DEF 14A: Definitive proxy statements

Published on November 23, 2016

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box: | ||

¨ |

Preliminary Proxy Statement |

|

¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

þ |

Definitive Proxy Statement |

|

¨ |

Definitive Additional Materials |

|

¨ |

Soliciting Material under § 240.14a-12 |

|

INTUIT INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ |

No fee required. |

|||

¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

(1) |

Title of each class of securities to which transaction applies: |

|||

(2) |

Aggregate number of securities to which transaction applies: |

|||

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

(4) |

Proposed maximum aggregate value of transaction: |

|||

(5) |

Total fee paid: |

|||

¨ |

Fee paid previously with preliminary materials. |

|||

|

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which

the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or

Schedule and the date of its filing.

| ||||

(1) |

Amount Previously Paid: |

|||

(2) |

Form, Schedule or Registration Statement No.: |

|||

(3) |

Filing Party: |

|||

(4) |

Date Filed: |

|||

INTUIT INC.

2700 Coast Avenue

Mountain View, CA 94043

NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholder:

You are cordially invited to attend our 2017 Annual Meeting of Stockholders, which will be held at 8:00 a.m. Pacific Standard Time on January 19, 2017 at our offices at 2750 Coast Avenue, Building 6, Mountain View, California 94043. We are holding the meeting for the following purposes:

1. To elect the nine directors nominated by the Board of Directors and named in the proxy statement to hold office until the next annual meeting of stockholders or until their respective successors have been elected and qualified;

2. To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2017;

3. To approve the Amended and Restated 2005 Equity Incentive Plan to (a) increase the share reserve by an additional 23,110,386 shares; (b) reapprove the material terms of performance-based compensation for purposes of Section 162(m); and (c) amend certain terms of the 2005 Equity Incentive Plan.

4. To approve, on an advisory basis, the Company’s executive compensation.

Stockholders will also consider any other matters that may properly be brought before the annual meeting and any postponement(s) or adjournment(s) thereof.

Only stockholders who owned our stock at the close of business on November 21, 2016 may vote at the annual meeting, or at any adjournment or postponement of the annual meeting.

Your vote is important. Whether or not you plan to attend the annual meeting, please cast your vote, as instructed in the Notice of Internet Availability of Proxy Materials, over the Internet or by telephone, as promptly as possible. You may also request a paper proxy card to submit your vote by mail, if you prefer. We encourage you to vote via the Internet. We believe it is convenient for our stockholders, while significantly lowering the cost of our annual meeting and conserving natural resources.

Important Notice Regarding the Availability of Proxy Materials for Annual Meeting of Stockholders to Be Held on January 19, 2017. The proxy statement is available electronically at http://investors.intuit.com/financial-information/proxy-statements/default.aspx and Intuit’s Annual Report on Form 10-K for fiscal year ended July 31, 2016 is available electronically at http://investors.intuit.com/financial-information/annual-reports/default.aspx.

By order of the Board of Directors, |

|

Laura A. Fennell |

|

Executive Vice President, General Counsel and Corporate

Secretary

|

Mountain View, California

November 23, 2016

INTUIT INC.

PROXY STATEMENT 2017 ANNUAL MEETING OF STOCKHOLDERS

Page |

|

Page |

|

A-1 |

|

INTUIT INC.

2700 Coast Avenue

Mountain View, CA 94043

PROXY STATEMENT FOR THE

2017 ANNUAL MEETING OF STOCKHOLDERS

2017 PROXY SUMMARY

Intuit Inc.’s (“Intuit” or the “Company”) Board of Directors (the “Board”) is asking for your proxy for use at the Intuit Inc. 2017 Annual Meeting of Stockholders (the “Meeting”) and at any adjournment or postponement of the Meeting for the purposes set forth in the accompanying Notice of 2017 Annual Meeting of Stockholders. This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

We have first released this proxy statement to Intuit stockholders beginning on November 23, 2016.

Annual Meeting of Stockholders

Time and Date |

Thursday, January 19, 2017 at 8:00 a.m. Pacific Standard Time |

|

Place |

Intuit’s offices at 2750 Coast Avenue, Building 6, Mountain View, California 94043 |

|

Record Date |

November 21, 2016 |

|

Voting |

Stockholders of Intuit as of the record date are entitled to vote. Each share of Intuit common stock is entitled to one vote for each director nominee and one vote for each of the other proposals to be voted on. |

|

Webcast of Meeting

If you are not able to attend the Meeting in person, you may join a live webcast of the Meeting on the Internet by visiting http://investors.intuit.com on Thursday, January 19, 2017 at 8:00 a.m. Pacific Standard Time.

Meeting Information

The following chart describes the proposals to be considered at the meeting, the vote required to elect directors and to approve each other proposal, the manner in which votes will be counted and the Board’s voting recommendation:

1

Proposal |

Voting Options |

Vote Required to Adopt the Proposal |

Effect of Abstentions |

Effect of “Broker Non-Votes”

|

Board’s Voting Recommendation |

|||||

1. Election of directors |

For, against or abstain on each nominee |

A nominee for director will be elected if the votes cast for such nominee exceed the votes cast against such nominee |

No effect |

No effect |

FOR the election of each of the director nominees |

|||||

2. Ratification of selection of Ernst & Young LLP |

For, against or abstain |

The affirmative vote of a majority of the shares of common stock represented at the annual meeting and voted for or against the proposal |

No effect |

Not applicable (1) |

FOR |

|||||

3. Approval of the Amended and Restated 2005 Equity Incentive Plan |

For, against or abstain |

The affirmative vote of a majority of the shares of common stock represented at the annual meeting and voted for or against the proposal |

No effect |

No effect |

FOR |

|||||

4. Advisory vote to approve Intuit’s executive compensation |

For, against or abstain |

The affirmative vote of a majority of the shares of common stock represented at the annual meeting and voted for or against the proposal |

No effect |

No effect |

FOR |

|||||

(1) This is considered to be a routine matter and, therefore, if you hold your shares in street name and do not provide voting instructions to the broker, bank or other nominee that holds your shares, the nominee has discretionary authority to vote on this Proposal but not any other Proposals since they are considered to be “non-routine” matters.

We will also consider any other matters that may properly be brought before the Meeting and any postponement(s) or adjournment(s) thereof. As of the date of this proxy statement, we have not received notice of other matters that may be properly presented at the Meeting.

How to Vote

Please act as soon as possible to vote your shares, even if you plan to attend the Meeting. You may vote via the Internet, by telephone or, if you have received a printed version of these proxy materials, by mail. If your shares are held on your behalf by a broker, bank or other nominee, you must instruct your nominee on how to vote the shares held in your account. If you do not provide your nominee with voting instructions, your nominee may only vote on Proposal 2 (ratifying the selection of our independent registered public accountant).

Board Nominees and Committee Memberships After Meeting

The following table provides summary information about each director nominee.

2

Committee Memberships |

||||||||

Name |

Director Since (1) |

Occupation |

Independent |

AC |

ARC |

CODC |

NGC |

Other Public Company Boards |

Eve Burton |

2016 |

Senior Vice President and General Counsel, The Hearst Corporation |

X |

X |

X |

|||

Scott D. Cook |

1984 |

Founder and Chairman of the Executive Committee, Intuit Inc. |

The Procter & Gamble Company |

|||||

Richard L. Dalzell |

2015 |

Former Senior Vice President and Chief Information Officer, Amazon.com, Inc. |

X |

C |

X |

Twilio, Inc. |

||

Diane B. Greene |

2006 |

Senior Vice President, Google, Inc., Former President and Chief Executive Officer, VMware, Inc. |

X |

X |

C |

Alphabet Inc. |

||

Suzanne Nora Johnson |

2007 |

Former Vice-Chairman, The Goldman Sachs Group |

X |

C |

X |

American International Group, Inc.; Pfizer Inc.; VISA Inc. |

||

Dennis D. Powell |

2004 |

Former Chief Financial Officer, Cisco Systems, Inc. |

X |

X |

C |

Applied Materials, Inc. |

||

Brad D. Smith |

2008 |

Chairman, President and Chief Executive Officer, Intuit Inc. |

Nordstrom, Inc. |

|||||

Raul Vazquez |

2016 |

Chief Executive Officer and Director, Oportun |

X |

X |

X |

|||

Jeff Weiner |

2012 |

Chief Executive Officer, LinkedIn Corporation (2) |

X |

X |

X |

LinkedIn Corporation (2) |

||

(1) Four of our nine directors have served on our Board for fewer than five years. These four directors constitute more than fifty percent of our seven independent directors.

(2) LinkedIn Corporation has entered into a Merger Agreement with Microsoft Corporation, pursuant to which LinkedIn will become a wholly owned subsidiary of Microsoft. Mr. Weiner is expected to continue to serve as Chief Executive Officer of LinkedIn following consummation of the transaction, which remains subject to certain conditions.

AC |

Acquisition Committee |

|

ARC |

Audit and Risk Committee |

|

CODC |

Compensation and Organizational Development Committee |

|

NGC |

Nominating and Governance Committee |

|

C |

Chair |

|

Attendance |

During fiscal 2016, all of our incumbent directors attended at least 75% of the aggregate number of meetings of the Board and committees on which he or she sits. |

|

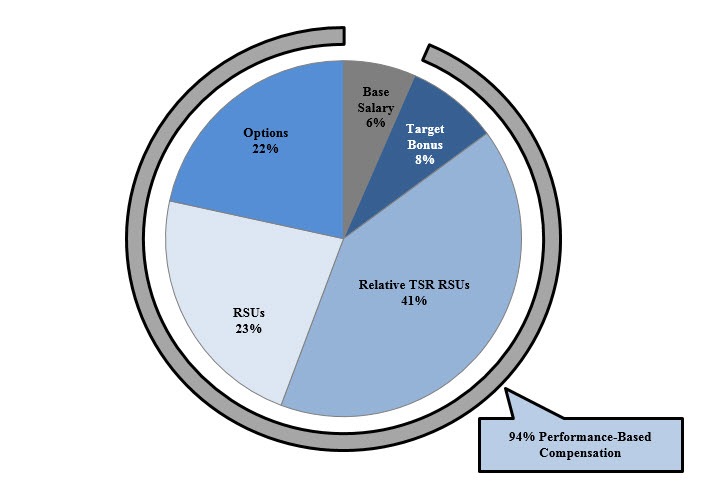

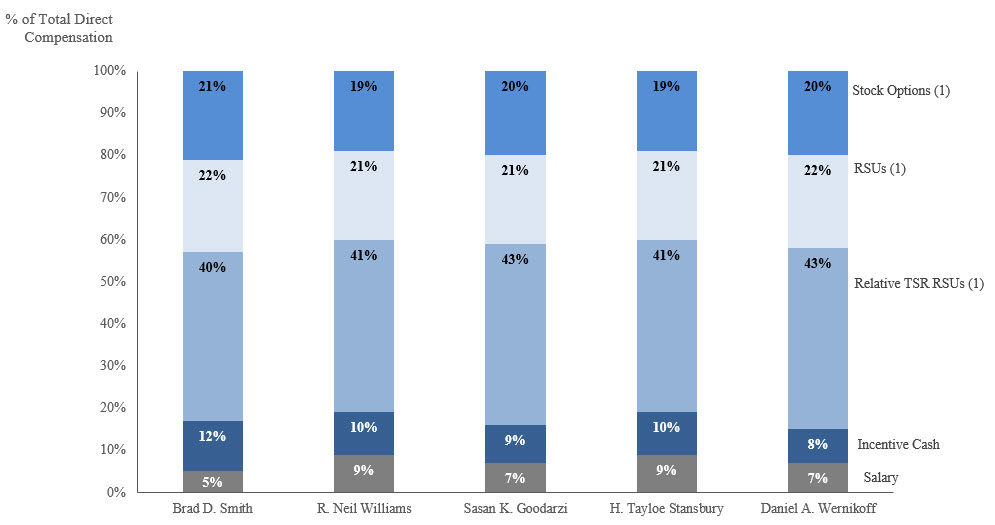

Fiscal 2016 Executive Compensation Highlights

Commitment to Pay for Performance

Our executive compensation programs are designed to reward both short- and long-term growth, as well as total stockholder return (“TSR”). Our short-term performance-based compensation consists of annual cash bonuses, which are based upon achievement of annual corporate operating goals, including revenue, non-GAAP operating income and deferred revenue balance at fiscal year end, as well as on an assessment of individual contribution and performance. Our fiscal 2016 long-term

3

compensation consisted of 50% performance-based restricted stock units (“RSUs”) based on relative total stockholder return (“Relative TSR RSUs”), 25% service-based RSUs and 25% non-qualified stock options.

Fiscal 2016 Business Highlights

Intuit achieved revenue of $4.7 billion, GAAP operating income of $1.2 billion, non-GAAP operating income of $1.6 billion, GAAP diluted earnings per share (EPS) of $3.69 and non-GAAP diluted EPS of $3.78 (see table on page A-3 of this proxy statement for a reconciliation of non-GAAP financial measures) and a one-year TSR of 6.19% for fiscal 2016.

Our revenue, GAAP and non-GAAP operating income and non-GAAP earnings per share for fiscal 2016 exceeded our guidance.

We believe that these non-GAAP financial measures provide meaningful supplemental information regarding Intuit’s operating results primarily because they exclude amounts that we do not consider part of ongoing operating results when planning and forecasting and when assessing the performance of the organization, our individual operating segments or our senior management.

Key highlights from fiscal 2016 include the following:

• |

Fiscal 2016 revenue of $4.7 billion, an increase of 12% over fiscal 2015; GAAP operating income of $1.2 billion, an increase of 68% over the prior year, and non-GAAP operating income of $1.6 billion, up 36%; GAAP diluted earnings per share of $3.69, up from $1.28 in 2015, and non-GAAP diluted EPS of $3.78, up 46%, in each case, exceeding our guidance for the year; note that fiscal 2016 GAAP earnings per share includes $0.65 net income per share from discontinued operations and fiscal 2015 GAAP earnings per share includes $0.17 net loss per share from discontinued operations; |

• |

A year-over-year increase of 15% in TurboTax Online units in the U.S., with total TurboTax units growing 12% (excluding the Free File Alliance, which is our free tax offering for eligible taxpayers); |

• |

The Consumer Tax business had revenue growth of 10% for fiscal 2016; |

• |

Two dozen product innovations in TurboTax, helping to drive share growth in the do-it-yourself software category for the third year in a row; |

• |

An increase of 41% in total QuickBooks Online subscribers, reaching 1.513 million subscribers at the end of the 2016 fiscal year, including 45% growth in QuickBooks Online subscribers outside the U.S. to 287,000 and growth in QuickBooks Self-Employed subscribers from 25,000 to 85,000; |

• |

Continued momentum in the Small Business Online ecosystem with revenue growth of 25% for the year; |

• |

Online payroll customer growth of 17% and online active payments customers growth of 6%; |

• |

Continued discipline in the Company’s financial strategy, focusing on cash management and maintaining a strong balance sheet, including paying dividends of $0.30 per share each quarter, and the repurchase of $2.3 billion of shares in fiscal 2016, reducing our weighted average share count by 7%; and |

• |

Employee engagement and customer satisfaction scores that continued to reflect best-in-class levels, with Intuit continuing its run of 15 consecutive appearances in Fortune Magazine’s “Top 100 Places to Work” list and placing at #4 on Fortune Magazine’s “Most Admired Software Company” list. |

Stockholder Value Delivered

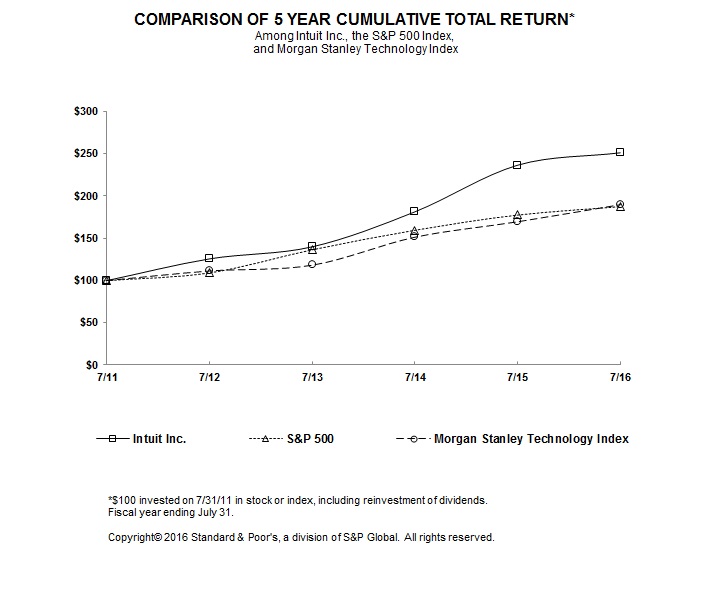

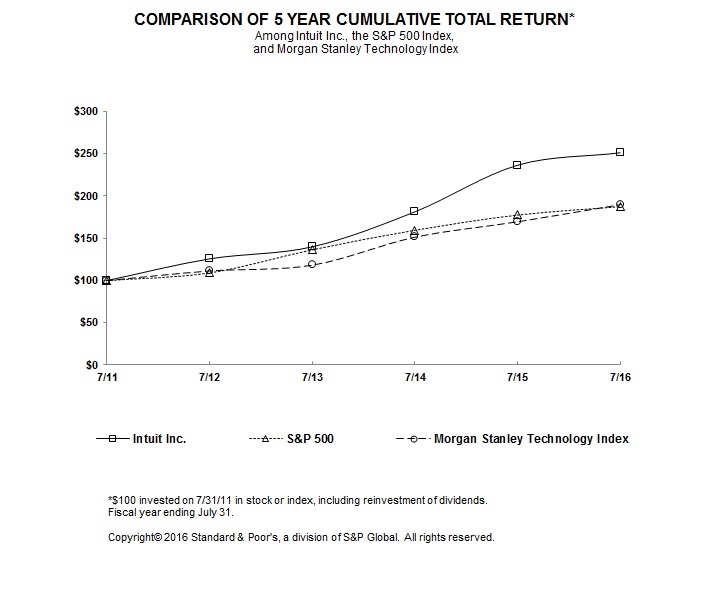

Intuit’s TSR has performed well in recent years. Measured at the end of fiscal 2016, we delivered one-year TSR of 6.19%, three-year annualized TSR of 21.52% and five-year annualized TSR of 20.22%, with our stock price achieving an all-time high as the fiscal year came to a close. The graph below compares the cumulative TSR on Intuit common stock for the last five full fiscal years with the cumulative total returns on the S&P 500 Index and the Morgan Stanley Technology Index for the same period. It assumes that $100 was invested in Intuit common stock and in each of the other indices on July 31, 2011 and that all dividends were reinvested. Over this five-year period, Intuit’s TSR exceeded both the broad market (as evidenced by a comparison against the S&P 500 Index) and the overall technology sector (as evidenced by a comparison against the Morgan Stanley Technology Index). The comparisons in the graph below are based on historical data – with Intuit common stock prices based on the closing price on the dates indicated – and are not intended to forecast the possible future performance of Intuit’s common stock.

4

July 31, 2011 |

July 31, 2012 |

July 31, 2013 |

July 31, 2014 |

July 31, 2015 |

July 31, 2016 |

||||||||||||||||||

Intuit Inc. |

$ |

100.00 |

$ |

125.62 |

$ |

139.91 |

$ |

181.28 |

$ |

236.44 |

$ |

251.09 |

|||||||||||

S&P 500 |

$ |

100.00 |

$ |

109.13 |

$ |

136.41 |

$ |

159.52 |

$ |

177.40 |

$ |

187.36 |

|||||||||||

Morgan Stanley Technology Index |

$ |

100.00 |

$ |

111.45 |

$ |

118.36 |

$ |

151.58 |

$ |

169.91 |

$ |

190.19 |

|||||||||||

Stockholder Engagement Process

Communication with our stockholders, and understanding their perspectives, is very important to us. During fiscal 2016 management, and on occasion, our Lead Independent Director, held discussions with many of our largest stockholders during scheduled events including our annual meeting and investor day, as well as in private meetings throughout the year. We solicited their feedback on various topics, including board succession planning, structure and diversity, our board evaluation process, executive compensation, cybersecurity, corporate governance, enterprise risk management and sustainability. We have considered such feedback in our adoption of proxy access and enhancements to our proxy disclosure. Both management and our Board of Directors will continue to engage with our stockholders on a regular basis in order to understand their perspectives and incorporate their feedback.

5

Compensation Practices

Intuit employs a number of practices that reflect our pay-for-performance compensation philosophy, including the following:

Compensation Practices |

ü A significant portion of our fiscal 2016 senior executive officer compensation is in the form of incentives tied to achievement of particular performance measures;

|

ü We have “clawback” provisions for operating performance-based equity awards and beginning in the 2016 fiscal year implemented “clawback” provisions for cash bonus payments under our Senior Executive Incentive Plan;

|

ü We have stock ownership guidelines for executive officers at the senior vice president level and above and non-employee directors, with the CEO guideline set at six times salary, the senior vice president level and above guideline set at one and a half times salary, and the non-employee director guideline set at five times annual cash retainer;

|

ü The CEO’s service-based RSUs and Relative TSR RSUs granted in fiscal 2015 and 2016 include a mandatory one-year holding period, requiring the CEO to hold the underlying shares for at least one year after the awards vest;

|

û We prohibit directors and executive officers from pledging Intuit stock or engaging in hedging transactions involving Intuit stock;

|

û We do not provide supplemental company-paid retirement benefits designed for executive officers;

|

û We do not provide any excise tax “gross-up” payments; and

|

û We do not provide perquisites or other executive benefits based solely on rank.

|

6

CORPORATE GOVERNANCE

Intuit is committed to excellence in corporate governance and maintains policies and practices that promote good corporate governance, including the following:

Corporate Governance Practices |

ü The Board has adopted majority voting in uncontested elections of directors;

|

ü A majority of the board members are independent of Intuit and its management;

|

ü The independent members of the Board meet regularly without the presence of management;

|

ü All members of the Audit and Risk Committee, Nominating and Governance Committee and Compensation and Organizational Development Committee of the Board are independent;

|

ü The charters of the committees of the Board clearly establish the committees’ respective roles and responsibilities;

|

ü Our bylaws provide our stockholders with a proxy access right;

|

ü The Board and its committees receive periodic updates on regulatory and other developments relevant to the Board from management and outside experts;

|

ü Intuit’s internal audit control function maintains critical oversight over the key areas of its business and financial processes and controls, and reports directly to Intuit’s Audit and Risk Committee;

|

ü Intuit’s investor relations team, management team and our Lead Independent Director regularly communicate with our stockholders and report to the Board on the stockholders’ perspectives;

|

ü Intuit has adopted a Code of Conduct & Ethics for employees that is monitored by Intuit’s ethics office and also has a Code of Ethics that applies to all Board members; and

|

ü Intuit’s ethics office has a hotline available to all employees, and Intuit’s Audit and Risk Committee has procedures in place to receive and process complaints, including on a confidential and anonymous basis, regarding accounting, internal accounting controls, auditing and federal securities law matters, or violations of the Code of Conduct & Ethics and for employees to make confidential, anonymous complaints regarding accounting, auditing and federal securities law matters or violations of the Intuit’s Code of Conduct & Ethics.

|

Our Board has adopted Corporate Governance Principles that are designed to assist the Board in observing practices and procedures that serve the best interests of Intuit and our stockholders. The Nominating and Governance Committee is responsible for overseeing these Corporate Governance Principles, reviewing them at least annually and making recommendations to the Board regarding any changes. These Corporate Governance Principles address, among other things, our policy on succession planning and senior leadership development, Board performance evaluations, committee structure and stock ownership requirements.

We maintain a corporate governance page on our company website that contains key information about corporate governance matters. This information includes copies of our Corporate Governance Principles, Political Accountability Policy, Code of Conduct & Ethics for all employees, including our Company’s senior executive and financial officers, our Operating Values, the charter for each Board committee and the Code of Ethics for our Board. The link to this corporate governance page can be found at http://investors.intuit.com/corporate-governance/conduct-and-guidelines/default.aspx.

Board Responsibilities, Leadership Structure and Executive Sessions

The Board oversees management’s performance on behalf of Intuit’s stockholders. The Board’s primary responsibilities are to (1) select, oversee and determine compensation for the Chief Executive Officer who, with senior management, runs Intuit on a day-to-day basis, (2) monitor management’s performance to assess whether Intuit is operating in an effective, efficient and ethical manner in order to create value for Intuit’s stockholders, and (3) periodically review Intuit’s long-range strategic plan, business initiatives, capital projects and budget matters.

The Board appoints a Chairman, who may be an officer of Intuit if the Board determines that it is in the best interests of Intuit and its stockholders. The roles of Chairman of the Board and Chief Executive Officer may be held by the same person or different people. If the Chairman is also the Chief Executive Officer, then the Board has determined that it will appoint a Lead Independent Director.

Currently, Mr. Smith holds the roles of both Chairman of the Board and Chief Executive Officer. The Board believes that the combination of the roles of Chairman of the Board and Chief Executive Officer is appropriate at this time because of Mr. Smith’s deep understanding of the Company’s business and culture as well as Mr. Smith’s instrumental contributions in developing and leading the Company’s strategic priorities. Mr. Smith’s leadership as the Chairman and CEO helps to effectively drive the Company’s strategy, and to facilitate critical flow of information between the Board of Directors and

7

management. This role, combined with the independent members of the Board of Directors, led by a Lead Independent Director acting in accordance with the Company’s robust corporate governance practices and policies, provides effective oversight.

Because Mr. Smith serves as both the Chairman and the Chief Executive Officer, the Company and the Board recognize the importance of providing additional, independent oversight of the Board. The independent directors of the Board designated Ms. Nora Johnson to serve as the Company’s Lead Independent Director for a period of at least one year. Her responsibilities and authority include:

• |

Authority to call executive sessions of the independent directors; |

• |

Presiding at meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors, which occur at least quarterly; |

• |

Conferring with the Chairman on agenda topics for Board meetings, and approving the agenda and schedule for Board meetings to ensure that there is sufficient time for discussion of all agenda items; |

• |

Approving information sent to the Board; |

• |

Serving as liaison between the Chairman and the independent directors; and |

• |

Being available for consultations and communications with major stockholders upon request. |

The Board and its committees meet throughout the year on a set schedule, and also hold special meetings and act by written consent from time to time as appropriate. The Board held five meetings during fiscal 2016. The Board has delegated certain responsibilities and authority to the committees described below. Committees report regularly on their activities and actions to the full Board.

Board Evaluation Process

The Board has an annual evaluation process that is led by the Chairman of the Board and our outside counsel and coordinated and overseen by our Nominating and Governance Committee. Each year, Board members complete an assessment of Board performance, including an evaluation of the issues addressed by the Board, Board culture and structure, processes and information received by the Board. Each Board member assesses the performance of the Committees, including both performance of the Committee and an assessment of how each Committee keeps the full Board informed. In addition, each Board member assesses his or her own performance as well as the performance of his or her fellow Board members. Board members then meet individually with the Chairman of the Board and outside counsel to discuss their assessments and to provide further feedback to share with the other Board members. The Chairman then shares that feedback with the Nominating and Governance Committee and the assessment is discussed by the full Board. The feedback received by the Board is used to identify the strengths and opportunities of each Board member and provide insight into the areas in which each Board member can be most valuable to the Company, as well as to identify skills or expertise that may be used as criteria when the Board considers new Board candidates. In addition, the committees use feedback to improve their agenda topics and the information presented to the committees in order to ensure they continue to address the issues most critical to them in an effective manner. The Nominating and Governance Committee reviews each director’s performance annually when considering whether to re-nominate the director for re-election to the Board.

Board Oversight of Risk

Intuit’s management is responsible for balancing risk and opportunity in support of Intuit’s objectives. Management exercises this responsibility day to day through ongoing identification of risks related to significant business activities, implementation of risk mitigation activities and alignment of risk management to the Company’s strategy. Intuit’s Chief Risk Officer, who reports through to our General Counsel, facilitates the Enterprise Risk Management, or “ERM,” program as part of our strategic planning process. The ERM program helps identify the top risks for each business unit and for Intuit as a whole.

The Board oversees risk management for the Company both directly and through its committees, as follows:

• |

The Audit and Risk Committee has primary responsibility for overseeing our ERM program. The Chief Risk Officer reports on a quarterly basis to the Audit and Risk Committee on Intuit’s top risk areas and the progress of the ERM program. The Audit and Risk Committee also has oversight responsibilities with respect to particular risks such as financial management, fraud and cybersecurity. |

• |

The Board’s other committees – Compensation and Organizational Development, Nominating and Governance, and Acquisition – oversee risks associated with their respective areas of responsibility. The Compensation and Organizational Development Committee considers the risks associated with our compensation policies and practices |

8

for executives and employees generally. The Nominating and Governance Committee considers risks associated with corporate governance and overall board effectiveness, including recruiting appropriate Board members. The Acquisition Committee considers risks associated with Intuit’s merger and acquisition activities and the strategy and business models of acquisition candidates.

• |

The full Board receives an annual update from the Chief Risk Officer regarding the top enterprise-wide risks and the mitigation plans associated with each risk. In addition, the Board provides oversight of specific business strategic risks including those relating to Intuit’s business models and inorganic growth strategy. |

• |

At quarterly Board meetings, the CEO and heads of our principal business units provide detailed reports to the Board, which include discussions of the risks involved in their respective areas of responsibility. In addition, members of each committee provide a report to the full Board covering the committee’s risk oversight and other activities. The senior management team also informs the Board routinely of developments that could affect our risk profile or other aspects of our business. |

Compensation Risk Assessment

The Company conducted a review of its key compensation programs, policies and practices in conjunction with Frederic W. Cook & Co., Inc. (“FW Cook”), the Compensation and Organizational Development Committee’s independent compensation consultant, which prepared a report on the Company’s incentive programs.

This analysis was reviewed with the Compensation and Organizational Development Committee at its October 19, 2016 meeting. The review and analysis did not identify any compensation programs, policies or practices that create incentives to take risks that are reasonably likely to have a material adverse effect on the Company.

The analysis noted the following factors:

•Overall compensation levels are in a competitive market range.

•Mix of short-term and long-term incentives, with different performance periods and a broad mix of performance measures.

•The compensation programs provide an effective balance in (1) cash and equity mix, (2) annual incentives that are based in part on company-wide performance metrics that align with the Company’s business plans and strategic objectives and in part on a qualitative evaluation of business unit and individual performance, and (3) long-term incentives generally provided through a combination of stock options (generally vesting over three years with terms of seven years), service-based RSUs (generally vesting over three years), and performance-based RSUs (earned after three years based on one-, two- and three-year relative TSR).

•Stock ownership guidelines for executive officers at the senior vice president level and above as well as for non-employee directors.

•The one-year holding requirement added to the CEO’s Relative TSR RSUs and service-based RSUs beginning with the fiscal 2015 grant, which make up the majority of his grant value.

•Severance that is limited in scope and at the lower end of the competitive range for a company of Intuit’s size and scope.

•The insider trading policy, which prohibits officers from pledging shares, trading put or call options, and engaging in short sales or hedging transactions involving the Company’s securities.

•“Clawback” provisions for operating performance-based equity awards and for cash bonus payments under the Company’s Senior Executive Incentive Plan (“SEIP”).

•A Compensation and Organizational Development Committee process that allows for the sharing of robust information and internal discussion prior to making key compensation decisions.

Director Independence

To be considered independent under NASDAQ rules, a director may not be employed by Intuit or engage in certain types of business dealings with Intuit. In assessing director independence under NASDAQ rules, the Nominating and Governance Committee and the full Board review relevant transactions, relationships and arrangements that may affect the independence of our Board members. In addition, as required by NASDAQ rules, the Board makes a determination as to each independent director that no relationship exists which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the Board reviewed and discussed

9

information provided by the directors and by Intuit with regard to each director’s business and personal activities as they relate to Intuit and Intuit’s management.

In determining the independence of our directors, our Board of Directors considered transactions involving payments made by us to companies in the ordinary course of business where Ms. Greene and Mr. Weiner serve as executives. Consistent with NASDAQ independence standards, Intuit did not make payments to, or receive payments from, any of these companies for property or services in the current or any of the last three fiscal years that exceed 5% of Intuit’s or any of the other parties’ consolidated gross revenues. In addition, in considering Mr. Weiner's independence, the Board considered a transaction involving a contribution made individually by Mr. Smith to DonorsChoose.org, a charitable institution where Mr. Weiner serves as a director. Upon review of these relationships and the other information provided by our directors and director nominees, the Board determined that none of these relationships would interfere with the exercise of independent judgment by these directors in carrying out their responsibilities as directors and that the following current directors are independent: Ms. Burton, Mr. Dalzell, Ms. Greene, Ms. Nora Johnson, Mr. Powell, Mr. Vazquez and Mr. Weiner. In addition, the Board previously determined that Edward Kangas, who did not stand for reelection to the Board in January 2016, was an independent director.

Attendance at Board, Committee and Annual Stockholders Meetings

The Board expects that each director will prepare for, attend and participate in all Board and applicable committee meetings and that each Board member will see that other commitments do not materially interfere with his or her service on the Board. Directors generally may not serve on the boards of more than six public companies, including Intuit’s Board. Any director, who has a principal job change, including retirement, must offer to submit a letter of resignation to the Chairman of the Board. The Board, in consultation with the Nominating and Governance Committee, will review each offered resignation and determine whether or not to accept such resignation after consideration of the continued appropriateness of Board membership under the new circumstances.

During fiscal 2016, all current directors attended at least 75% of the aggregate number of meetings of the Board and the committees on which he or she served. Seven of the eight directors nominated and elected at the 2016 Annual Meeting of Stockholders held in January 2016 attended the 2016 Annual Meeting of Stockholders. Neither Mr. Campbell nor Mr. Kangas, whose terms ended on the date of the 2016 Annual Meeting of Stockholders, were in attendance. Our Corporate Governance Principles encourage all directors to attend our Annual Meeting of Stockholders.

Board Committees and Charters

The Board currently has a standing Acquisition Committee, Audit and Risk Committee, Compensation and Organizational Development Committee, and Nominating and Governance Committee. Each committee has a charter which it reviews annually and makes recommendations to our Board for its revision to reflect evolving best practices. Copies of each committee charter can be found on our website at http://investors.intuit.com/corporate-governance/conduct-and-guidelines/default.aspx. The members of each committee are independent and appointed by the Board based on recommendations of the Nominating and Governance Committee and have the opportunity to meet in closed session, without management present, during each committee meeting. Current committee members are identified in the following table.

Director |

Acquisition Committee |

Audit and Risk Committee |

Compensation and Organizational Development Committee |

Nominating and Governance Committee |

||||

Eve Burton |

X |

X |

||||||

Scott D. Cook |

||||||||

Richard L. Dalzell |

Chair |

X |

||||||

Diane B. Greene |

X |

Chair |

||||||

Suzanne Nora Johnson |

Chair |

X |

||||||

Dennis D. Powell |

X |

Chair |

||||||

Brad D. Smith |

||||||||

Raul Vazquez |

X |

X |

||||||

Jeff Weiner |

X |

X |

||||||

Number of meetings in Fiscal 2016 |

6 |

12 |

5 |

4 |

||||

10

Acquisition Committee

The Acquisition Committee reviews and approves acquisition, divestiture and investment transactions proposed by Intuit’s management in which the total consideration to be paid or received by Intuit is within certain limits that may be established by the Board from time to time.

Audit and Risk Committee

The Audit and Risk Committee represents and assists the Board in its oversight of Intuit’s financial reporting, internal controls and audit functions, and is directly responsible for the selection, retention, compensation and oversight of the work of Intuit’s independent auditor. It also oversees cybersecurity and other risks relevant to our information technology environment.

Our Board has determined that each member of the Audit and Risk Committee is independent, as defined under applicable NASDAQ listing standards and SEC rules related to audit committee members, and is financially literate, as required by NASDAQ listing standards. Mr. Powell has been determined by the Board to meet the qualifications of an “audit committee financial expert,” as defined by SEC rules, and to meet the qualifications of “financial sophistication” in accordance with NASDAQ listing standards.

The Audit and Risk Committee held closed sessions with our independent auditors, Ernst & Young LLP, in all of its regularly scheduled meetings.

Compensation and Organizational Development Committee

The Compensation and Organizational Development Committee (the “Compensation Committee”) assists the Board in the review and approval of executive compensation and the oversight of organizational and management development for executive officers and other employees of Intuit. The Compensation Committee periodically reviews Intuit’s key management from the perspectives of leadership development, organizational development and succession planning through Intuit’s High Performance Organization Review. As part of this process, the Compensation Committee also meets with key senior executives. The systemic assessment of Intuit’s organization and talent planning helped the Compensation Committee to evaluate Intuit’s efforts at hiring, developing and retaining executives in an increasingly competitive environment, with the goal of creating and growing Intuit’s “bench strength” at the most senior executive levels.

Each member of this Committee is independent under NASDAQ listing standards and is a “Non-Employee Director,” as defined in Rule 16(b)-3 under the Securities Exchange Act of 1934, as amended, and an “outside director” under Section 162(m) of the Internal Revenue Code of 1986, as amended. The Compensation Committee held a portion of each meeting in closed session, with only the Compensation Committee members and, on certain occasions, William Campbell, who served as Chairman of the Board until the Company’s 2016 Annual Meeting of Stockholders in January 2016, present. For more information on the responsibilities and activities of the Compensation Committee, including the committee’s processes for determining executive compensation, see the “Compensation and Organizational Development Committee Report” on page 40 and “Compensation Discussion and Analysis” beginning on page 41, including in particular, the discussion of the “Role of Compensation Consultants, Executive Officers and the Board in Compensation Determinations” beginning on page 60.

The Compensation Committee is also responsible for reviewing the compensation for non-employee directors on an annual basis and making recommendations to the Board, in the event the Committee determines changes are appropriate.

Compensation Committee Interlocks and Insider Participation

None of Ms. Nora Johnson, Ms. Greene, Mr. Kangas, Mr. Dalzell or Mr. Weiner, each of whom served on the Compensation Committee during fiscal 2016, has at any time been one of our executive officers or employees. No executive officer of Intuit during fiscal 2016 served, or currently serves, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on Intuit’s Board or Intuit’s Compensation Committee.

Nominating and Governance Committee

The Nominating and Governance Committee reviews and makes recommendations to the Board regarding Board composition and appropriate governance standards. Our Board has determined that each member of the Nominating and Governance Committee is independent, as defined under applicable NASDAQ listing standards.

The Nominating and Governance Committee has adopted a process to identify and evaluate candidates for director, whether recommended by management, Board members, or stockholders (if made in accordance with the procedures set forth below under “Stockholder Recommendations of Director Candidates”). The Committee’s policy is to evaluate candidates properly recommended by stockholders in the same manner as candidates recommended by others.

11

Qualifications of Directors

The Nominating and Governance Committee believes that all nominees for Board membership should possess the highest ethics, integrity and values and be committed to representing the long-term interests of Intuit’s stockholders. In addition, nominees should have broad, high-level experience in business, government, education, technology or public interest. They should have sufficient time to carry out their duties as directors of Intuit and have an inquisitive and objective perspective, practical wisdom and mature judgment. The Nominating and Governance Committee will also consider additional factors – such as independence, diversity, expertise and specific skills, and other qualities that may contribute to the Board’s overall effectiveness – when evaluating candidates for director. The Nominating and Governance Committee may also engage third-party search firms to provide assistance in identifying and evaluating Board candidates.

Consideration of director candidates typically involves a series of discussions and a review of available information concerning the candidate, the existing composition of the Board and other factors the Committee deems relevant. In conducting its review and evaluation, the Nominating and Governance Committee may solicit the views of management, other Board members and other individuals it believes may have insight into a candidate.

In considering diversity in the selection of nominees, the Nominating and Governance Committee looks for individuals with varied professional experience, background, knowledge, skills and viewpoints in order to achieve and maintain a group of directors that, as a whole, provides effective oversight of the management of the Company. Although our nomination policy does not prescribe specific standards for diversity, the Board and the Nominating and Governance Committee do look for nominees with a diverse set of skills that will complement the existing skills and experience of our directors and provide an overall balance of diversity of perspectives, backgrounds and experiences. The Nominating and Governance Committee assesses its effectiveness in this regard as part of its annual evaluation process. Our Board is currently composed of a group of leaders with broad and diverse experience in many fields, including: management of large global enterprises; technology and innovation leadership; strategic planning; consumer software and technology products and services; public policy; social networking; financial services; legal and compliance; executive compensation; and corporate governance. Our Board members have acquired these diverse skills through their accomplished careers and their service as executives and directors of a wide range of other public and private companies.

Stockholder Recommendations of Director Candidates

As discussed above, our Nominating and Governance Committee will consider director candidates recommended by a stockholder. A stockholder seeking to recommend a candidate for the committee’s consideration should submit the candidate’s name and qualifications to: Nominating and Governance Committee, c/o Corporate Secretary, Intuit Inc., P.O. Box 7850, Mail Stop 2700, Mountain View, California 94039-7850 or via our website at http://investors.intuit.com/corporate-governance/conduct-and-guidelines/contact-the-board/default.aspx. You may find a copy of a document entitled “Process of Identifying and Evaluating Nominees for Director” on our website http://investors.intuit.com/corporate-governance/conduct-and-guidelines/default.aspx.

In addition, our bylaws permit a stockholder or group of up to 20 stockholders who have owned 3% or more of Intuit’s outstanding shares that are entitled to vote generally in the election of directors continuously for at least three years to submit director nominees (for the greater of 2 directors or up to 20% of our Board) for inclusion in our proxy materials if the stockholder(s) provide timely written notice of such nomination and the stockholder and nominee satisfy the requirements specified in our bylaws. Stockholders who wish to nominate directors for inclusion in our proxy materials or directly at an Annual Meeting of Stockholders in accordance with the procedures in our bylaws should follow the instructions under “Stockholder Proposals and Nominations for the 2018 Annual Meeting” section of this proxy statement.

12

Stockholder Engagement Process

Intuit regularly engages with stockholders to better understand their perspectives. During fiscal 2016 we held discussions with many of our largest stockholders during scheduled events, including our annual meeting and investor day, as well as in private meetings throughout the year.

In September 2016 we hosted our annual investor day, during which our management team interacted directly with our stockholders regarding our performance in the prior year as well as our short- and long-term growth strategies. In addition, members of the management team, and on occasion, the Lead Independent Director, held private in-person and telephonic meetings with stockholders to discuss their perspectives and feedback on various topics including executive compensation, corporate governance, cybersecurity, board structure and succession planning, our board evaluation process, and diversity, enterprise risk management and sustainability.

Since the beginning of fiscal 2016, management met with stockholders holding 33% of our outstanding shares. Management, the investor relations team and our Lead Independent Director, who participate in stockholder engagement meetings, regularly share stockholder feedback with relevant Board committees and the full Board. In general, feedback from our stockholders regarding our compensation programs and corporate governance practices is very positive. The Board carefully considers the feedback from stockholders and has implemented such feedback into our proxy disclosures and corporate governance practices, such as amending our bylaws to provide for proxy access.

We will continue to engage with our stockholders on a regular basis in order to understand their perspectives and incorporate their feedback, as appropriate, on our performance, business strategies, executive compensation programs and corporate governance practices.

Stockholder Communications with the Board

The Nominating and Governance Committee is responsible for receiving stockholder communications on behalf of the Board. Any stockholder may send communications by mail to the Board or individual directors c/o Corporate Secretary, Intuit Inc., P.O. Box 7850, Mail Stop 2700, Mountain View, California 94039-7850 or via our website at http://investors.intuit.com/corporate-governance/conduct-and-guidelines/contact-the-board/default.aspx. The Board has instructed the Corporate Secretary to review this correspondence and determine, in his or her discretion, whether matters submitted are appropriate for Board consideration. The Corporate Secretary may also forward certain communications elsewhere in the Company for review and possible response. In particular, communications such as product or commercial inquiries or complaints, job inquiries, surveys, business solicitations, advertisements or patently offensive or otherwise inappropriate material will not be forwarded to the Board.

13

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership Table

The following table shows shares of Intuit’s common stock that we believe are owned as of October 31, 2016 by:

• |

Each Named Executive Officer (defined on page 41); |

• |

Each director and nominee; |

• |

All current directors, nominees and executive officers as a group; and |

• |

Each stockholder beneficially owning more than 5% of our common stock. |

Unless indicated in the notes, each stockholder has sole voting and investment power for all shares shown, subject to community property laws that may apply to create shared voting and investment power. Unless indicated in the notes, the address of each beneficial owner is c/o Intuit Inc., P.O. Box 7850, Mountain View, California 94039-7850.

We calculated the “Percent of Class” based on 257,067,597 shares of common stock outstanding on October 31, 2016. In accordance with SEC regulations, we also include (1) shares subject to options that are currently exercisable or will become exercisable within 60 days of October 31, 2016, and (2) shares issuable upon settlement of RSUs that are vested but unreleased, or will become vested and settled within 60 days of October 31, 2016. Those shares are deemed to be outstanding and beneficially owned by the person holding such option or RSU for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

Name of Beneficial Owner |

Amount and Nature of Beneficial Ownership (#) |

Percent of Class (%) |

||||

Directors, Director Nominees and Executive Officers: |

||||||

Scott D. Cook(1) |

12,934,313 |

5.03 |

% |

|||

Brad D. Smith(2) |

857,662 |

* |

||||

R. Neil Williams(3) |

178,740 |

* |

||||

Sasan K. Goodarzi(4) |

259,707 |

* |

||||

H. Tayloe Stansbury(5) |

57,230 |

* |

||||

Daniel A. Wernikoff(6) |

174,884 |

* |

||||

Eve Burton(7) |

961 |

* |

||||

Richard L. Dalzell(8) |

5,424 |

* |

||||

Diane B. Greene(9) |

29,987 |

* |

||||

Suzanne Nora Johnson(10) |

30,831 |

* |

||||

Dennis D. Powell(11) |

31,780 |

* |

||||

Raul Vazquez |

— |

* |

||||

Jeff Weiner(12) |

18,220 |

* |

||||

All current directors and executive officers as a group (15 people)(13) |

14,730,493 |

5.70 |

% |

|||

Other 5% Stockholders: |

||||||

BlackRock, Inc.(14) |

18,411,014 |

7.16 |

% |

|||

Capital World Investors(15) |

17,255,000 |

6.71 |

% |

|||

The Vanguard Group(16) |

15,503,587 |

6.03 |

% |

|||

_______________________________________

* |

Indicates ownership of 1% or less. |

|

(1) |

Represents 12,782,312 shares held by trusts of which Mr. Cook is a trustee and 152,001 shares held by a trust Mr. Cook has investment control over, but of which he is not a trustee.

|

(2) |

Includes 649,374 shares issuable upon exercise of options held by Mr. Smith.

|

14

(3) |

Includes 174,013 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by Mr. Williams.

|

(4) |

Includes 259,707 shares issuable upon exercise of options held by Mr. Goodarzi.

|

(5) |

Includes 56,560 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by Mr. Stansbury.

|

(6) |

Includes 171,307 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by Mr. Wernikoff.

|

(7) |

Includes 961 shares issuable upon settlement of vested restricted stock units held by Ms. Burton.

|

(8) |

Includes 5,424 shares issuable upon settlement of vested restricted stock units held by Mr. Dalzell.

|

(9) |

Includes 15,094 shares issuable upon settlement of vested restricted stock units held by Ms. Greene.

|

(10) |

Includes 15,094 shares issuable upon settlement of vested restricted stock units held by Ms. Nora Johnson.

|

(11) |

Includes 15,094 shares issuable upon settlement of vested restricted stock units held by Mr. Powell.

|

(12) |

Represents 18,220 shares issuable upon settlement of vested restricted stock units held by Mr. Weiner.

|

(13) |

Includes 1,509,312 shares issuable upon exercise of options and upon settlement of vested restricted stock units. Represents shares and options held by the 13 individuals in the table, plus an additional 22,290 outstanding shares and 128,464 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by other executive officers.

|

(14) |

Ownership information for BlackRock, Inc. (“BlackRock”) is based on a Schedule 13G/A filed with the SEC on January 26, 2016 by BlackRock, reporting ownership as of December 31, 2015. BlackRock reported sole voting power as to 15,369,718 shares and sole dispositive power as to 18,411,014 shares. The address of BlackRock is 55 East 52nd Street, New York, New York 10022.

|

(15) |

Ownership information for Capital World Investors (“Capital World”) is based on a Schedule 13G filed with the SEC on February 12, 2016 by Capital World, reporting ownership as of December 31, 2015. Capital World reported sole voting power and sole dispositive power as to 17,255,000 shares. The address of Capital World is 333 Hope Street, Los Angeles, California 90071.

|

(16) |

Ownership information for The Vanguard Group (“Vanguard”) is based on a Schedule 13G/A filed with the SEC on February 10, 2016 by Vanguard, reporting ownership as of December 31, 2015. Vanguard reported sole voting power as to 494,119 shares, shared voting power over 26,100 shares, sole dispositive power as to 14,982,006 shares, and shared dispositive power as to 521,581 shares. The address of Vanguard is 100 Vanguard Blvd., Malvern, Pennsylvania 19355.

|

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires Intuit’s directors and executive officers, and greater-than-10% stockholders to file forms with the SEC to report their ownership of Intuit shares and any changes in ownership. Anyone required to file forms with the SEC must also send copies of the forms to Intuit. We have reviewed all forms provided to us. Based on that review and on written information given to us by our executive officers and directors, we believe that all Section 16(a) filing requirements were met during fiscal 2016.

15

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Election of Directors

The board currently consists of nine directors, all of whom were nominated for election to the Board at the 2017 Annual Meeting based on the recommendation of our Nominating and Governance Committee. Mr. Vazquez, who was appointed to the Board in May 2016, was recommended for consideration by the Nominating and Governance Committee at that time by Scott Cook. Mr. Vazquez’s name was provided to a third party search firm, who presented several candidates, including Mr. Vazquez, to the Board of Directors, for consideration. The Board conducted interviews of multiple candidates before concluding that Mr. Vazquez was the best match for the Board’s needs.

Each nominee, if elected, will serve until the next annual meeting of stockholders and until a qualified successor is elected, unless the nominee dies, resigns or is removed from the Board prior to such meeting. Although we know of no reason why any of the nominees would not be able to serve, if any nominee is unable to serve or for good cause does not serve, the proxy holder will vote your shares to approve the election of any substitute nominee proposed by the Board or just for the remaining nominees, leaving a vacancy. Alternatively, the Board may reduce the size of the Board.

Each of our director nominees is currently serving on the Board. If a nominee who is currently serving as a director is not re-elected, Delaware law provides that the director would continue to serve on the Board as a “holdover director.” However, in accordance with Intuit’s Bylaws and Corporate Governance Principles, each director has submitted an advance, contingent, irrevocable resignation that the Board may accept if stockholders do not elect the director. In that situation, our Nominating and Governance Committee would make a recommendation to the Board about whether to accept or reject the resignation, or whether to take other action. The Board would act on the Nominating and Governance Committee’s recommendation, and publicly disclose its decision and the rationale behind it within 90 days of the date that the election results were certified.

Intuit is committed to ongoing Board refreshment, while at the same time valuing the experience that our longer-tenured directors bring. Four of our nine directors have served on our Board for fewer than five years. These four directors constitute more than fifty percent of our seven independent directors.

Directors Standing for Election

Information concerning the nominees for director is provided below.

|

Eve Burton (Age 58)

Senior Vice President and General Counsel, The Hearst Corporation

Ms. Burton has been an Intuit Director since January 2016 and is a member of the Audit and Risk Committee and the Acquisition Committee. Ms. Burton has served as Senior Vice President and General Counsel of The Hearst Corporation, a diversified media company, since March 2012. She joined The Hearst Corporation in 2002 as Vice President and General Counsel. Ms. Burton is also a member of Hearst CEO’s

|

|

strategic advisory group and of the Hearst Venture Investment Committee. She also serves as an Adjunct Professor of Constitutional Law and Journalism at the Columbia University Graduate School of Journalism. Prior to joining The Hearst Corporation, Ms. Burton was Vice President and Chief Legal Officer of CNN from 2000 to 2001. Ms. Burton serves on the board of The Hearst Corporation and was a member of the AOL board of directors from 2013 to 2015 until its acquisition by Verizon Communications Inc. Her non-profit board affiliations include the David and Helen Gurley Brown Institute for Media Innovations at Stanford and Columbia Universities and the board of trustees of Middlebury College. Ms. Burton holds a Juris Doctorate from Columbia University.

| |

|

Relevant Expertise

Ms. Burton brings to the Board legal and business experience as a general counsel for a global company engaged in a broad range of diversified communications activities and strategic partnerships and investments. She also brings insights into operational and security issues facing online consumer services companies as well as an expertise in the area of government relations.

| |

|

Other Public Company Boards

None

| |

16

|

Scott D. Cook (Age 64)

Founder and Chairman of the Executive Committee, Intuit Inc.

Mr. Cook has been an Intuit director since 1984. A co-founder of Intuit, Mr. Cook served as Intuit’s President and Chief Executive Officer from 1984 to 1994 and served as Chairman of the Board from 1993 to 1998. Mr.

Cook was a director of eBay Inc. from 1998 to 2015 where he was a member of the Corporate Governance and Nominating Committee. Mr. Cook has been a director of The Procter & Gamble Company since 2000

|

|

where he chairs the Innovation & Technology Committee and is a member of the Compensation & Leadership Development Committee. Mr. Cook holds a Bachelor of Arts in Economics and Mathematics from the University of Southern California and a Master in Business Administration from Harvard Business School.

| |

|

Relevant Expertise

Mr. Cook brings to the Board experience as an entrepreneur and corporate executive with a background in guiding and fostering innovation at companies in technology and other sectors, as well as his knowledge of Intuit’s operations, markets, management and strategy and his experience as a Board member of other large, global, consumer-focused companies.

| |

|

Other Public Company Boards

The Procter & Gamble Company

| |

|

Richard L. Dalzell (Age 59)

Former Senior Vice President and Chief Information Officer, Amazon.com, Inc.

Mr. Dalzell has been an Intuit director since January 2015 and is a member of the Audit and Risk Committee and chairs the Acquisition Committee. Mr. Dalzell was Senior Vice President and Chief Information Officer at Amazon.com, Inc., an online retailer, until his retirement in 2007. Previously, Mr. Dalzell served in numerous other positions at Amazon.com, Inc., including Senior Vice President of Worldwide Architecture

|

|

and Platform Software and Chief Information Officer from 2001 to 2007, Senior Vice President and Chief Information Officer from 2000 to 2001 and Vice President and Chief Information Officer from 1997 to 2000. Prior to his employment with Amazon.com, Inc., Mr. Dalzell was Vice President of the Information Systems Division at Wal-Mart Stores, Inc. from 1994 to 1997. Since 2014, Mr. Dalzell has been a director of Twilio, Inc., where he is a member of the Nominating and Governance Committee. Mr. Dalzell was a director of AOL.com, Inc. from 2009 until its acquisition by Verizon Communications Inc. in 2015. Mr. Dalzell holds a Bachelor of Science degree in Engineering from the United States Military Academy at West Point.

| |

|

Relevant Expertise

Mr. Dalzell brings to the Board extensive experience, expertise and background in Internet information technology, platform software, cloud computing and cybersecurity, as well as a global perspective, gained from his service as the Chief Information Officer of Amazon.com, Inc. He also brings corporate leadership experience gained from his service in various senior executive roles at Amazon.com, Inc.

| |

|

Other Public Company Boards

Twilio, Inc.

| |

17

|

Diane B. Greene (Age 61)

Senior Vice President, Google Inc.

Ms. Greene has been an Intuit director since 2006 and is a member of the Compensation and Organizational Development Committee and chairs the Nominating and Governance Committee. Ms. Greene has served as the Senior Vice President of Enterprise Business at Google Inc. since December 2015. She has also served on the board of directors of Alphabet Inc. (and before its restructuring, Google Inc.) since January 2012. Ms.

|

|

Greene co-founded VMware, Inc. in 1998 and took the company public in 2007. Ms. Greene served as chief executive officer and president of VMware from 1998 to 2008, a member of the board of directors of VMware from 2007 to 2008, and as an Executive Vice President of EMC Corporation from 2005 to 2008. Prior to VMware, Ms. Greene held technical leadership positions at Silicon Graphics, Tandem, and Sybase and was chief executive officer of VXtreme. In addition to Ms. Greene’s public company board experience, she is a member of The MIT Corporation. Ms. Greene holds a Bachelor of Arts in mechanical engineering from the University of Vermont, a Master of Science degree in naval architecture from the Massachusetts Institute of Technology and a Master of Science degree in computer science from the University of California, Berkeley.

| |

|

Relevant Expertise

Ms. Greene brings to the Board experience and insight as a successful technology entrepreneur and former chief executive officer of a public company, as well as deep expertise and knowledge of cloud computing and software as a service businesses.

| |

|

Other Public Company Boards

Alphabet, Inc.

| |

|

Suzanne Nora Johnson (Age 59)

Former Vice-Chairman, The Goldman Sachs Group

Ms. Nora Johnson has been an Intuit director since 2007 and Lead Independent Director since January 2016. She also chairs the Compensation and Organizational Committee and is a member of the Nominating and Governance Committee. Ms. Nora Johnson joined The Goldman Sachs Group in 1985 and held several management positions throughout her tenure including: Vice Chairman, Chairman of the Global Markets

|

|

Institute, and Head of the Global Investments Research Division. Ms. Nora Johnson has been a member of the board of directors of: American International Group, Inc. since 2008; Pfizer Inc. since 2007; and VISA Inc. since 2007. Ms. Nora Johnson’s significant non-profit board affiliations include, among others, TechnoServe and the University of Southern California. Ms. Nora Johnson earned a Bachelor’s degree from the University of Southern California and a Juris Doctor from Harvard Law School.

| |

|

Relevant Expertise

Ms. Nora Johnson brings to the Board valuable business experience managing large, complex, global institutions as well as insights into how changes in the financial services industry, public policy and the macro-economic environment affect our businesses.

| |

|

Other Public Company Boards

American International Group, Inc.

Pfizer Inc.

VISA Inc.

| |

18

|

Dennis D. Powell (Age 68)

Former Chief Financial Officer, Cisco Systems, Inc.

Mr. Powell has been an Intuit director since 2004 and is Chairman of the Audit and Risk Committee and a member of the Acquisition Committee. Mr. Powell was executive advisor of Cisco Systems, Inc. from 2008 to 2010. Mr. Powell joined Cisco in 1997 and held several management positions throughout his tenure including: Executive Vice President and Chief Financial Officer from 2003 to 2008; Senior Vice President,

|

|

Corporate Finance Vice President from 2002 to 2003; and Corporate Controller from 1997 to 2002. Prior to Cisco, Mr. Powell held the position of senior partner at Coopers & Lybrand LLP, where his tenure spanned 26 years. Mr. Powell has been a member of the board of directors of Applied Materials, Inc. since 2007 and served on the board of directors of VMware, Inc. from 2007 until 2015. Mr. Powell holds a Bachelor of Science in Business Administration with a concentration in accounting from Oregon State University.

| |

|

Relevant Expertise

Mr. Powell brings to the Board executive management experience with large, global organizations as well as deep financial expertise and insights into operational issues, which he has gained through his tenure as an executive at a large public technology company.

| |

|

Other Public Company Boards

Applied Materials, Inc.

| |

|

Brad D. Smith (Age 52)

Chairman, President and Chief Executive Officer, Intuit Inc.

Mr. Smith has been an Intuit director since 2008 and Chairman of the Board since January 2016 and is currently Chairman, President and Chief Executive Officer of Intuit. Mr. Smith joined Intuit in 2003 and has served as Senior Vice President and General Manager, Small Business Division from 2006 to 2007, Senior Vice President and General Manager, QuickBooks from 2005 to 2006, Senior Vice President and General Manager,

|

|

Consumer Tax Group from 2004 to 2005 and as Vice President and General Manager of Intuit’s Accountant Central and Developer Network from 2003 to 2004. Before joining Intuit, Mr. Smith held the position of Senior Vice President of Marketing and Business Development of ADP, where he held several executive positions from 1996 to 2003. Mr. Smith served on the board of directors of Yahoo! Inc. from 2010 until 2013. Mr. Smith was elected to the board of directors of Nordstrom, Inc. in June 2013, where he chairs the Audit Committee and serves on the Technology Committee. Mr. Smith holds a Bachelor’s degree in Business Administration from Marshall University and a Master’s degree in Management from Aquinas College.

| |

|

Relevant Expertise

Mr. Smith, as Chairman and Chief Executive Officer of Intuit, brings to the Board the most relevant knowledge of Intuit’s strategy, markets, operations and employees and provides industry expertise and context on all matters that come before the Board.

| |

|

Other Public Company Boards

Nordstrom, Inc.

| |

19

|

Raul Vazquez (Age 45)

Chief Executive Officer and Director, Oportun

Raul Vazquez has been an Intuit director since May 2016 and serves as a member of the Audit and Risk Committee and the Acquisition Committee. Mr. Vazquez has served as chief executive officer and board member of Oportun, a financial technology company since April 2012. Prior to joining Oportun, Vazquez spent nine years at Walmart in various senior leadership roles, including executive vice president and

|

|

president of Walmart West, chief executive officer of Walmart.com, and executive vice president of Global eCommerce for developed markets. Mr. Vazquez previously worked in startup companies in e-commerce, at a global strategy consulting firm focused on Fortune 100 companies and as an industrial engineer for Baxter Healthcare. Mr. Vazquez also served as a member of the board of directors of Staples, Inc. from 2013 to June 2016. In September 2015, Mr. Vazquez was named to the Federal Reserve Board’s Community Advisory Council and currently serves as its chair, and in August 2016, Mr. Vazquez was named to the Consumer Financial Protection Bureau’s Consumer Advisory Board. Mr. Vazquez received a Bachelor of Science and a Master of Science degree in industrial engineering from Stanford University and an MBA from the Wharton Business School at the University of Pennsylvania.

| |

|

Relevant Expertise

Mr. Vazquez brings to the Board a wide range of experience in innovative consumer financial products, retail, marketing, e-commerce, technology and community development, as well as corporate leadership experience with global organizations.

| |

|

Other Public Company Boards

None

| |

|

Jeff Weiner (Age 46)

Chief Executive Officer, LinkedIn Corporation

Mr. Weiner has been a director of Intuit since April 2012 and is a member of the Compensation and Organizational Development Committee and Nominating and Governance Committee. He has served as the Chief Executive Officer of LinkedIn, an Internet professional network provider, since June 2009, and as a director of LinkedIn since July 2009. The acquisition of LinkedIn by Microsoft Corp. is pending. He served

|

|

as LinkedIn’s Interim President from December 2008 until June 2009. Before joining LinkedIn, Mr. Weiner was an executive in residence at Accel Partners and Greylock Partners, both venture capital firms, from September 2008 to June 2009. From May 2001 to June 2008 he held several positions at Yahoo! Inc., one of the world’s largest digital media companies, including most recently as an Executive Vice President of Yahoo’s network division. He holds a bachelor’s degree in economics from The Wharton School at the University of Pennsylvania.

| |

|

Relevant Expertise

Mr. Weiner brings to the Board experience and insights as the chief executive officer of a successful public technology company as well expertise and knowledge in social networking platforms, consumer web and mobile products.

| |

|

Other Public Company Boards

LinkedIn Corporation

| |

The Board recommends that you vote

FOR the election of each of the nominated directors.

20

DIRECTOR COMPENSATION

Overview

Our director compensation programs are designed to provide an appropriate incentive to attract and retain qualified non-employee board members. The Compensation Committee is responsible for reviewing the equity and cash compensation for directors on an annual basis and making recommendations to the Board, in the event the Compensation Committee determines changes are needed. The following table summarizes the fiscal 2016 compensation earned by each member of the Board other than Mr. Smith, whose compensation is described under “Executive Compensation” beginning on page 63.

Director Summary Compensation Table

Director Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1) |

All Other Compensation ($) |

Total ($) |

|||||||||||

Eve Burton |

— |

(2) |

424,896 |

(2) |

— |

424,896 |

|||||||||

William V. Campbell |

200,000 |

(3) (5) |

— |

— |

200,000 |

||||||||||

Scott D. Cook |

— |

— |

1,090,000 |

(4) |

1,090,000 |

||||||||||

Richard L. Dalzell |

— |

(2) |

367,419 |

(2) |

— |

367,419 |

|||||||||

Diane B. Greene |

102,500 |

259,955 |

— |

362,455 |

|||||||||||

Edward A. Kangas |

30,000 |

(5) |

— |

— |

30,000 |

||||||||||

Suzanne Nora Johnson |

139,375 |

259,955 |

— |

399,330 |

|||||||||||

Dennis D. Powell |

122,500 |

259,955 |

— |

382,455 |

|||||||||||

Raul Vazquez |

45,000 |

269,976 |

— |

314,976 |

|||||||||||

Jeff Weiner |

— |

(2) |

344,953 |

(2) |

— |

344,953 |

|||||||||

_______________________________________

(1) |

These amounts represent the aggregate grant date fair value of RSUs granted during fiscal 2016, computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, “Compensation – Stock Compensation,” (“FASB ASC Topic 718”), assuming no forfeitures. Please see the “Equity Grants to Directors During Fiscal Year 2016” and “Outstanding Equity Awards for Directors at Fiscal Year-End 2016 (Exercisable and Unexercisable)” tables for information regarding the grant date fair value of RSUs granted during the fiscal year and the number of awards outstanding for each director at the end of the fiscal year.

|

(2) |