, among other things, the quality of the materials the Board receives and the performance of advisors to the Board and its committees.

|

Effectiveness of each Board committee and fellow members

Board members assess the effectiveness of each committee and the quality of the reports that the Board receives from the committees.

|

||||||||||||||||||||||||||||||||||

Annual Board Evaluation |

Corporate Governance |

INTUIT 2025 Proxy Statement

|

19 |

||||||||

Transactions with Related Persons

The Audit and Risk Committee is responsible for reviewing, and approving or ratifying, as appropriate, transactions between Intuit (or one of our subsidiaries) and any “related person” of Intuit. Under Securities and Exchange Commission (“SEC”) rules, “related persons” include directors, officers, nominees for director, 5% stockholders, and any of their respective immediate family members. The Audit and Risk Committee has adopted a written policy, which is described below, to evaluate these transactions for approval or ratification.