DEF 14A: Definitive proxy statements

Published on November 26, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box: | ||

¨ |

Preliminary Proxy Statement |

|

¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

þ |

Definitive Proxy Statement |

|

¨ |

Definitive Additional Materials |

|

¨ |

Soliciting Material under § 240.14a-12 |

|

INTUIT INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ |

No fee required. |

|||

¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

(1) |

Title of each class of securities to which transaction applies: |

|||

(2) |

Aggregate number of securities to which transaction applies: |

|||

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

(4) |

Proposed maximum aggregate value of transaction: |

|||

(5) |

Total fee paid: |

|||

¨ |

Fee paid previously with preliminary materials. |

|||

|

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which

the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or

Schedule and the date of its filing.

| ||||

(1) |

Amount Previously Paid: |

|||

(2) |

Form, Schedule or Registration Statement No.: |

|||

(3) |

Filing Party: |

|||

(4) |

Date Filed: |

|||

INTUIT INC.

2700 Coast Avenue

Mountain View, CA 94043

NOTICE OF 2015 ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholder:

You are cordially invited to attend our 2015 Annual Meeting of Stockholders, which will be held at 8:00 a.m. Pacific Standard Time on January 22, 2015 at our offices at 2750 Coast Avenue, Building 6, Mountain View, California 94043. We are holding the meeting for the following purposes:

1. To elect the nine directors nominated by the Board of Directors and named in the proxy statement to hold office until the next annual meeting of stockholders or until their respective successors have been elected and qualified;

2. To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2015;

3. To hold an advisory vote to approve executive compensation;

4. To approve the Amended and Restated Employee Stock Purchase Plan to increase the number of shares of Intuit’s common stock authorized for issuance by 3,000,000 shares; and

5. To consider any other matters that may properly be brought before the annual meeting and any postponement(s) or adjournment(s) thereof.

Only stockholders who owned our stock at the close of business on November 24, 2014 may vote at the annual meeting, or at any adjournment or postponement of the annual meeting.

Your vote is important. Whether or not you plan to attend the annual meeting, please cast your vote, as instructed in the Notice of Internet Availability of Proxy Materials, over the Internet or by telephone, as promptly as possible. You may also request a paper proxy card to submit your vote by mail, if you prefer. We encourage you to vote via the Internet. We believe it is convenient for our stockholders, while significantly lowering the cost of our annual meeting and conserving natural resources.

Important Notice Regarding the Availability of Proxy Materials for Annual Meeting of Stockholders to Be Held on January 22, 2015. The proxy statement is available electronically at http://investors.intuit.com/financial-information/proxy-statements/default.aspx and Intuit’s Annual Report on Form 10-K for fiscal year ended July 31, 2014 is available electronically at http://investors.intuit.com/financial-information/annual-reports/default.aspx.

By order of the Board of Directors, |

|

Laura A. Fennell |

|

Senior Vice President, General Counsel and Corporate

Secretary

|

Mountain View, California

November 26, 2014

INTUIT INC.

PROXY STATEMENT 2015 ANNUAL MEETING OF STOCKHOLDERS

Page |

|

|

|

|

Page |

|

A-1 |

|

A-1 |

|

B-1 |

|

Amended and Restated Employee Stock Purchase Plan |

B-1 |

INTUIT INC.

2700 Coast Avenue

Mountain View, CA 94043

PROXY STATEMENT FOR THE

2015 ANNUAL MEETING OF STOCKHOLDERS

2015 PROXY SUMMARY

Intuit Inc.’s (“Intuit” or the “Company”) Board of Directors (the “Board”) is asking for your proxy for use at the Intuit Inc. 2015 Annual Meeting of Stockholders (the “Meeting”) and at any adjournment or postponement of the Meeting for the purposes set forth in the accompanying Notice of 2015 Annual Meeting of Stockholders. This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Annual Meeting of Stockholders

Time and Date |

Thursday, January 22, 2015 at 8:00 a.m. Pacific Standard Time |

|

Place |

Intuit’s offices at 2750 Coast Avenue, Building 6, Mountain View, California 94043 |

|

Record Date |

November 24, 2014 |

|

Voting |

Stockholders of Intuit as of the record date are entitled to vote. Each share of Intuit common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. |

|

Webcast of Meeting

If you are not able to attend the Meeting in person, you may join a live webcast of the Meeting on the Internet by visiting http://investors.intuit.com on Thursday, January 22, 2015 at 8:00 a.m. Pacific Standard Time.

Meeting Information

The following chart describes the proposals to be considered at the meeting, the vote required to elect directors and to adopt each other proposal, the manner in which votes will be counted and the Board’s voting recommendation:

Proposal |

Voting Options |

Vote Required to Adopt the Proposal |

Effect of Abstentions |

Effect of “Broker Non-Votes”

|

Board’s Voting Recommendation |

|||||

1. Election of directors |

For, against or abstain on each nominee |

A nominee for director will be elected if the votes cast for such nominee exceed the votes cast against such nominee |

No effect |

No effect |

FOR the election of each of the director nominees |

|||||

2. Ratification of selection of Ernst & Young LLP |

For, against or abstain |

The affirmative vote of a majority of the shares of common stock represented at the annual meeting and voted for or against the proposal |

No effect |

No effect |

FOR |

|||||

3. Advisory vote to approve Intuit’s executive compensation |

For, against or abstain |

The affirmative vote of a majority of the shares of common stock represented at the annual meeting and voted for or against the proposal |

No effect |

No effect |

FOR |

|||||

4. Approval of an Amendment and Restatement of the Employee Stock Purchase Plan |

For, against or abstain |

The affirmative vote of a majority of the shares of common stock represented at the annual meeting and voted for or against the proposal |

No effect |

No effect |

FOR |

|||||

1

We will also consider any other matters that may properly be brought before the Meeting and any postponement(s) or adjournment(s) thereof. We have not yet received notice of other matters that may be properly presented at the annual meeting.

How to Vote

Please act as soon as possible to vote your shares, even if you plan to attend the Meeting. You may vote via the Internet, by telephone or, if you have received a printed version of these proxy materials, by mail. If your shares are held on your behalf by a broker, bank or other nominee, you must instruct your nominee on how to vote the shares held in your account. If you do not provide your nominee with voting instructions, your nominee may only vote on Proposal 2 (ratifying the selection of our independent registered public accountant).

Board Nominees

The following table provides summary information about each director nominee.

Committee Memberships |

||||||||

Name |

Director Since |

Occupation |

Independent |

AC |

ARC |

CODC |

NGC |

Other Public Company Boards |

Incumbent Nominees | ||||||||

William V. Campbell |

1994 |

Chairman of the Board of Directors, Intuit Inc. |

GSV Capital Corp. |

|||||

Scott D. Cook |

1984 |

Founder and Chairman of the Executive Committee, Intuit Inc. |

eBay Inc.;

The Procter & Gamble Company

|

|||||

Diane B. Greene (1) |

2006 |

Former President and Chief Executive Officer, VMware, Inc. |

X |

X |

X |

Google, Inc. |

||

Edward A. Kangas |

2007 |

Non-Employee Chairman, Tenet Healthcare |

X |

X |

C |

X |

Tenet Healthcare; Hovnanian Enterprises, Inc.;

United Technologies Corporation; IntelSat

|

|

Suzanne Nora Johnson |

2007 |

Former Vice-Chairman, The Goldman Sachs Group |

X |

C |

X |

American International Group, Inc.; Pfizer Inc.; VISA Inc. |

||

Dennis D. Powell |

2004 |

Former Chief Financial Officer, Cisco Systems, Inc. |

X |

X |

C |

Applied Materials, Inc.; VMware, Inc. |

||

Brad D. Smith |

2008 |

President and Chief Executive Officer, Intuit Inc. |

Nordstrom, Inc. |

|||||

Jeff Weiner |

2012 |

Chief Executive Officer, LinkedIn Corporation |

X |

X |

LinkedIn Corporation |

|||

New Nominees | ||||||||

Richard Dalzell (2) |

N/A |

Former Senior Vice President and Chief Information Officer, Amazon.com, Inc. |

X |

AOL Inc. |

||||

(1) The Board has appointed Ms. Greene to serve as Chair of the Nominating and Governance Committee, effective as of the 2015 Annual Meeting date.

(2) The Board has appointed Mr. Dalzell to serve on the Compensation and Organizational Development Committee and the Nominating and Governance Committee, effective upon his election.

2

AC |

Acquisition Committee |

|

ARC |

Audit and Risk Committee |

|

CODC |

Compensation and Organizational Development Committee |

|

NGC |

Nominating and Governance Committee |

|

C |

Chair |

|

Attendance |

All of our incumbent directors, including Christopher Brody, who declined to stand for re-election to the Board, attended at least 75% of the aggregate number of meetings of the Board and committees on which he or she sits. |

|

Fiscal 2014 Executive Compensation Highlights

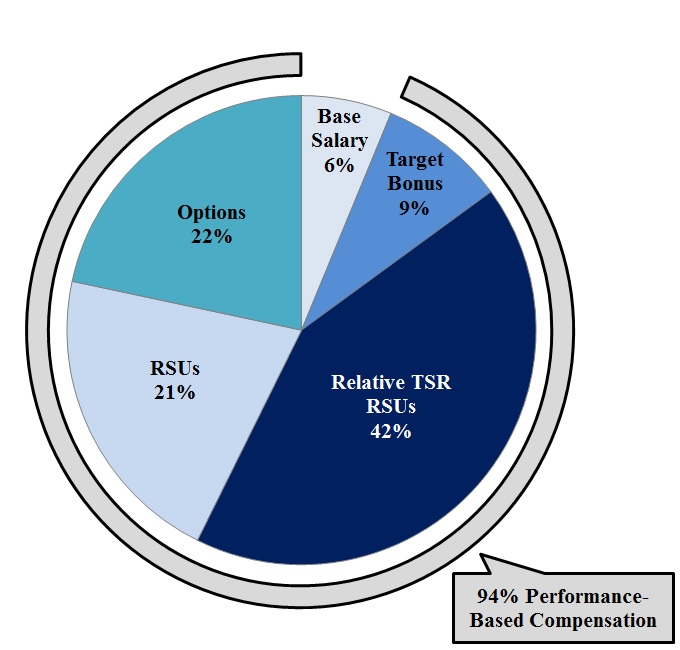

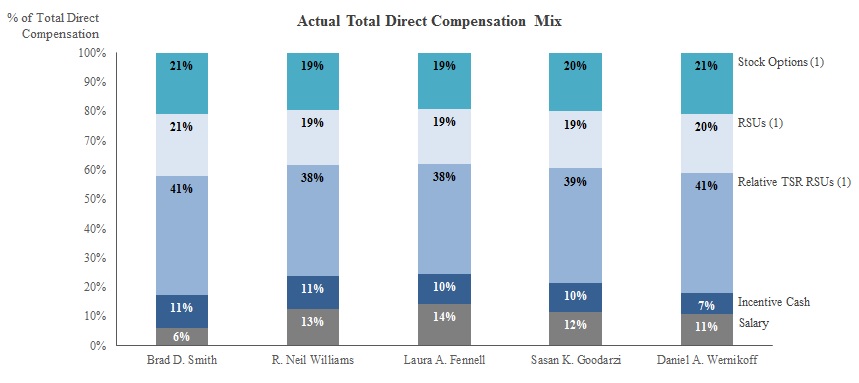

Intuit is strongly committed to pay for performance. To that end, our executive compensation programs are designed to reward both short- and long-term growth as well as total stockholder return (“TSR”). Our short-term performance-based compensation consists of annual cash bonuses, which are based upon achievement of annual corporate operating goals, including revenue and non-GAAP operating income growth, and individual performance. Our long-term compensation consists of performance-based RSUs based on relative total stockholder return (“Relative TSR RSUs”), RSUs and non-qualified stock options.

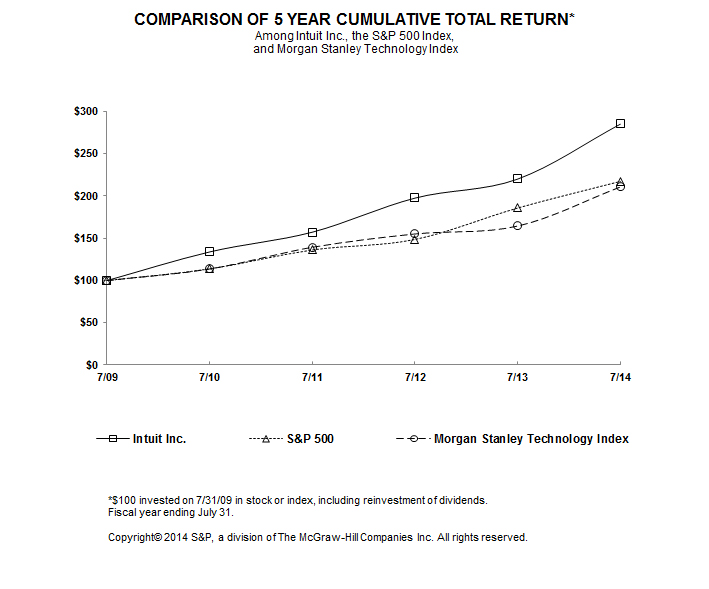

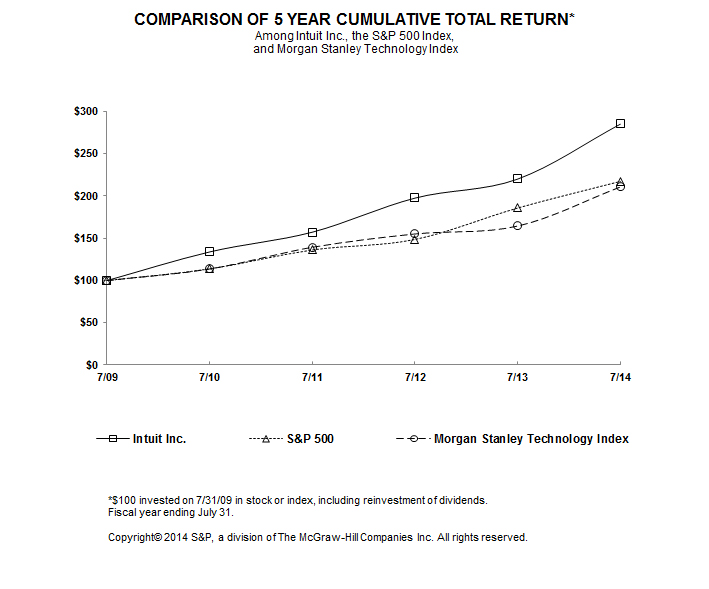

Intuit achieved fiscal 2014 revenue growth of 8.0%, non-GAAP operating income growth of 6.9% and non-GAAP earnings per share (“EPS”) growth of 10.0% (see table on page A-3 of this proxy statement for a reconciliation of non-GAAP financial measures) and a TSR of 29.5%. These results take into account both an acceleration to cloud-based subscriptions, which shifted some fiscal 2014 revenue into future reporting periods, as well expenses associated with a restructuring in the fourth quarter of fiscal 2014. Our revenue, operating income and earnings per share for the year were at the high end of our guidance range, after adjusting for the impact of the related restructuring charges.

Intuit’s TSR has performed well in recent years. We delivered 29.5% TSR during fiscal 2014, three-year annualized TSR of 21.9% and five-year annualized TSR of 23.3%, closing the year with our stock price at an all-time high. See the graph below, which compares the cumulative TSR on Intuit common stock for the last five full fiscal years with the cumulative total returns on the S&P 500 Index and the Morgan Stanley Technology Index for the same period. The graph assumes that $100 was invested in Intuit common stock and in each of the other indices on July 31, 2009 and that all dividends were reinvested. Intuit did not pay cash dividends prior to fiscal 2012. The comparisons in the graph below are based on historical data – with Intuit common stock prices based on the closing price on the dates indicated – and are not intended to forecast the possible future performance of Intuit’s common stock.

3

Compensation Practices

Intuit employs a number of practices that reflect our pay-for-performance compensation philosophy, including:

• |

a significant portion of our fiscal 2014 senior executive officer compensation is in the form of incentives tied to achievement of particular performance measures. In addition to our annual cash bonus, 50% of equity incentive value was granted in the form of performance-based RSUs, which measure relative TSR against a group of other software and services companies of comparable size. The remaining 50% of equity incentive value was granted in the form of RSUs (which incorporate a one-year GAAP operating income hurdle) and stock options, both of which the Compensation Committee also consider to be performance-based compensation; |

• |

we do not provide special retirement benefits solely for executive officers; |

• |

we do not provide any excise tax “gross-up” payments; |

• |

we do not provide perquisites or other executive benefits based solely on rank; |

• |

we prohibit directors and executive officers from pledging Intuit stock and engaging in hedging transactions involving Intuit stock; |

• |

we have “clawback” provisions for operating performance-based equity awards; and |

• |

we have stock ownership guidelines for executive officers at the senior vice president level and above and non-employee directors, with the CEO guideline set at six times salary, the senior vice president level and above guideline set at one and a half times salary, and the non-employee director guideline set at five times annual retainer. |

Fiscal 2014 Compensation Summary

Set forth below is the fiscal year 2014 compensation for each named executive officer as determined under the Securities and Exchange Commission rules. See the “Compensation Discussion and Analysis” and “Executive Compensation” sections of the proxy statement for a full explanation of each named executive officer’s compensation.

4

Name and Principal Position |

Salary

($)

|

Bonus

($)

|

Stock Awards

($)

|

Option Awards

($)

|

Non-Equity Incentive Plan Compensation

($)

|

All Other Compensation

($)

|

Total

($)

|

||||||||||||||

|

Brad D. Smith

President and Chief Executive Officer

|

1,000,000 |

— |

10,172,624 |

3,475,845 |

1,890,000 |

10,000 |

16,548,469 |

||||||||||||||

|

R. Neil Williams

Senior Vice President and Chief Financial Officer

|

700,000 |

— |

3,226,791 |

1,081,187 |

630,000 |

10,000 |

5,647,978 |

||||||||||||||

|

Laura A. Fennell

Senior Vice President, General Counsel and Corporate Secretary

|

575,000 |

— |

2,298,750 |

771,731 |

411,000 |

16,000 |

4,072,481 |

||||||||||||||

|

Sasan K. Goodarzi

Senior Vice President and General Manager, Consumer Tax Group

|

620,000 |

— |

3,163,836 |

1,081,187 |

524,000 |

250,000 |

5,639,023 |

||||||||||||||

|

Daniel A. Wernikoff

Senior Vice President and General Manager, Small Business Group

|

525,000 |

— |

3,010,934 |

1,029,229 |

358,500 |

13,000 |

4,936,663 |

||||||||||||||

5

CORPORATE GOVERNANCE

Intuit is committed to excellence in corporate governance and maintains policies and practices that promote good corporate governance, including the following:

• |

The Board has adopted majority voting in uncontested elections of directors; |

• |

A majority of the board members are independent of Intuit and its management; |

• |

The independent members of the Board meet regularly without the presence of management; |

• |

All members of the committees of the Board are independent; |

• |

The charters of the committees of the Board clearly establish the committees’ respective roles and responsibilities; |

• |

Intuit has adopted a Code of Conduct & Ethics for employees that is monitored by Intuit’s ethics office; |

• |

Intuit’s ethics office has a hotline available to all employees, and Intuit’s Audit and Risk Committee has procedures in place to receive and process complaints, including on a confidential and anonymous basis, regarding accounting, internal accounting controls, auditing and federal securities law matters, or violations of the Code of Conduct & Ethics and for employees to make confidential, anonymous complaints regarding accounting, auditing and federal securities law matters or violations of the Intuit’s Code of Conduct & Ethics; |

• |

Intuit has adopted a Code of Ethics that applies to all directors; |

• |

Intuit’s internal audit control function maintains critical oversight over the key areas of its business and financial processes and controls, and reports directly to Intuit’s Audit and Risk Committee; |

• |

Intuit’s investor relations and management teams regularly communicate with our stockholders and report to the Board on the stockholders’ perspectives; and |

• |

The Board and its committees receive periodic updates on regulatory and other developments relevant to the Board from management and outside experts. |

Our Board has adopted Corporate Governance Principles that are designed to assist the Board in observing practices and procedures that serve the best interests of Intuit and our stockholders. The Nominating and Governance Committee is responsible for overseeing these Corporate Governance Principles, reviewing them at least annually and making recommendations to the Board regarding any changes. These Corporate Governance Principles address, among other things, our policy on succession planning and senior leadership development, Board performance evaluations, committee structure and stock ownership requirements.

We maintain a corporate governance page on our company website that contains key information about corporate governance matters. This information includes copies of our Corporate Governance Principles, Political Accountability Policy, Code of Conduct & Ethics for all employees, including our Company’s senior executive and financial officers, our Operating Values, and the charter for each Board committee. The link to this corporate governance page can be found at http://investors.intuit.com/corporate-governance/conduct-and-guidelines/default.aspx.

6

Board Responsibilities, Leadership Structure and Executive Sessions

The Board oversees management’s performance on behalf of Intuit’s stockholders. The Board’s primary responsibilities are to (1) select, oversee and determine compensation for the Chief Executive Officer who, with senior management, runs Intuit on a day-to-day basis, (2) monitor management’s performance to assess whether Intuit is operating in an effective, efficient and ethical manner in order to create value for Intuit’s stockholders, and (3) periodically review Intuit’s long-range plan, business initiatives, capital projects and budget matters. The Chairman of the Board presides over all Board meetings and works with the Chief Executive Officer to develop agendas for Board meetings. The Chairman advises the Chief Executive Officer and other members of senior management on business strategy and leadership development. He also works with the Board to drive decisions about particular strategies and policies and, in concert with the independent Board committees, facilitates a performance evaluation process of the Board.

The Board appoints a Chairman, who may be a former officer of Intuit if the Board determines that it is in the best interests of Intuit and its stockholders. The roles of Chairman of the Board and Chief Executive Officer may be held by the same person or different people. However, if the Chairman is also the Chief Executive Officer, then the Board has determined that it will appoint a lead independent director. Currently, the positions of Chairman of the Board and Chief Executive Officer are held by separate persons. The Board believes that the separation of the roles of Chairman of the Board and Chief Executive Officer is appropriate at this time as it allows our Chief Executive Officer to focus primarily on management and strategy responsibilities and our Chairman to focus on leadership of the Board, providing feedback and advice to the Chief Executive Officer and serving as a channel of communication between the Board members and the Chief Executive Officer. William V. Campbell, the current Chairman of the Board, is a non-executive employee of Intuit and previously served as Intuit’s chief executive officer.

The Board and its committees meet throughout the year on a set schedule, and also hold special meetings and act by written consent from time to time as appropriate. The Board held four meetings during fiscal 2014. The independent directors also spend a portion of every regularly scheduled meeting in executive session and designate an independent director to serve as presiding director to chair these sessions. During fiscal 2014, Christopher Brody, the Nominating and Governance Committee chair, served as the presiding director of all executive sessions. In addition, the presiding director may advise the Chairman of the Board with respect to agendas and information to be provided to the Board and may perform such other duties as the Board may from time to time request to assist it in fulfilling its responsibilities. The Board has delegated certain responsibilities and authority to the committees described below. Committees report regularly on their activities and actions to the full Board.

Board Oversight of Risk

Intuit’s management is responsible for balancing risk and opportunity in support of Intuit’s objectives. Management exercises this responsibility day to day through ongoing identification of risks related to significant business activities, implementation of risk mitigation activities and alignment of risk management to the Company’s strategy. Intuit’s Chief Risk Officer, who reports through to our General Counsel, facilitates the Enterprise Risk Management, or “ERM,” program as part of our strategic planning process. The ERM program helps identify the top risks for each business unit and for Intuit as a whole.

The Board oversees risk management for the Company both directly and through its committees, as follows:

• |

The Audit and Risk Committee has primary responsibility for overseeing our ERM program. The Chief Risk Officer reports on a quarterly basis to the Audit and Risk Committee on Intuit’s top risk areas and the progress of the ERM program. The Audit and Risk Committee also has oversight responsibilities with respect to particular risks such as financial management and fraud. |

• |

The Board’s other committees – Compensation and Organizational Development, Nominating and Governance, and Acquisition – oversee risks associated with their respective areas of responsibility. The Compensation and Organizational Development Committee considers the risks associated with our compensation policies and practices for executives and employees generally. The Nominating and Governance Committee considers risks associated with corporate governance and overall board effectiveness, including recruiting appropriate Board members. The Acquisition Committee considers risks associated with Intuit’s merger and acquisition activities and the strategy and business models of acquisition candidates. |

• |

At each quarterly Board meeting, members of each committee provide a report to the full Board covering the committee’s risk oversight and other activities. The full Board receives an annual update from the Chief Risk Officer regarding the top enterprise-wide risks. The full Board also considers and provides oversight of specific strategic risks, including those relating to Intuit’s business models and inorganic growth strategy. The Board also receives detailed reports at quarterly Board meetings from the Chief Executive Officer and the heads of our principal business units, |

7

which include discussions of the risks involved in their respective areas of responsibility. The senior management team also informs the Board routinely of developments that could affect our risk profile or other aspects of our business.

Compensation Risk Assessment

The Company conducted a review of its key compensation programs, policies and practices in conjunction with Frederic W. Cook & Co., Inc. (“FW Cook”), the Compensation and Organizational Development Committee’s independent compensation consultant, which prepared a report on the Company’s incentive programs.

The review included an analysis of the Company’s short-term and long-term compensation programs, covering key program details, performance factors for each program, target award ranges, maximum funding levels, and plan administrative oversight and control requirements. The assessment of potential compensation-related risks considered pay mix, performance metrics, performance goals and payout curves, payment timing and adjustments, severance packages, equity incentives and stock ownership requirements and trading policies.

This analysis was reviewed with the Compensation and Organizational Development Committee at its October 28, 2014 meeting. The review and analysis did not identify any compensation programs, policies or practices that create risks that are reasonably likely to have a material adverse effect on the Company.

The analysis noted the following factors that reduce the likelihood of excessive risk-taking at Intuit:

•Overall compensation levels are in a competitive market range.

•The compensation programs provide an effective balance in (1) cash and equity mix, (2) annual incentives that are based in part on company-wide performance metrics that align with the Company’s business plans and strategic objectives and in part on a qualitative evaluation of business unit and individual performance, and (3) long-term incentives provided through a combination of stock options (generally vesting over three years with terms of seven years), time-based RSUs (generally vesting over three years), and performance-based RSUs (earned after three years based on one-, two- and three-year relative TSR).

•Stock ownership guidelines for executive officers at the senior vice president level and above as well as non-employee directors.

•The insider trading policy, which prohibits officers from pledging shares, trading put or call options, and engaging in short sales or hedging transactions involving the Company’s securities.

•“Clawback” provisions for operating performance-based equity awards.

Director Independence

To be considered independent under NASDAQ rules, a director may not be employed by Intuit or engage in certain types of business dealings with Intuit. In assessing director independence under NASDAQ rules, the Nominating and Governance Committee and the full Board review relevant transactions, relationships and arrangements that may affect the independence of our Board members. In addition, as required by NASDAQ rules, the Board makes a determination as to each independent director that no relationship exists which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the Board reviewed and discussed information provided by the directors and by Intuit with regard to each director’s business and personal activities as they relate to Intuit and Intuit’s management.

Each of Mr. Powell, Mr. Kangas, Ms. Nora Johnson, Ms. Greene and Mr. Weiner is or was during fiscal 2014 a director of companies with which Intuit conducts business in the ordinary course. Consistent with NASDAQ independence standards, Intuit did not make payments to, or receive payments from, any of these companies for property or services in the current or any of the last three fiscal years that exceed 5% of Intuit’s or any of the other parties’ consolidated gross revenues. Upon review of these relationships and the other information provided by our directors and director nominees, the Board determined that the following current directors and director nominees are independent: Mr. Brody, Mr. Dalzell (nominee), Ms. Greene, Mr. Kangas, Ms. Nora Johnson, Mr. Powell and Mr. Weiner.

Attendance at Board, Committee and Annual Stockholders Meetings

The Board expects that each director will prepare for, attend and participate in all Board and applicable committee meetings and that each Board member will see that other commitments do not materially interfere with his or her service on the Board. Directors generally may not serve on the boards of more than six public companies, including Intuit’s Board. Any director, who has a principal job change, including retirement, must offer to submit a letter of resignation to the Chairman of

8

the Board. The Board, in consultation with the Nominating and Governance Committee, will review each offered resignation and determine whether or not to accept such resignation after consideration of the continued appropriateness of Board membership under the new circumstances.

During fiscal 2014, all directors attended at least 75% of the aggregate number of meetings of the Board and the committees on which he or she served. Seven of our nine current directors attended the last Annual Meeting of Stockholders held in January 2014. Our Corporate Governance Principles encourage all directors to attend our annual meeting of stockholders.

Board Committees and Charters

The Board currently has a standing Acquisition Committee, Audit and Risk Committee, Compensation and Organizational Development Committee, and Nominating and Governance Committee. Each committee has a charter which it reviews annually and makes recommendations to our Board for its revision to reflect evolving best practices. Copies of each charter can be found on our website at http://investors.intuit.com/corporate-governance/conduct-and-guidelines/default.aspx. The members of each committee are independent and appointed by the Board based on recommendations of the Nominating and Governance Committee. Current committee members are identified in the following table.

Director (1) |

Acquisition Committee |

Audit and Risk Committee |

Compensation and Organizational Development Committee |

Nominating and Governance Committee |

||||

Christopher W. Brody(2) |

X |

Chair |

||||||

William V. Campbell |

||||||||

Scott D. Cook |

||||||||

Diane B. Greene |

X |

X (3) |

||||||

Edward A. Kangas |

X |

Chair |

X |

|||||

Suzanne Nora Johnson |

Chair |

X |

||||||

Dennis D. Powell |

X |

Chair |

||||||

Brad D. Smith |

||||||||

Jeff Weiner |

X |

|||||||

Number of meetings in Fiscal 2014 |

5 |

9 |

7 |

4 |

||||

(1) The Board has appointed Mr. Dalzell to serve on the Compensation and Organizational Development Committee and the Nominating and Governance Committee, effective upon his election.

(2) Mr. Brody declined to stand for re-election to the Board.

(3) Ms. Greene has been appointed by the Board to serve as Chair of the Nominating and Governance Committee, effective as of the 2015 Annual Meeting date.

Acquisition Committee

The Acquisition Committee reviews and approves acquisition, divestiture and investment transactions proposed by Intuit’s management in which the total consideration to be paid or received by Intuit is within certain limits that may be established by the Board from time to time.

Audit and Risk Committee

The Audit and Risk Committee represents and assists the Board in its oversight of Intuit’s financial reporting, internal controls and audit functions, and is directly responsible for the selection, retention, compensation and oversight of the work of Intuit’s independent auditor.

Our Board has determined that each member of the Audit and Risk Committee is independent, as defined under applicable NASDAQ listing standards and SEC rules related to audit committee members, and is financially literate, as required by NASDAQ listing standards. All members of the Audit and Risk Committee have been determined by the Board to meet the qualifications of an “audit committee financial expert,” as defined by SEC rules, and to meet the qualifications of “financial sophistication” in accordance with NASDAQ listing standards.

9

The Audit and Risk Committee held closed sessions with our independent auditors, Ernst & Young LLP, in all of its meetings.

Compensation and Organizational Development Committee

The Compensation and Organizational Development Committee (the “Compensation Committee”) assists the Board in the review and approval of executive compensation and the oversight of organizational and management development for executive officers and other employees of Intuit. The Compensation Committee periodically reviews Intuit’s key management from the perspectives of leadership development, organizational development and succession planning through Intuit’s High Performance Organization Review. As part of this process, the Compensation Committee also meets with key senior executives. The systemic assessment of Intuit’s organization and talent planning helped the Compensation Committee to evaluate Intuit’s effort at hiring, developing and retaining executives, with the goal of creating and growing Intuit’s “bench strength” at the most senior executive levels.

Each member of this Committee, as well as Mr. Dalzell, who has been nominated to serve on the Compensation Committee if elected at the 2015 Annual Meeting, is independent under NASDAQ listing standards and is a “Non-Employee Director,” as defined in Rule 16(b)-3 under the Securities Exchange Act of 1934, as amended. The Compensation Committee held a portion of each meeting in closed session, with only the Compensation Committee members and, on certain occasions, William Campbell, the Chairman of the Board, present. For more information on the responsibilities and activities of the Compensation Committee, including the committee’s processes for determining executive compensation, see the “Compensation and Organizational Development Committee Report” on page 25 and “Compensation Discussion and Analysis” beginning on page 26, including in particular, the discussion of the “Role of Compensation Consultants, Executive Officers and the Board in Compensation Determinations” beginning on page 43.

The Compensation Committee is also responsible for reviewing the compensation for non-employee directors on an annual basis and making recommendations to the Board, in the event the Committee determines changes are appropriate.

Section 162(m) Subcommittee

Because in fiscal 2014 not all of the members of the Compensation Committee were “outside directors” for purposes of Regulation 1.162-27 under Section 162(m) of the Internal Revenue Code (“Section 162(m)”), the Compensation Committee designated a Section 162(m) subcommittee and appointed Mr. Kangas and Mr. Brody, both of whom are “outside directors” to serve on it. This subcommittee has responsibility and authority to review and approve all elements of compensation that may require approval by a committee of “outside directors” in order for such compensation to qualify for deductibility under Section 162(m) and related regulations. This subcommittee met three times in fiscal 2014.

Compensation Committee Interlocks and Insider Participation

None of Messrs. Kangas, Brody or Weiner, each of whom served on the Compensation Committee during fiscal 2014, has at any time been one of our executive officers or employees. No executive officer of Intuit during fiscal 2014 served, or currently serves, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on Intuit’s Board or Intuit’s Compensation Committee.

Nominating and Governance Committee

The Nominating and Governance Committee reviews and makes recommendations to the Board regarding Board composition and appropriate governance standards. Our Board has determined that each member of the Nominating and Governance Committee is independent, as defined under applicable NASDAQ listing standards.

The Nominating and Governance Committee has adopted a process to identify and evaluate candidates for director, whether recommended by management, Board members, or stockholders (if made in accordance with the procedures set forth under “Stockholder Recommendations of Director Candidates” on page 11). The Committee’s policy is to evaluate candidates properly recommended by stockholders in the same manner as candidates recommended by others.

Qualifications of Directors

The Nominating and Governance Committee believes that all nominees for Board membership should possess the highest ethics, integrity and values and be committed to representing the long-term interests of Intuit’s stockholders. In addition, nominees should have broad, high-level experience in business, government, education, technology or public interest. They should have sufficient time to carry out their duties as directors of Intuit and have an inquisitive and objective perspective, practical wisdom and mature judgment. The Nominating and Governance Committee will also consider additional factors –

10

such as independence, diversity, expertise and specific skills, and other qualities that may contribute to the Board’s overall effectiveness – when evaluating candidates for director. The Nominating and Governance Committee may also engage third-party search firms to provide assistance in identifying and evaluating Board candidates.

Consideration of director candidates typically involves a series of discussions and a review of available information concerning the candidate, the existing composition of the Board and other factors the Committee deems relevant. In conducting its review and evaluation, the Nominating and Governance Committee may solicit the views of management, other Board members and other individuals it believes may have insight into a candidate.

In considering diversity in the selection of nominees, the Nominating and Governance Committee looks for individuals with varied professional experience, background, knowledge, skills and viewpoints in order to achieve and maintain a group of directors that, as a whole, provides effective oversight of the management of the Company. Although our nomination policy does not prescribe specific standards for diversity, the Board and the Nominating and Governance Committee do look for nominees with a diverse set of skills that will complement the existing skills and experience of our directors and provide an overall balance of diversity of perspectives, backgrounds and experiences. The Nominating and Governance Committee assesses its effectiveness in this regard as part of its annual evaluation process. Our Board is currently composed of a group of leaders with broad and diverse experience in many fields, including: management of large global enterprises; technology and innovation leadership; strategic planning; consumer software and technology products and services; public policy; social networking; healthcare; and financial services; legal and compliance; executive compensation; and corporate governance. Our Board members have acquired these diverse skills through their accomplished careers and their service as directors of a wide range of other public and private companies.

Stockholder Recommendations of Director Candidates

As discussed above, our Nominating and Governance Committee will consider director candidates recommended by a stockholder. A stockholder seeking to recommend a candidate for the committee’s consideration should submit the candidate’s name and qualifications to: Nominating and Governance Committee, c/o Corporate Secretary, Intuit Inc., P.O. Box 7850, Mail Stop 2700, Mountain View, California 94039-7850 or via our website at http://investors.intuit.com/corporate-governance/conduct-and-guidelines/contact-the-board/default.aspx. You may find a copy of a document entitled “Process of Identifying and Evaluating Nominees for Director” on our website http://investors.intuit.com/corporate-governance/conduct-and-guidelines/default.aspx.

Stockholder Engagement Process

Intuit regularly engages with stockholders to better understand their perspectives. During fiscal 2014 we held discussions with our largest stockholders during scheduled events such as our annual meeting and investor day, as well as regularly throughout the year. In September 2014 we hosted our annual investor day, which presents an opportunity for our management team to interact directly with our stockholders regarding our performance in the prior year and our short- and long-term growth strategies. Management and the investor relations team regularly share investor and stockholder feedback with the Board of Directors. In general, our stockholders have not raised concerns regarding our compensation programs. We will continue to engage with our stockholders on a regular basis in order to understand and consider their views on our executive compensation programs and corporate governance practices.

Stockholder Communications with the Board

The Nominating and Governance Committee is responsible for receiving stockholder communications on behalf of the Board. Any stockholder may send communications by mail to the Board or individual directors c/o Corporate Secretary, Intuit Inc., P.O. Box 7850, Mail Stop 2700, Mountain View, California 94039-7850 or via our website at http://investors.intuit.com/corporate-governance/conduct-and-guidelines/contact-the-board/default.aspx. The Board has instructed the Corporate Secretary to review this correspondence and determine, in his or her discretion, whether matters submitted are appropriate for Board consideration. The Corporate Secretary may also forward certain communications elsewhere in the Company for review and possible response. In particular, communications such as product or commercial inquiries or complaints, job inquiries, surveys and business solicitations or advertisements or patently offensive or otherwise inappropriate material will not be forwarded to the Board.

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Security Ownership Table

The following table shows shares of Intuit’s common stock that we believe are owned as of October 31, 2014 by:

• |

Each Named Executive Officer (defined on page 26), |

• |

Each director and nominee, |

• |

All current directors, nominees and executive officers as a group, and |

• |

Each stockholder beneficially owning more than 5% of our common stock. |

Unless indicated in the notes, each stockholder has sole voting and investment power for all shares shown, subject to community property laws that may apply to create shared voting and investment power. Unless indicated in the notes, the address of each beneficial owner is c/o Intuit Inc., P.O. Box 7850, Mountain View, California 94039-7850.

We calculated the “Percent of Class” based on 285,418,643 shares of common stock outstanding on October 31, 2014. In accordance with SEC regulations, we also include (1) shares subject to options that are currently exercisable or will become exercisable within 60 days of October 31, 2014, and (2) shares issuable upon settlement of RSUs that are vested but unreleased, or will become vested within 60 days of October 31, 2014. Those shares are deemed to be outstanding and beneficially owned by the person holding such option or RSU for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

Name of Beneficial Owner |

Amount and Nature of Beneficial Ownership (#) |

Percent of Class (%) |

||||

Directors, Director Nominees and Executive Officers: |

||||||

Scott D. Cook(1) |

13,091,835 |

4.59 |

% |

|||

Brad D. Smith(2) |

1,057,224 |

* |

||||

R. Neil Williams(3) |

67,526 |

* |

||||

Laura A. Fennell(4) |

69,768 |

* |

||||

Sasan K. Goodarzi(5) |

137,156 |

* |

||||

Daniel A. Wernikoff(6) |

79,613 |

* |

||||

Christopher W. Brody (7) |

358,972 |

* |

||||

William V. Campbell(8) |

92,642 |

* |

||||

Richard L. Dalzell |

— |

|||||

Diane B. Greene(9) |

83,530 |

* |

||||

Edward A. Kangas(10) |

62,116 |

* |

||||

Suzanne Nora Johnson(11) |

99,374 |

* |

||||

Dennis D. Powell(12) |

105,323 |

* |

||||

Jeff Weiner(13) |

10,017 |

* |

||||

All current directors and executive officers as a group (16 people)(14) |

15,323,634 |

5.34 |

% |

|||

Other 5% Stockholders: |

||||||

Capital Research Global Investors(15) |

17,910,200 |

6.28 |

% |

|||

BlackRock, Inc.(16) |

16,876,646 |

5.91 |

% |

|||

_______________________________________

* |

Indicates ownership of 1% or less. |

|

(1) |

Represents 13,091,835 shares held by trusts, of which Mr. Cook is a trustee.

|

(2) |

Includes 817,842 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by Mr. Smith and 84,918 shares held by a family trust, of which Mr. Smith is a trustee.

|

12

(3) |

Includes 56,018 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by Mr. Williams.

|

(4) |

Includes 68,789 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by Ms. Fennell.

|

(5) |

Includes 133,977 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by Mr. Goodarzi.

|

(6) |

Includes 79,583 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by Mr. Wernikoff.

|

(7) |

Includes 84,855 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by Mr. Brody.

|

(8) |

Includes 8,637 shares issuable upon settlement of vested restricted stock units held by Mr. Campbell.

|

(9) |

Includes 69,855 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by Ms. Greene.

|

(10) |

Represents 62,116 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by Mr. Kangas.

|

(11) |

Includes 83,637 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by Ms. Nora Johnson.

|

(12) |

Includes 88,637 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by Mr. Powell.

|

(13) |

Represents 10,017 shares issuable upon settlement of vested restricted stock units held by Mr. Weiner.

|

(14) |

Includes 1,572,114 shares issuable upon exercise of options and upon settlement of vested restricted stock units. Represents shares and options held by the 14 individuals in the table, plus an additional 8,538 outstanding shares and 8,151 shares issuable upon exercise of options and upon settlement of vested restricted stock units held by other executive officers.

|

(15) |

Ownership information for Capital Research Global Investors (“Capital Research”) is based on a Schedule 13G filed with the SEC by Capital Research, reporting ownership as of December 31, 2013. Capital Research reported sole voting power and sole dispositive power as to 17,910,200 shares. The address of Capital Research is 333 Hope Street, Los Angeles, California 90071.

|

(16) |

Ownership information for BlackRock, Inc. (“BlackRock”) is based on a Schedule 13G/A filed with the SEC by BlackRock, reporting ownership as of December 31, 2013. BlackRock reported sole voting power as to 14,017,281 shares and sole dispositive power as to 16,876,646 shares. The address of BlackRock is 40 East 52nd Street, New York, New York 10022.

|

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires Intuit’s directors and executive officers, and greater-than-10% stockholders to file forms with the SEC to report their ownership of Intuit shares and any changes in ownership. Anyone required to file forms with the SEC must also send copies of the forms to Intuit. We have reviewed all forms provided to us. Based on that review and on written information given to us by our executive officers and directors, we believe that all Section 16(a) filing requirements were met during fiscal 2014.

13

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Election of Directors

The board currently consists of nine directors, eight of whom were nominated for election to the Board based on the recommendation of our Nominating and Governance Committee. Christopher Brody declined to stand for re-election to the Board of Directors. The Nominating and Governance Committee also recommended Richard L. Dalzell for nomination by our full Board, after he was identified by Mr. Smith. The Board of Directors considered and conducted interviews of multiple candidates, including Mr. Dalzell. Based on the recommendations of the Nominating and Governance Committee, our Board has nominated William V. Campbell, Scott D. Cook, Richard L. Dalzell, Diane B. Greene, Edward A. Kangas, Suzanne Nora Johnson, Dennis D. Powell, Brad D. Smith and Jeff Weiner for election at the Meeting.

Each nominee, if elected, will serve until the next annual meeting of stockholders and until a qualified successor is elected, unless the nominee dies, resigns or is removed from the Board prior to such meeting. Although we know of no reason why any of the nominees would not be able to serve, if any nominee is unavailable for election, the proxy holder will vote your shares to approve the election of any substitute nominee proposed by the Board.

Each of our director nominees, except for Mr. Dalzell, is currently serving on the Board. If a nominee who is currently serving as a director is not re-elected, Delaware law provides that the director would continue to serve on the Board as a “holdover director.” However, in accordance with Intuit’s Bylaws and Corporate Governance Principles, each director has submitted an advance, contingent, irrevocable resignation that the Board may accept if stockholders do not elect the director. In that situation, our Nominating and Governance Committee would make a recommendation to the Board about whether to accept or reject the resignation, or whether to take other action. The Board would act on the Nominating and Governance Committee’s recommendation, and publicly disclose its decision and the rationale behind it within 90 days of the date that the election results were certified.

Directors Standing for Election

Information concerning the nominees for director is provided below.

William V. Campbell (Age 74)

Chairman of the Board of Directors, Intuit Inc.

Mr. Campbell has been an Intuit director since 1994. He served as Intuit’s President and Chief Executive Officer from April 1994 through July 1998. He has served as Chairman of the Board since August 1998 and was Acting Chief Executive Officer from September 1999 until January 2000. Mr. Campbell has served on the Board of Directors of GSV Capital Corporation since 2012 and recently retired from the Board of Directors of Apple, Inc. after 17 years of service. Mr. Campbell holds a Bachelor of Arts in Economics and a Masters of Science from Columbia University, where he was the Chair, and remains a member of, the Board of Trustees.

Mr. Campbell brings to the Board professional experience managing and advising innovative high growth companies, leadership throughout the technology industry and his understanding of Intuit, its strategy, markets, operations and management.

Scott D. Cook (Age 62)

Founder and Chairman of the Executive Committee, Intuit Inc.

Mr. Cook has been an Intuit director since 1984. A co-founder of Intuit, Mr. Cook served as Intuit’s President and Chief Executive Officer from 1984 to 1994 and served as Chairman of the Board from 1993 to 1998. Mr. Cook has been a director of eBay Inc. since 1998 where he is a member of the Corporate Governance and Nominating Committee. Mr. Cook has been a director of The Procter & Gamble Company since 2000 where he chairs the Innovation & Technology Committee and is a member of the Compensation & Leadership Development Committee. Mr. Cook holds a Bachelor of Arts in Economics and Mathematics from the University of Southern California and a Master in Business Administration from Harvard Business School.

Mr. Cook brings to the Board experience as an entrepreneur and corporate executive with a background in guiding and fostering innovation, as well as his knowledge of Intuit’s operations, markets, management and strategy and his experience as a Board member of other large consumer-focused companies.

14

Richard Dalzell (Age 57)

Former Senior Vice President and Chief Information Officer, Amazon.com, Inc.

Mr. Dalzell, a director nominee, was Senior Vice President and Chief Information Officer of Amazon.com, Inc., an online retailer, until his retirement in 2007. Previously, Mr. Dalzell served in numerous other positions at Amazon.com, Inc., including Senior Vice President of Worldwide Architecture and Platform Software and Chief Information Officer from 2001 to 2007, Senior Vice President and Chief Information Officer from 2000 to 2001 and Vice President and Chief Information Officer from 1997 to 2000. Prior to his employment with Amazon.com, Inc., Mr. Dalzell was Vice President of the Information Systems Division at Wal-Mart Stores, Inc. from 1994 to 1997. Mr. Dalzell has been a director of AOL.com, Inc. since 2009, where he serves on the Compensation and Leadership Committee. Mr. Dalzell holds a Bachelor of Science degree in Engineering from the United States Military Academy at West Point.

Mr. Dalzell will bring to the Board extensive experience, expertise and background in Internet information technology gained from his service as the Chief Information Officer of Amazon.com, Inc. He will also bring corporate leadership experience gained from his service in various senior executive roles at Amazon.com, Inc.

Diane B. Greene (Age 59)

Former President and Chief Executive Officer, VMware, Inc.

Ms. Greene has been an Intuit director since 2006 and is a member of the Audit and Risk Committee and the Nominating and Governance Committee. She has also been nominated to serve as Chair of the Nominating and Governance Committee, effective as of the 2015 Annual Meeting. Ms. Greene co-founded VMware, Inc. in 1998 and took the company public in 2007. Ms. Greene served as chief executive officer and president of VMware from 1998 to 2008, a member of the board of directors of VMware from 2007 to 2008, and as an Executive Vice President of EMC Corporation from 2005 to 2008. Prior to VMware, Ms. Greene held technical leadership positions at Silicon Graphics, Tandem, and Sybase and was chief executive officer of VXtreme. She has also served on the board of directors of Google since January 2012. In addition to Ms. Greene’s public company board experience, she is a member of The MIT Corporation. Ms. Greene holds a Bachelor of Arts in mechanical engineering from the University of Vermont, a Master of Science degree in naval architecture from the Massachusetts Institute of Technology and a Master of Science degree in computer science from the University of California, Berkeley.

Ms. Greene brings to the Board experience and insight as a successful technology entrepreneur and former chief executive officer of a public company, as well as expertise and knowledge of cloud computing and software as a service businesses.

Edward A. Kangas (Age 70)

Non-Employee Chairman, Tenet Healthcare

Mr. Kangas has been an Intuit director since 2007 and is Chairman of the Compensation and Organizational Development Committee and a member of the Acquisition and Nominating and Governance Committees. Mr. Kangas has been the non-executive chairman of Tenet Healthcare since 2003. From 1989 to 2000, Mr. Kangas was global chairman and chief executive officer of Deloitte. Mr. Kangas held the position of managing partner of Deloitte & Touche (USA) from 1989 to 1994. Mr. Kangas has been a member of the board of directors of: Hovnanian Enterprises, Inc. since 2002; United Technologies Corporation since 2008 and IntelSat since 2012. Mr. Kangas was a member of the board of Electronic Data Systems Corporation from 2004 to 2008, Eclipsys Corporation from 2004 to 2010 and Allscripts Healthcare Solutions from 2010 to 2012. Mr. Kangas holds a Bachelor’s degree and a Master’s degree in Business Administration from the University of Kansas.

Mr. Kangas brings to the Board global executive experience as well as his knowledge and expertise acquired through his service as a director of companies in industries that are highly relevant to Intuit’s businesses, including the software, technology, professional services and healthcare industries.

Suzanne Nora Johnson (Age 57)

Former Vice-Chairman, The Goldman Sachs Group

Ms. Nora Johnson has been an Intuit director since 2007 and is Chairman of the Acquisition Committee and is a member of the Audit and Risk Committee. Ms. Nora Johnson joined The Goldman Sachs Group in 1985 and held several management positions throughout her tenure including: Vice Chairman, Chairman of the Global Markets Institute, and Head of the Global Investments Research Division. Ms. Nora Johnson has been a member of the board of directors of: American

15

International Group, Inc. since 2008; Pfizer Inc. since 2007; and VISA Inc. since 2007. Ms. Nora Johnson’s significant non-profit board affiliations include, among others, the American Red Cross and the University of Southern California. Ms. Nora Johnson earned a Bachelor’s degree from the University of Southern California and a Juris Doctor from Harvard Law School.

Ms. Nora Johnson brings to the Board valuable business experience managing large, complex, global institutions as well as insights into how changes in the financial services industry, public policy and the macro-economic environment affect our businesses.

Dennis D. Powell (Age 66)

Former Chief Financial Officer, Cisco Systems, Inc.

Mr. Powell has been an Intuit director since 2004 and is Chairman of the Audit and Risk Committee and a member of the Acquisition Committee. Mr. Powell was executive advisor of Cisco Systems, Inc. from 2008 to 2010. Mr. Powell joined Cisco in 1997 and held several management positions throughout his tenure including: Executive Vice President and Chief Financial Officer from 2003 to 2008; Senior Vice President, Corporate Finance Vice President from 2002 to 2003; and Corporate Controller from 1997 to 2002. Prior to Cisco, Mr. Powell held the position of senior partner at Coopers & Lybrand LLP, where his tenure spanned 26 years. Mr. Powell has been a member of the boards of directors of Applied Materials, Inc. since 2007 and VMware, Inc. since 2007. Mr. Powell holds a Bachelor of Science in Business Administration with a concentration in accounting from Oregon State University.

Mr. Powell brings to the Board executive management experience with large, global organizations as well as insights into financial and operational issues, which he has gained through his tenure as an executive at a large public technology company.

Brad D. Smith (Age 50)

President and Chief Executive Officer, Intuit Inc.

Mr. Smith has been an Intuit director since 2008 and is currently President and Chief Executive Officer of Intuit. Mr. Smith joined Intuit in 2003 and has served as Senior Vice President and General Manager, Small Business Division from 2006 to 2007, Senior Vice President and General Manager, QuickBooks from 2005 to 2006, Senior Vice President and General Manager, Consumer Tax Group from 2004 to 2005 and as Vice President and General Manager of Intuit’s Accountant Central and Developer Network from 2003 to 2004. Before joining Intuit, Mr. Smith held the position of Senior Vice President of Marketing and Business Development of ADP, where he held several executive positions from 1996 to 2003. Mr. Smith served on the board of directors of Yahoo! Inc. from 2010 until 2013. Mr. Smith was elected to the board of directors of Nordstrom, Inc. in June 2013 and serves on the Audit Committee and Technology Committee. Mr. Smith holds a Bachelor’s degree in Business Administration from Marshall University and a Master’s degree in Management from Aquinas College.

Mr. Smith, as Chief Executive Officer of Intuit, brings to the Board the most relevant knowledge of Intuit’s strategy, markets, operations and employees and provides industry expertise and context on all matters that come before the Board.

Jeff Weiner (Age 44)

Chief Executive Officer, LinkedIn Corporation

Mr. Weiner has been a director of Intuit since April 2012 and is a member of the Compensation and Organizational Development Committee. He has served as the Chief Executive Officer of LinkedIn, an Internet professional network provider, since June 2009, and as a director of LinkedIn since July 2009. He served as LinkedIn’s Interim President from December 2008 until June 2009. Before joining LinkedIn, Mr. Weiner was an executive in residence at Accel Partners and Greylock Partners, both venture capital firms, from September 2008 to June 2009. From May 2001 to June 2008 he held several positions at Yahoo! Inc., one of the world’s largest digital media companies, including most recently as an Executive Vice President of Yahoo’s network division. He holds a bachelor’s degree in economics from The Wharton School at the University of Pennsylvania.

Mr. Weiner brings to the Board experience and insights as the chief executive officer of a successful public technology company as well expertise and knowledge in social networking, consumer web and mobile products.

The Board recommends that you vote

FOR the election of each of the nominated directors.

16

DIRECTOR COMPENSATION

Overview

Our director compensation programs are designed to provide an appropriate incentive to attract and retain qualified non-employee board members. The Compensation Committee is responsible for reviewing the equity and cash compensation for directors on an annual basis and making recommendations to the Board, in the event the Compensation Committee determines changes are needed. The following table summarizes the fiscal 2014 compensation earned by each member of the Board other than Mr. Smith, whose compensation is described under “Executive Compensation” beginning on page 45.

Director Summary Compensation Table

Director Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1) |

All Other Compensation ($) |

Total ($) |

|||||||||||

Christopher W. Brody |

102,500 |

260,002 |

— |

362,502 |

|||||||||||

William V. Campbell |

251,154 |

(2) |

260,002 |

5,000,000 |

(3) |

5,511,156 |

|||||||||

Scott D. Cook |

— |

— |

979,000 |

(4) |

979,000 |

||||||||||

Diane B. Greene |

85,000 |

260,002 |

— |

345,002 |

|||||||||||

Edward A. Kangas |

29,375 |

(5) |

379,969 |

(5) |

— |

409,344 |

|||||||||

Suzanne Nora Johnson |

107,500 |

260,002 |

— |

367,502 |

|||||||||||

Dennis D. Powell |

122,500 |

260,002 |

— |

382,502 |

|||||||||||

Jeff Weiner |

75,000 |

260,002 |

— |

335,002 |

|||||||||||

_______________________________________

(1) |

These amounts represent the aggregate grant date fair value of RSUs granted during fiscal 2014, computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, “Compensation – Stock Compensation,” (“FASB ASC Topic 718”), assuming no forfeitures. Please see the “Equity Grants to Directors During Fiscal Year 2014” and “Outstanding Equity Awards for Directors at Fiscal Year-End 2014 (Exercisable and Unexercisable)” tables for information regarding the grant date fair value of RSUs granted during the fiscal year and the number of awards outstanding for each director at the end of the fiscal year.

|

(2) |

This amount represents a stipend paid to Mr. Campbell for his role as a member and Non-Executive Chairman of the Board, in accordance with the compensation program adopted by the Board which became effective in January 2012. |

(3) |

The other compensation listed for Mr. Campbell consists of a $5,000,000 donation the Company made to the Campbell Legacy at Columbia, which supports the students of Columbia College, primarily via scholarships, and the faculty who teach them. In November 2013 when the donation was made, Mr. Campbell served as the Chair of the Columbia University board of trustees, and he now serves as its Chair Emeritus. Mr. Campbell was not involved in the solicitation, consideration or approval of this donation, and he receives no compensation from Columbia University and derives no financial benefit from the donation. The donation was unanimously approved by both the Audit and Risk Committee and the Compensation and Organizational Development Committee.

|

(4) |

Mr. Cook is an employee of Intuit; thus, he is not compensated as a director. Mr. Cook’s compensation represents an annual salary of $550,000; and an incentive bonus of $429,000 awarded for service in fiscal 2014. Mr. Cook did not receive any equity awards from Intuit during fiscal 2014.

|

(5) |

Mr. Kangas received fees due him for service on the Board during the quarter ended October 31, 2014 (the first quarter of Intuit’s fiscal 2014) in cash. He elected to receive fees due him for service on the Board during calendar year 2014 in RSUs, in accordance with Intuit’s Director Compensation Program, which is tied to the calendar year rather than Intuit’s fiscal year. These RSUs were awarded in January 2014, and are in respect of service provided during calendar year 2014 (which includes the first quarter of Intuit’s fiscal 2015). Please see the “Equity Grants to Directors During Fiscal Year 2014” table for more information. |

17

Equity Grants to Directors During Fiscal Year 2014

The following table shows each RSU grant made to each of our directors, other than Mr. Smith, during fiscal 2014, including the grant date, number of shares, and grant date fair value.

Stock Awards |

||||||||

Director Name |

Grant Date |

Shares Subject to Award (#) |

Grant Date Fair Value

($)(1)

|

|||||

Christopher W. Brody |

1/24/2014 |

3,550 |

(2) |

260,002 |

||||

William V. Campbell |

1/24/2014 |

3,550 |

(3) |

260,002 |

||||

Scott D. Cook |

— |

— |

||||||

Diane B. Greene |

1/24/2014 |

3,550 |

(2) |

260,002 |

||||

Edward A. Kangas |

1/24/2014 |

3,550 |

(2) |

260,002 |

||||

Edward A. Kangas |

1/24/2014 |

1,638 |

(4) |

119,967 |

||||

Suzanne Nora Johnson |

1/24/2014 |

3,550 |

(2) |

260,002 |

||||

Dennis D. Powell |

1/24/2014 |

3,550 |

(2) |

260,002 |

||||

Jeff Weiner |

1/24/2014 |

3,550 |

(2) |

260,002 |

||||

_______________________________________

(1) |

These amounts represent the aggregate grant date fair value of these awards computed in accordance with FASB ASC Topic 718 assuming no forfeitures. The grant date fair value of these awards is equal to the closing market price of Intuit’s common stock on the date of grant. See Intuit’s Annual Report on Form 10-K for the fiscal year ended July 31, 2014 for more information on the valuation of RSUs. |

(2) |

Annual Non-Employee Board Member grant which, subject to the director’s continued service, vests as to 100% of the shares on January 1, 2015.

|

(3) |

Annual Chairman of the Board grant which, subject to the director’s continued service, vests as to 100% of the shares on January 1, 2015.

|

(4) |

Represents RSUs awarded pursuant to a Conversion Grant (described below under “Annual Retainer and Equity Compensation Program for Non-Employee Directors”) for shares equivalent in fair value on the date of grant to Mr. Kangas’ annual retainers for Board and Committee service for calendar 2014. |

Outstanding Equity Awards for Directors at Fiscal Year-End 2014 (Exercisable and Unexercisable)

The following table provides information on the outstanding equity awards held by our directors, other than Mr. Smith, as of July 31, 2014.

|

Aggregate Shares

Subject to Outstanding

|

||||||

Director Name |

Stock

Awards (#)

|

Option

Awards (#)

|

||||

Christopher W. Brody |

13,405 |

(1) |

112,500 |

|||

William V. Campbell |

12,187 |

(2) |

— |

|||

Scott D. Cook |

— |

— |

||||

Diane B. Greene |

13,405 |

(3) |

60,000 |

|||

Edward A. Kangas |

18,166 |

(4) |

57,500 |

|||

Suzanne Nora Johnson |

12,187 |

(5) |

75,000 |

|||

Dennis D. Powell |

12,187 |

(6) |

80,000 |

|||

Jeff Weiner |

13,567 |

(7) |

— |

|||

_______________________________________

(1) Includes 5,772 vested RSUs for which Mr. Brody has elected to defer settlement and 4,083 vested RSUs on which settlement is deferred in accordance with Intuit’s Director Equity Compensation Plan.

18

(2) Includes 4,554 vested RSUs for which Mr. Campbell has elected to defer settlement and 4,083 vested RSUs on which settlement is deferred in accordance with Intuit’s Director Equity Compensation Plan.

(3) Includes 5,772 vested RSUs for which Ms. Greene has elected to defer settlement and 4,083 vested RSUs on which settlement is deferred in accordance with Intuit’s Director Equity Compensation Plan.

(4) Includes 10,123 vested RSUs for which Mr. Kangas has elected to defer settlement and 4,083 vested RSUs on which settlement is deferred in accordance with Intuit’s Director Equity Compensation Plan.

(5) Includes 4,554 vested RSUs for which Ms. Johnson has elected to defer settlement and 4,083 vested RSUs on which settlement is deferred in accordance with Intuit’s Director Equity Compensation Plan.

(6) Includes 4,554 vested RSUs for which Mr. Powell has elected to defer settlement and 4,083 vested RSUs on which settlement is deferred in accordance with Intuit’s Director Equity Compensation Plan.

(7) Includes 5,934 vested RSUs for which Mr. Weiner has elected to defer settlement and 4,083 vested RSUs on which settlement is deferred in accordance with Intuit’s Director Equity Compensation Plan.

Annual Retainer and Equity Compensation Program for Non-Employee Directors

The Compensation Committee periodically reviews best practices and considers how the Company’s compensation program for non-employee directors compares to the programs of its compensation peers. In conducting this review, the Compensation Committee relies upon information provided to it by FW Cook. The current compensation program approved by our Board for our non-employee directors and the Chairman of the Board has been in effect since January 2012, with the exception of an increase in the stipend for the Compensation Committee Chair from $17,500 to $20,000 effective January 2014 and the increase in the annual cash stipend paid to the Chairman of the Board in lieu of participation in the non-employee director cash compensation program from $240,000 for calendar year 2013 to $260,000 effective January 2014.

Annual Retainer

Non-employee directors are paid annual cash retainers for Board membership, plus additional cash retainers for their committee service in the amounts indicated in the following table:

Position |

Annual Amount ($) |

||

Non-Employee Board Member |

60,000 |

||

Members of each of Audit and Risk Committee, Acquisition Committee, and Compensation and Organizational Development Committee |

15,000 |

||

Members of the Nominating and Governance Committee |

10,000 |

||

Audit and Risk Committee Chair* |

32,500 |

||

Compensation and Organizational Development Committee Chair* |

20,000 |

||

Acquisition Committee and Nominating and Governance Committee Chairs* |

17,500 |

||

* Committee chair retainers are in addition to committee membership retainers.

These annual retainers are paid in quarterly installments and are pro-rated for any changes to a committee that occurs during any quarter. Directors may elect to defer cash retainers into additional tax-deferred Intuit stock units by making an irrevocable written election prior to the start of each calendar year. Such tax-deferred stock units, known as Conversion Grants, vest in four installments, commencing on the grant date (which is the first business day following the Company’s annual meeting of stockholders) and quarterly thereafter, and will be distributable at the earlier of (i) five years from the date of grant, (ii) separation from the Board, or (iii) a change in control of the ownership of Intuit. We reimburse non-employee directors for out-of-pocket expenses incurred in connection with attending Board and committee meetings.

Director Equity Compensation Program

Grants are made to non-employee directors and the Chairman of the Board in the form of a fixed dollar value of RSUs in the following amounts:

Board Position |

Fixed Amount of Award ($) |

||

Non-Employee Board Member and Chairman (annual grant) |

260,000 |

||

New Board Member (additional grant upon joining Board) |

75,000 |

||

19

Because the formula is based on a fixed dollar amount, the number of RSUs awarded annually to non-employee directors and the Chairman of the Board may vary, depending on the closing market price of Intuit’s common stock on the date of grant. The annual grants will be awarded on the day following each Annual Meeting of Stockholders. For a new Board Member, the annual grant will be prorated based on the number of full months of expected service until the next Annual Meeting of Stockholders. Subject to the director’s continued service, vesting of the annual RSU grants will occur on the first day of the twelfth month following the date of grant. For example, for grants made in January 2015, the vesting date would occur on January 1, 2016. A new Board Member’s additional grant will vest in two equal installments over two years. Once RSUs vest, settlement of the awards must be deferred until the earlier of (i) five years from the date of grant, (ii) separation from the Board, or (iii) a change in control of Intuit. Directors may defer settlement of their RSUs for a longer period of time at their option.

Board Members receive dividend equivalent rights in conjunction with RSU awards granted in July 2012 and thereafter. RSUs accrue dividends, which will be paid when the shares are issued.

Director Stock Ownership Requirement