DEF 14A: Definitive proxy statements

Published on November 23, 2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box: | ||

¨ |

Preliminary Proxy Statement |

|

¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

þ |

Definitive Proxy Statement |

|

¨ |

Definitive Additional Materials |

|

¨ |

Soliciting Material under Rule 240.14a-12 |

|

INTUIT INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ |

No fee required. |

|||

¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

(1) |

Title of each class of securities to which transaction applies: |

|||

(2) |

Aggregate number of securities to which transaction applies: |

|||

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

(4) |

Proposed maximum aggregate value of transaction: |

|||

(5) |

Total fee paid: |

|||

¨ |

Fee paid previously with preliminary materials. |

|||

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| ||||

(1) |

Amount Previously Paid: |

|||

(2) |

Form, Schedule or Registration Statement No.: |

|||

(3) |

Filing Party: |

|||

(4) |

Date Filed: |

|||

INTUIT INC.

2700 Coast Avenue

Mountain View, CA 94043

NOTICE OF 2012 ANNUAL MEETING OF STOCKHOLDERS

Dear Stockholder:

You are cordially invited to attend our 2012 Annual Meeting of Stockholders, which will be held at 8:00 a.m. Pacific Standard Time on January 19, 2012 at our offices at 2600 Casey Avenue, Building 9, Mountain View, California 94043. We will also offer a webcast of the annual meeting at http://investors.intuit.com.

We are holding the meeting for the following purposes:

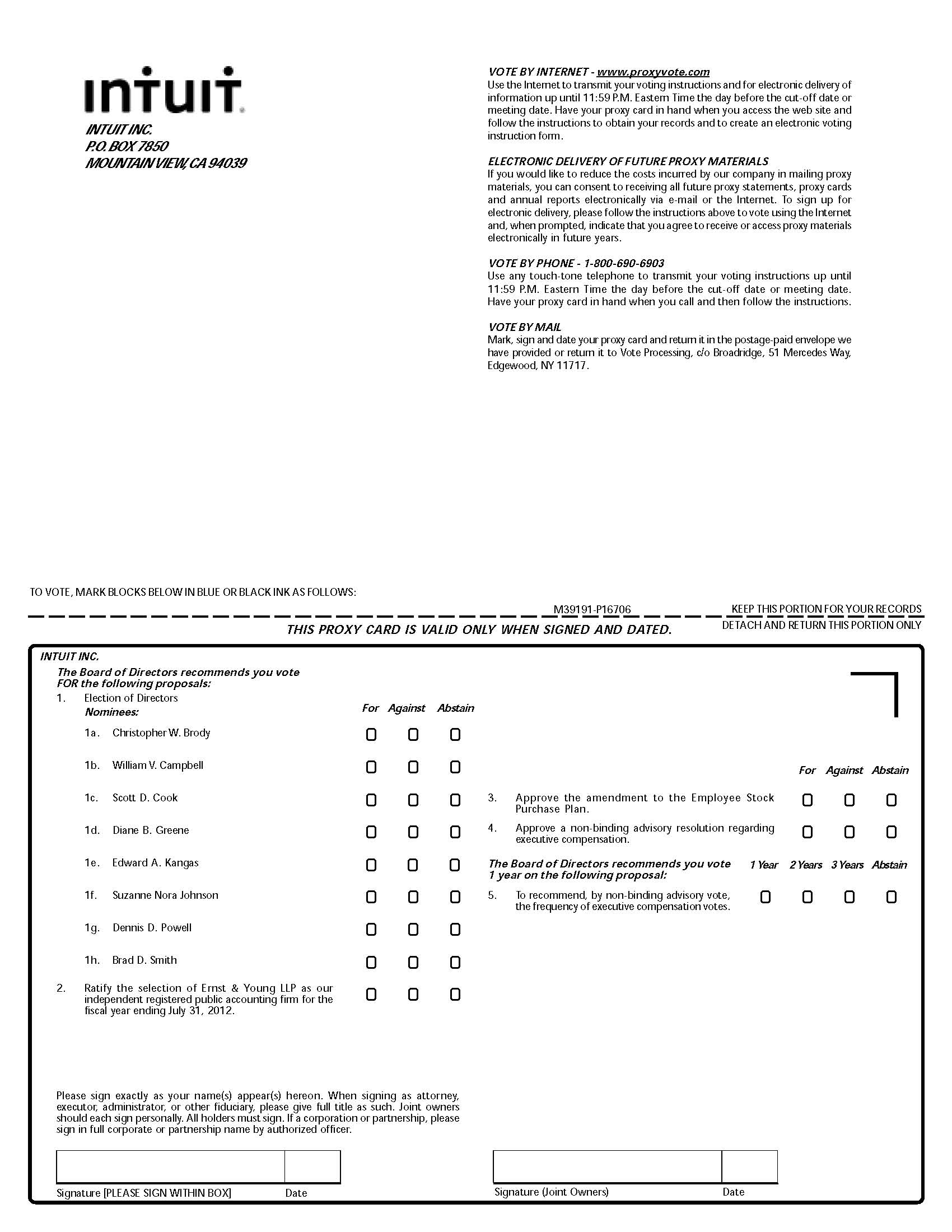

1. To elect eight directors nominated by the Board of Directors and named in the proxy statement to hold office until the next annual meeting of stockholders or until their respective successors have been elected;

2. To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2012;

3. To approve an amendment to our Employee Stock Purchase Plan to increase the number of shares available for issuance under that plan by 4,000,000 shares;

4. To hold an advisory vote on executive compensation;

5. To hold an advisory vote on the frequency of future advisory votes on executive compensation; and

6. To consider any other matters that may properly be brought before the annual meeting and any postponement(s) or adjournment(s) thereof.

Items 1 through 5 are more fully described in the attached proxy statement. We have not received notice of other matters that may be properly presented at the annual meeting.

Only stockholders who owned our stock at the close of business on November 21, 2011 may vote at the annual meeting, or at any adjournment or postponement of the annual meeting. For 10 days prior to the annual meeting, a list of stockholders eligible to vote at the annual meeting will be available for review during our regular business hours at our headquarters at 2700 Coast Avenue, Mountain View, California 94043. If you would like to view the stockholder list, please call Intuit Investor Relations at (650) 944-3560 to schedule an appointment.

Your vote is important. Whether or not you plan to attend the annual meeting, please cast your vote, as instructed in the Notice of Internet Availability of Proxy Materials, over the Internet or by telephone, as promptly as possible. You may also request a paper proxy card to submit your vote by mail, if you prefer. We encourage you to vote via the Internet. We believe it is convenient for our stockholders, while significantly lowering the cost of our annual meeting and conserving natural resources.

Important Notice Regarding the Availability of Proxy Materials for Annual Meeting of Stockholders to Be Held on January 19, 2012. The proxy statement is available electronically at http://investors.intuit.com/proxy.cfm and Intuit's Annual Report on Form 10-K for fiscal year ended July 31, 2011 is available electronically at http://investors.intuit.com/annuals.cfm.

By order of the Board of Directors, |

|

Laura A. Fennell |

|

Senior Vice President, General Counsel and Corporate

Secretary

|

Mountain View, California

November 23, 2011

INTUIT INC.

PROXY STATEMENT 2012 ANNUAL MEETING OF STOCKHOLDERS

Page |

|

1

Page |

|

2

2012 PROXY SUMMARY

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Annual Meeting of the Stockholders

Time and Date |

Thursday, January 19, 2012 at 8:00 a.m. Pacific Standard Time |

|

Place |

Intuit's offices at 2600 Casey Avenue, Building 9, Mountain View, California 94043 |

|

Record Date |

November 21, 2011 |

|

Voting |

Stockholders of Intuit as of the record date are entitled to vote. Each share of Intuit common stock is entitled to one vote for each director nominee and one vote for each of the proposals to be voted on. |

|

Meeting Agenda

1. |

Election of eight directors |

2. |

Ratification of Ernst & Young LLP as our independent registered public accounting firm for fiscal year ending July 31, 2012

|

3. |

Amendment to our Employee Stock Purchase Plan |

4. |

Advisory vote on executive compensation |

5. |

Advisory vote on the frequency of future advisory votes on executive compensation |

6. |

Consider other matters that may properly come before the meeting |

Intuit's Board of Directors (the "Board") recommends that you vote FOR the election of each of the director nominees, FOR Proposals 2, 3 and 4, and FOR an advisory vote on executive compensation every year.

Board Nominees

The following table provides summary information about each director nominee. Each director nominee is elected annually by a majority of votes cast.

Committee Memberships |

||||||||||

Name |

Age |

Director Since |

Occupation |

Experience/ Qualification |

Independent |

ARC |

CODC |

NGC |

AC |

Other Public Company Boards |

Christopher W. Brody |

67 |

1993 |

Chairman, Vantage Partners LLC |

Leadership, Finance, Industry |

X |

X |

C |

|||

William V. Campbell |

71 |

1994 |

Chairman of the Board of Directors, Intuit Inc. |

Leadership, Industry |

Apple, Inc. |

|||||

Scott D. Cook |

59 |

1984 |

Founder and Chairman of the Executive Committee, Intuit Inc. |

Leadership, Industry |

eBay Inc.;

The Procter & Gamble Company

|

|||||

Diane B. Greene |

56 |

2006 |

Former President and Chief Executive Officer, VMware, Inc. |

Leadership, Industry |

X |

X |

X |

|||

Edward A. Kangas |

67 |

2007 |

Non-Employee Chairman, Tenet Healthcare |

Industry, Global, Leadership |

X |

X |

X |

Tenet Healthcare; Allscripts Healthcare Solutions, Inc.; Hovnanian Enterprises, Inc.;

United Technologies Corporation

|

||

3

Committee Memberships |

||||||||||

Name |

Age |

Director Since |

Occupation |

Experience/ Qualification |

Independent |

ARC |

CODC |

NGC |

AC |

Other Public Company Boards |

Suzanne Nora Johnson |

54 |

2007 |

Former Vice-Chairman, The Goldman Sachs Group |

Leadership, Industry, Finance, Global |

X |

X |

X |

American International Group, Inc.; Pfizer Inc.; VISA Inc. |

||

Dennis D. Powell |

63 |

2004 |

Former Chief Financial Officer, Cisco Systems, Inc. |

Leadership, Industry, Finance |

X |

C |

X |

Applied Materials, Inc.; VMware, Inc. |

||

Brad D. Smith |

47 |

2008 |

President and Chief Executive Officer, Intuit Inc. |

Leadership, Industry |

Yahoo! Inc. |

|||||

________________________________________________________

ARC |

Audit and Risk Committee |

|

CODC |

Compensation and Organizational Development Committee |

|

NGC |

Nominating and Governance Committee |

|

AC |

Acquisition Committee |

|

C |

Chair |

|

Attendance |

No director nominee, all of which are current directors, attended fewer than 75% of the Board meetings and committee meetings on which he or she sits. |

|

Auditors

As a matter of good corporate governance, we are asking stockholders to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2012.

Employee Stock Purchase Plan

We are asking stockholders to approve the amendment of our Employee Stock Purchase Plan to increase the number of shares authorized for issuance under the Employee Stock Purchase Plan by 4,000,000 shares (from 16,800,000 shares to 20,800,000 shares). The Board recommends a FOR vote because the increase in the number of shares authorized for issuance under the Employee Stock Purchase Plan will enable us to continue to provide employees an opportunity to purchase shares of Intuit stock at a discounted price as an incentive for continued employment.

Executive Compensation Advisory Vote and Its Frequency

For the second year, our stockholders have the opportunity to cast a non-binding, advisory vote on our executive compensation program. We are gratified that last year's stockholders supported the policies, practices and philosophy of our compensation program. In evaluating this year's "say on pay" proposal, we recommend that you review our "Compensation Discussion and Analysis," which explains how and why the Compensation and Organizational Development Committee of our Board arrived at its compensation actions and decisions for fiscal year 2011, along with our "Summary Compensation Table" and the related compensation tables, notes and narrative in this proxy statement. The Board recommends a FOR vote because the Board believes that our compensation programs' policies and procedures are effective in implementing our compensation philosophy and in achieving its goals.

We are also asking our stockholders to cast a non-binding, advisory vote on the frequency of future "say on pay" votes – every one, two or three years. The Board recommends that you vote for the option of ONE YEAR because it will allow our stockholders to give us their valuable input in the timeliest manner.

Fiscal 2011 Compensation Decisions

Intuit delivered strong financial results in fiscal 2011, achieving revenue growth of 11%, non-GAAP operating income growth of 14% and non-GAAP earnings per share ("EPS") growth of 19%. Appendix A to this proxy statement includes a reconciliation of non-GAAP operating income and non-GAAP EPS to the most directly comparable financial measures prepared in accordance with Generally Accepted Accounting Principles ("GAAP"). Intuit and its management delivered these strong results in an environment of continued economic uncertainty and a sluggish recovery of the U.S. economy. Over the past one-year and three-year periods, these revenue and operating income results have placed Intuit between the 50th and 75th percentile of its compensation peer group (discussed in the "Compensation Discussion and Analysis" of the proxy statement).

4

Intuit continued to demonstrate excellent execution against its three-point strategy of building growth in its core businesses, building adjacent businesses and entering new geographies, and accelerating the transition to connected services.

Because Intuit was able to deliver such strong results for shareholders, customers and employees, the Compensation and Organizational Development Committee of the Board determined that our named executive officers would receive cash bonuses, equity grants and, in some cases, salary increases, in recognition of Company and individual performance. In particular, in recognition of the strength of the Company's results and outstanding individual performance, the named executive officers received total annual cash bonuses in the range of 132% to 163% of target, as further discussed in the "Compensation Discussion and Analysis" of the proxy statement.

Compensation Practices

Intuit employs a number of practices that reflect our pay-for-performance compensation philosophy, including:

• |

the majority of our long-term incentives are in the form of performance-based restricted stock units; |

• |

we do not provide special retirement benefits designed solely for executive officers; |

• |

we do not provide any excise tax "gross-up" payments if a severance payment is considered an excess parachute payment under U.S. tax laws; |

• |

we do not provide perquisites or other executive benefits based solely on rank; and |

• |

we have implemented "claw-back" provisions for our operating performance-based equity awards. |

Fiscal 2011 Compensation Summary

Set forth below is the fiscal year 2011 compensation for each named executive officer as determined under the Securities and Exchange Commission rules. See the "Compensation Discussion and Analysis" and "Executive Compensation" sections of the proxy statement for a full explanation of each named executive officers' compensation.

Name and Principal Position |

Salary |

Bonus |

Stock Awards |

Option Awards |

Non-Equity Incentive Plan Compensation |

All Other Compensation |

Total |

|||||||||||||||||||||

|

Brad D. Smith

President and Chief Executive Officer

|

$ |

950,000 |

$ |

— |

$ |

7,514,292 |

$ |

1,303,378 |

$ |

1,852,500 |

$ |

12,819 |

$ |

11,632,989 |

||||||||||||||

|

R. Neil Williams

Senior Vice President and Chief Financial Officer

|

$ |

625,000 |

$ |

— |

$ |

2,372,879 |

$ |

339,724 |

$ |

621,002 |

$ |

14,725 |

$ |

3,973,330 |

||||||||||||||

|

Kiran M. Patel

Executive Vice President and General Manager, Small Business Group

|

$ |

700,000 |

$ |

— |

$ |

2,623,398 |

$ |

372,602 |

$ |

1,033,004 |

$ |

14,986 |

$ |

4,743,990 |

||||||||||||||

|

Laura A. Fennell

Senior Vice President, General Counsel and Corporate Secretary

|

$ |

475,000 |

$ |

399,000 |

$ |

1,108,972 |

$ |

153,428 |

$ |

— |

$ |

16,780 |

$ |

2,153,180 |

||||||||||||||

|

Daniel R. Maurer

Senior Vice President and General Manager, Consumer Group

|

$ |

515,000 |

$ |

— |

$ |

2,397,810 |

$ |

339,724 |

$ |

512,001 |

$ |

13,751 |

$ |

3,778,286 |

||||||||||||||

2013 Annual Meeting

Deadline for stockholder proposals or director nominees for inclusion in the proxy statement: |

July 26, 2012 |

Deadline for director nominees or other stockholder proposals to be properly brought at annual meeting (but not included in the proxy statement): |

No earlier than October 6, 2012 and

no later than November 5, 2012

|

5

INTUIT INC.

2700 Coast Avenue

Mountain View, CA 94043

PROXY STATEMENT FOR THE

2012 ANNUAL MEETING OF STOCKHOLDERS

INFORMATION ABOUT THE MEETING, VOTING AND PROXIES

Date, Time and Place of Meeting

Intuit Inc.’s (“Intuit” or the “Company”) Board of Directors (the “Board”) is asking for your proxy for use at the Intuit Inc. 2012 Annual Meeting of Stockholders (the “Meeting”) and at any adjournment or postponement of the Meeting for the purposes set forth in the accompanying Notice of 2012 Annual Meeting of Stockholders. We are holding the Meeting on Thursday, January 19, 2012 at 8:00 a.m. Pacific Standard Time at our offices at 2600 Casey Avenue, Building 9, Mountain View, California 94043. We have first released this proxy statement to Intuit stockholders beginning on November 23, 2011.

Webcast of Meeting

If you are not able to attend the meeting in person, you may join a live webcast of the Meeting on the Internet by visiting http://investors.intuit.com on Thursday, January 19, 2012 at 8:00 a.m. Pacific Standard Time.

Proposals at the Meeting

There are five proposals scheduled to be voted on at the Meeting:

• |

to elect eight directors nominated by the Board of Directors to hold office until the next annual meeting of stockholders or until their respective successors have been elected; |

• |

to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending July 31, 2012;

|

• |

to approve an amendment to our Employee Stock Purchase Plan to increase the number of shares available for issuance under that plan by 4,000,000 shares; |

• |

to hold an advisory vote on executive compensation; and |

• |

to hold an advisory vote on the frequency of future advisory votes on executive compensation. |

We will also consider any other matters that may properly be brought before the Meeting and any postponement(s) or adjournment(s) thereof.

Internet Availability of Proxy Materials

We are pleased to continue to furnish proxy materials to our stockholders on the Internet, rather than mailing printed copies of those materials to each stockholder. If you received a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) by mail, you will not receive a printed copy of the proxy materials unless you request one. Instead, the Notice of Internet Availability will instruct you as to how you may access and review the proxy materials and cast your vote on the Internet. If you received a Notice of Internet Availability by mail and would like to receive a printed copy of our proxy materials, please follow the instructions included in the Notice of Internet Availability. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of the Meeting. We anticipate that the Notice of Internet Availability will be mailed to stockholders on or about November 23, 2011.

Record Date, Outstanding Shares and Quorum

Only holders of record of Intuit common stock at the close of business on November 21, 2011 (called the “Record Date”) will be entitled to vote at the Meeting. On the Record Date, we had approximately 297,569,788 shares of common stock outstanding and entitled to vote. We need a quorum to take action at the Meeting. We will have a quorum if a majority of the shares outstanding and entitled to vote on the Record Date are present at the Meeting, either in person or by proxy.

If by the date of the Meeting we do not receive proxies representing sufficient shares to constitute a quorum or approve one or more of the proposals, the Chair of the Meeting, or the persons named as proxies, may propose one or more

6

adjournments of the Meeting to permit further solicitation of proxies. The persons named as proxies would typically exercise their authority to vote in favor of adjournment.

Voting Rights

Holders of our common stock are entitled to one vote for each share they owned on the Record Date. The Inspector of Elections appointed for the Meeting will tabulate all votes. The Inspector will separately tabulate yes and no votes, abstentions and broker non-votes for each proposal.

Stockholder of Record or Beneficial Owner

Stockholder of Record (Record Holder). If your shares are registered directly in your name with the Company’s transfer agent, American Stock Transfer & Trust Company (“AST”), you are considered the stockholder of record with respect to those shares, and the Notice of Internet Availability was sent directly to you by Intuit. If you request printed copies of the proxy materials by mail, you will also receive a proxy card.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,” and the Notice of Internet Availability was forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. If you do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. Only Proposal 2 (ratifying the appointment of our independent registered public accounting firm) is considered a routine matter. Proposals 1 (election of directors), 3 (amendment to our Employee Stock Purchase Plan), 4 (advisory vote on executive compensation) and 5 (advisory vote on the frequency of the advisory vote on executive compensation) are not considered routine matters, and without your instruction, your broker cannot vote your shares. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a "broker non-vote."

Voting and Revoking Proxies

The Board is soliciting proxies to vote your shares at the Meeting. All stockholders of record have three options for submitting their vote prior to the Meeting:

• |

via the Internet at www.proxyvote.com (as described in the Notice of Internet Availability);

|

• |

by phone (your Notice of Internet Availability provides information on how to access your proxy card, which contains instructions on how to vote by telephone); or |

• |

by requesting, completing and mailing in a paper proxy card, as outlined in the Notice of Internet Availability. |

We encourage you to register your vote via the Internet. If you attend the Meeting, you may also submit your vote in person, and any votes that you previously submitted — whether via the Internet, by phone or by mail — will be superseded by the vote that you cast at the Meeting. If you properly submit your proxy, via the Internet, by phone or by mail, and do not revoke it prior to the Meeting, your shares will be voted in the manner described in this proxy statement or as you may otherwise direct.

If you sign and return your proxy card but do not give any instructions on how you would like to vote your shares, your shares will be voted in favor of the election of each of the director nominees listed in Proposal 1, in favor of Proposals 2, 3 and 4, and in favor of "one year" for Proposal 5. As far as we know, no other matters will be presented at the Meeting. However, if any other matters of business are properly presented, the proxy holders named on the proxy card are authorized to vote the shares represented by proxies according to their judgment.

If you are a beneficial owner of shares held in “street name” through a brokerage firm, bank, broker-dealer, or other similar organization, you may receive a Notice of Internet Availability of Proxy Materials from the holder of record containing instructions that you must follow in order for your shares to be voted. Certain of these institutions offer Internet and telephone voting. If you wish to vote at the Meeting, you must bring to the Meeting a letter from the record holder confirming your beneficial ownership of the shares.

Whether you submit your proxy via the Internet, by phone or by mail, you may revoke it at any time before voting takes place at the Meeting. If you are the record holder of your shares and you wish to revoke your proxy, you must deliver instructions to: Laura A. Fennell, Corporate Secretary, at Intuit Inc., P.O. Box 7850, Mail Stop 2700, Mountain View, California

7

94039-7850. You may also revoke a proxy by submitting a later-dated vote, in person at the Meeting. If a broker, bank or other nominee is the record holder of your shares and you wish to revoke your proxy, you must contact the record holder of your shares directly.

Votes Required to Elect Directors and Adopt Proposals

Each share of our common stock outstanding on the Record Date is entitled to one vote on each of the eight director nominees and one vote on each other matter. To be elected, directors must receive a majority of the votes cast (the number of shares voted “for” a director nominee must exceed the number of votes cast “against” that nominee). Each director who is standing for re-election at the Meeting has tendered a contingent, irrevocable resignation from the Board that will become effective only if the director fails to receive the required majority vote. In that event, the Nominating and Governance Committee of the Board will make a recommendation to the Board whether to accept or reject the resignation, or whether some other action should be taken. The Board will act on the recommendation of the Nominating and Governance Committee and publicly disclose its decision and the rationale behind it within 90 days after the date of the certification of the election results. Approval of each of the other proposals on the agenda requires the affirmative vote of the majority of the shares of common stock present at the Meeting in person or represented by proxy and entitled to vote on each proposal.

Abstentions and Broker Non-Votes

Any shares represented by proxies that are marked to abstain from voting on a proposal will be counted as present in determining whether we have a quorum. They will also be counted in determining the total number of shares entitled to vote on a proposal. Abstentions and, if applicable, broker non-votes will not be counted as votes “for” or “against” a Director nominee or the other proposals. Accordingly, abstentions are not counted for the purpose of determining the number of votes cast on these proposals.

If your shares are held in street name and you do not instruct your broker on how to vote your shares, your broker, in its discretion, may either leave your shares unvoted or vote your shares on routine matters. If your broker returns a proxy card but does not vote your shares, this results in a “broker non-vote.” Broker non-votes will be counted as present for the purpose of determining a quorum, but they will not be counted for the purpose of determining the number of votes cast on the proposals.

Soliciting Proxies

Intuit will pay all expenses of soliciting proxies to be voted at the Meeting. After the proxies are initially distributed, Intuit and/or its agents may also solicit proxies by mail, electronic mail, telephone or in person. We have hired a proxy solicitation firm, Innisfree M&A Incorporated, to assist us in soliciting proxies. We will pay Innisfree a fee of $9,000 plus their expenses, which we estimate will be approximately $2,000. We will ask brokers, custodians, nominees and other record holders to prepare and send a Notice of Internet Availability of Proxy Materials to people or entities for whom they hold shares and forward copies of the proxy materials to beneficial owners who request paper copies.

Voting Results

The preliminary voting results will be announced at the Meeting. The final voting results will be tallied by our Inspector of Elections and published in a Current Report on Form 8-K that we expect to file within four business days of the Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Meeting, we intend to file a Form 8-K to disclose preliminary voting results and, within four business days after the final results are known, we will file an additional Form 8-K to disclose the final voting results.

Delivery of Voting Materials to Stockholders Sharing an Address

To reduce the expense of delivering duplicate materials to stockholders sharing the same address, we have adopted a procedure approved by the Securities and Exchange Commission ("SEC") called “householding.” Under this procedure, certain stockholders of record who have the same address and last name and do not participate in electronic delivery of proxy materials will receive only one copy of the Notice of Internet Availability, Annual Report on Form 10-K and proxy materials, as applicable, sent to stockholders until such time as one or more of these stockholders notifies us that they wish to receive individual copies. This procedure will reduce duplicate mailings and save printing costs and postage fees, as well as natural resources.

How to Obtain a Separate Set of Voting Materials

If you received a householded mailing this year, and you would like to have additional copies of our Notice of Internet Availability of Proxy Materials, Annual Report on Form 10-K and proxy materials, as applicable, mailed to you, please submit

8

your request to Investor Relations, Intuit Inc., P.O. Box 7850, Mail Stop 2700, Mountain View, California, 94039-7850, or call (650) 944-3560 and we will deliver these materials to you promptly upon such written or oral request. You may also contact us at the address or phone number above if you received multiple copies of the annual meeting materials and would prefer to receive a single copy in the future. If you would like to opt out of householding for future mailings, call (800) 542-1061 or send a written request to Investor Relations at the above address.

Annual Report on Form 10-K and Additional Materials

The Notice of 2012 Annual Meeting of Stockholders, this proxy statement and our Annual Report on Form 10-K for the fiscal year ended July 31, 2011 have been made available to all stockholders entitled to vote at the Meeting and who received the Notice of Internet Availability. The Annual Report on Form 10-K can also be viewed at http://investors.intuit.com/annuals.cfm.

Paper copies of our Annual Report on Form 10-K (excluding exhibits) for the fiscal year ended July 31, 2011 may be obtained without charge by writing to Investor Relations, Intuit Inc., P.O. Box 7850, Mail Stop 2700, Mountain View, California, 94039-7850, or by calling (650) 944-3560.

OUR BOARD OF DIRECTORS AND NOMINEES

Our Board currently consists of 10 directors, of whom eight are standing for re-election. In July 2011, we announced that Michael R. Hallman has decided not to stand for re-election and is expected to serve as a director until the date of the Meeting. In October 2011, we announced that David H. Batchelder has decided not to stand for re-election and is expected to serve as a director until the date of the Meeting. The nominees for election include five independent directors, as defined in the applicable rules for companies traded on the NASDAQ Global Select Market (NASDAQ) and three directors who are employees of Intuit. Stockholders elect all directors annually. The authorized number of directors is currently 10, which will be decreased to eight after the Meeting.

Directors Standing for Election

Each of the incumbent directors listed below has been nominated for election by the Board upon recommendation by the Nominating and Governance Committee and has agreed to stand for election to a one-year term. Information concerning the nominees for director is provided below.

Christopher W. Brody (Age 67)

Chairman, Vantage Partners LLC

Mr. Brody has been an Intuit director since 1993 and is a member of the Compensation and Organizational Development Committee and Chairman of the Nominating and Governance Committee. Mr. Brody has been chairman of Vantage Partners LLC, a private investment firm that he founded, since 1999. From 1971 to 1998 Mr. Brody was a partner of Warburg, Pincus & Co., a venture capital and private equity investment firm. Over the past 29 years, Mr. Brody has served on the boards of over 15 public and private companies in a number of different industries. Currently, Mr. Brody serves as a director of several private companies. Mr. Brody holds a Bachelor of Arts in English Literature from Harvard College and a Master in Business Administration from Harvard Business School. The Board believes that Mr. Brody should be re-elected to the Board because of his experience and knowledge of corporate finance, strategic planning and general management; his experience and knowledge of operational matters gained as a past and present director of several other public and private companies; his experience in building high-growth businesses; and his knowledge of Intuit, its markets and operations developed over his tenure as a director of Intuit.

William V. Campbell (Age 71)

Chairman of the Board of Directors, Intuit Inc.

Mr. Campbell has been an Intuit director since 1994 and Chairman of the Board since 1998. Mr. Campbell is currently Non-Executive Chairman of Intuit. Mr. Campbell served as Intuit’s President and Chief Executive Officer from 1994 to 1998 and was Acting Chief Executive Officer from September 1999 to January 2000. Mr. Campbell has been a member of the board of directors of Apple, Inc. since 1997. In addition to Mr. Campbell’s public company leadership experience, he serves as the Chair of the Board of Trustees of Columbia University. Mr. Campbell holds a Bachelor of Arts in Economics and a Masters of Science from Columbia University. The Board believes that Mr. Campbell should be re-elected to the Board because of his professional experience managing and advising innovative high growth companies; his leadership throughout the technology industry; and his understanding of Intuit, its strategy, markets, operations and management.

9

Scott D. Cook (Age 59)

Founder and Chairman of the Executive Committee, Intuit Inc.

Mr. Cook has been an Intuit director since 1984. A co-founder of Intuit, Mr. Cook served as Intuit’s President and Chief Executive Officer from 1984 to 1994 and served as Chairman of the Board from 1993 to 1998. Mr. Cook has been a director of eBay Inc. since 1998 where he is a member of the Corporate Governance and Nominating Committee. Mr. Cook has been a director of The Procter & Gamble Company since 2000 where he chairs the Innovation & Technology Committee and is a member of the Compensation & Leadership Development Committee. Mr. Cook holds a Bachelor of Arts in Economics and Mathematics from the University of Southern California and a Master in Business Administration from Harvard Business School. The Board believes that Mr. Cook should be re-elected to the Board because of his experience as an entrepreneur and corporate executive; his knowledge of Intuit’s operations, markets, management and strategy; his role in guiding and fostering innovation; and his experience as a Board member of other large consumer-focused companies.

Diane B. Greene (Age 56)

Former President and Chief Executive Officer, VMware, Inc.

Ms. Greene has been an Intuit director since 2006 and is a member of the Audit and Risk Committee and the Nominating and Governance Committee. Ms. Greene co-founded VMware, Inc. in 1998 and took the company public in 2007. Ms. Greene served as chief executive officer and president of VMware from 1998 to 2008, a member of the board of directors of VMware from 2007 to 2008, and as an Executive Vice President of EMC Corporation from 2005 to 2008. Prior to VMware, Ms. Greene held technical leadership positions at Silicon Graphics, Tandem, and Sybase and was chief executive officer of VXtreme. In addition to Ms. Greene’s public company board experience, she is a member of The MIT Corporation. Ms. Greene holds a Bachelor of Arts in mechanical engineering from the University of Vermont, a Master of Science degree in naval architecture from the Massachusetts Institute of Technology and a Master of Science degree in computer science from the University of California, Berkeley. The Board believes that Ms. Greene should be re-elected to the Board because she brings to the Board her experience and insights as a successful technology entrepreneur and former chief executive officer of a public company as well as her expertise and knowledge of cloud computing and software as a service businesses.

Edward A. Kangas (Age 67)

Non-Employee Chairman, Tenet Healthcare

Mr. Kangas has been an Intuit director since 2007 and is a member of the Acquisition Committee and the Compensation and Organizational Development Committee. Mr. Kangas has been chairman of Tenet Healthcare since 2003. From 1989 to 2000, Mr. Kangas was global chairman and chief executive officer of Deloitte. Mr. Kangas held the position of managing partner of Deloitte & Touche (USA) from 1989 to 1994. Mr. Kangas has been a member of the board of directors of: Allscripts Healthcare Solutions, Inc. since 2010; Hovnanian Enterprises, Inc. since 2002; and United Technologies Corporation since 2008. Mr. Kangas was a member of the board of Electronic Data Systems Corporation from 2004 to 2008 and Eclipsys Corporation from 2004 to 2010. Mr. Kangas holds a Bachelor’s degree and a Master’s degree in Business Administration from the University of Kansas. The Board believes that Mr. Kangas should be re-elected to the Board because he brings to the Board global executive experience as well as his knowledge and expertise acquired through his service as a director of companies in industries that are highly relevant to Intuit’s businesses, including software, technology, professional services, and healthcare.

Suzanne Nora Johnson (Age 54)

Former Vice-Chairman, The Goldman Sachs Group

Ms. Nora Johnson has been an Intuit director since 2007 and is a member of the Acquisition Committee and the Audit and Risk Committee. Ms. Nora Johnson held the Honorary Title of Senior Director of The Goldman Sachs Group from 2007 to 2009. Ms. Nora Johnson joined The Goldman Sachs Group in 1985 and held several management positions throughout her 22 year tenure including: Vice Chairman, Chairman of the Global Markets Institute, and Head of the Global Investments Research Division. Ms. Nora Johnson has been a member of the board of directors of: American International Group, Inc. since 2008; Pfizer Inc. since 2007; and VISA Inc. since 2007. Ms. Nora Johnson’s significant non-profit board affiliations include, among others, the American Red Cross and the University of Southern California. Ms. Nora Johnson earned a Bachelor’s degree from the University of Southern California and a Juris Doctor from Harvard Law School. The Board believes that Ms. Nora Johnson should be re-elected to the Board because she brings valuable business experience managing large, complex, global institutions as well as insights into how changes in the financial services industry, public policy and the macro-economic environment affect our businesses.

Dennis D. Powell (Age 63)

Former Chief Financial Officer, Cisco Systems, Inc.

Mr. Powell has been an Intuit director since 2004 and is Chairman of the Audit and Risk Committee and a member of the

10

Acquisition Committee. Mr. Powell was executive advisor of Cisco Systems, Inc. from 2008 to 2010. Mr. Powell joined Cisco in 1997 and held several management positions throughout his tenure including: Senior Vice President and Chief Financial Officer from 2003 to 2008; Senior Vice President, Corporate Finance from 2002 to 2003; and Vice President, Corporate Controller from 1997 to 2002. Prior to Cisco, Mr. Powell held the position of senior partner at Coopers & Lybrand LLP, where his tenure spanned 26 years. Mr. Powell has been a member of the boards of directors of Applied Materials, Inc. since 2007 and VMware, Inc. since 2007. Mr. Powell holds a Bachelor of Science in Business Administration with a concentration in accounting from Oregon State University. The Board believes Mr. Powell should be re-elected to the Board because he brings to the Board his executive management experience with large, global organizations as well as insights into financial and operational issues gained through his tenure as an executive at a large public technology company.

Brad D. Smith (Age 47)

President and Chief Executive Officer, Intuit Inc.

Mr. Smith has been an Intuit director since 2008 and is currently President and Chief Executive Officer of Intuit. Mr. Smith joined Intuit in 2003 and has served as Senior Vice President and General Manager, Small Business Division from 2006 to 2007, Senior Vice President and General Manager, QuickBooks from 2005 to 2006, Senior Vice President and General Manager, Consumer Tax Group from 2004 to 2005 and as Vice President and General Manager of Intuit’s Accountant Central and Developer Network from 2003 to 2004. Before joining Intuit, Mr. Smith held the position of Senior Vice President of Marketing and Business Development of ADP, where he held several executive positions from 1996 to 2003. Mr. Smith was elected to the board of directors of Yahoo! Inc. in 2010. Mr. Smith holds a Bachelor’s degree in Business Administration from Marshall University and a Master’s degree in Management from Aquinas College. The Board believes Mr. Smith should be re-elected because, as Chief Executive Officer of Intuit, he possesses the most relevant knowledge of Intuit’s strategy, markets, operations and employees and provides industry expertise and context on all matters that come before the Board.

Directors Not Standing for Re-election

David H. Batchelder (Age 62)

Principal, Relational Investors LLC

Mr. Batchelder has been an Intuit director since 2009 and is a member of the Compensation and Organizational Development Committee and Acquisition Committee. Mr. Batchelder has been a Principal of Relational Investors LLC, an investment advisory firm that he founded, since 1996. Mr. Batchelder has decided that he will not stand for re-election to the Board, but is expected to continue to serve on the Board until the Meeting.

Michael R. Hallman (Age 66)

President, The Hallman Group

Mr. Hallman has been an Intuit director since 1993 and is the Chairman of the Compensation and Organizational Development Committee and a member of the Nominating and Governance Committee. Mr. Hallman has been President of The Hallman Group, a management consulting firm, since 1992. Mr. Hallman has decided that he will not stand for re-election to the Board, but is expected to continue to serve on the Board until the Meeting.

CORPORATE GOVERNANCE

Intuit is committed to excellence in corporate governance and maintains policies and practices that promote good corporate governance, including the following:

• |

the Board has adopted majority voting in uncontested elections of directors; |

• |

a majority of the board members are independent of Intuit and its management; |

• |

the independent members of the Board meet regularly without the presence of management; |

• |

all members of the committees of the Board are independent; |

• |

the charters of the committees of the Board clearly establish the committees' respective roles and responsibilities; |

• |

Intuit has adopted a code of business conduct and ethics for employees that is monitored by Intuit's ethics office; |

11

• |

Intuit's ethics office has a hotline available to all employees, and Intuit's Audit and Risk Committee has procedures in place to receive and process complaints regarding accounting, internal accounting controls or auditing matters and for employees to make confidential, anonymous complaints regarding questionable accounting or auditing matters; |

• |

Intuit has adopted a code of ethics that applies to all directors; |

• |

Intuit's internal audit control function maintains critical oversight over the key areas of its business and financial processes and controls, and reports directly to Intuit's Audit and Risk Committee; and |

• |

Intuit has stock ownership guidelines for its non-employee directors and executive officers. |

Our Board has adopted Corporate Governance Principles that are designed to assist the Board in observing practices and procedures that serve the best interests of Intuit and our stockholders. The Nominating and Governance Committee is responsible for overseeing these Corporate Governance Principles and periodically making recommendations to the Board regarding any changes. These Corporate Governance Principles address, among other things, our policy on succession planning and senior leadership development, Board performance evaluations, committee structure and stock ownership requirements.

We maintain a corporate governance page on our company website that contains key information about corporate governance matters. This information includes copies of our Corporate Governance Principles, Code of Conduct & Ethics for all employees, including our Company’s senior executive and financial officers, our Operating Values, and the charter for each Board committee. The link to this corporate governance page can be found at http://investors.intuit.com/governance.cfm.

Board Responsibilities and Leadership Structure

The Board oversees management’s performance on behalf of Intuit’s stockholders. The Board’s primary responsibilities are (1) to select, oversee and determine compensation for the Chief Executive Officer who, with senior management, runs Intuit on a day-to-day basis, (2) to monitor management’s performance to assess whether Intuit is operating in an effective, efficient and ethical manner in order to create value for Intuit’s stockholders, and (3) to periodically review Intuit’s long-range plan, business initiatives, capital projects and budget matters.

The Board appoints the Chairman of the Board, who may be a former officer of Intuit if the Board determines that it is in the best interests of Intuit and its stockholders. The roles of Chairman of the Board and Chief Executive Officer may be held by the same person or may be held by different people. However, if the Chairman is also the Chief Executive Officer, then the Board has determined that it will appoint a lead independent director. Currently, the positions of Chairman of the Board and Chief Executive Officer are held by separate persons. The Board believes that the separation of the roles of Chairman of the Board and Chief Executive Officer is appropriate at this time as it allows our Chief Executive Officer to focus primarily on management and strategy responsibilities, while allowing our Chairman to focus on leadership of the Board, providing feedback and advice to the Chief Executive Officer, and providing a channel of communication between the Board members and the Chief Executive Officer. William V. Campbell, the current Chairman of the Board, is a non-executive employee of Intuit and previously served as Intuit’s chief executive officer. The Chairman of the Board presides over all Board meetings and works with the Chief Executive Officer to develop agendas for Board meetings. The Chairman advises the Chief Executive Officer and other members of senior management on business strategy and leadership development. He also works with the Board to drive decisions about particular strategies and policies and, in concert with the independent Board committees, facilitates a performance evaluation process of the Board.

The Board and its committees meet throughout the year on a set schedule, and also hold special meetings and act by written consent from time to time as appropriate. The Board held five meetings during fiscal 2011. The independent directors also meet in executive session without management present. During fiscal 2011, the independent directors held three executive sessions. With respect to executive sessions of the independent directors, the independent directors may from time to time designate an independent director to serve as presiding director to chair these sessions. In addition, the presiding director may advise the Chairman of the Board with respect to agendas and information to be provided to the Board and may perform such other duties as the Board may from time to time delegate to assist it in fulfilling its responsibilities. The Board has delegated certain responsibilities and authority to the committees described below. Committees report regularly on their activities and actions to the full Board.

Board Oversight of Risk

Intuit's management is responsible for balancing risk and opportunity in support of Intuit's objectives. Management exercises this responsibility day to day through ongoing identification of risks related to significant business activities, implementation of risk mitigation activities and alignment of risk management to the Company's strategy. Intuit's Chief Risk

12

Officer, who reports to our General Counsel, facilitates the Enterprise Risk Management, or "ERM," program as part of our strategic planning process. The ERM program helps identify the top risks for each business unit and for Intuit as a whole.

Our Board has responsibility for overseeing risk management for the Company. The Board exercises this oversight responsibility directly and through its committees, as follows:

• |

The Audit and Risk Committee has primary responsibility for overseeing our ERM program. The Chief Risk Officer reports on a quarterly basis to the Audit and Risk Committee on Intuit’s top risk areas and the progress of the ERM program. The Audit and Risk Committee also has oversight responsibilities with respect to particular risks such as financial management and fraud. |

• |

The Board’s other committees — Compensation and Organizational Development, Nominating and Governance, and Acquisition — oversee risks associated with their respective areas of responsibility. The Compensation and Organizational Development Committee considers the risks associated with our compensation policies and practices for executives and employees generally. The Nominating and Governance Committee considers risks associated with corporate governance and overall board effectiveness, including recruiting appropriate Board members. The Acquisition Committee considers risks associated with Intuit’s merger and acquisition activities and the strategy and business models of acquisition candidates. |

• |

At each quarterly Board meeting, members of each committee provide a report to the full Board covering the committee’s risk oversight and other activities. The full Board receives an annual update from the Chief Risk Officer regarding the top enterprise-wide risks. The full Board also considers and provides oversight of specific strategic risks, including those relating to Intuit's business models and inorganic growth strategy. The Board also receives detailed reports at quarterly Board meetings from the Chief Executive Officer and the heads of our principal business units, which include discussions of the risks involved in their respective areas of responsibility. The senior management team also informs the Board routinely of developments that could affect our risk profile or other aspects of our business. |

Compensation Risk Assessment

The Company conducted a review of its key compensation programs, policies and practices in conjunction with Frederic W. Cook & Co., Inc. (“FW Cook”), the Compensation and Organizational Development Committee’s independent compensation consultant, which prepared a report on the Company’s incentive programs.

Our review included an analysis of the Company's short-term and long-term compensation programs covering key program details, performance factors for each program, target award ranges, maximum funding levels, and plan administrative oversight and control requirements. Key program elements assessed relating to potential compensation risks were pay mix, performance metrics, performance goals and payout curves, payment timing and adjustments, severance packages, equity incentives and stock ownership requirements and trading policies.

Our analysis was reviewed with the Compensation and Organizational Development Committee at its October 18, 2011 meeting. The review and analysis did not identify any compensation programs, policies or practices that create risks that are reasonably likely to have a material adverse effect on the Company.

Our assessment noted the following factors that reduce the likelihood of excessive risk-taking:

•Our overall compensation levels are competitive with the market.

•Our compensation programs provide an effective balance in (1) cash and equity mix, (2) annual incentives that are based in part on company-wide performance metrics that align with the Company's business plans and strategic objectives and in part on a qualitative evaluation of business unit and individual performance to mitigate any tendency for focus exclusively on the specific financial metrics under the plan, and (3) long-term incentives provided through a combination of stock options (generally vesting over three years with terms of seven years), time-based restricted stock units ("RSUs") (generally vesting over three years), performance-based RSUs with vesting based on three-year operating income and revenue growth, and performance-based RSUs with vesting based on three-year relative total shareholder return.

•The Company has adopted stock ownership guidelines for executives at the senior vice president level and above.

•The Company has an insider trading policy that prohibits trading put or call options, short sales and hedging transactions.

13

Director Independence

Our Board currently includes seven independent directors, five of whom are standing for election. To be considered independent under NASDAQ rules, a director may not be employed by Intuit or engage in certain types of business dealings with Intuit. In addition, as required by NASDAQ rules, the Board has made a determination as to each independent director that no relationship exists which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the Board reviewed and discussed information provided by the directors and by Intuit with regard to each director’s business and personal activities as they relate to Intuit and Intuit’s management. Based on this review, the Board has determined that Mr. Batchelder, Mr. Brody, Ms. Greene, Mr. Hallman, Mr. Kangas, Ms. Nora Johnson and Mr. Powell are independent directors.

In assessing director independence under NASDAQ rules, the Nominating and Governance Committee and the full Board review relevant transactions, relationships and arrangements that may affect the independence of our Board members. Each of Mr. Powell, Mr. Kangas and Ms. Nora Johnson is or was during fiscal 2011 a director of companies with which Intuit conducts business in the ordinary course. Consistent with NASDAQ independence standards, Intuit did not make payments to, or receive payments from, any of these companies for property or services in the current or any of the last three fiscal years that exceed 5% of Intuit’s or any of the other parties’ consolidated gross revenues. Following review of these transactions, the Board determined that each of these directors was independent under NASDAQ rules.

Attendance at Board, Committee and Annual Stockholders Meetings

The Board expects that each director will prepare for, attend and participate in all Board and applicable committee meetings and that each Board member will see that other commitments do not materially interfere with his or her service on the Board. Directors generally may not serve on the boards of more than six public companies, including Intuit’s Board. Any director, who has a principal job change, including retirement, must offer to submit a letter of resignation to the Chairman of the Board. The Board, in consultation with the Nominating and Governance Committee, will review each offered resignation and determine whether or not to accept such resignation after consideration of the continued appropriateness of Board membership under the new circumstances.

During fiscal 2011, no director attended less than 75% of the aggregate number of meetings of the Board and the committees on which he or she served. All of our current directors attended the last Annual Meeting of Stockholders, held in January 2011. Under the Corporate Governance Principles, all directors are encouraged to attend the annual meetings of Intuit’s stockholders.

14

Board Committees and Charters

The Board currently has a standing Acquisition Committee, Audit and Risk Committee, Compensation and Organizational Development Committee, and Nominating and Governance Committee. The members of each committee are appointed by the Board based on recommendations of the Nominating and Governance Committee. Each member of these committees is an independent director as determined by the Board in accordance with NASDAQ listing standards and each member of the Audit and Risk Committee meets heightened independence criteria. Each committee has a charter and annually reviews its charter and makes recommendations to our Board for revision of its charter to reflect evolving best practices. Copies of each charter can be found on our website at http://investors.intuit.com/charters.cfm. Current committee members are identified in the following table.

Director |

Acquisition Committee |

Audit and Risk Committee |

Compensation and Organizational Development Committee |

Nominating and Governance Committee |

||||

David H. Batchelder |

X |

X |

||||||

Christopher W. Brody |

X |

Chair |

||||||

William V. Campbell |

||||||||

Scott D. Cook |

||||||||

Diane B. Greene |

X |

X |

||||||

Michael R. Hallman |

Chair |

X |

||||||

Edward A. Kangas |

X |

X |

||||||

Suzanne Nora Johnson |

X |

X |

||||||

Dennis D. Powell |

X |

Chair |

||||||

Brad D. Smith |

||||||||

Acquisition Committee

The Acquisition Committee reviews and approves acquisition, divestiture and investment transactions proposed by Intuit’s management in which the total consideration to be paid or received by Intuit is within certain limits that may be established by the Board from time to time.

In fiscal 2011, the Acquisition Committee held five meetings.

Audit and Risk Committee

The Audit and Risk Committee represents and assists the Board in its oversight of Intuit’s financial reporting, internal controls and audit functions, and is directly responsible for the selection, retention, compensation and oversight of the work of Intuit’s independent auditor.

Our Board has determined that each member of the Audit and Risk Committee is independent, as defined under applicable NASDAQ listing standards and SEC rules related to audit committee members, and is financially literate, as required by NASDAQ listing standards. All members of the Audit and Risk Committee have been determined by the Board to meet the qualifications of an “audit committee financial expert,” as defined by SEC rules, and to meet the qualifications of “financial sophistication” in accordance with NASDAQ listing standards. Stockholders should understand that these designations related to an Audit and Risk Committee member’s experience and understanding do not impose upon him or her any duties, obligations or liabilities greater than those generally imposed on other members of the Board.

In fiscal 2011, the Audit and Risk Committee held 14 meetings. The Audit and Risk Committee held closed sessions with our independent auditors, Ernst & Young LLP, present in 12 of these meetings. The responsibilities and activities of the Audit and Risk Committee are described in greater detail in “Audit and Risk Committee Report” beginning on page 55.

Compensation and Organizational Development Committee

The Compensation and Organizational Development Committee (the “Compensation Committee”) assists the Board in the review and approval of executive compensation and the oversight of organizational and management development for executive officers and other employees of Intuit. The Compensation Committee periodically reviews Intuit's key management from the perspectives of leadership development, organizational development and succession planning through Intuit's High Performance Organization Review. As part of this process, the Compensation Committee also meets with key senior executives. The systemic assessment of Intuit's organization and talent planning helped the Compensation Committee to

15

evaluate Intuit's effort at hiring, developing and retaining executives, with the goal of creating and growing Intuit's “bench strength” at the most senior executive levels.

Each member of this committee is independent under NASDAQ listing standards and is a “Non-Employee Director,” as defined in Rule 16(b)-3 under the Securities Exchange Act of 1934, as amended. The Compensation Committee met nine times in fiscal 2011. The Compensation Committee held a portion of each meeting in closed session, with only the Compensation Committee members and, on certain occasions, William Campbell, the Chairman of the Board, present. For more information on the responsibilities and activities of the Compensation Committee, including the committee’s processes for determining executive compensation, see the “Compensation and Organizational Development Committee Report” on page 25 and “Compensation Discussion and Analysis” beginning on page 26.

The Compensation Committee is also responsible for reviewing the compensation for non-employee directors on an annual basis and making recommendations to the Board, in the event they determine changes are needed.

Section 162(m) Subcommittee

In the event that not all of the members of the Compensation Committee are “outside directors” for purposes of Regulation 1.162-27 under Section 162(m) of the Internal Revenue Code, the Charter of the Compensation Committee authorizes the designation of a subcommittee of not less than two members who are “outside directors.” This subcommittee has responsibility and authority to review and approve all elements of compensation that may require approval by a committee of “outside directors” in order for such compensation to qualify for deductibility under Section 162(m) and related regulations. In July 2010, the Board and the Compensation Committee designated such a subcommittee, consisting of Mr. Batchelder, Mr. Hallman and Mr. Kangas. This subcommittee met three times in fiscal 2011. Because all of the members of Compensation Committee are currently "outside directors", no subcommittee has been designated for fiscal year 2012.

Nominating and Governance Committee

The Nominating and Governance Committee reviews and makes recommendations to the Board regarding Board composition and appropriate governance standards. Our Board has determined that each member of the Nominating and Governance Committee is independent, as defined under applicable NASDAQ listing standards. The Nominating and Governance Committee held four meetings in fiscal 2011.

The Nominating and Governance Committee has adopted a process to identify and evaluate candidates for director, whether recommended by management, Board members, or stockholders (if made in accordance with the procedures set forth under “Stockholder Recommendations of Director Candidates” on page 22). The committee's policy is to evaluate candidates properly recommended by stockholders in the same manner as candidates recommended by others.

Qualifications of Directors

The Nominating and Governance Committee believes that all nominees for Board membership should possess the highest ethics, integrity and values and be committed to representing the long-term interests of Intuit’s stockholders. In addition, nominees should have broad, high-level experience in business, government, education, technology or public interest. They should also have sufficient time to carry out their duties as directors of Intuit and have an inquisitive and objective perspective, practical wisdom and mature judgment. The committee will also consider additional factors — such as independence, diversity, expertise and specific skills, and other qualities that may contribute to the Board’s overall effectiveness — when evaluating candidates for director. Intuit may also engage third-party search firms to provide assistance in identifying and evaluating Board candidates.

Consideration of director candidates typically involves a series of discussions and a review of available information concerning the candidate, the existing composition of the Board, and other factors the committee deems relevant. In conducting its review and evaluation, the committee may solicit the views of management, other Board members and other individuals it believes may have insight into a candidate.

In considering diversity in the selection of nominees, the Nominating and Governance Committee looks for individuals with varied professional experience, background, knowledge, skills and viewpoints in order to achieve and maintain a group of directors that, as a whole, provides effective oversight of the management of the Company. Although our nomination policy does not prescribe specific standards for diversity, the Board and the Nominating and Governance Committee do look for nominees with a diverse set of skills that will complement the existing skills and experience of our directors and provide an overall balance of diversity of perspectives, backgrounds and experiences. Our Board is currently composed of a group of leaders with broad and diverse experience in many fields, including: management of large global enterprises; technology and innovation leadership; consumer products and services; healthcare; financial services; legal and compliance; executive compensation; and corporate governance. Our Board members have acquired these diverse skills through their accomplished

16

careers and their service as directors of a wide range of other public and private companies.

Compensation Committee Interlocks and Insider Participation

No executive officer of Intuit during fiscal 2011 served, or currently serves, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on Intuit’s Board or Intuit’s Compensation Committee.

DIRECTOR COMPENSATION

Overview

Our director compensation programs are designed to provide an appropriate incentive to attract and retain qualified non-employee board members. The Compensation Committee is responsible for reviewing the equity and cash compensation for directors on an annual basis and making recommendations to the Board, in the event it determines changes are needed. On October 19, 2011, the Board approved a new compensation program for our non-employee directors and Chairman of the Board, as discussed under "Prospective Annual Retainer and Equity Compensation Program for Non-Employee Directors" beginning on page 20. The following table summarizes the fiscal 2011 compensation earned by each member of the Board other than Mr. Smith, whose compensation is described under “Executive Compensation” beginning on page 41.

Director Summary Compensation Table

Director Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($)(1) |

All Other Compensation ($) |

Total ($) |

|||||||||||

David H. Batchelder |

60,000 |

289,921 |

— |

349,921 |

|||||||||||

Christopher W. Brody |

55,000 |

307,425 |

— |

362,425 |

|||||||||||

William V. Campbell |

180,000 |

(2) |

289,968 |

— |

469,968 |

||||||||||

Scott D. Cook |

— |

— |

919,637 |

(3) |

919,637 |

||||||||||

Diane B. Greene |

55,000 |

289,921 |

— |

344,921 |

|||||||||||

Michael R. Hallman |

55,000 |

307,425 |

— |

362,425 |

|||||||||||

Edward A. Kangas |

60,000 |

289,921 |

— |

349,921 |

|||||||||||

Suzanne Nora Johnson |

60,000 |

289,921 |

— |

349,921 |

|||||||||||

Dennis D. Powell |

75,000 |

307,425 |

— |

382,425 |

|||||||||||

_______________________________________

(1) |

These amounts represent the aggregate grant date fair value of awards granted during fiscal 2011, computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, “Compensation – Stock Compensation,” (“FASB ASC Topic 718”) assuming no forfeitures. For each of the restricted stock unit ("RSU") awards, the grant date fair value of these awards was calculated using the closing price of Intuit’s common stock on the grant date as if these awards were vested and issued on the grant date. Please see the “Equity Grants to Directors During Fiscal Year 2011” and “Outstanding Equity Awards for Directors at Fiscal Year-End 2011 (Exercisable and Unexercisable)” tables for information regarding the grant date fair value of awards granted during the year and the number of awards outstanding for each director at the end of the fiscal year.

|

(2) |

This amount represents a stipend paid to Mr. Campbell for his role as Non-Executive Chairman of the Board. |

(3) |

Mr. Cook’s compensation represents an annual salary of $500,000; an incentive bonus of $415,000 awarded for service in fiscal 2011; and premiums for Intuit’s Executive Long-Term Disability Plan of $4,637. Mr. Cook did not receive any equity awards from Intuit during fiscal 2011.

|

17

Equity Grants to Directors During Fiscal Year 2011

The following table shows each RSU grant made to each of our directors, other than Mr. Smith, during fiscal 2011, including the grant date, number of shares, and grant date fair value.

Stock Awards |

||||||||

Director Name |

Grant Date |

Shares Subject to Award (#) |

Grant Date Fair Value ($)(1) |

|||||

David H. Batchelder |

1/20/2011 |

3,709 |

(2) |

174,991 |

||||

1/20/2011 |

1,218 |

(3) |

57,465 |

|||||

1/20/2011 |

1,218 |

(3) |

57,465 |

|||||

6,145 |

289,921 |

|||||||

Christopher W. Brody |

1/20/2011 |

3,709 |

(2) |

174,991 |

||||

1/20/2011 |

1,218 |

(3) |

57,465 |

|||||

1/20/2011 |

1,589 |

(3) |

74,969 |

|||||

6,516 |

307,425 |

|||||||

William V. Campbell |

1/20/2011 |

3,709 |

(2) |

174,991 |

||||

1/20/2011 |

2,437 |

(4) |

114,977 |

|||||

6,146 |

289,968 |

|||||||

Scott D. Cook |

— |

— |

||||||

Diane B. Greene |

1/20/2011 |

3,709 |

(2) |

174,991 |

||||

1/20/2011 |

1,218 |

(3) |

57,465 |

|||||

1/20/2011 |

1,218 |

(3) |

57,465 |

|||||

6,145 |

289,921 |

|||||||

Michael R. Hallman |

1/20/2011 |

3,709 |

(2) |

174,991 |

||||

1/20/2011 |

1,218 |

(3) |

57,465 |

|||||

1/20/2011 |

1,589 |

(3) |

74,969 |

|||||

6,516 |

307,425 |

|||||||

Edward A. Kangas |

1/20/2011 |

3,709 |

(2) |

174,991 |

||||

1/20/2011 |

1,218 |

(3) |

57,465 |

|||||

1/20/2011 |

1,218 |

(3) |

57,465 |

|||||

6,145 |

289,921 |

|||||||

Suzanne Nora Johnson |

1/20/2011 |

3,709 |

(2) |

174,991 |

||||

1/20/2011 |

1,218 |

(3) |

57,465 |

|||||

1/20/2011 |

1,218 |

(3) |

57,465 |

|||||

6,145 |

289,921 |

|||||||

Dennis D. Powell |

1/20/2011 |

3,709 |

(2) |

174,991 |

||||

1/20/2011 |

1,218 |

(3) |

57,465 |

|||||

1/20/2011 |

1,589 |

(3) |

74,969 |

|||||

6,516 |

307,425 |

|||||||

18

_______________________________________

(1) |

These amounts represent the aggregate grant date fair value of these awards computed in accordance with FASB ASC Topic 718. The grant date fair value of these awards is calculated using the closing market price of Intuit’s common stock on the date of grant. |

(2) |

Annual Continuing Board Member grant which vests as to 50% of the shares on January 1, 2012 and 50% of the shares on January 1, 2013. |

(3) |

Annual Committee Member or Committee Chair grant which vests as to 100% of the shares on January 1, 2012. |

(4) |

Annual Chairman of the Board grant which vests as to 50% of the shares on January 1, 2012 and 50% of the shares on January 1, 2013. |

Outstanding Equity Awards for Directors at Fiscal Year-End 2011 (Exercisable and Unexercisable)

The following table provides information on the outstanding equity awards held by our directors, other than Mr. Smith, as of July 31, 2011.

|

Aggregate Shares

Subject to Outstanding

|

||||||

Director Name |

Stock Awards (#) |

Option Awards (#) |

||||

David H. Batchelder |

12,346 |

— |

||||

Christopher W. Brody |

9,410 |

385,000 |

||||

William V. Campbell |

9,040 |

— |

||||

Scott D. Cook |

— |

— |

||||

Diane B. Greene |

9,039 |

165,000 |

||||

Michael R. Hallman |

16,686 |

(1) |

222,500 |

|||

Edward A. Kangas |

11,210 |

(2) |

142,500 |

|||

Suzanne Nora Johnson |

9,039 |

150,000 |

||||

Dennis D. Powell |

9,410 |

152,500 |

||||

_______________________________________

(1) Includes 7,276 vested RSUs for which Mr. Hallman has elected to defer settlement.

(2) Includes 2,171 vested RSUs for which Mr. Kangas has elected to defer settlement.

Current Annual Retainer and Equity Compensation Programs for Non-Employee Directors

Annual Retainer for Non-Employee Directors in Fiscal Year 2011

During fiscal 2011 and continuing until the date of the Meeting, non-employee directors are paid an annual cash retainer of $30,000, plus additional annual cash retainers based on their committee service. These annual retainers are paid in quarterly installments and the cash retainers for committee service are paid in the following amounts: Audit and Risk Committee Chair ($30,000), Non-Chair Audit and Risk Committee Members ($15,000), Acquisition Committee Members ($15,000), Compensation and Organizational Development Committee Member ($15,000) and Nominating and Governance Committee Member ($10,000). We reimburse non-employee directors for out-of-pocket expenses incurred in connection with attending Board and committee meetings.

Automatic Restricted Stock Unit Grants to Non-Employee Directors (from December 15, 2009 to January 19, 2011)

Between December 19, 2009 and January 19, 2011, the Company made automatic equity grants to non-employee directors according to a formula set forth in the 2005 Equity Incentive Plan, as amended. These awards were made in the form of a fixed dollar value of RSUs in the following amounts: new Board members ($250,000 on date of joining Board), continuing

19

Board members ($175,000 annually), Committee members ($57,500 annually), and Board-designated Committee chairs ($17,500 annually). Because the formula was based on a fixed dollar amount, the number of RSUs awarded annually to non-employee directors varied, depending on the closing market price of Intuit's common stock on the date of grant. Annual Board and committee grants were awarded each year on the first business day after the Annual Meeting of Stockholders. Initial Board and committee grants were awarded shortly after the director first joined the Board or committee and were pro-rated based on the number of full months the director served between grant date and the next vesting date. If the non-employee director elected, settlement of the awards could be deferred for up to five years. A non-employee director could receive committee grants for a maximum of two committees.